BTC Bull Token rewards holders as Bitcoin hits price milestones. This guide explores BTCBULL’s price prediction through 2030.

What Is Credit Karma and How Does It Work?

Last Updatedby Andy Watson · 8 mins read

As a consumer, you probably know that your credit score can affect a variety of your financial plans, from taking a loan to getting a mortgage. If you are eager to know your credit score without paying a cent, then look no further than Credit Karma.

If, like many financial consumers, you have ever been planning to borrow money, then you are already familiar with the concept of a credit score. This is the number which shows your financial trustworthiness, or, in other words, how likely you are to pay off your debts. Based on credit score, you are going to be awarded with all range of services, from loans and credits to insurance payments and mobile phone contracts.

To receive your credit report, you need to apply to an agency specializing in credit reporting for individual customers. There are three major ones specializing in this: Equifax, Experian, and TransUnion, from where you can retrieve your copy once in every 12 months.

This can be done by filling in an online form on AnnualCreditReport.com, and after that, you are granted permission to your report. However, the problem is that it does not actually contain the credit score – in the past, that could be purchased only for an additional price.

The revolution happened when an American company created a platform offering credit score unlimited, online, and absolutely free of charge. The name of this company is Credit Karma.

What Is Credit Karma?

Founded in 2007, Credit Karma is a private personal finance company based in San Francisco. Unlike a credit reporting bureau, it does not collect and research information on its consumers – rather, it brings into public access information already created by other agencies.

This way, anyone can easily get TransUnion credit reports or credit scores from TransUnion and Equifax. All that is needed is to sign up to creditcarma.com – and the platform even does not require your credit card details, as it is often requested by other companies.

Main Features

Credit Karma’s features, however, are not limited to credit scores. The platform is much broader than that and also specializes in personal finance services, such as automobile and personal loan offers. In this case, Credit Karma provides a list of advice based on customers’ credit history and helps to find an ideal match. It also shows the details of each offer (such as loan amount and APR), together with reviews from users who already work with lenders on the list.

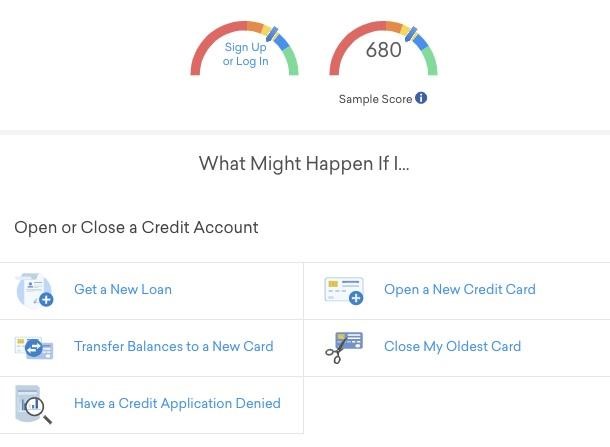

Stimulation. Needless to say, the information on the credit score is comprehensive and covers all the important aspects of this factor. Further than that, users can get the list of credit factors affecting their credit performance and even participate in a simulation. This feature allows users to see how their credit score will be affected by some particular actions, such as closing a credit card or paying a loan with a delay.

The platform helps to stimulate the effect of such important actions as opening/closing credit account, changing the way the card is used, changing payment habits and getting new negative marks.

All of these factors can be stimulated:

- Get a New Loan

- Open New Credit Card

- Transfer Balances to a New Card

- Close My Oldest Card

- Have a Credit Application Denied

- Get a Credit Limit Increase

- Increase or Decrease My Balances

- Let My Accounts Go Past Due

- Wipe Out My Late Payments

- Go Into Foreclosure

- Have My Wages Garnished

- Have an Account Sent to Collections

Community Forum. But that is not the end. Credit Karma also integrates a community forum, where all types of questions are brought to discussion. From an amateur to a finance professional, anyone can participate in the discussions and share expertise.

