AI cryptocurrencies combine blockchain with artificial intelligence to power decentralized machine learning networks, GPU computin...

Is Bitcoin Hyper a legitimate project? In this article we analyze its team, tokenomics, utility, audits, and more.

Bitcoin Hyper is an emerging Layer 2 solution designed to boost Bitcoin’s scalability and programmability. In other words, it uses tech like the Solana Virtual Machine (SVM) and zero-knowledge (ZK) rollups to improve Bitcoin’s speed, lower costs, and enable smart contracts.

It’s a relatively new crypto project that is still in its presale phase. Naturally, as an investor, you’d want to learn if it is a serious crypto project worthy of your time and money or just ambitious marketing copy that’s not going anywhere. In this post, we will explore what Bitcoin Hyper is, whether it’s legit, and how to buy it if you decide to dive in.

- First Bitcoin Layer 2 enabling fast, low-cost transactions

- Fixes Bitcoin’s speed and fee limitations with near real-time performance

- Enables a Bitcoin-native DeFi ecosystem

Is Bitcoin Hyper Legit? Key Takeaways

- Bitcoin Hyper uses Solana Virtual Machine (SVM) and zero-knowledge proofs for programmability and more efficient transaction batching.

- So far, the project has raised over $31.2M in its presale, indicating strong demand and investor interest.

- The project has undergone security audits, which boost its trustworthiness.

- The HYPER token facilitates gas fees, staking, and governance.

- The project’s team lacks transparency, and a minimum viable product (MVP) is not yet available.

Is Bitcoin Hyper Legit? Vital Questions to Ask

When evaluating a new crypto project like Bitcoin Hyper, it is important to ask the right questions about legitimacy, security, and long-term potential. Let’s take a look at the project fundamentals and the main aspects to consider.

Who Is Behind the Project?

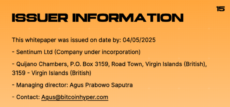

Bitcoin Hyper is developed by a company called Sentinum Ltd, registered in the British Virgin Islands. According to the project’s whitepaper, the managing director of the project is Agus Prabowo Saputra. The team claims experience in blockchain engineering, Web3 development, and cryptography.

While the official whitepaper and the website highlight the team’s expertise and experience, there is very limited independent verification of their past projects.

A strong team usually has a verifiable track record, but, as of now, public details about Sentinum’s past projects are sparse. Also, no other team members have been mentioned, so team transparency isn’t this project’s strong suit.

Bitcoin Hyper issuer information. Source: Bitcoin Hyper Whitepaper

Analysis: A project with a partially anonymous team isn’t necessarily a bad one. Remember, Bitcoin’s founder remains pseudonymous to this very day, and he created the first and most successful cryptocurrency worldwide. Countless other anonymous and semi-anonymous coins have performed well.

Still, transparency is a good sign for a new crypto project, so this isn’t ideal for Bitcoin Hyper.

How Reliable Are Bitcoin Hyper’s Tokenomics?

The HYPER token has a total supply of 21 billion tokens with the following allocation:

- 30% for development

- 25% for treasury

- 20% for marketing

- 15% for rewards

- 10% for listings

Bitcoin Hyper tokenomics. Source: Bitcoin Hyper

The presale is public and divided into multiple stages, with no private allocations or insider deals reported. Prices start at $0.0115 and increase per stage, all with the goal to reward early investors.

Staking is available immediately after the Token Generation Event (TGE), with rewards distributed over two years.

Analysis: The Bitcoin Hyper tokenomics are quite reliable. The allocation for this project favors development and marketing, which seems to be a good sign and somewhat of a standard for new projects.

The public presale and gradual staking model can reduce early market dumps, which can be a major problem for new projects.

While this is all positive, it is important to note that the project remains to be listed on major exchanges. This means that liquidity will likely depend on future listings.

Does Bitcoin Hyper Have Real-World Utility?

Bitcoin Hyper claims to solve Bitcoin’s speed, cost, and programmability limitations by introducing a Layer 2 network integrated with the SVM. Key utilities here include:

- Near-instant BTC transactions on Layer 2

- Smart contract execution and decentralized applications

- DeFi capabilities like staking, swaps, and lending

- NFT and gaming platforms

Analysis: While the proposed technology is promising, real-world adoption remains untested. This project is still in its early stages, which means that it can face integration and user adoption challenges in the future.

