LiquidChain is a Layer 3 blockchain project that wants to unify the liquidity of Bitcoin, Ethereum, and Solana into a single execu...

Want to earn competitive interest rates on stablecoins like USDT, USDC, and DAI? Read our beginner’s guide on stablecoin yields, savings accounts, and other top DeFi methods.

If you’re wondering how to earn interest on stablecoins, our exhaustive guide will teach you everything you need to know. As a simple explainer, crypto investors typically use centralized exchanges or decentralized finance (DeFi) protocols for methods such as staking, yield farming, liquidity provision, and lending platforms. The top yield-bearing stablecoins for 2026 are Tether (USDT) and USDC.

Stablecoins remain the most popular digital assets to generate passive income. Investors can earn competitive interest rates without needing to consider volatility risk, outside of rare, depegging events.

Read on to discover the top platforms for stablecoin yields, how to stay safe, and what best practices to follow to maximize returns.

Key Takeaways

- Stablecoins are cryptocurrencies pegged to the USD, as well as other major currencies such as EUR and AUD.

- Since stablecoins are designed to retain their value against the underlying fiat currency, holders avoid market volatility.

- To earn interest on stablecoins, some investors deposit assets into centralized platforms (CEXs) like Nexo, Bybit, and Crypto.com.

- To mitigate counterparty risks, non-custodial solutions like Best Wallet remain a popular alternative to CEXs, since investors retain full control of their private keys.

- The most common ways to earn interest on stablecoins like USDT and USDC are staking, yield farming, and lending platforms.

Quick Walkthrough: How to Earn Interest on Stablecoins in 2026

Here is a simplified overview of how to earn interest on stablecoins:

- Create a Nexo Account: Nexo is our top pick for stablecoin yields. Visit the Nexo website to open an account. As a licensed provider, Nexo users must complete a quick KYC process to unlock full functionality.

- Deposit Funds: You need some stablecoins in the Nexo account to earn interest. Transfer tokens from a private wallet or buy some with traditional payment methods like Visa, MasterCard, and Google/Apple Pay.

- Choose a Stablecoin Account: Nexo supports several top stablecoins, including USDT, USDC, and Dai (DAI). Choose between a flexible or fixed savings account, depending on whether you prioritize fund accessibility or yields.

- Confirm and Earn Interest: Confirm the stablecoin account to start earning competitive interest payments. NEXO distributes stablecoin rewards daily, allowing users to compound their returns.

- Withdraw Funds: Users may withdraw funds from Nexo at any time when using flexible accounts. Fixed accounts, which include one, three, and 12-month terms, require users to complete the chosen lock-up period before they cash out.

5 Top Methods to Earn Stablecoin Yields

Investors can use several methods to earn passive income on stablecoins. Each method, from lending platforms and savings accounts to staking, offers various risks and potential rewards. Read on to explore the best ways to generate stablecoin interest in 2026.

Crypto Savings Accounts

Stablecoin savings accounts are the best method for beginners. They function like traditional savings accounts, since users deposit funds to earn interest. Most platforms offer flexible and fixed accounts.

Flexible accounts come without lock-up terms, so users may withdraw their stablecoin investments at any time. This account type suits investors who prefer the safety net of instant liquidity.

Nexo offers basic stablecoin savings accounts with USDT yields of up to 16%. Source: Nexo

Fixed accounts resemble certificates of deposit (CDs), as they require investors to meet a lock-up period. Stablecoin holders cannot withdraw their assets until they complete the term. Terms may range from a few days to a year, depending on the savings account provider. In general, fixed accounts offer higher stablecoin yields than flexible plans.

We found that Nexo is a top choice for crypto savings accounts. The licensed platform offers yields of up to 16% on USDT, and 14% on DAI, USDC, and Pax Dollar (USDP). Users receive stablecoin yields daily, a key factor to compound long-term returns. Other popular options include Bybit and Binance.