Once the question is posted, the community of users evaluates it in the same way as on Facebook – by putting thumbs up or thumbs down. This helps the platform to estimate the usefulness of question/answer and to see how many people gained from it.

Articles. What is more, the platform posts free educational articles to help users improve their financial decisions. These publications offer an insight into a variety of credit cards on the market and assist you in choosing the most beneficial one based on your financial capabilities and preferences. Moreover, you can also learn more about repaying your credit card debt and gain a better understanding of a variety of credit card fees and perks.

Blog Posts & Reviews. In the same way as with articles, Credit Karma blogposts help its readers to navigate better in the financial world. However, its coverage expands to more general topics such as Company News and Product Updates, while also covering Engineering section where more technical concepts are brainstormed.

On top of all of this, Credit Karma has a separate section of the website dedicated solely to reviews of all types of financial products, starting from credit cards and ending with life insurance and home equity.

Why Is Credit Karma Free?

Analyzing its features, it becomes clear that Credit Karma offers valuable services for which other platforms usually charge money. So why to make it all free? Firstly, the company puts a focus on transparency, which means that every consumer can unveil the topic of credit score and understand almost effortlessly.

Secondly, Credit Karma wants to improve the soundness of the financial system by giving its users the information they are eligible for, making them look better after their financial health. That all makes Credit Karma almost a non-profit organization, which in reality is not entirely true.

When it comes to money, Credit Karma is very careful in its approach and does not take a path of selling personal data of its consumers, that’s what it claims. Rather, the company leverages personal data to create specially-tailored ads of financial services directed on its users. As a result, this is a win-win situation for everybody: a user benefits from financial service advertised by the financial company, while Credit Karma maintains its wellbeing.

Business Model of Credit Karma

To better understand how the company earns its profits, it is helpful to take a look inside the process that keeps the company ahead of the game.

Credit Karma describes the whole business model as fairly simple and straightforward. It consists just of three main stages:

- Consumer obtains scores and reports;

- Credit Karma makes recommendations;

- The company receives money from the bank or lender.

During the first stage, you receive the information on credit score from two main agencies – either Equifax or TransUnion, with the following updates on a weekly basis. Next, a team of Credit Karma takes part in the analysis of your personal data based on your credit profile.

As a result, the company comes up with recommendations that may help you save money on fees and credit charges. In the last stage, if the recommendation was successful and the customer was convinced to use the service on offer, Credit Karma reaps the benefits of its good work.

To sum up, the company gets paid for matching customer’s profile with financial services that have a high chance of approval. However outright it may sound, in reality, Credit Karma did not manage to escape some debates regarding the safety of its personal data.

Concerns With Credit Karma’s Data Safeguarding

The incident took place in August 2019, when several users reportedly made a statement that they were exposed to information from other people’s accounts. While refreshing the data on the platform, a number of customers accidentally spotted private account details of other participants instead of their own.

In some particular cases, sensitive details such as credit card account and current balance got on a display. Worthwhile to mention, however, that the user’s information such as name and address was concealed.

The company justified the occurrence as a technical bug, not as a cyberattack. That’s what the official statement said: “What our members experienced this morning was a technical malfunction that has now been fixed. There is no evidence of a data breach”.

This nevertheless did not save Credit Karma’s reputation from being negatively affected by this event.

Conclusion

Despite it all, there is a 60-million user base that still continues to actively engage with the service. That happens because up to this day, Credit Karma is the most comprehensive free platform offering not only credit scores and free report, but also a variety of complementary services and additional features that can largely benefit its users and improve their financial health.

Whether to use it or not is a matter of personal preference, however, it is still important to keep in mind the defining role credit score plays in the financial lives of all customers – and Credit Karma may be a great support for keeping track of it.

This guide is a must-read when joining the SNORT presale. Discover the Snorter Bot launch date and its projected exchange listings...

Bitcoin Hyper is a L2 for Bitcoin with dApp support. Its presale started on May 14, 2025, and is expected to end in Q3 or Q4. Lear...