LiquidChain is a Layer 3 blockchain project that wants to unify the liquidity of Bitcoin, Ethereum, and Solana into a single execu...

Meme coins are a unique category of cryptocurrency often inspired by internet jokes, viral culture, and fun online communities.

They might not have utility, but they grab the crowd’s attention, and knowing how to buy them using secure wallets or centralized exchanges is crucial if you want to take part.

Our guide explains how to buy meme coins step by step, as well as highlighting the risks and rewards of meme coin trading, so that you can safely get involved in 2026.

How to Buy Meme Coins in 5 Easy Steps

Let’s start with a quick walkthrough of how to buy meme coins in 2026:

- Choose a platform (wallet, centralized exchange, or decentralized exchange).

- Set up basic security (passwords, backups, and authentication).

- Research the meme coin (contract address, liquidity, community activity).

- Decide how much to invest based on your risk tolerance.

- Complete the purchase and confirm storage.

The exact steps can vary depending on what you are using, but the core process remains the same.

How & Where to Buy Meme Coins: Step-by-Step Instructions

Read on for a more detailed tutorial on how to trade meme coins. It takes less than 10 minutes from start to finish.

Step 1: Choose Where to Buy Meme Coins

Meme coins can be purchased through three main routes:

- Non-custodial wallets with built-in trading or swap features

- Centralized exchanges (CEXs) that list popular meme coins

- Decentralized exchanges (DEXs) for early-stage or newly launched tokens

Wallets and DEXs are often used for early access. Centralized exchanges offer easier onboarding and higher liquidity for established tokens.

If you’ve decided on using a wallet, our research shows that Best Wallet is the top crypto wallet for meme coin trading. The mobile app enables instant purchases with fiat money, which includes everyday payment methods like Visa, MasterCard, and PayPal.

Best Wallet also supports new crypto launches, so users can invest in meme coins before they hit public exchanges.

To get started, visit the Best Wallet website and download the iOS or Android app. Open the wallet to complete the setup process. Choose a PIN, write down your 12-word seed phrase, and activate biometrics and two-factor authentication (2FA).

Step 2: Research the Meme Coin Carefully

Knowing which meme coins offer explosive potential is a difficult task. On-chain data confirms that millions of new meme coins launch monthly on popular blockchains like Ethereum, Solana, Base, and BNB Chain.

To avoid unnecessary risk, diversifying across multiple meme coins is often the best strategy.

Before buying, verify:

- Official contract address

- Liquidity depth

- Market capitalization

- Token distribution

- Community engagement

Large-cap meme coins like DOGE, SHIB, and PEPE generally carry lower relative risk, while new launches offer higher upside with significantly higher failure rates.

Crypto world investors with a higher risk appetite often trade new cryptocurrencies with undervalued market caps.

To avoid unnecessary risk, diversifying across multiple meme coins is often the best strategy.

Step 3: Choose a Payment or Swap Method

Fiat purchases are usually available on centralized platforms or wallet on-ramps. Crypto-to-crypto swaps are required on DEXs.

Always check final quotes, slippage settings, and network fees before confirming a transaction.

Note: Fiat gateways directly support meme coins, although they typically focus on established tokens to reduce market exposure. If the Best Wallet app doesn’t support your preferred meme coin, buy Tether (USDT) and trade the stablecoin via the built-in swap tool.

Step 4: Enter the Amount

Choosing the right investment size matters, since meme coins present significant volatility risks. Experts suggest various approaches to position sizing.

One option is to spread your investment funds into different meme coin projects, rather than invest in any single token. A simple example is splitting a $1,000 budget into 20 meme coins at $50 each. If one of your purchases becomes the next 1000x crypto, you’d still make substantial returns even if the other token prices went to zero.

