LiquidChain is a Layer 3 blockchain project that wants to unify the liquidity of Bitcoin, Ethereum, and Solana into a single execu...

Driven by its presale success and social media hype, Ozak AI (OZ) is drawing a remarkable amount of attention from crypto media outlets and retail investors.

The buzz around it has been impossible to ignore lately. The project has already sold nearly a billion tokens in its presale, raising over $3.4 million.

Ozak AI pitches itself as a predictive AI platform for financial markets, complete with real-time analytics and decentralized physical infrastructure networks. This mix of hype and tech talk is what fuels the price speculations, but few investors have analyzed the project closely enough to determine if it’s the real deal or not.

The question here is: Can OZ really climb from its current presale price of $0.012 toward a $1 price target?

Featured Alternative – Editor’s Choice

- First Bitcoin Layer 2 enabling fast, low-cost transactions

- Fixes Bitcoin’s speed and fee limitations with near real-time performance

- Enables a Bitcoin-native DeFi ecosystem

Key Takeaways: Ozak AI Token Price Forecast

- Presale momentum is strong: $3.4 million raised with nearly 1 billion tokens sold.

- Short-term (2026) realistic range $0.03-$0.05, with a bullish case up to $0.15 if adoption and hype align perfectly.

- Long-term (2030) realistic baseline $0.50-$1.50, with a bullish case up to $5 if it becomes a recognized player.

- Supply unlocks and vesting schedules could create downward pressure after launch.

- Real demand for Prediction Agents, analytics feeds, and staking will decide whether OZ sustains value or fades post-hype.

- This is a high-risk crypto that could see rapid gains, but sharp corrections are equally possible.

Ozak AI Price Prediction 2026-2030

Predicting the future price of any asset is tricky at best, especially when it comes to new tokens. Ozak AI is still in presale, which means its success depends on how it performs once it is listed publicly and whether the team can deliver on its promises. Below, we will walk you through what OZ might look like in 2026, 2027, and 2030, with a realistic and bullish scenario for each.

2026 ($0.03-$0.05)

Base Case:

Given OZ is currently in presale at $0.012, a likely first step is listing and initial volatility. In a modest growth scenario, OZ might rise to $0.03-$0.05 by the end of 2026. That would depend on decent adoption, initial utility rollout, and positive sentiment. We should also expect some pullbacks, given token unlocks and profit-taking. Many, if not most, presale projects dip right after the Token Generation Event (TGE).

Bullish Scenario:

If Ozak Ai manages to deliver working prediction agents, attract real users, and get visibility in AI and crypto circles, then it might reach $0.10-$0.15 in 2026. This would require strong marketing and few regulatory or technical setbacks.

2027 ($0.20-$0.40)

Base Case:

By 2027, assuming everything has gone to plan, the project should be more mature and have more users, more stable infrastructure, improved data access, and better models. In a realistic scenario, the OZ token might trade in the $0.20-$0.40 range, perhaps averaging around $0.25-$0.30, barring major disruptions. Token utilities like staking, data fees, and rewards might generate more demand, helping support this level.

Bullish Scenario:

If Ozak Ai becomes a reputable name in AI-blockchain and captures a nontrivial share of predictive analytics demand, it could hit $0.60-%1+ by 2027. This assumes strong partnerships, solid adoption, and that the AI and crypto macro trends remain strong.

2030 ($0.50-$1)

Base Case:

By 2030, many of the early risks, like infrastructure and bugs, should be resolved, provided that the project survives. A conservative baseline might place OZ in the $0.50-$1 zone, possibly edging toward $1.20-$1.50 under favorable growth. At this point, token utility (charging for analytics, rewarding nodes, and staking yield) will be critical to keep demand.

Bullish Scenario:

In the very bullish case, in which Ozak AI has become a go-to predictive platform in crypto, equities, and forex markets, the token could surpass $2-$5 or even more. This, of course, depends on network effects, a sizable technical moat, and sustained sector growth.

