Based on our research, the best short-term cryptocurrencies to buy have deep liquidity, high volatility, and sustained positive ma...

Is WEEX the right exchange for you? Learn more about the WEEX exchange and how it compares in fees, markets, safety, features, and more.

WEEX is an established cryptocurrency exchange that suits a wide range of investors. Platform users can buy digital assets instantly with local money, trade them via spot exchange markets, or speculate on leveraged perpetual futures. Our WEEX exchange review reveals everything traders need to know.

For this review, we opened a WEEX account and traded hundreds of markets with real capital. Read on for our findings on WEEX’s diverse asset library, which includes over 1,700 popular cryptocurrencies, and discover the exchange’s safety record, fee structure, KYC requirements, and other important factors.

WEEX Exchange Review: Key Points You Need to Know

WEEX is a cryptocurrency exchange that provides access to a huge range of crypto markets. Users can trade over 1,700 coins and tokens on the spot exchange or via perpetual futures. Derivative products invite substantial leverage multipliers of up to 400x. Additional investment tools include copy trading, simulated markets, and instant USDT purchases with fiat money.

While the exchange also offers a peer-to-peer feature, this is limited to Russian and Vietnamese traders. A major advantage is the no-KYC process, which allows users to trade anonymously and withdraw up to 10,000 USDT daily. WEEX, which boasts excellent reviews from existing users, approves withdrawal requests in 15–30 minutes.

- Since WEEX lists over 1,700 markets across spot and futures trading, users build diversified portfolios from one account.

- Its diverse derivatives exchange lets users amplify their position sizes by up to 400x and trade in both market directions.

- Although WEEX lacks Tier 1 regulation like Coinbase and Kraken, this setup allows the exchange to offer trading accounts without KYC verification.

- WEEX has a robust security framework that includes strong proof of reserves and a 1,000 BTC insurance fund.

WEEX Advantages & Disadvantages Summarized

According to our research, here are WEEX’s pros and cons:

Pros:

- Deep Asset Support: WEEX lists over 1,700 cryptocurrencies, ranging from new meme coins to large-cap powerhouses like Bitcoin (BTC).

- Wide Market Offering: Traders choose between spot and futures markets depending on their financial goals.

- Various Payment Methods: The exchange accepts crypto wallet deposits, as well as debit/credit cards and e-wallet purchases.

- Strong Security: Platform users protect their account balances through two-factor authentication and other security features. WEEX stores client assets in cold storage, which users verify via audited proof of reserves.

- No-KYC Trading: Users trade cryptocurrencies without revealing their identity. Unverified traders get 24-hour withdrawal limits of 10,000 USDT.

- Top-Rated App: WEEX offers a fully optimized trading app for mobile devices. iOS and Android users rate the app 4.6/5 and 4.4/5.

Cons:

- No Tier-1 Regulation: No licensing bodies from the U.S. or Europe regulate the exchange, so accounts lack consumer protections.

- Limited Demo Facilities: While WEEX offers a free demo account that resembles live trading markets, it supports BTC and Ethereum (ETH) futures only.

What Is WEEX? An Overview

Founded in 2018, WEEX is a centralized cryptocurrency exchange (CEX) that allows users to buy, sell, and trade digital assets. More than 6.2 million traders from over 130 countries use the exchange on a daily basis. It handles over $40 billion in daily spot and derivative volume, and major markets provide deep liquidity with narrow bid-ask spreads.

Our WEEX review confirms that the exchange appeals to most investor profiles. First-time traders can buy cryptocurrencies with traditional payment methods like Visa, MasterCard, and Apple/Google Pay, while experienced users trade over 1,700 digital assets on the spot exchange. Traders who seek margin facilities also rate WEEX highly, since the platform offers perpetual futures with leverage of up to 400x.

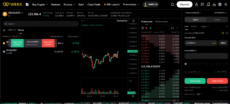

WEEX is a mid-tier exchange that provides spot trading markets and perpetual futures. Source: WEEX

While WEEX isn’t as well-known as Tier-1 exchanges such as Binance and Coinbase, it still offers a safe trading experience. In addition to institutional-grade cold wallet security and a 1,000 BTC protection fund, WEEX safeguards user assets with two-factor authentication methods and email/phone verification.

