Based on our research, the best short-term cryptocurrencies have deep liquidity, high volatility, and sustained positive market se...

XRPTundra is building a bridge between XRP and Solana with real staking rewards and a highly transparent token model. Here is what we expect from its price, performance, and potential in the coming years.

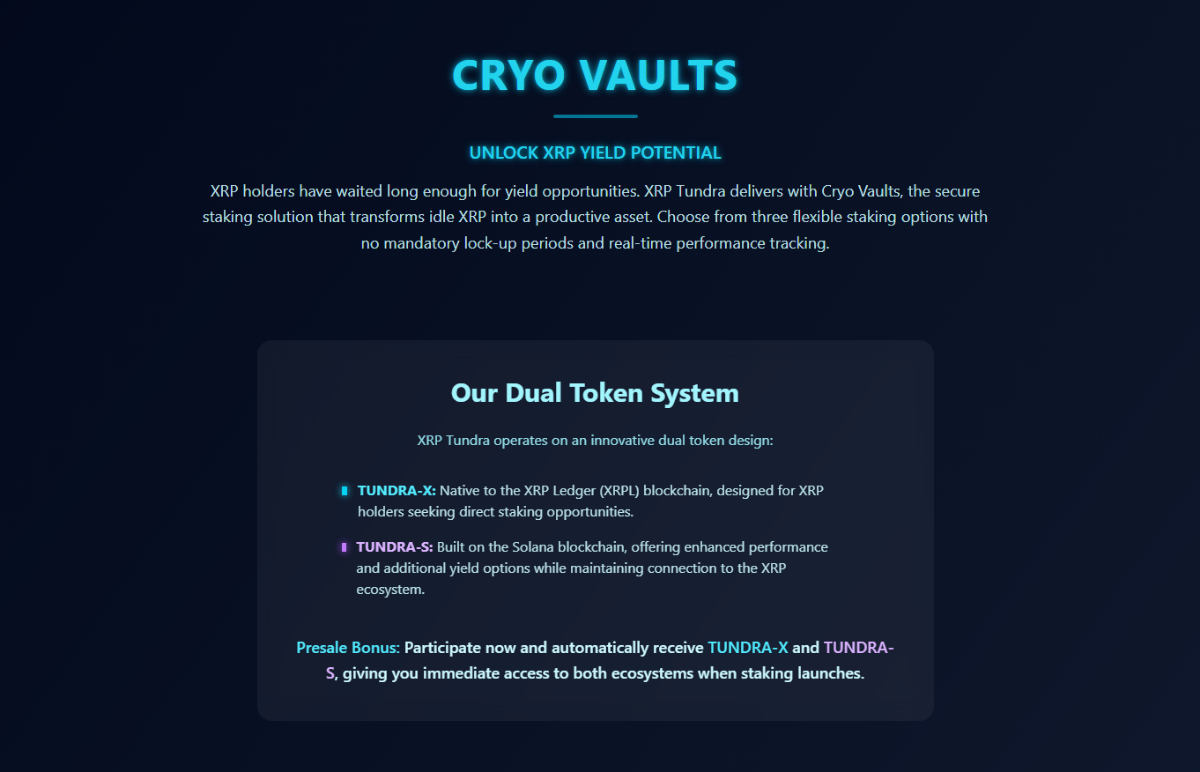

If you are holding XRP or keeping an eye on trending crypto projects, XRP Tundra might have piqued your interest. The XRP Tundra project is tied to the Cryo Vault ecosystem, which has given XRP holders a new way to earn rewards without taking on the risks that come with traditional DeFi platforms.

When you “freeze” your XRP in Cryo Vaults, you can generate TUNDRA rewards while keeping your assets fully secure on the XRP Ledger. This approach has generated considerable buzz around XRP Tundra, and as a result, it has raised questions about its price potential.

XRP Tundra’s value is closely linked to its utility within the Cryo Vault ecosystem. The more people stake and interact with the vaults (Glacier, Frostbite, or Cryostasis), the stronger the demand for TUNDRA becomes.

In this article, we will explore the project, the factors that could influence its price, as well as the perks and risks of investing in it.

Key Takeaways: XRP Tundra Token Price Forecast

- XRP Tundra shows potential for steady growth as the Cryo Vault ecosystem attracts more long-term XRP and TUNDRA holders.

- By 2027, the token could see significant adoption-driven price increases, with mid-range projections around $0.115.