What Is Ozak AI?

Ozak AI claims to be building a predictive analytics platform designed for financial markets, with tools for real-time analytics, forecasting, and decentralized infrastructure.

It relies on established models such as ARIMA (Autoregressive Integrated Moving Average), linear regression, and neural networks. The goal is to forecast outcomes in crypto, equities, and forex markets. Here is how this works:

- Neural networks handle pattern recognition across large datasets.

- ARIMA focuses on time-series forecasting, looking at past prices to project future prices.

- Linear regression maps relationships between different financial variables, like asset prices and interest rates.

The idea is that, by combining these methods with real-time data streams, Ozak AI could give investors better and more accurate market predictions. It’s important to note here that we don’t know whether these models will work as Ozak has suggested or even whether they will ever finish building the tech. Investing before it proves that its tech works is especially risky.

The Ozak Stream Network (OSN)

The project highlights the Ozak Streaming Network (OSN) as its backbone. This system is built to collect and process live financial data at scale. According to the project’s whitepaper, it uses tools like Apache Kafka for data streaming and Apache Flink for event processing.

The goal here is low-latency analytics, which means that traders and analysts get insights as fast as possible, not hours later. In financial markets, speed often makes the difference between profit and loss, and this is especially true in the crypto world.

Decentralized Infrastructure (DePIN)

Ozak AI also leans heavily on the concept of Decentralized Physical Infrastructure Networks (DePIN). Instead of relying on centralized servers, they plan to use a network of nodes for:

- AI computation (nodes with GPUs handling heavy inference tasks)

- Data storage (encrypted vaults for financial datasets)

- Data relay (nodes that bring in both on-chain and off-chain information)

This setup is meant to make the system more secure, censorship-resistant, and scalable.

Prediction Agents (PAs)

Ozak AI is also working on what it calls Prediction Agents. These are customizable AI models that users can train to assist them with their financial strategies. They can be tailored for short-term trading signals, long-term portfolio management, or risk assessments for specific assets.

In practice, these agents could help traders without extensive coding knowledge create their own forecasting tools.

Token Utility: The Role of OZ

Ozak AI runs on its native token, OZ, with a fixed supply of 10 billion tokens. The OZ token is designed to be more than a speculative asset:

- Access: use it to pay fees to unlock Prediction Agents and premium analytics.

- Staking: earn yield by locking up tokens.

- Rewards: contributors with high-accuracy models get rewarded in OZ.

- Data vaults: OZ is required to store and access financial datasets.

- Referral system: presale buyers can earn a 10% bonus for referring new participants.

Ozak AI token utility. Source: Ozak AI

Right now, OZ is in presale at $0.012, with the next phase at $0.014, and an advertised target price of $1.

Ozak AI presale homepage. Source: Ozak AI

Why Are Investors Watching Ozak AI?

With an endless flood of new tokens launching every day, why is the Ozak AI presale pulling so much attention? A few reasons stand out here:

Strong presale numbers

Nearly 918 million tokens sold and over $3.4 million raised suggest there is already an appetite for the Ozak prediction agent. Early momentum often sets the tone for how a token performs when it lists on exchanges.

AI + blockchain narrative

Ever since projects like Render and SingularityNET showed how AI-linked tokens can surge in hype cycles, investors have been looking for the next one. Ozak AI is leaning heavily into this theme with its advanced data analytics platform.

Staking and rewards

The project promises staking yields for holders, as well as performance-based rewards for users who build accurate prediction models. This adds a layer of passive income potential on top of speculation.

Utility beyond trading

OZ is tied to access for Prediction Agents, real-time data feeds, and data vaults. If these tools function correctly and gain widespread adoption, token demand could come from actual usage, not just hype.

Referral incentives

With a 10% referral bonus in place, Ozak AI is also leaning on network effects to grow its base of early holders.

Audits and security

The team lists completed audits from CertiK and Sherlock, which can give early investors more confidence in the project’s smart contracts.