One of the platform’s key selling points is its know-your-customer (KYC) framework. Unlike most crypto exchanges, WEEX enables users to trade anonymously. Unverified clients may withdraw up to 10,000 Tether (USDT), or the currency equivalent, daily without providing personal information or a government-issued ID.

WEEX Trading Markets

WEEX offers a diverse selection of crypto markets for all trading goals and risk tolerances.

As per exchange data, WEEX’s most popular trading market is perpetual futures. These financial instruments offer leverage of up to 400x and allow traders to go long or short. To eliminate liquidity risks, users buy and sell cryptocurrencies on the WEEX spot exchange. Most spot markets pair cryptocurrencies with USDT, and positions execute once other exchange participants match target prices.

We found that WEEX also offers trading products for inexperienced investors. Those who find spot exchanges intimidating can buy cryptocurrencies instantly with a debit/credit card or e-wallet. WEEX simply requires the purchase asset, amount, and payment details, and immediately processes the transaction.

WEEX’s most popular market is perpetual futures, which support leverage of up to 400x. Source: WEEX

Unlike the top peer-to-peer crypto exchanges, which typically support hundreds of fiat currencies, WEEX’s P2P dashboard allows VND and RUB only. The copy trading feature provides access to over 5,000 elite crypto traders, letting users replicate their positions automatically. The passive investment tool incurs an average profit-sharing commission of 20%.

WEEX Supported Coins and Tokens

Research shows that WEEX is one of the best crypto exchanges when it comes to supported assets. It lists over 1,700 coins and tokens across a wide spectrum of investment categories. It supports the majority of top assets by market capitalization, including BTC, ETH, BNB (BNB), Solana (SOL), Cardano (ADA), and popular stablecoins like USDT and USDC (USDC).

With almost 50 meme coins listed, WEEX appeals to high-risk traders seeking the next 1000x crypto. Meme trading markets range from Dogecoin (DOGE), Floki (FLOKI), and Bonk (BONK) to Popcat (POPCAT) and Shiba Inu (SHIB).

WEEX helps users find suitable markets through investment categories and real-time trading data. Source: WEEX

Our review of WEEX found that users search for suitable markets in several ways. The platform categorizes assets by category, such as BRC-20, GameFi, proof-of-work, Solana ecosystem, and Layer 2.

Once traders choose a category, they sort cryptocurrencies by daily trading volume, performance, and 24-hour highs and lows. Tapping the “Trends” button reveals additional market insights. Traders explore cryptocurrencies through new listings, trending projects, and the top performers. Alternatively, users may search for their preferred coin or token, and WEEX takes them to the required trading page.

WEEX Fees (Trading and Non-Trading)

We analyzed WEEX fees across all trading markets, as well as non-trading charges such as deposits and withdrawals. The review team compared those fees with other exchanges to evaluate competitiveness.

Trading Fees

The spot and futures platforms use separate fee schedules:

Spot Trading Fees

WEEX offers competitive spot trading commissions, although exact fees vary by three core metrics: 30-day trading volume, 5-day average account balance, and WXT holdings.

The spot commission starts at just 0.1% per side, which aligns with Binance, OKX, and Bybit. These fees are significantly more competitive than Coinbase Advance, which charges 1.2% per side for entry-level traders.

Traders who achieve VIP level 1 get lower commissions of 0.08% and 0.09%, based on whether they place market or limit orders. This VIP level requires 30-day spot volumes of $500,000, an average account balance of $10,000, or WXT token holdings of 5,000. VIP level 8 is the highest account tier, and it allows spot traders to buy and sell cryptocurrencies at 0% commission, regardless of the order type.

Futures Trading Fees

WEEX futures traders who place limit orders get the best fees. Non-VIP users pay 0.02% per side, which aligns with Binance and Bybit. However, placing market orders raises the futures commission to 0.08%, which is more than most derivative platforms.