- The deflationary mechanic, like TUNDRA token burns from fees, can strengthen scarcity and support higher valuations.

- Staking through Cryo Vaults offers secure and passive yields, which could encourage HODLing.

- Long-term projections to 2030 suggest XRP Tundra could reach $0.426 on average, thanks to sustainable rewards, adoption, and economic incentives.

| Year | Bearish | Moderate | Bullish |

| 2025 | $0.028 | $0.042 | $0.068 |

| 2027 | $0.072 | $0.115 | $0.195 |

| 2030 | $0.215 | $0.426 | $0.670 |

Featured Alternative – Editor’s Choice

- First Bitcoin Layer 2 enabling fast, low-cost transactions

- Fixes Bitcoin’s speed and fee limitations with near real-time performance

- Enables a Bitcoin-native DeFi ecosystem

XRP Tundra Price Prediction in Detail

Let’s now dig a bit deeper into our predictions and how we made them.

2025: Building Trust and Early Adoption

Bearish ($0.028): If the broader crypto market enters a correction phase or adoption of Cryo Vaults grows more slowly than expected, the token could remain near or below its presale price levels. Also, delayed exchange listings might limit its short-term momentum.

Moderate ($0.042): In a scenario with a steady rollout of staking options and gradual user adoption, XRP Tundra could achieve modest but healthy gains. With users testing both TUNDRA-X and TUNDRA-S, they would have more trust and visibility.

Bullish ($0.068): If marketing and community engagement grow, plus if early yield results attract XRP holders searching for passive income, XRP Tundra could see stronger traction by late 2025.

In short, 2025 is all about credibility and onboarding. If the project proves it can deliver safe and transparent staking on both XRPL and Solana, it can easily become the next big cryptocurrency.

2027: Expansion, Deflationary Effects, Stronger Demand

Bearish ($0.072): If the market remains risk-averse and DeFi regulations tighten, the growth might slow. Even so, established users and ongoing burns would likely keep the token above its early levels.

Moderate ($0.115): By this point, Cryo Vaults could be fully functional with strong participation across Balanced and Premium staking tiers. The burn mechanism reducing the supply, combined with cross-chain liquidity, could help it find consistent support.

Bullish ($0.195): A major influx of users and DeFi partnerships could propel the token into a recognized position in the XRP ecosystem. If GlacierChain launches successfully, the token could experience an even stronger value climb.

In 2027, XRP Tundra’s story is no longer experimental, but it would have shifted to established. At this point, sustainable staking and start tokenomics would begin to reflect in its market value.

XRP Tundra’s GlacierChain explained. Source: XRP Tundra

2030: Ecosystem Maturity and Long-Term Stability

Bearish ($0.215): Even in a weaker scenario, say if competition in cross-chain DeFi increases, XRP Tundra could still hold steady because of its governance and yield mechanisms.

Moderate ($0.426): A realistic midpoint assumes GlacierChain is widely used, staking rewards remain sustainable, and transaction burns reduce supply consistently. The ecosystem should have proven utility at this point.

Bullish ($0.670): In a highly optimistic outcome, XRP Tundra becomes a cornerstone of XRP-based DeFi, with large-scale adoption and integration across exchanges and wallets.

What Is XRP Tundra?

XRP Tundra is a next-generation DeFi platform designed to give XRP holders real yield opportunities without losing control of their assets. It is built on both the XRP Ledger (XRPL) and the Solana blockchain.

The project bridges two powerful ecosystems, aiming to offer secure and flexible staking through its signature feature, Cryo Vaults.

XRP Tundra Cryo Vaults explained. Source: XRP Tundra

Instead of keeping the XRP tokens idle in a wallet, users can freeze their assets in these vaults through XRP Tundra and earn passive income while maintaining self-custody. Every staking operation is verified through audited smart contracts, which means that your tokens won’t ever leave your wallet. This is a crucial difference from traditional DeFi platforms that require full custody transfers.

Here is what sets it apart:

- Audited, non-custodial staking: You can earn yield directly from your wallet, without third parties and intermediaries.

- Dual-token design: Two separate tokens manage stability and yield, keeping the system balanced.

- Cross-chain functionality: By connecting XRP Ledger with Solana, users can benefit from fast and low-cost transactions across two ecosystems.

- Real-time tracking: Users can monitor staking performance, reward growth, and token distribution.