Pros

- The best way to earn interest on stablecoins as a beginner

- Choose between flexible and fixed accounts

- Some platforms distribute yields daily

Cons

- Counterparty risks include client fund mismanagement

- Many providers have strict KYC requirements

- The highest yields require users to meet long lock-up terms

Liquidity Provision

Investors also generate stablecoin yields by lending their crypto assets to decentralized exchanges (DEXs) like Uniswap, PancakeSwap, and Raydium. DEXs typically offer millions of pairs, and most contain top stablecoins like USDT and USDC. To provide liquidity, users must cover both cryptocurrencies contained within the pair in equal amounts.

For example, to fund the ETH/USDT pair on Uniswap, an investor may provide $500 worth of ETH and USDT, which totals $1,000. The investor earns a share of trading commissions, which traders pay whenever they swap ETH for USDT, or vice versa.

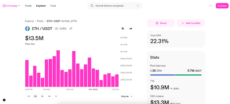

Investors fund DEX liquidity pools to earn a share of trading fees. Source: Uniswap

The key benefit of liquidity provision is that users deposit stablecoins and other assets into decentralized liquidity pools. Meanwhile, smart contracts govern those pools via immutable code, which helps investors reduce counterparty risks. As DEX pools are purely for token swaps, they do not (and cannot) lend user-owned cryptocurrencies to third parties.

Regarding drawbacks, investors need two different assets to earn interest, which means they cannot solely deposit a single stablecoin. Liquidity provision also carries impermanent loss risks. This risk arises when non-stablecoin assets experience large pricing swings, which can result in investors receiving less value compared to leaving them in a private wallet.

Pros

- Earn a share of trading fees by providing exchange liquidity

- Avoid centralized counterparty risks like fund misuse

- The non-custodial framework ensures users fully control their assets

Cons

- Investors must deposit two different cryptocurrencies to form a trading pair

- Impermanent loss risks can lead to negative yields

- The process requires basic knowledge of DEXs and non-custodial storage

Yield Farming

Yield farming is a similar stablecoin investment strategy to liquidity provision. While investors provide two or more cryptocurrencies into decentralized liquidity pools, they actively seek new opportunities to maximize interest rates.

One example is an investor who deposits USDC and SOL into a pool, and they receive an equivalent number of liquidity pool (LP) tokens. They allocate those LP tokens into decentralized finance (DeFi) staking pools, which generate yields in addition to the original assets deposited. As such, the investor magnifies their returns without investing additional capital.

Yearn.finance is a popular DeFi protocol that supports yield farming strategies. Source: Yearn.finance

Platforms like Yearn.finance let users deposit LP tokens into optimized farming strategies, which let investors automatically reallocate funds to earn the highest yields. Another example is Idle Finance. The DeFi protocol automatically reinvests LP rewards into other yield sources like Aave, Lido, Clearpool, and Compound.

Yield farming can be a highly profitable way to earn interest on stablecoins, yet it’s also a risky strategy. In addition to impermanent loss, investors can lose access to their original assets if the platform holding the LP tokens is hacked or turns out to be a scam. As the DeFi initiative is complex, beginners may find the process intimidating.

Pros

- High-growth DeFi strategy that maximizes stablecoin yields

- Automatically allocate funds into the best-paying protocols

- Ideal for investors who want to actively compound their returns

Cons

- The strategy does not suit inexperienced DeFi users

- Smart contract exploits and other LP risks may lead to significant losses

- Extreme volatility increases impermanent loss risks

Staking

Staking is a hugely popular interest-earning strategy available for assets on proof-of-stake blockchains. The best cryptocurrencies to stake include native coins like Ethereum (ETH), Cardano (ADA), and Solana (SOL). Staking helps secure the blockchain ecosystem, and stakers earn rewards in the same digital asset.

Since stablecoins are secondary tokens that operate on existing networks, they cannot be staked in the traditional sense. Third-party platforms, including CEXs and DEXs, offer various stablecoin staking alternatives. Unlike liquidity provision and yield farming, these solutions allow investors to deposit single stablecoins rather than form pairs.

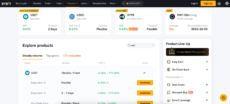

Centralized exchanges offer staking-like products for simple stablecoin yields. Source: Binance

Centralized platforms like Binance and Bybit offer competitive yields in a user-centric environment. You deposit funds via traditional accounts rather than engage with smart contracts. However, users relinquish control of their assets by using centralized providers.