Ozak AI audits. Source: Ozak AI

What Can Drive Ozak AI’s Price Higher?

Several factors could support OZ moving beyond its presale price once it hits exchanges.

The first factor to watch is a successful launch and listing spree. Listings on major platforms like CoinGecko and CoinMarketCap are already confirmed, but exchange listings could play a major role in the coin’s liquidity and visibility.

The second is the adoption of prediction agents. If traders actually use Ozak’s Prediction Agents and the Streaming Network, it could create a consistent demand for OZ tokens.

Next, we have staking and performance rewards. Offering staking yields and rewards for accurate models could incentivize long-term holding and reduce sell pressure. This often isn’t enough to keep a token afloat by itself, but it can be a strong incentive for some investors.

The intersection of the AI and blockchain sectors has been one of the hottest topics in crypto for over two years. If that trend continues into 2026, Ozak could ride the wave, similar to how Render and SingularityNET benefitted from the hype. A strong AI narrative can make all the difference here.

Our Methodology – How We Created This Ozak AI Price Prediction

Price predictions are largely speculative but our aim here is to base them on the project’s fundamental pros and cons to make them as realistic as possible. To do this, we look at several concrete factors before we put forward any numbers.

Presale Structure and Tokenomics (25%)

First, we analyzed the project’s tokenomics. Ozak AI has a total supply of 10 billion OZ, with 30% allocated to the presale, and another 30% to ecosystem and community incentives. Knowing how much is locked, vested, and reserved helps us estimate the potential supply shocks once the tokens unlock.

Ozak AI tokenomics diagram. Source: Ozak AI

Market Sentiment and Hype Cycles (25%)

Nearly 918 million tokens have already been sold, raising $3.4 million in presale funds. This shows strong momentum, but we also compare it with other AI-themed projects that launched during bull runs. For example, Render (RNDR) shot up sharply during the AI hype wave, but then corrected just as quickly. Similarly, SingularityNET (AGIX) saw major gains when AI tokens were trending, and then settled into a lower range.

Utility and Adoption Potential (25%)

Ozak AI isn’t just about speculation (though it is absolutely a factor, like every other crypto). It promises real products like Prediction Agents and the Ozak Stream Network (OSN). We factor in whether these features could actually drive token demand versus being just marketing buzzwords.

Macro and Sector Trends (15%)

AI-related tokens have been among the top gainers in the past year. Projects like Render and Fetch.ai (FET) saw big rallies during the hype cycle. We use those benchmarks to frame what kind of upside OZ might realistically capture.

Risk Adjustments (10%)

Even with audits by CertiK and Sherlock, we don’t ignore the red flags like the heavy reliance on presale funding or the possibility of sharp post-listing dumps. These risks are also included in our scenarios.

Risks from Investing in Ozak AI

As with any new presale project, there are serious risks that we, as crypto analysts, as well as you, as investors, should consider:

| Post-presale sell pressure | With 10% unlocked at listing and linear vesting over six months, early investors or team allocations could trigger big sell-offs once tokens hit the market. |

| Delivery risk | Building a scalable predictive AI system with decentralized infrastructure is technically complex. If Ozak fails to deliver, utility may never materialize. |

| Overstated partnerships | The project lists collaborations with various companies, but not all of them may be substantial. Inflated claims can undermine trust. |

| Regulatory uncertainty | Tokens sold through presales often face scrutiny from regulators if they resemble unregistered securities. |

How to Buy Ozak AI Tokens

If you decide to get into the Ozak AI presale, the process is pretty straightforward.

First, you need to head to the official website. It’s often best to bookmark it to avoid scams. Presales attract phishing sites, so make sure you are on the real one.

Next, connect your wallet. Click “Connect Wallet” and choose from options like MetaMask, Coinbase Wallet, or another WalletConnect-compatible wallet like Best Wallet. Make sure your wallet is funded and connected to the Ethereum network.