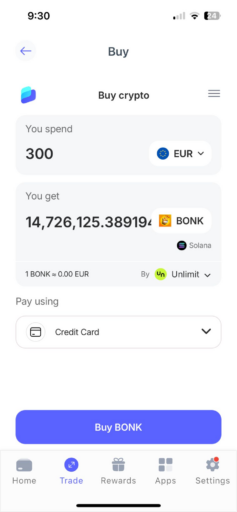

An example of a meme coin purchase on the Best Wallet app. Source: Best Wallet

Another method is dollar-cost averaging. Experienced traders use this strategy when they have a strong conviction on certain projects. Knowing that prices rise and fall sharply, they buy small amounts at regular intervals, instead of investing one lump sum. This process helps traders avoid buying at the peak, as each purchase averages the token cost basis.

Since meme coins can move violently in either direction, you should:

- Avoid allocating a large portion of capital to a single token

- Consider spreading exposure across multiple projects

- Dollar-cost averaging can help reduce entry risk

Step 5: Store and Monitor Your Meme Coins

Once you complete your purchase, you should:

- Confirm where the tokens are stored

- Track liquidity, volume, and social activity

- Be prepared for rapid market changes

Meme coin investments often require more active monitoring than traditional cryptocurrencies.

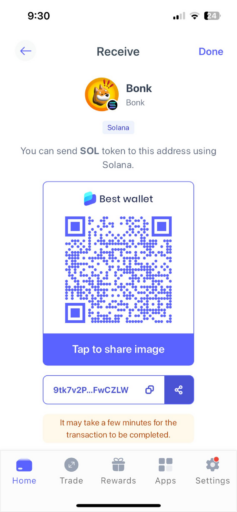

A core benefit of buying meme coins on the Best Wallet app is that it automatically stores tokens in non-custodial storage. Investors may hold their meme coins in Best Wallet until they choose to sell.

As a non-custodial wallet, Best Wallet users have full ownership of their meme coin investments. Source: Best Wallet

If you want to increase the meme coin’s potential yield, Best Wallet supports a staking aggregator. Staking pools pay passive rewards with competitive APYs, similar to earning interest in a traditional bank account.

Key Takeaways

- The best way to buy meme coins is via a non-custodial wallet, since users avoid counterparty risks. Wallets like Best Wallet ensure investors fully own and control their meme coins.

- Another option is to purchase meme coins from an online exchange, although investors relinquish ownership unless they withdraw tokens to a private wallet.

- New meme coins often launch on DEXs before appearing on centralized platforms, increasing both opportunity and risk.

- Investors should prioritize liquidity, token authenticity, and contract verification when buying meme coins.

- Risk management is essential here. Diversification and small position sizes, combined with independent research, can reduce downside exposure in the highly volatile market. Never invest more than you can afford to lose.

What are Meme Coins?

