LiquidChain is a Layer 3 blockchain project that wants to unify the liquidity of Bitcoin, Ethereum, and Solana into a single execu...

Lightchain AI promises a decentralized AI ecosystem with its AIVM virtual machine and its PoI consensus. But, is the project legit or just hype? We will break down audits, tokenomics, staking, and the roadmap, all to give you a clear and realistic assessment.

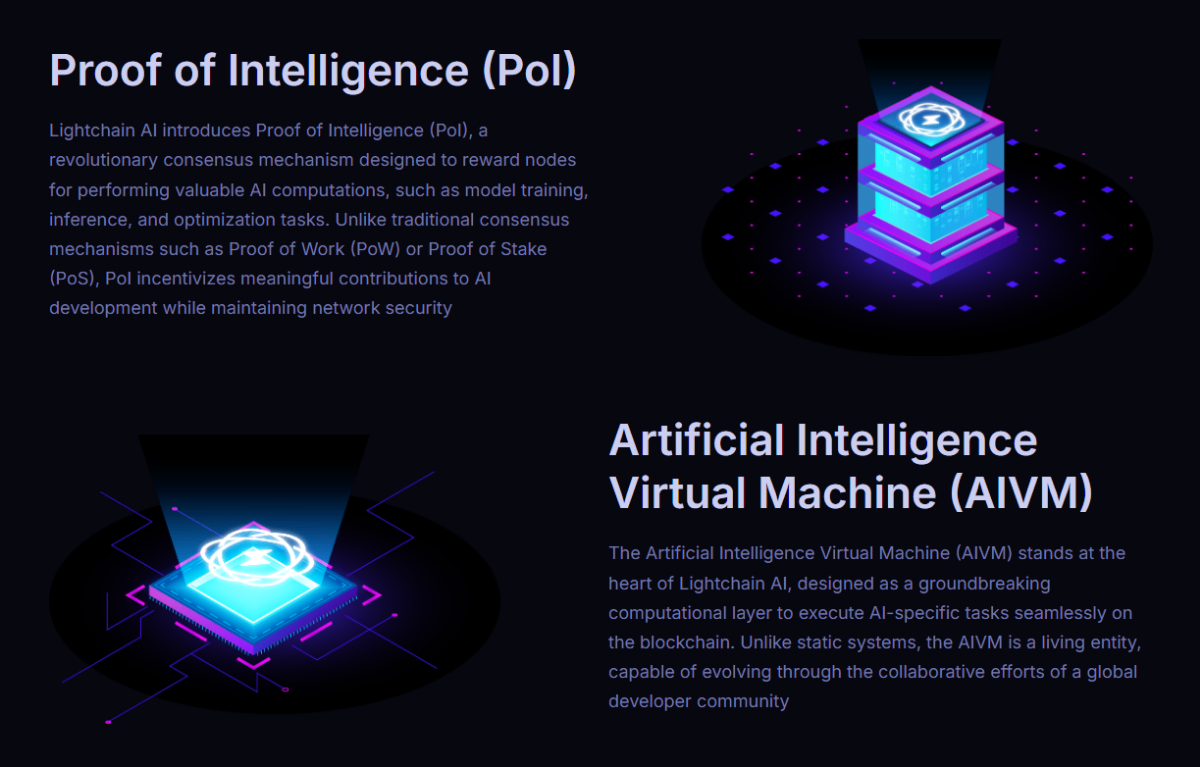

If you’ve been following the new projects on the crypto market, you’ve probably seen some chatter online about Lightchain AI, the so-called next-generation blockchain platform that mixes artificial intelligence with decentralized infrastructure. The pitch here sounds exciting. They are promising a Proof of Intelligence (PoI) consensus mechanism, an Artificial Intelligence Virtual Machine (AIVM), developer grants, and a full token ecosystem.

However, while its vision is bold, it will need much more than an interesting roadmap. The project’s presale has been a success, with it raising over $20 million and positioning itself as a major player in the new decentralized AI market. Still, a handful of important clues that warrant caution are cropping up. The full mainnet launch date remains vague, and many of the key metrics are still pending.

There are promising elements here, but the “legit” box hasn’t been fully checked at this point. In this post, we will tell you what Lightchain AI promises, what it actually achieved, and highlight the risks that still linger.