Another option is the Best Wallet app, which lets users stake stablecoins via a built-in aggregator. It connects with hundreds of staking DeFi protocols across major networks such as Ethereum, Solana, and Base. Users enter their preferred stablecoin, and the app matches users with the best protocols by yield, lock-up terms, and liquidity. While Best Wallet users access on-chain products, the beginner-friendly interface requires no learning curve.

Pros

- Deposit stablecoins into single-asset staking products

- Staking rewards are more stable compared with yield farming

- Aggregator tools help users find the most competitive stablecoin yields

Cons

- Conventional staking does not support secondary stablecoin tokens

- Some staking agreements have long lock-up terms

- Third-party platforms often charge high fees

Lending Platforms

Stablecoin investors lend their digital assets to borrowers, either through centralized or decentralized providers. Borrowers may be individuals or entities, depending on the provider. The lending structure functions like a traditional loan. The stablecoin holder becomes the bank, as they receive regular interest payments from borrowers.

The most beginner-friendly way to lend stablecoins is to use a CEX. Binance offers retail-friendly products like savings accounts, and it allocates those funds to third-party loans. Bybit’s earn plans offer a similar framework, with users generating an APY of 8.12% on USDT flexible accounts.

Aave is a decentralized loan platform that lets users lend stablecoins via smart contracts. Source: Aave

DeFi protocols offer decentralized loan agreements between lenders and borrowers. Platforms like Aave and Compound use algorithmic systems to set interest rates based on risk, demand, and market volatility. Smart contracts handle loan agreements on the blockchain, and borrowers avoid credit checks and application procedures.

Investors mitigate default risks in DeFi lending because borrowers must post collateral to receive funds. As a secured loan, platforms liquidate the collateral if the market value drops below the set risk threshold. Volatility drives risk when borrowers provide collateral in non-stablecoin assets.

Pros

- Borrowers pay regular interest to stablecoin lenders

- DeFi solutions typically offer flexible withdrawals

- Algorithmic systems help set sustainable interest rates

Cons

- Lower stablecoin yields compared with other interest products

- Centralized exchanges often set minimum lock-up requirements

- Extreme volatility can lead to failed liquidations and bad debts

Best Stablecoin Interest Platforms Reviewed

Learn where to earn competitive interest on popular stablecoins. We review the best platforms for safety, user-friendliness, yields, withdrawal terms, and available products.

1. Nexo: The Overall Best Stablecoin Savings Accounts for Beginners

Our research shows that Nexo is the best option to earn stablecoin yields. The established platform offers a beginner-friendly experience, and its licensed framework ensures safety and regulatory oversight.

Nexo specializes in crypto savings accounts with both flexible and fixed terms. It supports the leading stablecoin assets, including USDT, USDC, DAI, and USDP. Users also earn interest on other stablecoin currencies, including eToro Pound Sterling (GBPx) and eToro Euro (EURx).

Nexo offers USDT savings accounts with a top APY of 16%. Source: Nexo

In terms of yields, USDT offers the highest stablecoin interest rates. Flexible accounts pay an APY of 13%, and 16% on 12-month plans. Nexo also offers three and six-month terms with lower yields.

The platform offers a quick sign-up process, and users may deposit stablecoins through wallet transfers. Account holders can also buy stablecoins with debit/credit cards and e-wallets, and allocate the assets straight into a savings account.

Nexo provides top customer service via 24/7 live chat and boasts an excellent Trustpilot score of 4.5/5 across 16,000 reviews.

Pros

- Beginner-friendly savings accounts for stablecoin holders

- Earn up to 16% APY on USDT

- Other supported stablecoins include USDC, DAI, and GBPx

- Choose between flexible or fixed accounts

- Users receive their stablecoin yields daily

- The platform is registered and licensed in multiple jurisdictions

Cons

- Counterparty risks include loan defaults and insolvency

- Huge transaction fees to buy stablecoins with fiat money

2. Best Wallet: Access Hundreds of Decentralized Staking Pools in a Non-Custodial Environment

Best Wallet appeals to stablecoin investors who prefer non-custodial solutions, since they control encrypted private keys on a mobile device. The iOS and Android app provides a decentralized experience, and the built-in staking aggregator connects users to hundreds of liquidity pools.

