Tron (TRX) price forecast for 2025–2030 with insights on token utility, growth drivers, market trends, and long-term investment ou...

What Is Grayscale Bitcoin Trust?

Last Updatedby José Oramas · 6 mins read

If you want to know what Grayscale Bitcoin Trust is and how it can be beneficial for you, read this guide.

Grayscale Bitcoin Trust (GBTC) is a platform designed for mainstream investors looking to stake their capital in this cryptocurrency. GBTC is a financial product that allows you to invest in digital currencies. The platform has made more than 13.1 billion in assets under management (AUM) valued at more than $18 billion in Over-the-counter markets.

The Security and Exchange Commission (SEC) approved the Trust in 2013. Since then, the trust offers exposure to the BTC market even to investors who are unable to invest in unregulated markets or assets.

GBTC debuted on September 25, 2013, under the name Bitcoin Investment Trust. Barry Silbert founded it and designed it to be a private placement for accredited investors. Subsequently, the Trust received FINRA (Financial Industry Regulatory Authority) approval for securities eligible for public trading.

But do not confuse the Trust with an ETF, although the company claims that it is modeled similarly to commodity investment products, such as SPDR Gold Trust – as if it were an ETF with a physical underlying.

How Does the Grayscale Bitcoin Trust Work?

Investors don’t actually buy, sell, or hold BTC but grantor shares. The company stores these shares on a high-security system to protect investors from possible malicious actors. Then, Grayscale calls in the portfolio of many rich individuals to inject money into that fund, this is what’s called a “private pool”.

GBTC uses the Alternative Reporting Standard provided by over-the-counter (OTC) markets to inform its investors about the current state of their investments. GBTC relies on the TradeBlock XBX index to track BTC price, mirroring its performance. But the stock price usually could exaggerate or diminish the performance, based on the current market sentiment.

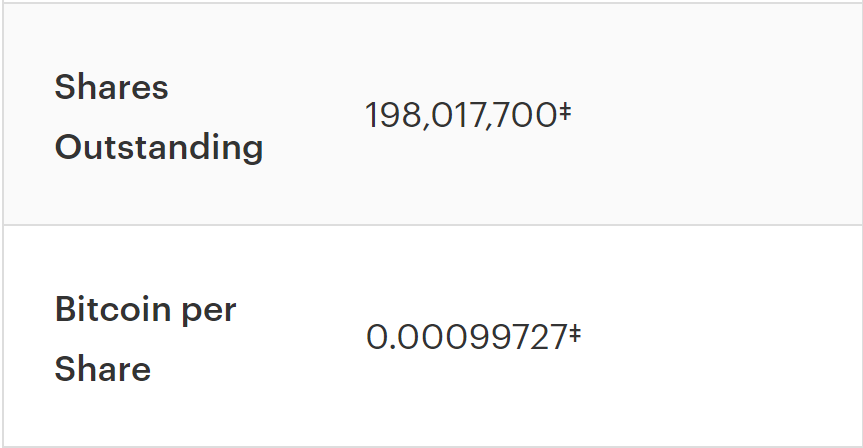

There’s a current number of shares outstanding. Grayscale launches those shares representing an amount of Bitcoin on the Stock Exchange.

Photo: Grayscale

Grayscale saves time and energy from investors who don’t know anything about Bitcoin, or don’t have the time but are looking to invest in this crypto due to the advantages that it offers. Hence, the company lists the GBTC on the stock exchange, keeping track of any recent movement in the price.

GBTC and Bitcoin ETF

Grayscale has stated before that its underlying model is similar to an Exchanged-Traded Fund (ETF). But Bitcoin ETFs are not legal yet in the US. The SEC has stated on multiple occasions that a Bitcoin ETF will not set ground in the country, as the cryptocurrency market tends to be different from the traditional one. Thus, subject to manipulation and extreme price volatility, according to the SEC.

With a Bitcoin ETF, you would be doing the same as an ETF: tracking the value of the crypto on the traditional market instead of exchanges. Bitcoin ETFs could offer several advantages, as they could offer the same benefits out of an ETF like tax-friendly investments, convenience, and asset diversification.

With ETFs, you have an investment vehicle as well as Grayscale. Both policies seek to replicate the behavior of the assets that make up a stock index, be it fixed income, equities, currencies or commodities or other financial assets.

We can define them as a hybrid financial asset since they maintain similarities with traditional investment funds in themselves, but also with stocks. It has the ability to diversify funds and liquidity of stocks. You can hold Apple Stocks and BTC in the same fund, or any other asset traded in the stock market. In other words, they are collective investment institutions (CII).

Although both methods tend to change the original concept of cryptocurrencies. By being subject to the SEC, a GBTC and a Bitcoin ETF become centralized to regulatory bodies, something completely antagonist to the original concept of Bitcoin. GBTC is a close-ended fund and Bitcoin ETF lacks ownership.

Advantages and Disadvantages of the GBTC

The GBTC allows investors exposure to Bitcoin without actually having to manage them, like worrying about storage, security, regulations, wallet keys, etc. Grayscale manages these issues thanks to the SEC’s approval.

Currently, the GBTC fund has an approximate market cap of $27,800,000,000. But retail investors don’t usually look for Grayscale as it’s intended for accredited investors who can invest a minimum of $50,000.