Featured Alternative – Editor’s Choice

- First Bitcoin Layer 2 enabling fast, low-cost transactions

- Fixes Bitcoin’s speed and fee limitations with near real-time performance

- Enables a Bitcoin-native DeFi ecosystem

Key Takeaways: Is Lightchain AI Legit?

- Team and transparency: The project provides some public information and a roadmap, but the team’s full credentials are not widely verified. Lack of high-profile advisors may raise caution.

- Tokenomics and sustainability: LCAI has a clear total supply, staking, and deflationary mechanisms. Token incentives are well-structured, but early-stage presales always carry risk and volatility.

- Project utility: Lightchain AI’s Pol consensus and AIVM offer genuine use cases beyond typical meme tokens. Still, real-world adoption remains untested.

- Security and audits: Smart contracts are audited, providing some reassurance. However, audits alone don’t eliminate governance or operational risks.

Factors to Explore to Determine if Lightchain Is Legit

In short, Lightchain AI shows some signals of legitimacy (published whitepaper, an ERC-20 contract that’s publicly verifiable, and presale money raised), but it also has meaningful gaps and inconsistencies.

These include limited public team transparency, some unresolved audit findings, mixed messaging regarding token utility, and, most importantly, numerous delays. This combination doesn’t scream “rug pull”, but it also doesn’t check every box a cautious investor would want. Let’s see what we explored to determine the legitimacy of this project.

Team Transparency

What we looked for:

Named founders, LinkedIn profiles, advisors, core developers, legal contacts, etc.

What we found:

- Lightchain AI’s site and documents present the project, whitepaper, roadmap, and developer resources. However, the marketing and docs do not prominently publish a clear, verifiable leadership team (founders + LinkedIn + verifiable corporate history). The official documentation focuses on protocol features, not personal biographies.

- Independent coverage and online sources repeatedly note the absence of verifiable team profiles as a red flag. Some sources, like CryptoWeekly, even tried to contact the support to get more information, but they never got it.

Analysis: Transparent teams are a baseline for accountability. A lack of verifiable identities doesn’t automatically mean that it’s a scam, since some legitimate teams simply prefer anonymity. However, this does raise the risk since there is no one to hold publicly accountable, and it is harder to validate claims.

Tokenomics and Sustainability

What we looked for:

Total supply, distribution, token utility consistency, burn mechanics, and inflation mechanics.

What we found:

- Official documents and token pages consistently list the token supply as 10,000,000,000 LCAI, as well as the presale mechanics (multiple presale stages, bonus round).

- The public presale reporting shows Lightchain raised about $20.9 million in presale rounds, which indicates the project has real funds to develop.

- We found a significant amount of messaging inconsistency here. Section 9.1 of the whitepaper states that LCAI functions exclusively as a governance token, without operational utility. However, the tokenomics page and other documentation describe the native token as being used for payments for AI tasks, staking for governance, premium features, and burn mechanisms.

Lightchain AI token utility explained. Source: Lightchain AI docs

Analysis: Conflicting statements about token utility change how you value the token and the economics. Also, token distribution details matter a lot for centralization risk. While documents mention allocations and growth funds, there is limited public line-item transparency. The exact percentages and vesting schedules should be clear in the documentation or the token contract metadata.

Utility of the Project

What we looked for:

Working testnet/mainnet, Artificial Intelligence Virtual Machine (AIVM) demos, Proof of Intelligence (PoI) examples, open-source code, etc.

What we found:

- The project published a whitepaper describing details about Pol, AIVM, federated learning, ZKPs, etc. This is detailed (and quite ambitious).

Lightchain AI PoI and AIVM explained. Source: Lightchain AI

- Lightchain runs a testnet/explorer, developer docs, and a grant program (with a $150k grants pool per their roadmap). These are all signals of development activity and community onboarding.

- The mainnet launch has been postponed to Q4 2025 in official announcements. This means that full production functionality is still pending. It is not unusual for such complex protocols, but it means that much of the “AIVM at scale” promises remain prospects rather than being proven.

Analysis: The combination of a testnet, lengthy documentation, and a hefty grant program shows active development. Still, until the mainnet, AIVM, and Pol are running in production with third-party integrations, the core product is still just a plan, not a reality.