Once users input their preferred stablecoin and network standard, Best Wallet displays available staking providers. Users select appropriate pools by APYs, liquidity depth, minimum lock-up terms, and reputation. Since stablecoin holders invest via decentralized smart contracts, they avoid centralized and counterparty risks.

Best Wallet offers stablecoin yields through a non-custodial staking aggregator. Source: Best Wallet

In addition to stablecoin yields, Best Wallet ranks as one of the top crypto wallets. It supports major stablecoin ecosystems like Ethereum, BNB Chain, and Solana, so users safely store their digital assets in a unified environment. Other notable features include decentralized application (dApp) integration, instant token swaps, and launchpad events for new cryptocurrencies.

Pros

- Built-in staking aggregator connects with hundreds of liquidity pools

- Choose stablecoin pools by yields and lock-up terms

- Non-custodial framework ensures users control their digital assets

- Available as a user-friendly iOS and Android app

- Supports stablecoins on 60+ network standards

Cons

- Some DeFi pools have weak liquidity

- The browser extension is under development

3. Bybit: Easy Earn Plans with Competitive Yields and Flexible Withdrawals

Bybit is a tier-one crypto exchange with over 77 million registered users. Besides spot and derivative trading markets, the exchange offers a wide selection of yield-generating products. The easy earn feature suits beginners who prefer crypto savings accounts without lock-up terms. Investors may withdraw their assets at any time without financial penalty.

Bybit offers USDT and USDC yields of 8.2% on the first $200. The rate drops to 3.2% for deposits above this threshold. The platform also offers fixed accounts with seven-day lock-up terms and the APY increases to 777%. Users also access on-chain yields on USDT. While rates are lower at 4.1% (flexible) and 6% (fixed), stablecoin investors reduce counterparty risks.

Bybit’s easy earn products offer stablecoin savings accounts with instant withdrawals. Source: Bybit

Joining Bybit takes seconds, since the platform does not implement KYC requirements. EU users are the exception, as Bybit’s MiCA framework operates on a separate European platform. Payment methods include digital assets and traditional deposit types like Visa, MasterCard, and SEPA transfers.

Pros

- Earn USDC and USDT yields of up to 8.2%

- Savings accounts offer flexible withdrawal terms

- On-chain yield solutions reduce counterparty risks

- Non-EU users skip KYC verification

Cons

- Limited support for non-USD stablecoins

- Some yield products face impermanent loss risks

4. Crypto.com: Earn Stablecoin Interest Rates with Flexible or Fixed Terms

Crypto.com is another popular CEX that offers simple earning products. Its savings accounts support the best cryptocurrencies to buy, including major stablecoins USDT, USDC, and DAI.

Yields vary by the selected asset and term. Crypto.com offers flexible, one-month, and three-month plans, and longer terms yield the highest interest rates. DAI, for instance, yields a top rate of 6.5% on three-month accounts, yet rates drop to just 0.5% on flexible terms.

Crypto.com offers various APYs on stablecoins with flexible and fixed terms. Source: Crypto.com

Crypto.com implements three investment tiers, and it reduces the APY after the first $3,000 deposited. It also requires users to hold Cronos (CRO) tokens to maximize rewards.

Users access Crypto.com on a user-friendly app and desktop browsers. The sign-up process requires strict KYC verification, including a government-issued ID. Fee-free deposits include local bank transfers such as ACH and UK Faster Payments. The platform also supports debit/credit cards, but variable transaction fees apply.

Pros

- Tier-one exchange with robust security and strong regulation

- Available stablecoin terms include flexible, one-month, and three-month

- Supported stablecoins include USDT, USDC, and DAI

Cons

- Users must hold CRO tokens to maximize yields

- APYs decline after the first $3,000 invested

- Interest rates are much lower compared with other CEX platforms

5. Binance: On-Chain and Off-Chain Yield Features on Top Stablecoin Assets

Binance is the largest crypto exchange globally and a popular choice to earn interest on stablecoins. It supports several earning tools to suit different investment goals and risk tolerances.