Still, a project with numerous utilities and real-world uses sounds like a promising and legitimate project.

Have Security Firms Audited Its Smart Contracts?

The official website mentions two safety audits by Spywolf and Coinsult, one of the most trusted auditing bodies for crypto projects. Neither firm found any issues of moderate or high risk. You can check out the audits from Coinsult and Spywolf yourself if you want to dive deeper.

Bitcoin Hyper ecosystem and safety audits. Source: Bitcoin Hyper

Analysis:

Audits are standard in reputable projects and provide confidence in contract safety and bug mitigation. Passing audits from two separate auditors is a great sign for the security of the smart contract.

However, because the project has not finished its full Layer 2 tech, it remains to be seen whether it is as secure as the token contract.

What Is Bitcoin Hyper and How Does It Work?

Bitcoin Hyper is a Layer 2 network that uses the Solana Virtual Machine to enable smart contract execution and facilitate decentralized applications (dApps), decentralized finance (DeFi), and non-fungible tokens (NFTs) on the Bitcoin network.

The core components of the Bitcoin Hyper ecosystem are:

- Solana Virtual Machine (SVM): Implements SVM to support high-speed smart contract execution.

- Zero-knowledge rollups (ZK-rollups): Batch transactions off-chain for vastly reduced costs and faster processing, while maintaining Bitcoin’s security.

- Canonical bridge: Allows users to wrap their BTC 1:1, enabling its use within the Layer 2 ecosystem and seamless withdrawal back to the Bitcoin blockchain.

- HYPER tokens: Serve multiple purposes, including transaction fees, staking rewards, and governance within the network.

What’s the Roadmap Progress?

Bitcoin Hyper’s roadmap is structured in five phases:

- Foundation (Q2 2025): Website, branding, community building, whitepaper release.

- Presale and staking (Q2-Q3 2025): Token presale, staking launch, first security audit.

- Mainnet launch (Q3 2025): Layer 2 deployment, Canonical Bridge activation, dApp support.

- Ecosystem expansion (Q4 2025): Developer toolkit, exchange listings, DeFi/NFT partnerships.

- Decentralization and governance (Q1 2026): DAO launch, node operator incentives, governance programs.

Analysis:

The project is in the presale phase, and it has raised over $31.2M, so the roadmap is going as planned so far. Still, there is a lot more to come, seeing how the project is in its early days now.

Bitcoin Hyper vs Its Competition

| Feature | Bitcoin Hyper | Lightning Network | Stacks | Ethereum Layer 2 |

| Layer 1 base | Bitcoin (BTC) | Bitcoin (BTC) | Bitcoin (BTC) | Ethereum (ETH) |

| Smart contract support | Yes, via modified Solana Virtual Machine (SVM) | Limited | Yes, through Proof-of-Transfer (PoX) | Yes, through rollups (e.g., Optimism, Arbitrum) |

| Transaction speed | Near-instant, sub-second latency | Sub-second | Moderate (due to PoX mechanism) | Fast (depending on rollup solution) |

| Transaction cost | Low (<$0.01) | Low | Low | Low to moderate (varies by rollup) |

| Security model | Anchored to Bitcoin’s security via Canonical Bridge | Secured by Bitcoin’s base layer | Secured by Bitcoin’s base layer via PoX | Secured by Ethereum’s base layer |

| Developer ecosystem | Emerging, with focus on DeFi, NFTs, and dApps | Mature, with extensive Lightning Network applications | Growing, with emphasis on Bitcoin integration | Extensive, with many dApps and protocols |

| Strengths | Combines Bitcoin’s security with Solana’s speed and Ethereum’s programmability | Proven scalability and adoption for microtransactions | Uses Bitcoin’s security for smart contract support and execution | Established developer tools and infrastructure |

| Weaknesses | New project and limited track record | Limited programmability and adoption for complex applications | Complex consensus mechanism and slower transaction finality | Centralization concerns and higher gas fees during congestion |

Red Flags in New Crypto Projects to Watch Out For

When you evaluate crypto presales or projects to invest in, it is important to look for the red flags that may indicate risks or, in some cases, even fraudulent activities. Here are some common warning signs you should consider:

- Anonymous or unverified teams: Little or no transparency regarding the team’s members and their backgrounds.

- Unclear or unrealistic roadmaps: Absence of a clear development timeline or promises of rapid returns without any substantiated plans.