Security and Audits

What we looked for:

Third-party audits, results, and unresolved findings, code verification.

What we found:

- Lightchain lists multiple audit reports (Cyberscope, SolidProof/SpyWolf references, and others). It also publishes audit reports and GitHub links, which is very positive.

- The token contract is publicly verified on Etherscan. This is an important transparency milestone.

- Independent display of the Cyberscope audit shows there were findings, and public records indicate six unresolved items were listed, including one critical issue.

Lightchain AI Cyberscope audit results. Source: Cyberscope

Analysis: Audits are necessary, but they aren’t enough to prove legitimacy. The content of findings matters, too. Unresolved security issues without clear remediation are real red flags. Also, a verified contract is a good sign, but the audit timeline and remediation history should also be visible.

Is the Project Generating Income?

What we looked for:

Revenues, partnerships, real usage, or just presale proceeds.

What we found:

- The clearest funding signal is the presale. Lightchain publicly reported raising over $20 million in the presale, and they opened a bonus round. This is real capital to run development and operations.

- As for operational revenue from third-party customers, we didn’t find any public evidence to suggest that the AIVM or Pol is yet generating any money. The project appears to be in developer/testnet/mainnet-ramp mode.

Analysis:

Presale funds show the ability to pay development teams and auditors. Recurring revenue from services or enterprise contracts would be a stronger legitimacy signal. This would show market demand rather than only investor interest.

Presale Progress and Structure Transparency

What we looked for:

Presale stages, caps, KYC, payout timing, and public reporting.

What we found:

- Presale structure (stages, bonus round pricing, soft/hard caps listed in public ICO entries) is all documented. The crypto calendar entries show dates and stage info, and the presale claimed to have concluded its planned stages and opened bonus rounds.

- In the public documentation on the website, the reporting on how presale funds are secured, allocated, or audited is quite limited.

Analysis: Presales can be legitimate fundraising. The best practice is to have clear escrow/multi-sig governance for funds and transparent spend policies.

Project’s Roadmap and Progress

What we looked for:

Milestones vs reality.

What we found:

The roadmap lists prototype (Nov 2024), testnet (Feb 2025), ecosystem growth (Mar 2025), mainnet planned, then later phases. The site shows the testnet and the docs are live, but the mainnet was postponed to Q4 2025 in the official announcement.

Analysis: A roadmap and a demonstrable testnet activity are good signs. Postponement is a bit worrisome, but it’s the norm for such complex systems. This is where frequency and transparency of updates matter. If the team explains the reasons and provides evidence of progress, this is legitimate project management. However, if the roadmap stops updating or the communication goes dark, that’s concerning.

Presale Legality and Ethical Considerations

What we looked for:

KYC, jurisdiction, and token sale compliance.

What we found:

Public materials reference the presale structure, the caps, as well as the participation rules. We didn’t find a clear regulatory disclosure on KYC/AML protections for presale participants. Also, legal disclosures about the issuer’s corporate registration or any regulatory compliance statements are not available in the project’s documentation.

Analysis: Presales operate in a complex regulatory environment. Lack of clear disclosures about KYC policy, tax/compliance frameworks, and the issuing legal entity raises potential legal risks for buyers.

Overall Risk Summary

| Stronger signals | Risks and red flags |

| Public whitepaper and detailed technical claims | Team anonymity / weak public team transparency |

| Live docs, developer portal, testnet explorer, and grants program | Audit findings with unresolved items, including one critical issue |

| Contract verified on Etherscan and public token/address data | Inconsistent messaging about token utility |

| Multiple audit reports are listed publicly | Limited public legal/ KYC disclosure about how presale funds are held |

How to Buy Lightchain AI Tokens

If you decided to invest in this project, here is a short guide on how you can buy the tokens:

-

- Set a compatible crypto wallet like MetaMask and TrustWallet on the Ethereum network.

- Fund your wallet with ETH (make sure to have some ETH for gas fees also)

- Visit the official presale platform and connect your secure crypto wallet.

- Choose your payment method, enter the amount you wish to spend, and review the number of LCAI tokens you will receive. Submit the transaction.

- Confirm in your wallet.