Simple earn is the beginner-friendly option, as it allows users to invest stablecoins in flexible savings accounts. Binance offers 10.54% and 7.62% yields on USDT and USDC, respectively. Another method is to deposit USDT and receive an equivalent amount of RWUSD tokens.

Binance users earn USDT interest rates of over 10% with flexible terms. Source: Binance

Real-world assets like US Treasury Bills generate yields, and users may redeem the original USDT at any time.

Alongside on-chain yields, the exchange also offers dual investments with APYs of up to 347%. However, this DeFi product is high-risk, as investors may receive less than they initially invested.

Pros

- Deposit USDT to earn 10.54% yields

- Savings accounts offer flexible withdrawal terms

- Advanced yield products include dual investments and smart arbitrage

Cons

- Variable APYs change frequently

- Some products have small investment limits

- Interest accounts remain banned in several countries, including the UK

How Does Stablecoin Interest Work?

The most popular way to earn interest is through savings accounts. Centralized platforms like Nexo, Binance, and Bybit allocate client-owned assets to various channels, such as third-party loans, exchange liquidity, and derivative margin. Since platforms generate interest on those assets, stablecoin holders earn a share of the rewards. The process works similarly to traditional finance, where banks pay interest on customer balances.

Decentralized finance unlocks additional stablecoin opportunities. Products like staking, yield farming, and liquidity provision allow investors to earn yields without relying on centralized intermediaries. Immutable smart contracts, which operate on the blockchain, facilitate agreements between lenders and borrowers.

While specific terms vary by agreement, investors typically receive interest payments in the same stablecoin. Platforms often distribute yields daily or weekly, which lets stablecoin holders reinvest their interest in other earning products. Some products offer flexible withdrawals without penalties, and others require minimum lock-up periods.

Do Stablecoins Offer Higher Yields Than Banks?

According to recent Bankrate data, the average savings account interest rate in the U.S. is just 0.6%, and the highest APY is 4.35%. In contrast, several crypto platforms offer stablecoin yields of over 10%. This structure makes stablecoins considerably more lucrative for investors who favor passive income.

The drawback is that U.S. banks are members of the Federal Deposit Insurance Corporation (FDIC), which protects account balances up to $250,000 in the event of bankruptcy. Stablecoins do not benefit from FDIC insurance, creating a higher risk-reward spectrum.

How Much Interest Can You Earn on Stablecoins?

Stablecoin yields vary by multiple factors, including the asset, platform, lock-up terms, and investment size. Our research shows that USDT yields are typically more competitive than USDC, and investors earn higher APYs on longer-term plans.

Many platforms implement investment thresholds on their highest interest rates, which means large-scale investors often receive less competitive returns. Bybit, for example, offers 8.2% stablecoin yields on the first $200 only. The interest rate declines to 3.2% thereafter.

Here are some examples of existing stablecoin interest rates in 2026:

| Stablecoin | Yields |

| USDT |

|

| USDC |

|

| DAI |

|

Stablecoin vs Crypto Yields: Which Digital Assets Offer the Best Rates?

While interest rates vary by different metrics, major cryptocurrencies like Bitcoin (BTC), ETH, and SOL generally offer less competitive yields than stablecoins.

For example, while Bybit offers APYs of over 8% on USDT accounts, BTC yields are just 2.3%. Much higher interest rates are available with lower-cap assets. Camp Network (CAMP) and 0G (0G) yield 500% and 400%, respectively.

This dynamic is due to volatility risks. As lower-cap cryptocurrencies face wilder pricing swings, yield providers must offer higher rates to incentivize investors.

What Are the Risks of Earning Interest on Stablecoins?

Similar to traditional investment products, stablecoin yields carry various risks, including:

- Stablecoin Depegging: Stablecoins stay pegged to the underlying currency, usually through cash or cash-equivalent reserves. However, as seen with TerraUSD (UST), which was once worth $60 billion at its peak, stablecoins can lose their peg. Holding a depegged stablecoin can lead to significant financial losses.