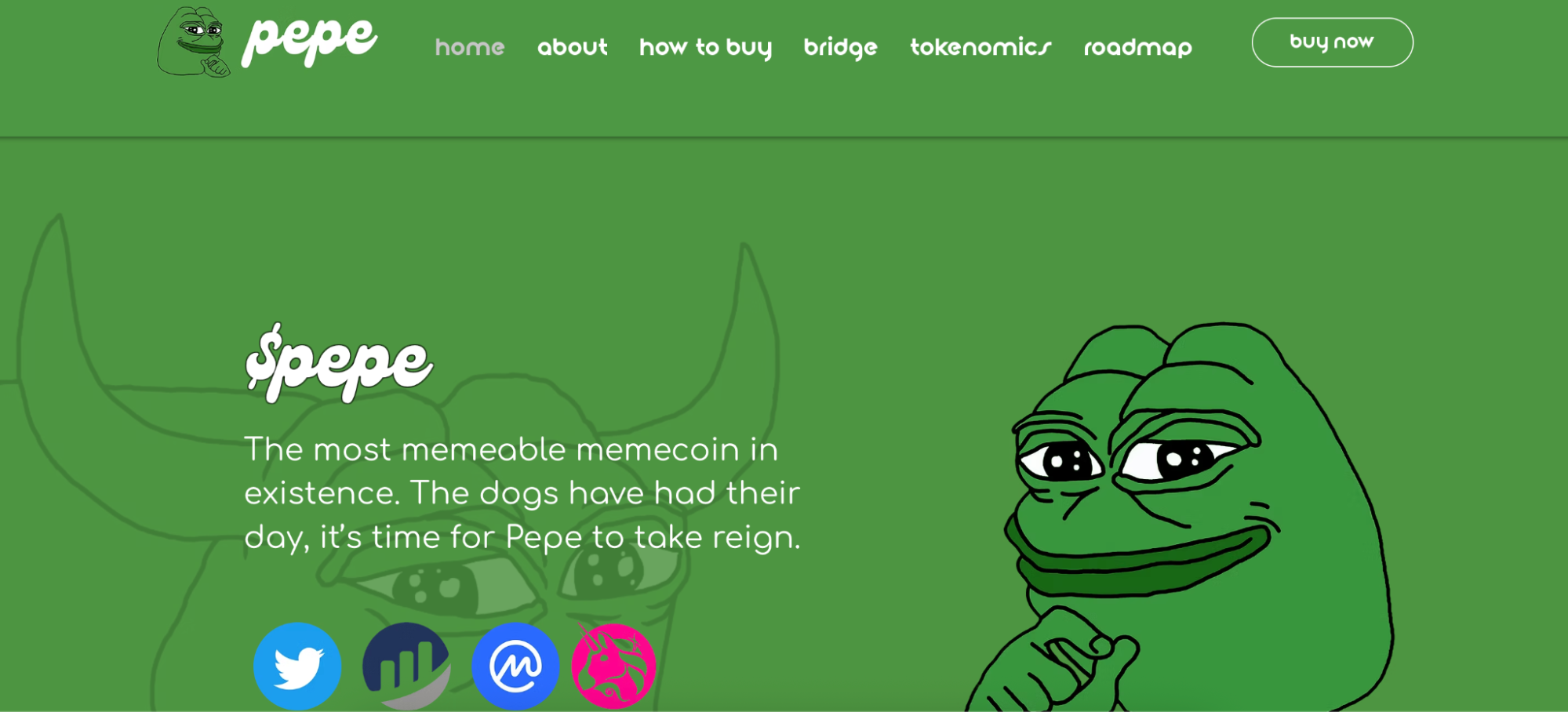

Meme coins are cryptocurrencies with speculative concepts, and most have no intrinsic value or use cases. The original meme coin, DOGE, launched in 2013 and inspired millions of other meme coins across a wide range of narratives. PEPE, for instance, is based on Pepe the Frog, while other popular meme coins reference cats, political figures, or internet memes.

While meme coins are high-risk, projects can produce substantial gains in short timeframes, a dynamic that fuels community-driven hype and viral participation. Learn more in our guide Best meme coins to invest in.

Why Buy Meme Coins?

It’s not just casual traders that buy meme coins. Bloomberg reports that hedge funds increasingly gain exposure to this volatile and high-potential market. This section explores why meme coins remain popular with retail and institutional clients alike.

Significant Growth Potential

The overarching appeal for meme coins lies in their sizable growth potential. Once a meme coin “blows up”, returns are often parabolic, allowing early holders to cash out with significant profits.

On-chain data shows that the PEPE price was just $0.00000000001063 in 2023. PEPE reached an all-time high of $0.00002825 about 18 months later. This trajectory reflects gains of over 256 million percent.

Pepe is one of the best-performing meme coins of all time. Source: Pepe

Bonk (BONK) is another example of a successful meme coin launch. Those who invested in BONK in late 2022 paid about $0.00000009197. The meme coin hit $0.00005916 about two years later, yielding gains of over 64,000%.

Fast Gains in a Short Timeframe

Successful tech companies, such as Apple and Microsoft, have delivered unprecedented shareholder value since their inception. However, to achieve those significant gains, investors held for multiple years. In contrast, explosive meme coins often skyrocket in value within months.