The Dual-Token System: TUNDRA-X and TUNDRA-S

XRP Tundra runs on a dual-token architecture, splitting governance and utility functions between two assets:

| Token | Blockchain | Role | Key Function |

| TUNDRA-X | XRP Ledger (XRPL) | Reserve and Governance | Governs system parameters, provides stability, and represents the foundation of the ecosystem. |

| TUNDRA-S | Solana | Yield and Utility | Used for staking in Cryo Vaults, liquidity provision, and earning rewards. |

This separation prevents any single token from carrying all network responsibilities. TUNDRA-X ensures reserve stability and governance on XRP, while TUNDRA-S focuses on yield and liquidity on Solana.

XRP Tundra’s dual token structure. Source: XRP Tundra

CryoVaults: The Heart of the Project

The CryoVaults are the centerpiece of this project’s design. They allow users to stake their tokens and earn rewards based on the vault tier they choose. Each vault type offers a different level of commitment, flexibility, and potential yield.

| Vault Type | Commitment | Rewards | Description |

| Liquid Staking | No lock-up | Steady | Withdraw anytime while still earning (ideal for flexible users). |

| Balanced Staking | 30 days | Moderate | A balanced option for those seeking higher rewards without full lock-in. |

| Premium Staking | 90 days | Highest | Longer-term commitment with the top reward rates (best for dedicated stakers). |

GlacierChain

To make XRP really DeFi-ready, XRP Tundra introduces GlacierChain, a Layer 2 solution built on the XRP Ledger. It brings smart contracts and decentralized applications to XRP’s network without compromising speed or scalability.

Why Are Investors Watching XRP Tundra: Benefits from Investing

XRP Tundra is quickly gaining attention across the communities of both XRP and Solana, and for good reason. This doesn’t seem to be just another DeFi token chasing the hype. The platform actually solves one of the longest-standing frustrations for XRP holders: idle assets that don’t generate yields.

Let’s consider the main reasons why investors are keeping a close eye on this project.

1. Real Utility, Not Just Speculation

One of the strongest selling points behind XRP Tundra is that it is useful from day one. Through its Cryo Vaults, XRP and TUNDRA holders can earn yield without leaving the XRP Ledger or relying on third-party lending platforms.

- XRP holders can “freeze” their assets to earn TUNDRA rewards.

- TUNDRA holders can stake for passive income and higher yields.

- Dual staking (XRP + TUNDRA) offers some of the ecosystem’s best returns.

2. A Sustainable Reward Model

Many DeFi projects rise quickly and collapse just as fast because they depend on new deposits to pay the old stakers. XRP Tundra avoids this trap through a pre-allocated rewards structure.

All the yields come from:

- A fixed portion of the TUNDRA token supply.

- Protocol fees are recycled through the Cryo Finance, which burns a third of all collected tokens and redistributes another third to the rewards pool.

This setup creates somewhat of a self-sustaining economic cycle. Most others have an inflation-driven one, which can be an issue.

3. Strong Security Design

Security is one of the main reasons investors trust XRP Tundra more than many other new DeFi projects. Here is why:

- No lending or rehypothecation: tokens are never loaned out.

- Immutable smart contracts: once they are deployed, the parameters can’t be altered.

- Multi-signature admin functions and time locks to prevent misuse.

- Regular audits: the team works with Solana’s top security firms, including SolidProof and Cyberscope, for code verification.

The DeFi world is now full of hacks and rug pulls, so such a layered security model that retains full self-custody ownership gives a lot of confidence to investors.

4. Dual-Chain Ecosystem Means Double Exposure

XRP Tundra operates both on Solana (TUNDRA-S) and the XRP Ledger (TUNDRA-X). This gives investors exposure to two of the most advanced blockchain networks without having to choose sides.

On one hand, Solana brings high-speed, low-fee DeFi capabilities. On the other hand, XRP Ledger adds stability, security, and established network trust.

5. Deflationary Tokenomics

Deflationary pressure is baked into XRP Tundra’s design, as explained in the project’s official whitepaper. Every time a user stakes, withdraws, or claims rewards, a fixed TUNDRA fee is charged. These tokens don’t just disappear. They get funneled into the Cryo Furnace, where:

- 33% are burned forever, reducing the circulating supply.

- 33% go back into the rewards pool for stakers.

- 34% are used for ecosystem expansion, marketing, and liquidity.

The constant removal of tokens makes long-term holding more appealing for investors.

6. Transparent and Verified Team

The team behind XRP Tundra has undergone KYC verification and multiple security audits, which adds an extra layer of legitimacy that many DeFi projects lack. On the official website, you can find a link to their numerous KYC verification certificates.