Both makers and takers can lower their commission rate by raising their VIP level. Top-tier VIPs pay 0.01% and 0.04% on limit and market orders, respectively.

Perpetual futures incur variable funding rates every eight hours. BTC/USDT rates average 0.005%, while a lower-cap market like MANA/USDT is higher at 0.01%.

Non-Trading Fees

Instant buy fees differ from spot and futures trading, since WEEX includes commissions in the final quote. Our WEEX exchange review 2026 found that most currencies and payment methods incur a 3% spread. Buying $100 worth of USDT, for instance, converts to approximately 97 USDT.

While crypto deposits are free, WEEX charges flat fees when users withdraw digital assets from the exchange. Bitcoin withdrawals are expensive at 0.00016 BTC (approximately $18), yet most other cryptocurrencies are cost-effective. Ethereum and Tether withdrawals cost 0.0015 ETH and 3 USDT, which is approximately $6 and $3, respectively.

| Max Spot Commission | 0.1% |

| Max Futures Commission (market) | 0.08% |

| Max Futures Commission (limit) | 0.02% |

| Funding Fees | Perpetuals only. Variable fee every eight hours, depending on the pair |

| Average Debit/Credit Card Fee | 3% |

| WXT Discounts | Depends on how many WXT tokens the user holds |

| Crypto Deposits | Free |

| Crypto Withdrawals | Flat fee varies by coin and token |

WEEX User Experience

The WEEX user experience suits beginners, intermediate investors, and professional traders alike.

The onboarding process takes seconds, as users register accounts with an email or mobile, and without uploading ID documents (unless they plan to withdraw over 10,000 USDT daily). Platform users choose their preferred language from 17 options, including English, Chinese, Turkish, German, and Vietnamese. The chosen platform language also extends to customer support.

WEEX offers a user-friendly experience in 17 platform languages. Source: WEEX

Finding a suitable market is seamless, and desktop users access a comprehensive trading dashboard with indicators, chart drawing tools, and order book data. The spot and futures exchanges use similar layouts, so traders switch between each product without additional learning curves.

Mobile Experience

Registered users connect their accounts to the WEEX mobile app for iOS and Android. The app offers the same list of cryptocurrencies, markets, and products as WEEX’s desktop website. Optimized layouts ensure a smooth trading experience, and as long as users have a stable internet connection, they get fast execution speeds.

The WEEX app has an excellent 4.6/5 rating with iOS users. Source: WEEX

iOS users rate the WEEX app 4.6/5 across 1,400 ratings. While the Android version has a slightly lower rating at 4.4/5, this is based on over 8,700 reviews and more than 1 million downloads.

While WEEX exchange reviews on Trustpilot are less positive at 2.4/5, low ratings remain commonplace in the broader market. The two largest exchanges, Binance and Bybit, have a 1.4/5 and 3.4/5 rating, respectively.

WEEX Top Features

Next in this WEEX exchange review, we reveal the most popular trading tools and features.

High-Leverage Derivatives

We found that WEEX is one of the best crypto leverage trading platforms for perpetual futures. As it offers a maximum leverage multiplier of 400x on pairs like BTC/USDT, users with a futures account magnify a $100 position to $40,000. In contrast, Binance and Kraken limit their multipliers to 150x and 50x, respectively.

WEEX lists over 600 perpetual futures markets, and each allows long and short trading. Users post margin collateral in USDT, so instruments resemble linear contracts.

Copy Trading

Beginners and time-starved traders can use WEEX’s copy trading feature. It partners them with over 5,000 experienced derivative traders, who buy and sell cryptocurrencies on behalf of their followers.

As a top copy trading platform, WEEX users copy more experienced traders passively. Source: WEEX

Users browse successful traders by past performance, risk, and average holding times, and invest a fixed amount upfront. Thereafter, WEEX replicates the trader’s positions in the user’s portfolio. Alongside standard platform commissions, followers pay an average of 20% of the profits generated in copy trading.

Weekly Airdrops

WEEX users earn free cryptocurrencies when they hold WXT tokens. The exchange partners with new crypto projects that airdrop native assets to WXT holders, and APYs are often several hundred percent.