A recent example is MemeCore (M). Launched on the BNB Chain in July 2025 at $0.03524, the M price traded at $2.59 in September. In just two months, early backers made over 7,200%.

Market Diversification

Coinbase CEO Brian Armstrong estimates that about one million new cryptocurrencies launch weekly. Our research shows that the majority of these tokens operate in the meme coin category.

This dynamic gives investors ample market choice and enables them to diversify accordingly. A well-balanced meme coin portfolio could contain established market leaders like DOGE and SHIB, plus a collection of up-and-coming projects with small market capitalizations.

Another diversification strategy is to gain exposure to various meme coin ecosystems, like Ethereum, Solana, and Base.

Highly Accessible

Meme coins are globally accessible, regardless of location or budget. The top no-KYC crypto exchanges enable anonymous trading, so investors may buy, sell, and trade meme coins anonymously. These platforms often only require an email address from their clients, which promotes an inclusive and private trading experience.

When exploring how to buy meme coins, beginners often notice their high token supplies. This leads to low unit prices, and most tokens trade for under a cent. As such, meme coins are affordable, and traders can invest any amount they’re comfortable losing.

Where to Buy Meme Coins

Several options exist when trading cryptocurrencies online. Some methods appeal to investors who prefer privacy and convenience, while others favor traditional platforms with custodian services.

Consider the following options when exploring where to buy meme coins.

Non-Custodial Wallets

Since the FTX bankruptcy, where the then-second-largest exchange mishandled billions of dollars in client-owned cryptocurrencies, investors prioritize non-custodial solutions.

Providers like Best Wallet, MetaMask, and Exodus allow users to store meme coins without relying on centralized exchanges. Users control their investments fully, which prevents counterparty risks and enables them to transact without approval.

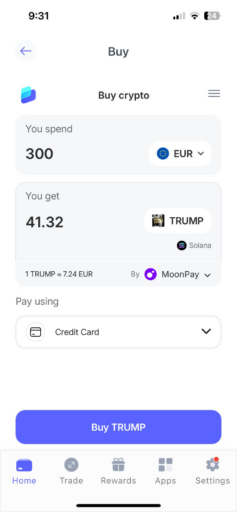

Best Wallet is popular with investors who want to buy Solana meme coins like TRUMP. Source: Best Wallet

These wallet solutions also function as trading platforms, as they often allow users to buy and sell meme coins with local payment methods.

Pros

- Trade meme coins without relying on a centralized custodian

- Purchased tokens automatically transfer to the wallet balance

- Investors own and control their meme coins through non-custodial storage

- Easily access meme coin ecosystems like DEXs and staking pools

Cons

- Users must follow wallet best practices to avoid security risks

- Non-custodial wallets often charge higher fees than CEXs

Centralized Exchanges (CEXs)

Although non-custodial wallets remain the safest option, CEXs like MEXC, Binance, and Coinbase generate the largest meme coin trading volumes.

These platforms function like conventional stock brokerages. Users open accounts with KYC verification, deposit funds with fiat money, and purchase their preferred meme coins.

The CEX acts as the custodian, which means it’s responsible for asset security. The drawback is that users never truly possess their meme coins, as the exchange holds wallet private keys. If you request a withdrawal from the CEX, it must approve the transfer before you receive any tokens.

Third-party threats include external hacks, client-fund mismanagement, and general business risks like debt and bankruptcy.

Pros

- Buy meme coins with a wide range of traditional payment methods

- Access trading tools like pricing charts and indicators

- Trading commissions average 0.1% per side

Cons

- CEXs control your private keys, which lacks true ownership

- Counterparty risks include hacks and bankruptcy

- Most platforms apply strict KYC procedures

Decentralized Exchanges (DEXs)

DEXs operate on the blockchain, which allows traders to buy and sell meme coins on-chain. Traders connect non-custodial wallets to the DEX and perform crypto-to-crypto swaps, as decentralized platforms do not accept fiat payments. This makes DEX trading less convenient for investors buying meme coins for the first time.