- Counterparty Risks: CEX platforms typically offer the best yields on stablecoins. They allocate client-owned cryptocurrencies to various stakeholders like market makers, retail clients, and institutional funds. This creates counterparty risks, including loan defaults, fund mismanagement, and security breaches. In the event of a widespread incident, investors may lose access to their stablecoins.

- Liquidity Risks: While flexible plans offer instant withdrawals, fixed products lock investor stablecoins until the term concludes. Long-term plans of 12 months or more often yield the highest returns, but investors may face liquidity issues if they need the funds early. The best practice is to choose flexible or short-term lock-up terms.

- Smart Contract Vulnerabilities: Although decentralized protocols reduce some counterparty risks, smart contract exploits can lead to platform hacks. This potentially results in hackers stealing client-owned stablecoins from liquidity pools.

- Regulatory Risks: Increased stablecoin regulations in recent years have created additional risks. In Europe, stablecoin issuers must hold an EU license, while in China, they’re banned outright. Adverse regulatory developments could impact stablecoin legality and broader market sentiment.

Best Assets to Earn Yield on Stablecoins

The best stablecoins to earn interest depend on the investor’s risk tolerance, yield objectives, and preferred custodianship.

Research shows that USDC is the safest stablecoin to hold due to its strong regulatory commitment, monthly audits, and transparent reserves. US dollars and cash equivalents like Treasury Bills back USDC 1:1.

USDT is the largest stablecoin by market capitalization, and it provides most crypto exchanges and DeFi protocols with platform liquidity. While platforms typically offer the highest yields on USDT deposits, cash and cash equivalents do not back the stablecoin entirely. In addition, USDT relies on precious metals, secured loans, and BTC.

Tether relies on cash, precious metals, and secured loans to back USDT tokens. Source: Tether

DAI is a popular choice with investors who prioritize non-custodial ownership. The Ethereum-based stablecoin is pegged to USD without cash reserves. Instead, algorithmically-adjusted smart contracts rely on other stablecoins, cryptocurrencies, and an overcollateralized framework.

The Verdict

While investors should consider counterparty and depegging risks, stablecoins remain an effective way to earn competitive interest rates. Our research confirms that Nexo is the best option for USDT and USDC yields.

The licensed platform offers interest rates of up to 16%, and investors choose between fixed and flexible terms. Nexo also supports fiat payments, so first-time users can buy stablecoins with traditional money and earn yields right away.

FAQ

Can you earn yields on stablecoins?

Where is the best stablecoin yield platform?

Can I earn yield on USDC?

Where can you earn interest on USDT?

References

- Current Understanding of Impermanent Loss Risk in AMMs (Blockchain: Research and Applications, ScienceDirect)

- Crypto lending, borrowing, and staking (European Banking Authority)

- FDIC Clarifies Process for Banks to Engage in Crypto-Related Activities (Federal Deposit Insurance Corporation)

- Tether Reserves (Tether)

- Fact Sheet: President Donald J. Trump Signs GENIUS Act into Law (The White House)

- Widely-used stablecoins need to be regulated like money, BoE’s Bailey says (Reuters)

Coinspeaker in Numbers

Monthly Users

Articles & Guides

Research Hours

Authors

The team behind IPO Genie has not yet announced an end date for the presale.

AI cryptocurrencies combine blockchain with artificial intelligence to power decentralized machine learning networks, GPU computin...

Fact-Checked by:

Fact-Checked by:

21 mins

21 mins

Ibrahim Ajibade

, 373 postsI’m a research analyst with experience supporting Web3 startups and financial organizations through data-driven insights and strategic analysis. My goal is to help organizations make smarter decisions by bridging the gap between traditional finance and blockchain innovation.

With a background in Economics, I bring a solid understanding of market dynamics, financial systems, and the broader economic forces shaping the crypto industry. I’m currently pursuing a Master’s degree in Blockchain and Distributed Ledger Technologies at the University of Malta, where I’m expanding my expertise in decentralized systems, smart contracts, and real-world blockchain applications.

I’m especially interested in project evaluation, tokenomics, and ecosystem growth strategies, as these are areas where innovation can drive lasting impact. By combining my academic foundation with hands-on experience, I aim to provide meaningful insights that add value to both the financial and blockchain sectors.