Once your wallet is connected, choose your payment method. Select whether you want to pay with ETH, USDT, or USDC. Enter the amount you wish to buy, or hit “Max” if you want to use your full balance. Make sure to keep at least a small amount of ETH aside to cover gas fees.

Once you’re done, you can confirm the transaction. Your wallet will prompt you to approve. Once it goes through, your purchase is complete.

Note: During the presale, purchased tokens won’t immediately show up in your wallet. After the Token Generation Event (TGE), you can claim your OZ directly from the presale dashboard.

Other Top Presales to Consider in 2026

To better estimate what the price of Ozak AI will look like in the near future, it helps to frame it against other trending presales. Let’s take a look at a few.

Maxi Doge (MAXI)

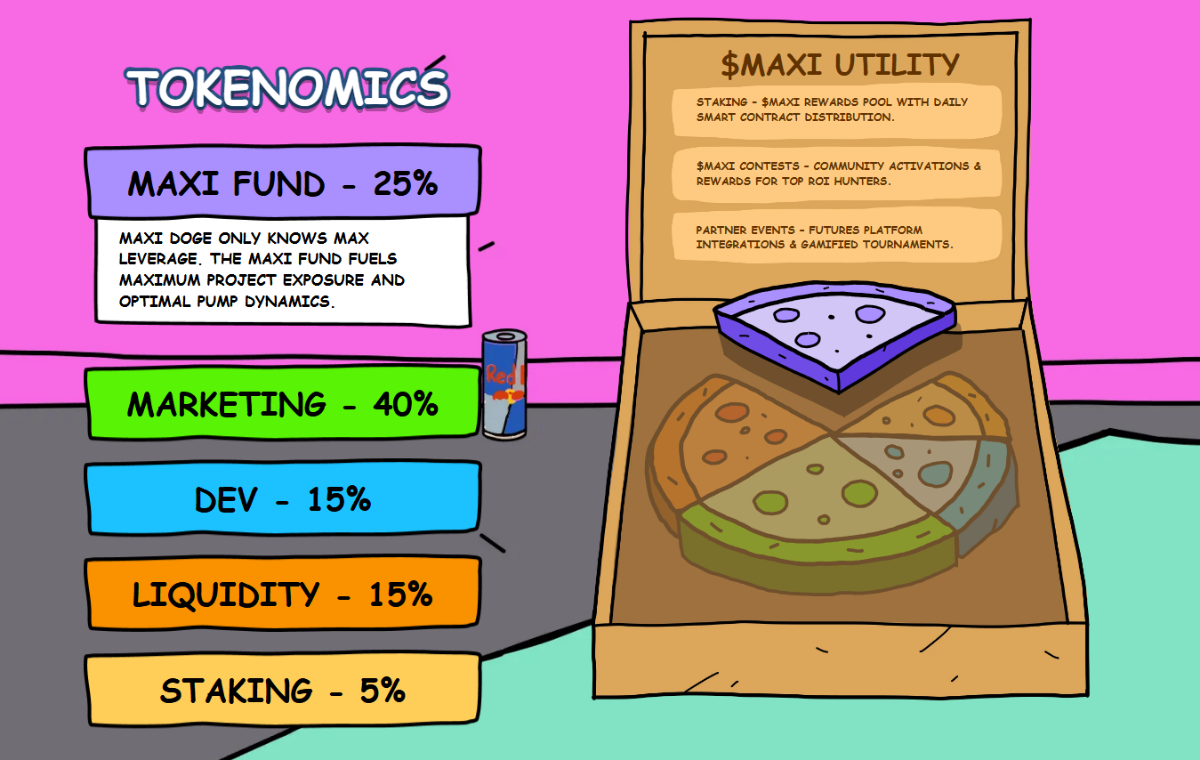

Maxi Doge is a meme-coin presale that is aggressively leaning into style and community energy. It launched around $0.00025 and its presale has already raised over $1.5+ million in early funding. The presale has many stages, with price increases in each stage. They also offer staking rewards for holders during presale, which makes the token more attractive for speculative holders.