Risks from Investing in XRP Tundra

XRP Tundra has a promising structure and a strong community, but it is still a very young project in a highly volatile market. Just like any DeFi or crypto investment, it carries its share of risks that you should also consider before getting involved.

1. Market Volatility and Liquidity Risk

Even with a strong use case, XRP Tundra’s token is still exposed to the same extreme price swings that affect the crypto market in general. A sudden drop in XRP or Bitcoin prices could cause panic selling across altcoins. Also, since XRP Tundra’s market cap and liquidity levels are still developing, price movements can be amplified by smaller trades.

Note: For investors, this means potential short-term losses even if the project’s fundamentals remain strong. The token’s value may only stabilize after more exchange listings and better adoption.

2. Early-Stage Project Risks

XRP Tundra is still in its growth and testing phase, and not every aspect of its roadmap has been proven under market pressure. Some Cryo Vault features and GlacierChain integrations are still rolling out, and performance under larger-scale user load remains untested.

Note: Early adopters can benefit from the low entry prices. However, they also face the highest project risk. If development slows or community interest fades, the token can struggle to maintain value.

3. Dependence on XRP and Solana Ecosystems

XRP Tundra is a cross-chain project, which is one of its biggest strengths, but it is also a point of dependency. If either network is congested or faces security issues and/or regulatory pressure, XRP Tundra’s operations will likely be disrupted. Also, network upgrades or compatibility changes on Solana or XRP could require technical adjustments, which may take a lot of time to implement.

4. Smart Contract and Technical Vulnerabilities

Even with security audits and KYC verification, no DeFi project is completely immune to technical flaws. The interoperability between Solana and XRP introduces a new level of complexity, which increases the chance of bridge-related vulnerabilities.

How to Buy XRP Tundra

If you have already analyzed the advantages and risks of XRP Tundra and decided to invest in the project, here is a short guide on how you can buy their tokens:

Step 1: Create an account

Visit the official XRP Tundra website and look for “Buy Tokens”. Register with your email and set up a password. You might need to complete KYC steps. After registration, log in and confirm your account.

XRP Tundra login page. Source: XRP Tundra

Step 2: Buy tokens

Once you are logged in, click the ‘Buy Now’ button on the homepage.

XRP Tundra runs its sale in phases. Each phase has a different price for TUNDRA-S and may include bonus allocations or free TUNDRA-X tokens. For instance, in Phase 4, TUNDRA-S is priced at $0.068, and buyers receive a 16% bonus plus free TUNDRA-X allocation at $0.034.

Select the currency you want to pay with. The options include XRP, USDT, BTC, ETH, ADA, DOGE, SOL, etc. Type in how much you want to invest (note that the minimum is 50.1 USD). The system will automatically show how much of your chosen crypto you’ll need to send.

If everything is correct, confirm the purchase and click continue. Once you do this, a payment window will open with a wallet address, QR code you can scan with your wallet app, and the amount you need to send. Copy the address or scan the QR to send funds from your crypto wallet.

Step 3: Track the transactions

If you wish to track the transaction, you can do so through the ‘Transactions’ button on the main menu. When you click on it, you will see your purchase listed. Note that purchases can take a few minutes or more to process, depending on network congestion.

Remember, once you’ve bought TUNDRA-X or TUNDRA-S, you can stake your tokens through Cryo Vaults:

- Glacier Vault – TUNDRA only

- Frostbite Vault – XRP and TUNDRA

- Cryostasis Vault – XRP only

Each vault offers different APYs depending on how long you lock your tokens (7, 30, 60, or 90 days). The longer you stake, the higher your reward multiplier.

How XRP Tundra Compares to Other Presales

One factor to consider when you are predicting a new token’s price is its competition. That being said, we compared XRP Tundra with some of the best crypto presales on the market right now.

Bitcoin Hyper vs XRP Tundra

Bitcoin Hyper ($HYPER) is positioning itself as a Layer 2 solution for Bitcoin, leveraging Solana’s execution environment to add utility and scalability to the network. While its main focus is utility, it’s also harnessing the viral potential of meme coins on Solana, with the goal of building the new foundation for the meme token ecosystem. Like XRP Tundra, HYPER also focuses heavily on staking in its roadmap. The token is used for staking, governance, and transaction processing within its ecosystem.