Most people tend to look for premium investments, one of the most successful types of grayscale, but these come with annual fees of 2.0% of daily accumulation. There’s another problem associated with these, the cryptocurrency market can experience extreme volatility periods.

The trust does not match the exact underlying value of Bitcoin, as this depends on the current sentiment of the market. Despite this, the GBTC trust is currently the easiest way to gain exposure to the cryptomarket, without worrying about the usual problems that come with doing it by yourself.

Grayscale Bitcoin Trust in 2020

In 2020, Bitcoin and cryptocurrencies saw a significant wave of institutional investors ready to embrace them. Multiple factors triggered this decision collaterally, the decline of fiat use, inflation, political instability in the US, and so on.

Thus, Grayscale and other major institutions started hoarding BTC and several cryptos in mid-2020. Last year, the Bitcoin portfolio of Grayscale was up by 90% in just six months. At the end of June, GBTC trust reached $3.5 billion, according to a report from the SEC.

By the end of 2020, Grayscale put itself as the largest crypto hoarder, with greater inflow into the company’s products and a considerable increase in its Assets Under Management AUM. By the end of last December, the company had $13.1 billion in AUM.

Despite the massive growth, the institutional hoarding of cryptocurrencies sparked fear of Bitcoin illiquidity. Only 20 % of the BTC supply is available, even surpassing the total amount of BTC mined in 2020.

The Takeaway

Grayscale has become a leading authority when it comes to trust investing. GBTC is currently the only fund that allows investors to explore the advantages of the cryptomarket. The company has made record profits since it started embracing cryptocurrencies and urged other institutional investors to jump in on digital assets.

FAQ

What is an ETF?

Exchange-Traded Funds (ETFs) are investment funds that keep track of an underlying asset that makes up a stock index. These funds allow the investors an entry to several securities like stocks or bonds.

ETFs maintain similarities with traditional investment funds and stocks. They have the ability to diversify funds and liquidity of stocks. In other words, they are collective investment institutions with shares listed on the stock market, settled and traded in real-time.

This is the fundamental difference with respect to classic funds in which case the net asset value is not established until the close of the session (at which point it is possible to trade with them), while in ETFs the theoretical net asset value varies continuously as it does. the reference, so that the investor can buy and sell at any time.

In the case of stocks, the divergence is that exchange-traded funds through a single transaction invest in a highly diversified portfolio (as much as the index they take as reference).

Although we pointed out that the ETF management commissions are lower, it is also true that after each operation there is a purchase and sale commission, which varies depending on the bank.

On the other hand, ETF units, unlike traditional funds, cannot be transferred. To make a change we must sell the listed fund, pay the capital gain, and open a new one, also paying the purchase and sale commission.

What is a Bitcoin ETF?

A Bitcoin ETF has an underlying frame similar to an ETF, but they are not allowed in the US currently. The Securities and Exchange Commission has denied multiple petitions for its approval. One of the main reasons is the volatility of the cryptocurrency market. Thus, regulatory bodies don’t approve this type of funds yet.

With Bitcoin ETF you’re also tracking the value of the cryptocurrency on the traditional stock market instead of exchanges. Cryptocurrency ETFs can offer several advantages of traditional ETF-like. Some of them are asset diversification and tax-friendly investments.

In both cases, the GBTC and ETFs would allow you to gain certain exposure to the cryptocurrency market without having to study that specific market. Investors don’t have to worry about custody, price movements, storage, and so on. But some advantages both methods have is the high fees and lack of ownership, as they are close-ended funds.

Another considerable aspect is the centralization of cryptocurrencies. By being subject to the SEC, a GBTC and a Bitcoin ETF become centralized to regulatory bodies, changing completely the original concept of Bitcoin.

Is Grayscale Bitcoin Fund an ETF?

It has a similar framework as an ETF, but they are not the same. With GBTC you’re buying shares in a trust. With an ETF, you’re tracking an underlying asset’s price directly.

How many Bitcoins does Grayscale have?

Out of the 20% of the BTC supply left, Grayscale owns 3.1% which would be translated to 572.644 BTC, according to Bitcointrasuries.org. You can visit this site to check in on publicly traded investment trust and firms.

Keep in mind the BTC supply is finite, as there are only 21 million Bitcoins that will ever exist. Besides, there are about 2.500 million BTC stranded in the net, and they might be lost forever. The reason is multiform, as this could be the result of lost keys, hard drive crashes, etc.

Why does GBTC trade at a premium?

Premiums are similar to indicators in the stock market. A premium is a reference to the underlying value that the trust is holding, compared to the market price of that holding. It’s similar to trading leverage as well: If the direction of a given asset goes on a strong bullish run, the premium will magnify your gains. But if it goes down, it will shrink, magnifying your losses.

The Native Asset Value (NAV) plays a key role here. The NAV is the underlying value of an asset. The costs of trust depend on the current market price of the holdings. When the market price surpasses the NAV, the difference in value is what’s called “premium”.

You can put it this way: NAV + premium = market price. But the premium has no underlying formula, it heavily relies on supply and demand on the stock market.

This guide explains how to buy TOKEN6900, a new meme coin project with an attractive market capitalization. Learn how to join the ...

Pepe Coin surged in popularity after its 2023 launch. This article covers market trends, price forecasts, technical signals, and h...