VerifiedX (VFX) has officially launched, offering a Bitcoin-inspired decentralized network with unique on-chain features. Learn wh...

VerifiedX (VFX) has officially launched, offering a Bitcoin-inspired decentralized network with unique on-chain features. Learn where to buy it, upcoming roadmap updates, and what investors should watch for.

VerifiedX (VFX) has been building something rather ambitious: a decentralized network designed to make self-custody, peer-to-peer commerce, and tokenized assets more usable for everyday people. This is an open-source blockchain that works as a universal layer 1 and a Bitcoin-specific sidechain. It is built with the same core principles that made Bitcoin trustworthy: security and independence. On top of that, it adds real on-chain features that go beyond simple value transfer.

There is currently on single launch date that flips everything on at once. VerifiedX has been rolling out components throughout 2025 and into 2026. Its mainnet wallet (SwitchBlade) with native Bitcoin utility is already live. Future milestones like decentralized smart contract releases and privacy upgrades are mapped out through 2026. Let’s see what this means in terms of its launch.

VFX Launch and Live Features

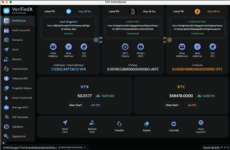

VerifiedX is not a concept-stage or pre-build project. The network is already live and operating in several important ways. We can see this from:

- The live blockchain with the latest block number, block time (10 seconds), total transactions, burned fees, circulating supply, and active validators.

- A working non-custodial crypto wallet (Switchblade) available on Mac, Windows, web, and CLI.

VFX non-custodial crypto wallet. Source: VerifiedX

- Native support for both VFX and BTC, including tokenized Bitcoin (vBTC) with native deposits and withdrawals (settling on the Bitcoin network).

- Functional features like vault accounts, token minting, domains, on-chain media, and P2P auctions.

- A live validator set with 100 active validators and on-chain governance is already enabled.

Based on all of this, VFX has already launched at a network level. This is not exactly a “launch coming soon” blockchain. It is already running, being validated, and used.

VerifiedX’s mainnet non-custodial wallet has already been released. This launched publicly around January 10, 2025, enabling users to use Bitcoin features and VFX functionality directly in the wallet.

VFX homepage. Source: VerifiedX

VFX Token Is Already Trading Publicly

The VFX token is actively listed and trading on multiple centralized exchanges, with BitMart being the most prominent place where VFX/USDT is traded. On top of this, market data sites like CoinGecko list VFX with live price feeds and confirmed trading volume. This means that the token isn’t just theoretical, but it is actually live in the market.

VFX/USD price chart. Source: CoinGecko

What Has Happened So Far

Here is what has already happened with the VFX project so far:

The VerifiedX mainnet is live

Blocks are being produced.

Transactions are happening.

Fees are being burned, reinforcing the deflationary model.

Core user infrastructure is live

The Switchblade wallet exists and supports advanced features

Users can self-custody VFX and BTC

On-chain assets, domains, and vaults are functional.

Governance is active

Validators participate via one CPU-one vote.

Governance rights are the incentive, not block rewards.

No lockups are required for validation.

Bitcoin integration is already implemented

vBTC exists with a 1:1 peg.

Deposits and withdrawals settle on Bitcoin natively.

BTC functionality is already usable, not theoretical.

This places VerifiedX in a post-launch, pre-expansion phase.

What the Roadmap Tells Us about What’s Next

Instead of announcing a launch, the roadmap is about deepening capabilities. The project’s roadmap reinforces the fact that VFX has already launched, and what’s coming next are capability upgrades.

The end of 2025 brought on some key developments: a token unlocking schedule, the release of Butterfly (a P2P social payment and yield application), and a bug bounty program.

Moving into Q1 2026, the project has announced its plans to introduce a privacy layer and quantum-resistant addresses, along with advanced P2P smart contracts that enable decentralized lending and borrowing.

The mid-year updates in Q2 and Q3 should bring an AI-powered smart contract writer, a mainnet upgrade, and a smart order routing system.

| Completed | Planned (Roadmap) |

| Foundation network live | Privacy layer and quantum-resistant addresses |

| SwitchBlade wallet released | Advanced smart contracts and P2P borrowing/lending |

| Exchange trading enabled | AI smart contract writer |

| Merkle Science integration | Mainnet upgrades |

| Crypto.com Pay on-ramp integration | Smart order routing system |

What VFX’s Progress Tells Us

VerifiedX has moved beyond its initial launch and presale phase. The token is live and trading on major exchanges like BitMart. It has also already delivered key infrastructure, such as the SwitchBlade wallet and compliance integrations. The price growth shows great market interest. The roadmap shows that the focus now is no deepening capabilities, rather than launching the network itself.

Looking ahead, VFX is gearing up for more advanced features like AI-driven smart contracts and quantum-resistant addresses. If you are tracking the project, the message here is clear. VerifiedX is evolving steadily and not rushing toward hype.

Still, it is important to note that the project is a highly volatile one, which creates substantial risk for investors.

FAQ

Has VerifiedX launched yet?

What do the VerifiedX upcoming features include?

Where can I buy VFX?

Has the VFX token price grown?

What has VerifiedX achieved so far?

References

- VerifiedX Releases VFX SwitchBlade Wallet Featuring First-Mover Bitcoin Utility at BitMart – PRNewswire

- What Is Block Time in Blockchain? A Complete Guide – Nervos

- What Is Token Minting in Crypto – 101blockchains

- Custodial vs. Non-Custodial Wallets: What’s the Difference – Crypto

- The Key Differences between Inflationary and Deflationary Cryptocurrency – OSL

- VerifiedX Foundation Unveils Butterfly, a Self-Custodial P2P Payment Platform – Phemex

Coinspeaker in Numbers

Monthly Users

Articles & Guides

Research Hours

Authors

BMIC doesn't have a fixed presale end date yet. The team said they want to keep things flexible and let demand dictate when it wra...

In this guide, we break down the LiquidChain presale timeline, including stage deadlines, token generation event (TGE) expectation...

Fact-Checked by:

Fact-Checked by:

6 mins

6 mins

Ibrahim Ajibade

, 371 postsI’m a research analyst with experience supporting Web3 startups and financial organizations through data-driven insights and strategic analysis. My goal is to help organizations make smarter decisions by bridging the gap between traditional finance and blockchain innovation.

With a background in Economics, I bring a solid understanding of market dynamics, financial systems, and the broader economic forces shaping the crypto industry. I’m currently pursuing a Master’s degree in Blockchain and Distributed Ledger Technologies at the University of Malta, where I’m expanding my expertise in decentralized systems, smart contracts, and real-world blockchain applications.

I’m especially interested in project evaluation, tokenomics, and ecosystem growth strategies, as these are areas where innovation can drive lasting impact. By combining my academic foundation with hands-on experience, I aim to provide meaningful insights that add value to both the financial and blockchain sectors.