Maxi Doge ($MAXI) tokenomics. Source: Maxi Doge

Maxi Doge is more about hype, meme branding, and community momentum. In contrast, Ozak’s forecast is more dependent on the adoption of AI and data protocols. In Ozak’s case, forecasts are more tied to whether its tech and use cases actually get traction.

Bitcoin Hyper (HYPER)

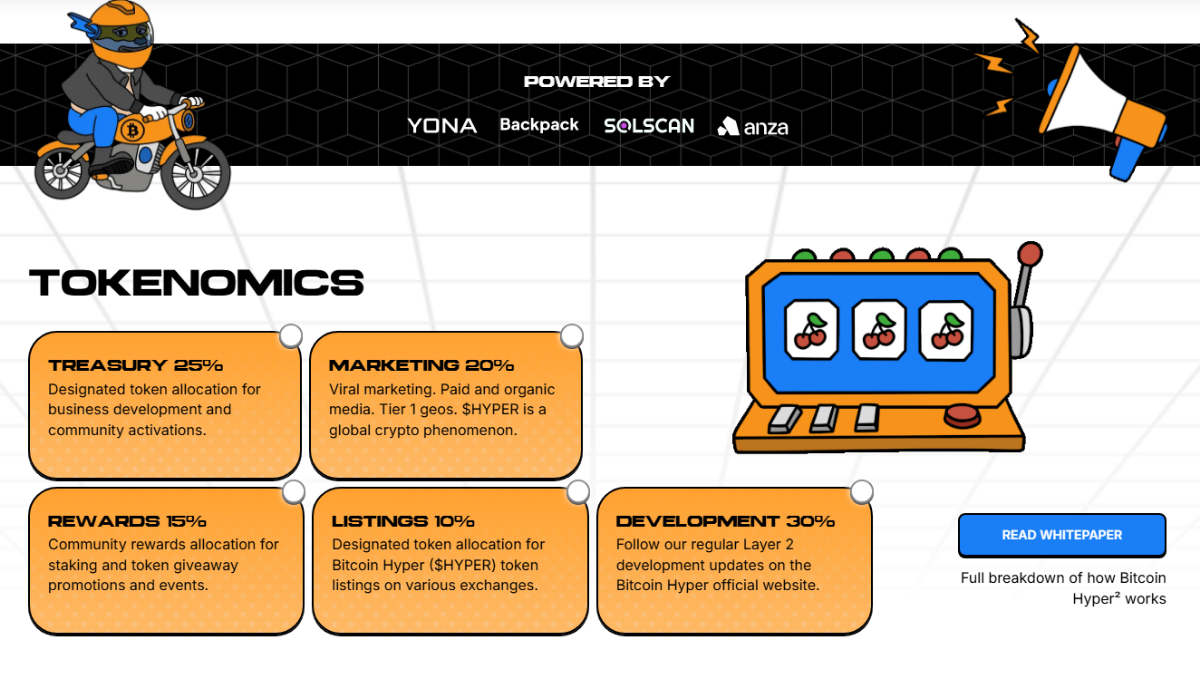

Bitcoin Hyper is a Layer 2 solution for Bitcoin, bringing smart contracts, low fees, and faster transactions into the major BTC ecosystem. The team is harnessing a custom implementation of the Solana Virtual Machine (SVM) to combine the scalability and utility of Solana with the security of Bitcoin.

The project has already raised over $24.4 million in its presale so far, building momentum and buzz with each stage. It uses a dynamic pricing model where each presale stage increases the token price, rewarding early participants. HYPER also has strong tokenomics, allocating a large portion of the supply to build out and reward its community with staking rewards, viral marketing, token giveaways, and other events.