Uniswap is the best way to buy meme coins on the Ethereum blockchain. Source: Uniswap

DEXs rely on liquidity pools rather than traditional order books. Smart contracts execute trades almost instantly and transfer the purchased tokens to the connected wallet.

Choosing a DEX depends on the meme coin’s native network. Ethereum meme coins typically trade on Uniswap. Solana ecosystem tokens often use Raydium and Jupiter, while BNB Chain projects operate on PancakeSwap.

Pros

- Swap meme coins in a decentralized environment

- No requirement to open accounts or upload ID

- Smart contracts transfer tokens to the user’s wallet

Cons

- You can only buy meme coins that operate on the DEX’s network

- Users are unable to use traditional payment methods like debit/credit cards

- Too complicated for first-time investors

Comparing the Best Places to Buy Meme Coins

This table highlights the most popular platforms for buying meme coins, comparing them by type, fees, and overall suitability for different types of users.

| Platform | Type | Best For | Typical Fees |

| Binance | CEX | Large-cap meme coins, liquidity | 0.1% trading fee |

| MEXC | CEX | Mid-cap and trending meme coins | 0-0.1% |

| OKX | CEX, P2P | Fiat access and meme exposure | 0.1% |

| Coinbase | CEX | Beginners, regulated markets | Spread and fees |

| Best Wallet | Non-custodial wallet | Self-custody and on-ramp access | Variable on-ramp fees |

| MetaMask | Non-custodial wallet | Ethereum and Base meme coins | Variable swap fees |

| Uniswap | DEX | Ethereum meme coins | Dynamic |

| PancakeSwap | DEX | BNB Chain meme coins | 0.25% |

How to Decide Which Meme Coins to Buy

Discovering the next cryptocurrencies to explode requires carrying out your own research and analysis. Seasoned investors often avoid buying meme coins because of hype. Instead, they assess proven fundamentals like narratives, token supply, community growth, and market cap.

The sections below explain how to pick meme coins with high profit potential.

Market Capitalization Determines Risk-Reward

Beginners should evaluate their risk tolerance and trading objectives when exploring meme coin investments.

Experts consider meme coins with large valuations to be the lowest-risk option. While these meme coins remain volatile, they often experience milder pricing swings.

If you’re searching for the next 1000x token, micro-cap meme coins are a better fit. Consider tokens that trade with market capitalizations below $50 million, as they have the potential to grow by substantial multiples.

Explore Meme Coin Narratives

In crypto, narratives are trending concepts, ideas, or stories that influence broader market sentiment. They’re particularly important in the speculative meme coin industry.

A new narrative, such as dog-themed or political tokens, often drives price appreciation. Narratives also cover specific ecosystems, such as Solana or Base meme coins.

Some narratives last for days and others for months. The longer the narrative remains relevant, the higher the growth potential.

Data aggregation platforms like CoinGecko and DefiLlama help investors discover emerging narratives and trends. The key requirement is getting in before the narrative peaks.

Use On-Chain Data Platforms

Experienced meme coin traders avoid mainstream sources and instead extract data directly from the blockchain. This concept, known as “on-chain data”, includes transactions, wallet activity, volume, token distribution, and other core metrics.