- Aggressive marketing tactics: Overhyping the project through exaggerated claims and unrealistic projections.

- Lack of independent audits: Failure to undergo third-party security audits.

- Unverifiable endorsements and partnerships: Claims of endorsements and partnerships that cannot be independently verified.

- Unclear tokenomics: Lack of transparency regarding token distribution, utility, and/or incentives.

Conclusion: Is Bitcoin Hyper a Legit Project?

Bitcoin Hyper aims to enhance Bitcoin’s scalability and programmability, which is one of the most pressing issues in the crypto market. It has undergone audits by Coinsult and Spywolf without critical issues reported, which promotes transparency and security. Also, the project is engaged in marketing and community-building efforts, which indicates active development.

On the negative side, the development teams remain somewhat anonymous, except for the name mentioned for the director and the company. This raises some questions about accountability. The project also doesn’t have listings on major exchanges just yet, given that it is still in its presale stage. Going forward, this could affect accessibility and liquidity.

So, is Bitcoin Hyper legit? While the project presents quite an ambitious vision for enhancing the blockchain’s capabilities, it’s important for all investors to do their own research and approach new projects with caution. Carefully consider the risks involved, remain updated on developments related to Bitcoin Hyper (through its X and Telegram), and only invest what you can afford to lose.

Bitcoin Hyper Legit or Scam FAQ

What is Bitcoin Hyper (HYPER), and what does it claim to offer?

Who is behind Bitcoin Hyper, and is the team verifiable?

Does Bitcoin Hyper’s whitepaper make sense for the project?

Has Bitcoin Hyper’s smart contract or blockchain code been audited?

Are there any signs of a potential rug pull with Bitcoin Hyper?

How reliable is Bitcoin Hyper’s social media presence?

Does Bitcoin Hyper promise guaranteed profits or unrealistic returns?

References

- What is the Solana Virtual Machine (SVM) – CoinGecko

- What are Zero-Knowledge Rollups – Coinbase

- What Is a Canonical Bridge in Crypto – Messari.io

- What Is APY and How Is It Calculated – Investopedia

- Token Generation Event – Binance Academy

- Who Is Satoshi Nakamoto – Investopedia

- Layer 1 vs. Layer 2: The Difference Between Blockchain Scaling Solutions – Investopedia

- Blockchain Auditors: Why Poor Security Audits are a Million-Dollar Risk – Finextra

Coinspeaker in Numbers

Monthly Users

Articles & Guides

Research Hours

Authors

If you have been following VFX token, you probably noticed the same question popping up everywhere: when does Vortex FX token actu...

The VFX token is tied directly to Vortex FX, a regulated forex broker that’s already executing trades and publishing live trading ...

Fact-Checked by:

Fact-Checked by:

10 mins

10 mins

Nadica Metuleva

, 45 postsI’m a seasoned writer with over a decade of professional experience, specializing in crypto, technology, business, and iGaming. Over the years, I’ve built a reputation as a trusted contributor to well-known outlets such as InsideBitcoins, CEOTodayMagazine, and Promo, while also collaborating with leading content and marketing agencies including Skale and Boosta. My portfolio spans a wide range of content types, exchange reviews, how-to guides, long-form comparisons, trend analyses, and thought leadership pieces, crafted to both inform and engage readers across different levels of expertise.

In the crypto space, I’ve developed a deep understanding of blockchain technology, digital assets, and the fast-moving decentralized finance (DeFi) ecosystem. I’ve written extensively on topics such as cryptocurrency exchanges, wallets, tokenomics, NFTs, and global regulatory developments. As a crypto investor myself, I bring a valuable firsthand perspective that allows me to balance technical accuracy with practical insights that resonate with traders, investors, and newcomers alike. Whether I’m breaking down blockchain mechanics or analyzing the latest market shifts, my work combines rigorous research, industry knowledge, and a keen sense of storytelling.

My educational background plays a key role in shaping my writing approach. I hold a Bachelor’s degree in Translation and a Master’s degree in English Literature and Teaching, disciplines that sharpened my ability to research complex subjects, distill technical information into accessible language, and adapt my tone to diverse audiences. This strong academic foundation underpins my clear, insightful, and authoritative style.

Passionate about making complex topics accessible, my mission is to cut through the jargon and deliver content that empowers readers to make informed decisions.

You can learn more about me and explore my portfolio on LinkedIn.