LiquidChain is a Layer 3 blockchain project that wants to unify the liquidity of Bitcoin, Ethereum, and Solana into a single execu...

This guide is for those who want to better understand what USD Coin is and what its main use cases are.

Stablecoins are becoming more popular as the crypto market becomes more attractive for people looking to invest in better stores of funds. People looking to save their profits in bullish runs are choosing stablecoins to protect themselves against future price drops and corrections. One popular stablecoin is the USD coin. To know how it works, read this article we prepared for you.

What Is US Dollar Coin?

USD Coin (USDC) is the first stablecoin to enter the world’s largest trading platform Coinbase. As the name indicates, stablecoin refers to a stable version of cryptocurrencies, leaving aside the inherent volatility of common cryptocurrencies. Each stablecoin is always equivalent to a fiat, whether be Euro, Sterling Pound, or in this case, 1:1 with a US Dollar.

USDC runs on the Ethereum blockchain as an ERC-20 token. Each USDC token is 100% legally backed by a single USD held in accounts exposed to regular public reserve reporting. The underlying technology behind the USDC was developed in collaboration between Coinbase and the Circle platform.

History of the USDC

The history of the USDC goes back to May 18, 2018, when the Centre Consortium – a partnership between Circle and Coinbase – announced the US Dollar Coin thanks to a pool investment fund of $110 million. In the beginning, the consortium took charge of the underlying technology of the stablecoin while Circle and Coinbase were the first commercial issuers of the USDC.

In September 2018, it was officially launched, gaining popularity in the market and rivaling Tether – another dollar-pegged stablecoin – by ranking #5 in market cap in Coinmarketcap. USDC expanded even further when in May 2019, USDC opened for trading in more than 80 countries.

With the rise of Decentralized Finance (DeFi) in 2020, USDC became essential to DeFi users. Likewise, there was another boost for USDC when Bitcoin started its bull run in November 2020, driving a massive amount of traffic to USDC.

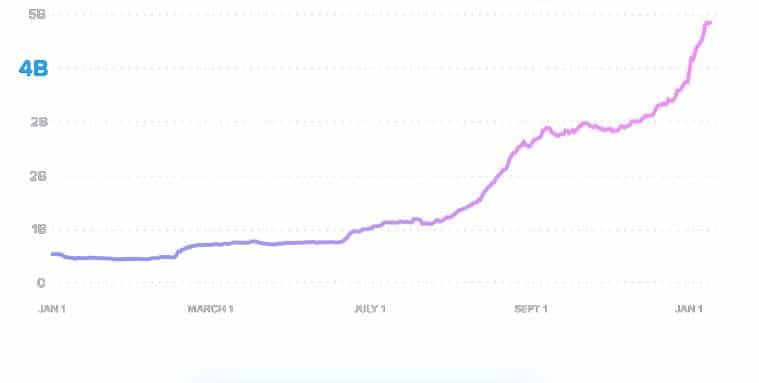

Since its creation, the USDC has had enormous success. From January 2020 to today, it achieved 5.8 billion in market capitalization, and a $4.8 billion circulation supply.

Photo: Circle USDC

Circle is a platform in charge of transmitting official money. Money transmitters are companies that offer money services in the United States. They must comply with all federal laws and regulations. Therefore, all USDC tokens are regulated, transparent, and fully verifiable.

How Does It Work?

Despite being backed by US Dollars, USDCs can’t be printed and they can’t be mined like common cryptos either. This is where tokenization comes to play thanks to smart contracts (ERC-20s). The tokenization process relies mostly on these essential parts:

- First, you need to meet the KYC – Know Your Customer – verification process.

- Once completed, the issuer will give a specific bank account where you will make a wire transfer.

- The issuer uses a smart contract to create the amount of USDC you sent.

- You receive your USDC and the dollars are kept in reserve.

If you want to trade USDC for USD, you just have to reverse the process. You send a petition to the issuer of the USDC to trade a number of tokens to USD. The issuer uses a smart contract to exchange a number of tokens for USD.

USDCs are regulated and fully supported by institutional bodies in the US, this is why USDC issuers are obligated to provide transparency to their users, as they work along with these institutions.

How Do You Use USD Coin?

By working with the Ethereum blockchain, the USDC is an ERC-20 token that can perfectly work with decentralized applications that support the ERC-20 standard. Once you register your account on Circle and completed the KYC process, the platform allows you four main functions for your tokens:

- Tokenizing USD

- Redeeming USDC

- Transferring USDC to ETH addresses compatible with ERC-20 standards

- Depositing USDC from compatible wallets

Generally speaking, stablecoins offer a wide range of uses compared to traditional fiat:

- 100x leveraged trading

- Work throughout hyperinflated, destroyed economies

- Avoid financial institutions (except when trading USDC to USD)

- Sending money with low fees, in a secured, instant manner

- DeFi uses, as you can buy several crypto products in dApps

What’s So Special about USDC?

USDC made room for itself in the crypto community due to its advantages compared with other stablecoins, and of course, thanks to the institutional power that Circle and Coinbase have put behind the coin since its creation.

USDC allows banking for the unbanked, as it doesn’t require a proper bank account. USDC is usually considered a solution for the democratization of international finance, through the use of Blockchain technology. International operations can be carried out much easier and faster than with traditional fiat money.

Finally, the value of USD Coin is currently backed by a reserve fund of dollars for the same amount as the USDC issued. This reserve would be in a special bank account, audited, and constantly monitored.

All of this makes USDC a very versatile currency, and with a safe value for international operations, to which the weight of two giants of the crypto world such as Coinbase and Circle contributes, by driving and expanding the adoption of USD Coin with their users.