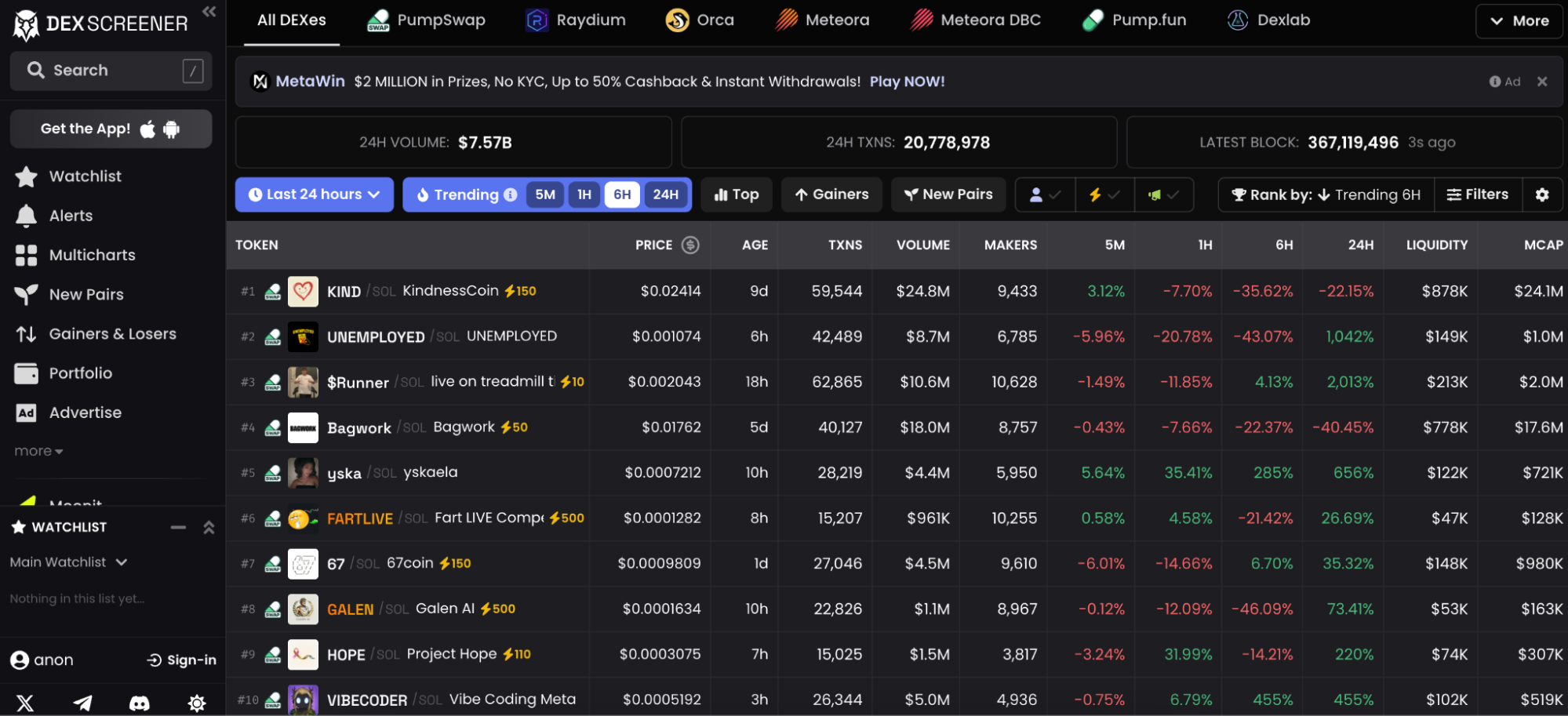

DEX Screener helps users find the next explosive meme coins via on-chain data. Source: DEX Screener

Popular on-chain providers like DEX Screener and Birdeye cover dozens of blockchains and Layer 2 networks. They offer user-friendly filters that let users find suitable projects, whether that’s a $1 million meme coin on BNB Chain or a mid-cap token experiencing a surge in unique wallet holders.

By using blockchain analytics, traders identify trends before the broader market, giving them a first-mover advantage.

Find Meme Coins With Strong Communities

SHIB, PEPE, BONK, and other billion-dollar meme coins achieve success because of their native communities.

In addition to a large number of token holders, strong communities are active on social media. They help promote their meme investments on X, Reddit, TikTok and other networks, which often results in virality.

If you notice that the same meme projects appear on your social feed, it could be an early sign. Once meme coins achieve social viability, the token price often explodes rapidly.

Evaluate the Tokenomics

Meme coin traders must analyze the tokenomics before they invest funds. It covers token fundamentals like the total and circulating supply, founder holdings, wallet distribution, and potential inflationary pressures.