However, the key difference here is that XRP Tundra is built around making XRP itself productive via Cryo Vaults and a dual-token model across two networks. Bitcoin Hyper, on the other hand, is more infrastructure-oriented, trying to layer DeFi features onto Bitcoin.

PEPENODE vs XRP Tundra

PEPENODE leans heavily into game mechanics and meme/virtual mining. Participants build nodes that generate meme tokens, blending gamification with speculative appeal. In contrast, XRP Tundra is more structured and more utility-driven. It uses Cryo Vaults to produce a sustainable yield from token staking. PEPENODE’s model is more playful and speculative, which will likely make it more volatile than XRP Tundra.

Conclusion: Is XRP Tundra a Good Investment?

XRP Tundra stands out as one of the few presale projects that mix utility, staking, and real value with existing ecosystems like XRP and Solana. It focuses on long-term sustainability, letting holders earn rewards through Cryo Vault staking while contributing to its deflationary model, which balances supply and demand.

Of course, it is still much too early to determine its full potential. The project is in its presale stage, and as with any new crypto, prices can be unpredictable once the trading starts. But XRP Tundra has a clear plan, transparent audits, and a working system for yield.

It is important to remember that this project, like all crypto, is not risk-free. Still, XRP Tundra is very appealing for those who like earning passive income and getting early on projects with real blockchain connections. Just make sure to do your own research and never invest more than you can afford to lose.

FAQ

What is XRP Tundra?

How can I buy XRP Tundra?

Can I stake my TUNDRA tokens?

Is XRP Tundra safe?

When will XRP Tundra launch?

References

- XRP Tundra Launches Cross-Chain Staking Platform for XRP Holders – Globenewswire

- Ripple vs. XRP vs. XRP Ledger: What’s the Difference – Trustwallet

- XRP Tundra Presale Introduces Dual-Token Structure Alongside XRP Ecosystem – Globenewswire

- Beginner’s Guide to DeFi Yield Farming – Hedera

- XRP Tundra Tokenomics Explained – XRP Tundra Whitepaper

- What Is a Token Audit, and Why Should You Care About It – Auditone.io

- What Is Know-Your-Customer (KYC) in Crypto, and Why Do Exchanges Require It – Notabene

- KYC Certificates for XRP Tundra – Github

- Seven Key Cross-Chain Bridge Vulnerabilities Explained – Chain.link

- XRP Tundra Cryo Vaults: Security, Functionality, and the Critical Role of TUNDRA-S and TUNDRA-X – XRP Tundra

Coinspeaker in Numbers

Monthly Users

Articles & Guides

Research Hours

Authors

VerifiedX (VFX) has officially launched, offering a Bitcoin-inspired decentralized network with unique on-chain features. Learn wh...

BMIC doesn't have a fixed presale end date yet. The team said they want to keep things flexible and let demand dictate when it wra...

Fact-Checked by:

Fact-Checked by:

16 mins

16 mins

Nadica Metuleva

, 43 postsI’m a seasoned writer with over a decade of professional experience, specializing in crypto, technology, business, and iGaming. Over the years, I’ve built a reputation as a trusted contributor to well-known outlets such as InsideBitcoins, CEOTodayMagazine, and Promo, while also collaborating with leading content and marketing agencies including Skale and Boosta. My portfolio spans a wide range of content types, exchange reviews, how-to guides, long-form comparisons, trend analyses, and thought leadership pieces, crafted to both inform and engage readers across different levels of expertise.

In the crypto space, I’ve developed a deep understanding of blockchain technology, digital assets, and the fast-moving decentralized finance (DeFi) ecosystem. I’ve written extensively on topics such as cryptocurrency exchanges, wallets, tokenomics, NFTs, and global regulatory developments. As a crypto investor myself, I bring a valuable firsthand perspective that allows me to balance technical accuracy with practical insights that resonate with traders, investors, and newcomers alike. Whether I’m breaking down blockchain mechanics or analyzing the latest market shifts, my work combines rigorous research, industry knowledge, and a keen sense of storytelling.

My educational background plays a key role in shaping my writing approach. I hold a Bachelor’s degree in Translation and a Master’s degree in English Literature and Teaching, disciplines that sharpened my ability to research complex subjects, distill technical information into accessible language, and adapt my tone to diverse audiences. This strong academic foundation underpins my clear, insightful, and authoritative style.

Passionate about making complex topics accessible, my mission is to cut through the jargon and deliver content that empowers readers to make informed decisions.

You can learn more about me and explore my portfolio on LinkedIn.