To qualify, participants must purchase at least 1,000 WXT, which converts to approximately $36 based on current WXT/USD prices. Existing airdrop projects feature RZTYO Token (RZTO) and VMS Classic (VMC).

30,000 USDT Welcome Bonus

Another way to earn digital assets without directly investing in projects is to claim the WEEX welcome package. Valued at 30,000 USDT, users earn coupons when they complete a wide range of account tasks.

For example, new customers receive a 100 USDT coupon simply for linking a mobile number. The platform credits additional coupons when users make deposits, trade spot and futures markets, and use the copy trading feature.

Demo Trading

WEEX’s demo trading feature helps users craft trading strategies in a risk-free environment. It provides replenishable virtual funds without time restrictions, and prices reflect real-time market movements.

WEEX’s demo trading platform supports BTC and ETH futures. Source: WEEX

However, the demo tool supports BTC/USDT and ETH/USDT futures markets only. This drawback means traders cannot practice buying and selling assets on the spot exchange or learn about more volatile markets like meme coins.

Does WEEX Have a Wallet?

Like most online exchanges, WEEX integrates a custodial wallet into client accounts. WEEX controls private keys, so users cannot send and receive funds in a decentralized environment. Instead, users make transfer requests on the WEEX wallet interface and receive approval from the provider.

As its main purpose is to store cryptocurrencies while users trade, withdrawing assets to a non-custodial wallet is essential. These wallet types eliminate counterparty risks, since investors avoid trusting centralized exchanges to safeguard their funds. Most online crypto wallets also connect with decentralized exchanges (DEXs) like Uniswap and Raydium.

WEEX Payment Methods and Timeframes

WEEX users fund their accounts with digital assets only, as the exchange specializes in crypto-to-crypto trading pairs.

Platform users can, however, purchase cryptocurrencies with a wide range of traditional fiat methods. WEEX partners with OSL Pay for fiat transactions, and accepted deposit types include Google/Apple Pay, debit/credit cards, SEPA, and more. While USDT is the only supported asset, the stablecoin unlocks access to over 1,700 WEEX markets. If users want to buy Bitcoin on WEEX, they can simply swap USDT for BTC on the spot exchange at a 0.1% commission.

On WEEX, users buy USDT instantly with debit/credit cards and e-wallets. Source: WEEX

The P2P tool supports bank transfers and select e-wallets, although it is limited to Vietnam and Russia only. In addition to USDT, P2P traders also access BTC, ETH, and USDC.

The exchange also lets users deposit any supported crypto via wallet transfers. Select an asset and network, and WEEX generates a unique deposit address for the account holder. The platform has minimum deposit requirements for each asset, yet they rarely convert to more than $1. Depositing less than the stated minimum results in a loss of funds.

Withdrawals on WEEX are crypto-only, and fees vary by asset. Similar to deposits, withdrawal minimums depend on the crypto. The provider reports average payout timeframes of 15–30 minutes. Withdrawal limits are initially 10,000 USDT daily (previously 50,000 USDT), which users can increase to 1 million USDT by completing the KYC process.

| Payment Methods | Debit/credit cards, Google/Apple Pay, SEPA, and more |

| Minimum Deposit | Crypto deposit minimums vary by digital asset. The quick buy feature requires $15 |

| Maximum Deposit | No limits on crypto deposits. The quick buy feature caps purchases at $3,000 |

| Minimum Withdrawal | Varies by digital asset |

| Maximum Withdrawal | Daily withdrawals of up to 10,000 USDT (non-verified) or 1 million USDT (KYC-verified) |

| Withdrawal Time | 15–30 minutes after the withdrawal request |

Is WEEX Safe and Legit?

WEEX is an established and legitimate exchange with excellent reviews in the public domain. The platform stores client funds and general reserves in cold storage wallets, and verified proof of reserves ensures transparency.

