Please check out latest news, expert comments and industry insights from Coinspeaker's contributors.

Discover how EigenLayer’s competitors are shaping the future of DeFi with innovative restaking models and driving new opportunities for yield optimization.

Decentralized Finance (DeFi) has emerged as a compelling alternative to traditional investment models, offering enhanced accessibility, transparency, and the potential for higher returns. Within DeFi, staking mechanisms allow users to lock their crypto assets in smart contracts, which in turn secure blockchain networks and validate transactions. In return, stakers receive rewards, typically in the form of additional tokens – thus creating passive income streams.

Staking in DeFi lets users earn yields on their crypto holdings while contributing to the stability and security of blockchain networks. This process incentivizes users to participate actively in the network, supporting its integrity and operations.

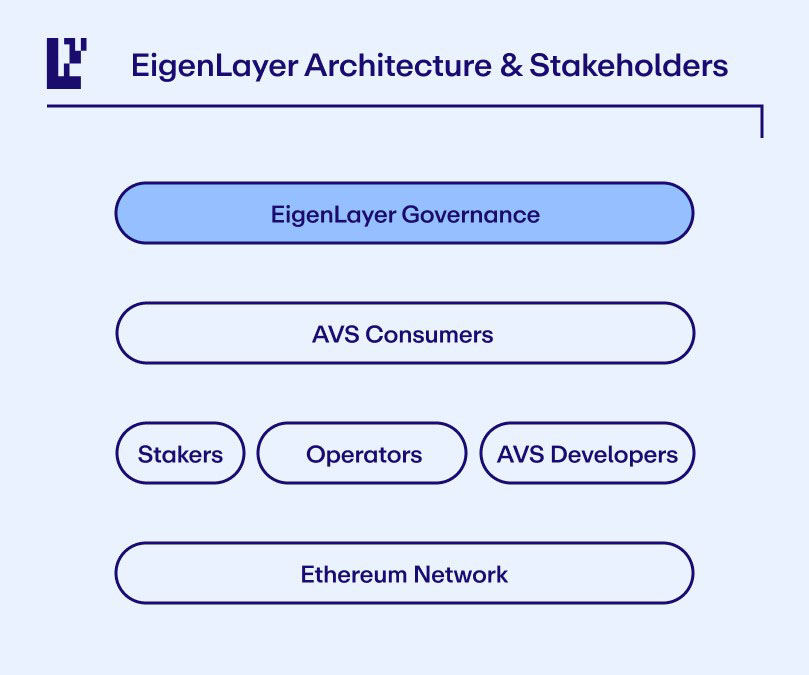

EigenLayer expands on this concept by introducing a restaking model that leverages Ethereum’s pooled security. EigenLayer is a shared security model for protocols that require infrastructure decentralization.

Building on traditional staking, EigenLayer introduces a novel concept: restaking. Restaking allows Ethereum stakers to support multiple networks and decentralized applications (dApps) simultaneously. By restaking their ETH, users can maximize potential rewards while contributing to a greater variety of blockchain projects. This approach aims to increase capital efficiency and fortify network security.

While EigenLayer has pioneered the restaking concept on Ethereum, the protocol is not without its challenges. Issues such as scalability and the complexity of managing multiple staking contracts have prompted competitors to innovate and potentially solve these limitations.

Let’s meet the key EigenLayer competitors.

Karak Network takes the idea of restaking further by supporting a variety of assets, including Ethereum, liquid staking tokens, and stablecoins. This broader asset support allows for enhanced security and reduced costs in maintaining decentralized secure services (DSSs). Karak’s versatile model offers a scalable alternative to EigenLayer, aiming to decrease operational expenses while enhancing crypto-economic security.

Lido, known for its liquid staking solutions on Ethereum, collaborates with Paradigm to support Symbiotic. This tech goes beyond Ethereum’s native tokens to allow the restaking of any ERC-20 token. This flexibility can attract a diverse user base and expand the protocol’s reach across various dApps, giving it an advantage in the competitive restaking landscape.

The concept of restaking isn’t only supported by Ethereum. Other proof-of-stake (PoS) blockchains could adopt this model, enhancing their security by allowing a larger pool of validators and increasing capital efficiency by letting stakers earn from multiple networks. But integrating restaking requires careful consideration of each blockchain’s consensus mechanisms and governance structures to maintain compatibility and security.

Marginly supports several innovative methods to boost yields on restaking, leveraging various trade strategies.

Moving beyond traditional staking and restaking models, Marginly introduces advanced trading mechanisms and leveraged yield farming. This protocol uses smart contracts to allow margin trading and use of derivatives, which can significantly enhance yield optimization. For instance, traders can use liquid restaking tokens as collateral to secure loans or buy yield-enhancing tokens, enabling higher returns under controlled risk conditions.

It’s important to clarify that Marginly only offers exposure to leveraged positions via Principal Tokens (PTs), contrary to some misconceptions about available strategies.

Protocols like EigenLayer and Marginly both demonstrate that DeFi can integrate traditional financial strategies, making sophisticated investment tools more accessible and tailoring them to the needs of the modern investor. As these platforms evolve, they continue to broaden the scope of DeFi, paving the way for its integration into wider financial systems.

Disclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article aims to deliver accurate and timely information but should not be taken as financial or investment advice. Since market conditions can change rapidly, we encourage you to verify information on your own and consult with a professional before making any decisions based on this content.

Please check out latest news, expert comments and industry insights from Coinspeaker's contributors.