Bitcoin Hyper tokenomics. Source: Bitcoin Hyper

While Ozak AI blends AI, data, and DePIN with predictive modeling, Bitcoin Hyper is more pure infrastructure. Hyper has a clearer layer utility narrative, and its large presale numbers help validate the interest in infrastructure plays. Bitcoin Hyper’s success can be a useful comparison point to help determine whether Ozak AI’s presale strength is real or just hype.

Conclusion: Is Ozak AI a Good Investment

OzakAI has a lot going for it: a clear use case around predictive analytics, an ambitious infrastructure design, and a strong presale momentum. Features like staking, performance-based rewards, and access to AI-driven tools add some genuine utility beyond speculation. This is more than many presale tokens can claim.

That said, the risks are just as clear. Delivering a functional and scalable AI blockchain platform is extraordinarily technically complex and far from guaranteed. The vesting schedule also means early sell pressure is almost certain. The heavy reliance on hype and bonuses could make OZ vulnerable to sharp corrections once it lists.

So, is this a good investment? The answer is – it depends on your outlook on the project, risk tolerance, and whether you trust the team to follow through with its promises. If you are a speculative investor comfortable with high volatility and looking for exposure to AI coins, it could be an interesting (albeit bold) bet for you. If you are a cautious, long-term investor, you may want to find another more established coin. Ozak AI is undoubtedly a high-risk, high-reward play and not a guaranteed winner.

FAQ

When will I receive my OZ tokens?

Do I need to complete KYC to buy OZ?

Which tokens can I use to buy OZ?

What is the vesting schedule?

Is Ozak AI audited?

References

- Could the Render Token Make You a Millionaire – Yahoo Finance

- What Is a Token Audit, and Why Should You Care About It? – Auditone

- Bullish in Crypto: Definition and Meaning – TokenMetrics

- What Is Volatility in Crypto – Coinbase

- ARIMA: Your Guide to Time Series Forecasting – Investopedia

- What Is Linear Regression – IBM

- Decentralized Physical Infrastructure Network Explained – Cointelegraph

- Ozak AI Whitepaper – OzakAI

- What Is Apache Kafka – Confluent

- What Are Gas Fees – Web3Labs

Coinspeaker in Numbers

Monthly Users

Articles & Guides

Research Hours

Authors

The team behind IPO Genie has not yet announced an end date for the presale.

AI cryptocurrencies combine blockchain with artificial intelligence to power decentralized machine learning networks, GPU computin...

fact-Checked by:

fact-Checked by:

15 mins

15 mins

Nadica Metuleva

, 47 postsI’m a seasoned writer with over a decade of professional experience, specializing in crypto, technology, business, and iGaming. Over the years, I’ve built a reputation as a trusted contributor to well-known outlets such as InsideBitcoins, CEOTodayMagazine, and Promo, while also collaborating with leading content and marketing agencies including Skale and Boosta. My portfolio spans a wide range of content types, exchange reviews, how-to guides, long-form comparisons, trend analyses, and thought leadership pieces, crafted to both inform and engage readers across different levels of expertise.

In the crypto space, I’ve developed a deep understanding of blockchain technology, digital assets, and the fast-moving decentralized finance (DeFi) ecosystem. I’ve written extensively on topics such as cryptocurrency exchanges, wallets, tokenomics, NFTs, and global regulatory developments. As a crypto investor myself, I bring a valuable firsthand perspective that allows me to balance technical accuracy with practical insights that resonate with traders, investors, and newcomers alike. Whether I’m breaking down blockchain mechanics or analyzing the latest market shifts, my work combines rigorous research, industry knowledge, and a keen sense of storytelling.

My educational background plays a key role in shaping my writing approach. I hold a Bachelor’s degree in Translation and a Master’s degree in English Literature and Teaching, disciplines that sharpened my ability to research complex subjects, distill technical information into accessible language, and adapt my tone to diverse audiences. This strong academic foundation underpins my clear, insightful, and authoritative style.

Passionate about making complex topics accessible, my mission is to cut through the jargon and deliver content that empowers readers to make informed decisions.

You can learn more about me and explore my portfolio on LinkedIn.