WEEX’s proof of reserves show ratios of 105%, 106%, 114%, and 128% on USDT, ETH, BTC, and USDC holdings, respectively. The reserves also verify WEEX’s 1,000 BTC protection fund, which operates similarly to Binance’s Secure Asset Fund for Users (SAFU). The self-funded insurance fund covers client balances in the event of a hack, up to the available reserves.

WEEX offers transparent proof of reserves to ensure platform integrity. Source: WEEX

WEEX users set up various security controls to protect their accounts from unauthorized access. Mechanisms include custom passwords exclusively for withdrawals, two-factor authentication, and additional verification codes via email and SMS. While WEEX supports wallet whitelisting, the security tool doesn’t cover IP addresses or devices.

Despite its excellent safety record, robust security protections, and transparent reserves, WEEX has limited regulatory oversight. The exchange claims to hold a Bitcoin Services Provider (BSP) license in El Salvador, yet this provides little to no consumer protection. Crypto investors who favor Tier-1 regulatory approval may prefer exchanges like Coinbase, Kraken, or Gemini.

WEEX Customer Service

WEEX offers detailed guides for payments, P2P trades, placing orders, and other core platform functions. These self-help documents solve most account queries.

To contact the support team, users tap the floating live chat button. It requires the user’s account ID, telephone number, or email address before connecting them with a live agent. We tested the live chat service across various time zones, and in most cases, we were instantly connected.

The customer service team is available in 17 languages, with the exchange adding new ones frequently.

What Account Types Does WEEX Offer?

WEEX offers standard account types for all exchange users. The platform triggers KYC requirements if traders withdraw over 10,000 USDT daily. The simple workaround is splitting withdrawals over several transactions.

Note that KYC-free accounts cover crypto deposits and withdrawals, so buying USDT with fiat money requires a government-issued ID. Users provide documents to OSL Pay, the partnered fiat gateway.

While just one account type exists, VIP tiers run from 0 to 9. As users increase their VIP level, they secure more competitive trading commissions.

Getting Started on WEEX: Step-by-Step Guide

Here is a beginner’s walkthrough on how to get started with WEEX.

Step 1: Open a WEEX Account

Visit the WEEX website and click “Sign Up”. Input an email or mobile number, password, and the six-digit verification code.

WEEX lets new customers open an account without KYC details. Source: WEEX

Unless you plan to withdraw over 10,000 USDT daily, no additional information is needed.

Step 2: Activate Account Security Features

Go to “Settings” in the account area and activate security controls. This extra step helps secure the account before you deposit funds or trade.

WEEX traders stay safe by activating advanced security measures. Source: WEEX

Two-factor authentication is the most secure feature, as the system requires a verification code for each login attempt. We also recommend activating email and SMS verification.

Step 3: Deposit or Buy Crypto

WEEX allows users to deposit cryptocurrencies from an external wallet or buy USDT instantly with debit/credit cards and e-wallets.

To add digital assets, tap the “Deposit” button and select “On-Chain Deposit”. Search for the asset and select the network from the drop-down list. Review the minimum requirement and select “Get Deposit Address”. WEEX generates a new wallet address, which you can copy or scan.

WEEX generates a new deposit address for wallet-to-wallet payments. Source: WEEX

For fiat payments, select “Quick Buy” and choose a currency. Enter the purchase amount, review the exchange rate, and complete the payment via OSL Pay. The gateway transfers USDT to your WEEX account right away.

Step 4: Trade Crypto

Select “Markets” from the top menu bar and explore available pairs. Navigate between spot and futures, depending on whether you prefer to trade real assets or use leverage.

WEEX’s trading dashboard supports charts, order book data, and various order types. Source: WEEX

Click the required pair, and WEEX displays the trading dashboard for that market. To place a trade, scroll below the pricing chart and select a “Limit” or “Market” order. Input the position size (and leverage multiplier if trading futures) and confirm.

Step 5: Sell or Withdraw Assets

Selling cryptocurrencies on WEEX works similarly to buying, but in reverse. Return to the pair’s trading page, set up the opposite order type, and confirm. Once executed, the exchange adds the receiving asset to the spot account balance.