Top cryptocurrencies and meme coins have strong tokenomics, which means a finite supply with almost 100% of tokens in circulation. This structure reduces the investment risks, as founders cannot manipulate markets if most tokens trade in the public float.

Meme projects with burn mechanisms are an added feature. These projects frequently reduce the total supply by transferring tokens to a “burn wallet address”. That address is inaccessible, which effectively removes those tokens from the supply. Therefore, as the meme coin has a deflationary supply, tokens become more scarce over time.

How to Sell Meme Coins

Investors may sell meme coins for fiat money or other digital assets. Availability depends on the exchange or wallet provider.

At Best Wallet, users cash out their meme coin investments instantly via the built-in DEX. The wallet partners with over 330 liquidity providers to secure the best exchange rates.

Here’s how to sell meme coins on the Best Wallet app:

- Open Best Wallet and click “Trade”

- Select the meme coin that you wish to sell

- Choose the receiving asset like USDT or SOL

- Input the trade amount and confirm

- The newly purchased tokens appear in your wallet balance right away

Conclusion

Buying meme coins today is easier than ever, but also riskier compared to most other crypto investments. Prices are driven by sentiment, narratives, and social momentum rather than adoption or utility.

Choosing where to buy matters just as much as what you buy. Wallets, centralized exchanges, and decentralized platforms each offer different trade-offs between accessibility, security, or early access.

For beginners, the most important rules remain unchanged: start small, verify everything, diversify exposure, and never invest more than you are prepared to lose.

FAQs

How can I purchase meme coins?

Is buying meme coins legal?

How do I buy meme coins before listing?

Can I buy meme coins with fiat currency?

Can you convert meme coins to cash?

References

- This type of coin is ‘among the riskiest of cryptocurrencies,’ investing expert says—here’s what to know (CNBC)

- Staff statement on meme coins (U. S. Securities and Exchange Commission)

- Mainstream memecoins signal changing markets (Financial Times)

Coinspeaker in Numbers

Monthly Users

Articles & Guides

Research Hours

Authors

The team behind IPO Genie has not yet announced an end date for the presale.

AI cryptocurrencies combine blockchain with artificial intelligence to power decentralized machine learning networks, GPU computin...

Fact-Checked By:

Fact-Checked By:

16 mins

16 mins

Nadica Metuleva

, 47 postsI’m a seasoned writer with over a decade of professional experience, specializing in crypto, technology, business, and iGaming. Over the years, I’ve built a reputation as a trusted contributor to well-known outlets such as InsideBitcoins, CEOTodayMagazine, and Promo, while also collaborating with leading content and marketing agencies including Skale and Boosta. My portfolio spans a wide range of content types, exchange reviews, how-to guides, long-form comparisons, trend analyses, and thought leadership pieces, crafted to both inform and engage readers across different levels of expertise.

In the crypto space, I’ve developed a deep understanding of blockchain technology, digital assets, and the fast-moving decentralized finance (DeFi) ecosystem. I’ve written extensively on topics such as cryptocurrency exchanges, wallets, tokenomics, NFTs, and global regulatory developments. As a crypto investor myself, I bring a valuable firsthand perspective that allows me to balance technical accuracy with practical insights that resonate with traders, investors, and newcomers alike. Whether I’m breaking down blockchain mechanics or analyzing the latest market shifts, my work combines rigorous research, industry knowledge, and a keen sense of storytelling.

My educational background plays a key role in shaping my writing approach. I hold a Bachelor’s degree in Translation and a Master’s degree in English Literature and Teaching, disciplines that sharpened my ability to research complex subjects, distill technical information into accessible language, and adapt my tone to diverse audiences. This strong academic foundation underpins my clear, insightful, and authoritative style.

Passionate about making complex topics accessible, my mission is to cut through the jargon and deliver content that empowers readers to make informed decisions.

You can learn more about me and explore my portfolio on LinkedIn.