How Lightchain AI Compares to Other Presales

When we evaluate newer crypto presales like Lightchain AI, one helpful question to ask is: How does it compare to other presales in the same high-risk class?

By comparing the project with its competition, you can see whether it is above average in utility, progress, traction, and transparency, or whether it is lagging.

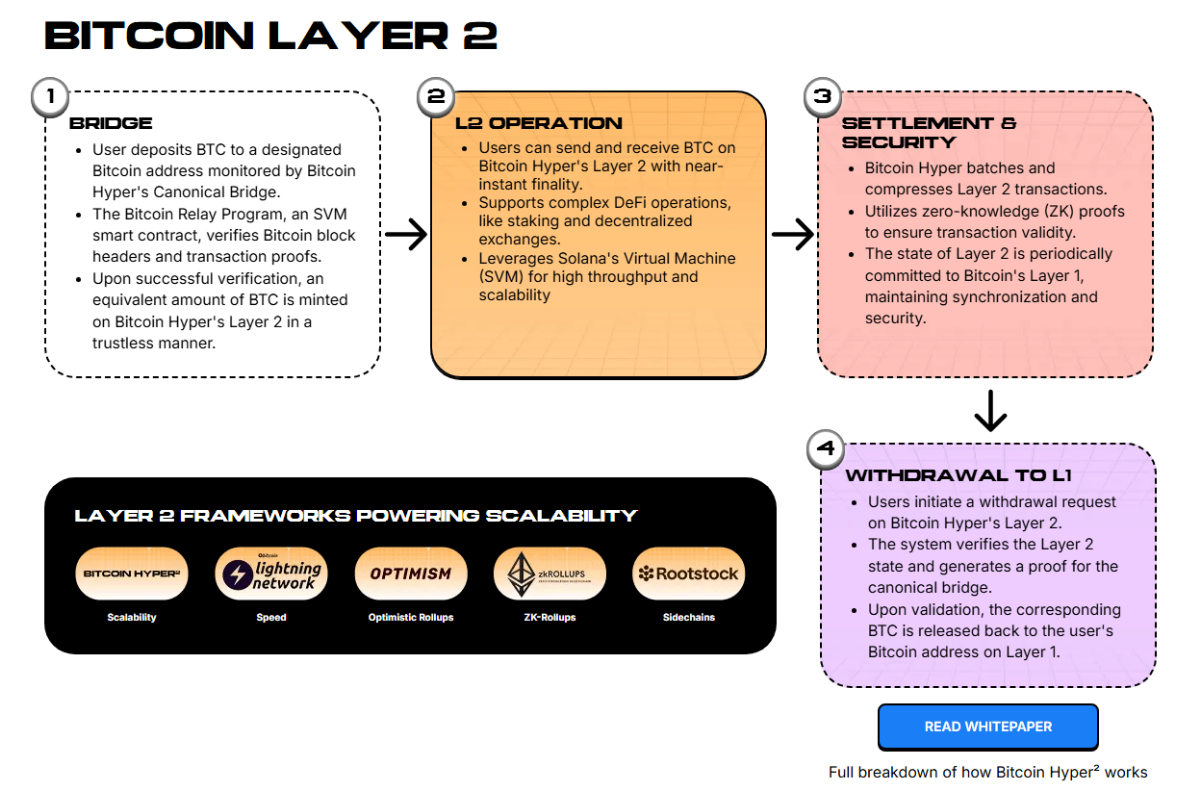

Bitcoin Hyper

Bitcoin Hyper is pitched as a Layer 2 solution for Bitcoin, aiming to bring smart contract capability and high throughput to the Bitcoin ecosystem via the Solana Virtual Machine (SVM). Its presale has pulled in substantial capital so far, with over $25 million raised.

Bitcoin Hyper Layer 2 network diagram. Source: Bitcoin Hyper

Compared to Lightchain AI, Hyper shows high fundraising traction and strong market momentum, both positive signals for investor interest. However, traction alone doesn’t guarantee execution. We still need to look at team transparency and actual product rollout.

If Lightchain AI can match or exceed Bitcoin Hyper on these fronts, it would look comparatively stronger. At present, Bitcoin Hyper appears more advanced in raising funds and marketing.