WEEX usually approves crypto withdrawals in 15–30 minutes. Source: WEEX

You may then request a withdrawal to a private wallet. In the account dashboard, select “Withdraw” and enter the asset, network, and wallet address. Check the withdrawal details, and once submitted, WEEX processes the request in 15–30 minutes.

WEEX Token (WXT) Use Cases

The exchange’s native token, WXT, was released in 2024 to provide users with additional utility:

- Reduced Trading Fees: WEEX users get lower spot and futures commissions when they hold WXT. Discounts correlate with the number of tokens held.

- Free Airdrops: Every week, WEEX partners with up-and-coming cryptocurrencies. Users who hold at least 1,000 WXT receive free tokens via airdrop events.

- Governance: Token holders receive governance rights. This feature allows them to vote on exchange proposals, such as new listings and partnerships.

- Burn Mechanism: To help drive the WXT price, WEEX frequently removes tokens from the circulating supply.

WEEX Review: Our Research Methodology

Our WEEX exchange review findings are based on real platform experiences. We opened and funded a trading account, placed orders across hundreds of available trading pairs, and recorded commissions, spreads, and average slippage. The team evaluated user-friendliness on the main desktop platform, plus the iOS and Android apps.

To assess the exchange’s strengths and weaknesses, we compared our WEEX findings with 25+ other reputable platforms. The transparent review process helps readers decide whether WEEX aligns with their crypto trading goals.

Conclusion

Overall, WEEX provides everything traders need to buy and sell cryptocurrencies in a safe environment. Our WEEX crypto exchange review confirms that the platform lists over 1,700 coins and tokens, and users can access markets via spot trading or perpetual futures.

Traders avoid cumbersome KYC processes and remain anonymous when withdrawing under 10,000 USDT per day. While WEEX does not handle fiat payments directly, clients may purchase USDT instantly with debit/credit cards and e-wallets.

FAQ

How secure is WEEX?

Who is behind the WEEX exchange?

What coins are on WEEX?

Does WEEX exchange require KYC?

Does WEEX exchange accept fiat money?

References

- WEEX Terms of Use (WEEX)

- WEEX Proof of Reserves (WEEX)

- WEEX Fee Schedule (WEEX)

- Real-Time Exchange Data (CoinMarketCap)

- Proof of Reserves Explained (Hacken)

- WEEX Exchange Unveils WXT Token (Decrypt)

Coinspeaker in Numbers

Monthly Users

Articles & Guides

Research Hours

Authors

VerifiedX (VFX) has officially launched, offering a Bitcoin-inspired decentralized network with unique on-chain features. Learn wh...

BMIC doesn't have a fixed presale end date yet. The team said they want to keep things flexible and let demand dictate when it wra...

Fact-Checked by:

Fact-Checked by:

20 mins

20 mins

Tony Frank

Crypto Editor, 39 postsTony Frank is an accomplished cryptocurrency analyst, author, and educator whose work bridges the gap between complex blockchain technology and accessible, actionable insights for global audiences. Over the past decade, he has emerged as a respected voice in the rapidly evolving world of digital assets, combining technical expertise with a talent for storytelling to help readers navigate everything from Bitcoin’s monetary philosophy to the intricacies of decentralized finance (DeFi). Tony earned his Bachelor’s degree in Economics and Finance from the University of Melbourne, where he developed a deep interest in monetary systems and market structures. He later pursued a Master’s degree in Blockchain and Digital Currency from the University of Nicosia, one of the first academic institutions to offer accredited programs in cryptocurrency studies. Before focusing full-time on blockchain, Tony worked as a financial analyst for a multinational investment firm, covering emerging technologies and alternative asset classes. His early exposure to macroeconomic policy, global market behavior, and fintech innovation laid the foundation for his later work in crypto research and writing. Tony’s expertise spans multiple sectors of the blockchain industry, including cryptocurrency fundamentals, altcoin market cycles, DeFi and web3 trends and regulatory landscapes. Tony combines on-chain data analysis with macroeconomic research, providing readers with both the technical “how” and the market “why” of cryptocurrency movements.