Uniswap Launches on BNB Chain Network

By expanding to the BNB Chain, Uniswap will now be able to offer its users a network with lower transaction fees.

By expanding to the BNB Chain, Uniswap will now be able to offer its users a network with lower transaction fees.

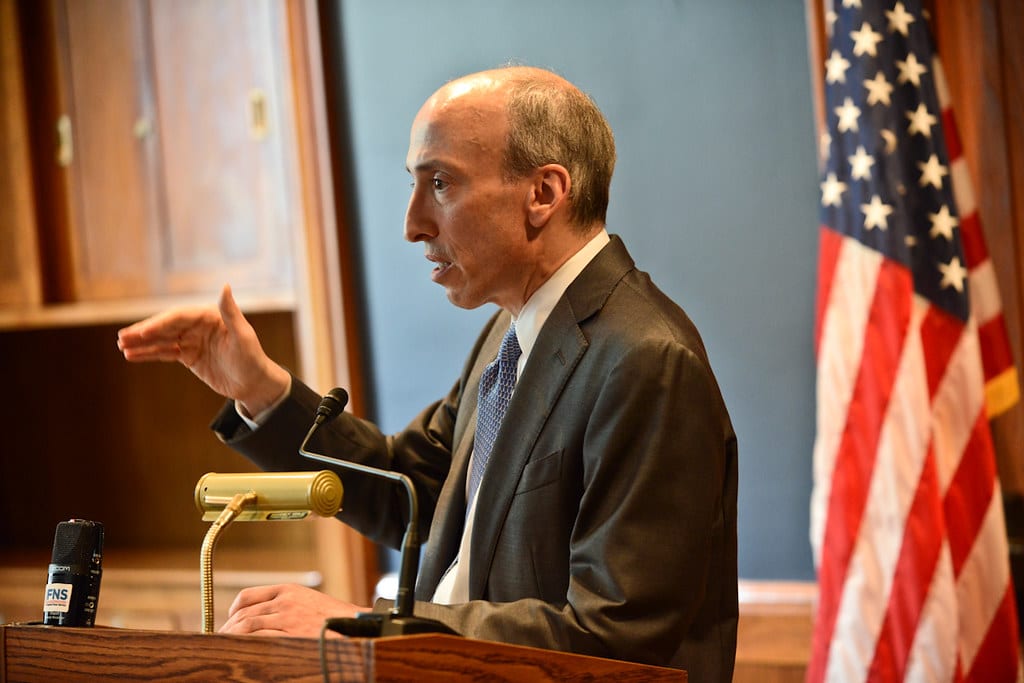

SEC Chair said that operators of the Proof-of-Stake protocols attract investors with a promise to offers rewards and thus they should be subjected to securities laws.

In building the NFT platform, Salesforce considered the importance of user privacy and its implications.

The demand for mortgage is rising as high rates do not discourage prospective homebuyers for making mortgage applications.

The firm’s Chairman Axel Lehmann declined to comment on whether it will need assistance from the government in the future, he highlighted that the bank has no problems as it has good return capital ratios.

Robinhood users have taken to Twitter to express their displeasure as they are unable to revel in the SVB and Signature Bank failure.

Leading exchange KuCoin participated in a $10 million funding exercise for CNHC to support stablecoin adoption.

As unveiled by Circle, it has started processing its redemption through a new banking partner after it was able to access the funds worth $3.3 billion locked up in Silicon Valley Bank.

The arrival of the Filecoin Virtual Machine on the mainnet presents a slew of rewarding opportunities to developers.

Google’s API for PaLM will help businesses “generate text, images, code, videos, audio, and more from simple natural language prompts”.

OpenAI revealed that it has been using GPT-4 internally, functioning in sales, programming, support, and content moderation.

Coinbase has integrated Singpass, making it more convenient for customers to sign up on the exchange.

The Amazon Project Kuiper aims to offer high-speed internet to every part of the world.

The collapse of Silicon Valley Bank is unprecedented and the reverberations in the broader tech and financial ecosystem are notably very resounding.

SEC filing shows Becker’s share sales were part of a scheduled program dubbed 10b5-1 plan, however, the securities regulator is considering a 90-day “cooling down” period between the filing and the first sale.