Maxi Doge

Maxi Doge is a meme-coin style presale project inspired by Dogecoin, aimed at community branding, staking, and high-yield rewards. It has raised over $1-2 million in its early presale rounds and is actively marketing high-staking APYs.

Maxi Doge homepage. Source: Maxi Doge

When compared to Lightchain AI, Maxi Doge appears to have less technological ambition. This likely means that the bar for success is lower, but the risk may also be higher in terms of a lack of deep utility. Still, Lightchain AI’s vision is much harder to accomplish, and there is a lot more execution risk.

Verdict: Is Lightchain AI Legit?

Based on our full analysis of the project, Lightchain AI appears to be an ambitious but still unproven project. It presents a polished version, merging blockchain with AI through innovations like PoI and the AIVM. Its roadmap and presale structure are clearly documented.

Still, the lack of public information about the core team and the unresolved critical issue found in its Cyberscope audit are both significant red flags. Also, the project’s income streams rely entirely on the yet-to-launch mainnet and token utility (which is also unclear).

In short, Lightchain AI looks more like an ambitious early-stage project than a scam, but it still needs to prove itself. With more technological progress and transparency, it could become a safer bet in the future.

As a potential investor, you should treat this as a high-risk, highly speculative project, at least until it delivers audited code and a functioning mainnet.

Featured Alternative – Editor’s Choice

- Degen meme coin inspired by max-leverage trading

- A tribute to high-risk hustle — fueled by sweat and conviction

- Ethereum-born, culture-driven, aiming for multichain

FAQ

Is Lightchain AI a scam?

How can I buy LCAI tokens?

How can I stake LCAI tokens?

How do I add LCAI to my wallet?

Can I earn through referrals?

References

- Proof of Importance (PoI) – Crypto.com

- What Are ERC-20 Tokens on the Ethereum Network – Investopedia

- Due Diligence Checklist to Unpack Legitimacy of Lightchain AI – CryptoWeekly

- What Is Token Burning – Coinbase

- Lightchain AI Opens Bonus Round Following $20.9M Raised Across 15 Presale Stages – Globenewswire

- Token Details and Tokenomics – Lightchain AI’s Whitepaper

- Mainnet Launch Announcement for Lightchain AI Community – Lightchain AI

- Audit of Lightchain AI – Cyberscope

- Hard Cap vs. Soft Cap – Tokenminds

Coinspeaker in Numbers

Monthly Users

Articles & Guides

Research Hours

Authors

The team behind IPO Genie has not yet announced an end date for the presale.

AI cryptocurrencies combine blockchain with artificial intelligence to power decentralized machine learning networks, GPU computin...

Fact-Checked by:

Fact-Checked by:

13 mins

13 mins

Nadica Metuleva

, 47 postsI’m a seasoned writer with over a decade of professional experience, specializing in crypto, technology, business, and iGaming. Over the years, I’ve built a reputation as a trusted contributor to well-known outlets such as InsideBitcoins, CEOTodayMagazine, and Promo, while also collaborating with leading content and marketing agencies including Skale and Boosta. My portfolio spans a wide range of content types, exchange reviews, how-to guides, long-form comparisons, trend analyses, and thought leadership pieces, crafted to both inform and engage readers across different levels of expertise.

In the crypto space, I’ve developed a deep understanding of blockchain technology, digital assets, and the fast-moving decentralized finance (DeFi) ecosystem. I’ve written extensively on topics such as cryptocurrency exchanges, wallets, tokenomics, NFTs, and global regulatory developments. As a crypto investor myself, I bring a valuable firsthand perspective that allows me to balance technical accuracy with practical insights that resonate with traders, investors, and newcomers alike. Whether I’m breaking down blockchain mechanics or analyzing the latest market shifts, my work combines rigorous research, industry knowledge, and a keen sense of storytelling.

My educational background plays a key role in shaping my writing approach. I hold a Bachelor’s degree in Translation and a Master’s degree in English Literature and Teaching, disciplines that sharpened my ability to research complex subjects, distill technical information into accessible language, and adapt my tone to diverse audiences. This strong academic foundation underpins my clear, insightful, and authoritative style.

Passionate about making complex topics accessible, my mission is to cut through the jargon and deliver content that empowers readers to make informed decisions.

You can learn more about me and explore my portfolio on LinkedIn.