Besides, USDC is considered more transparent compared to Tether, especially when the New York Attorney General’s office started investigating Tether and Bitfinex over shady processes. Thus, the need for a legal, regulated stablecoin arose.

Different currencies fulfill different functions in the market. For instance, Tether would have as a fundamental objective to be an intermediary in transactions between cryptocurrencies, a reason why still is a crucial element in the crypto market today.

But the USD Coin has another view about its role in the economy: Prioritizing the development of a more efficient mechanism to carry out financial operations, than in building a Tether-style stablecoin.

Conclusion

The USD Coin is probably one of the most useful cryptocurrencies in the world. By being an ERC-20 token created by the CENTER Consortium, it creates and enhances several functions that facilitate the realization of international financial transactions taken advantage of USDC.

FAQ

What Are Stablecoins?

Stablecoins are digital, US-pegged currencies, although they can be linked to other fiats, like Euros, Sterling Pounds, and so on. Stablecoins are back by these traditional currencies, and they offer the same advantages of the crypto-technology like the blockchain— but without the inherent volatility of cryptocurrencies.

Since the appearance of Bitcoin, there are many types of crypto assets that have emerged, responding to the needs of the environment and solving problems that this technology presented.

What is USDC on Coinbase?

The USDC is the first stablecoin to enter the world’s largest trading platform Coinbase. Stablecoins are a mix between cryptocurrencies and fiat money, as they use the technology behind them, like the blockchain, but without the inherent volatility of cryptocurrencies. Each stablecoin is always equivalent to a fiat, whether be Euro, Sterling Pound, or in this case, 1: 1 with a US Dollar.

USDC runs on the Ethereum blockchain as an ERC-20 token. Each USDC token is 100% legally backed by a single USD held in accounts exposed to regular public reserve reporting. The underlying technology behind the USDC was developed in collaboration between Coinbase and the Circle platform.

Why is a digital dollar beneficial?

Digital dollars, like the USDC, allows banking for the unbanked, as it doesn’t require a proper bank account. USDC is usually considered a solution for the democratization of international finance, through the use of Blockchain technology. International operations can be carried out much easier and faster than with traditional fiat money.

Digital dollars are backed by a reserve fund of dollars for the same amount as the token issued. This reserve would be kept in a special bank account, audited, and constantly monitored.

Digital dollars can be versatile currencies In an environment where volatility can be extreme. Thus, having an instrument that allows avoiding those strong price variations is essential for any operator. If you want to keep your money in crypto assets without depending on fiat money, having a preferred stablecoin makes it easier for you to operate.

Having a stablecoin allows you to avoid converting your crypto-positions to traditional fiat, rather a mix between them and cryptocurrencies. In the same way, an operator can use stablecoins to send cryptos from exchanges at a minimal cost.

Stablecoins offers advantages over fiat themselves. Transferring USD is already an expensive and slow process. It can take days, and sometimes weeks when it comes to wire transfers.

Besides, due to the conflictive nature that the US has with cryptocurrencies and the regulatory weather by financial institutions, dealing with fiat can become riskier for crypto-exchanges: their bank accounts can be frozen and even risk prosecution in some cases. Working with fiat-backed stablecoins instead is far less burdensome, particularly for such exchange operators.

What does it mean to be a programmable dollar?

Programmable money refers to a specific code written to execute automatically transactions within certain parameters using digital currencies, this is where decentralized finance products, like smart contracts, come into play.

The main infrastructure of a smart contract is the blockchain network and that code is the agreement itself. The blockchain allows a space where you can write that code to interact with digital assets, like stablecoins. Thus, digital dollars allows you to send value with USDC or any other currency.

When you deposit money in your bank account, you don’t know what traditional institutions are doing with your funds. But in the world of decentralized finance, smart contracts change this. These agreements, powered by decentralized products, called dApp allow you to see the lines of code that support the process and how it operates without any shady movement.

Programmed money provides you with a broader set of financial independence and transparency, putting businesses and applications in your hands. If you’re a developer, you can easily create a line of code to program your smart contract. Thus, making financial activities faster, transparent, and cheaper.

Why did Coinbase participate in building USD Coin?

The main objective of Coinbase and Circle was to create an open, enhanced financial world for everybody. The idea was not only to facilitate banking for the unbanked but to protect exchanges from using fiats, as Anti Money Laundering laws in the US make it harder for exchanges to trade crypto with fiat. Regulatory bodies see cryptocurrencies as assets subject to extreme volatility and market manipulation.

USDT or USDC?

Both currencies are widely used in the crypto market. So it’s better to check in on the difference between both so you can choose what suits you best. Different currencies fulfill different functions in the market. For instance, Tether would have as a fundamental objective to be an intermediary in transactions between cryptocurrencies, a reason why still is a crucial element in the crypto market today.

Besides, USDC is considered more transparent compared to Tether, especially when the New York Attorney General’s office started investigating Tether and Bitfinex over shady processes. Thus, the need for a legal, regulated stablecoin arose.

But the USD Coin has another view about its role in the economy: Prioritizing the development of a more efficient mechanism to carry out financial operations, than in building a Tether-style stablecoin.

Coinspeaker in Numbers

Monthly Users

Articles & Guides

Research Hours

Authors

The team behind IPO Genie has not yet announced an end date for the presale.

AI cryptocurrencies combine blockchain with artificial intelligence to power decentralized machine learning networks, GPU computin...

6 mins

6 mins

José Oramas

Author, 37 postsI'm a finance journalist and copywriter with a keen interest in the fintech field. I have keen on blockchain technology and cryptocurrency and I believe it can reshape the way we see money and financial freedom.