Amazon (AMZN) Stock Price Up 2% as Its Brand Value Crosses $400 Billion

Amazon (AMZN) stock price is up today as the brand has been rated as the most valued in the world with a $415.9 billion valuation.

Amazon (AMZN) stock price is up today as the brand has been rated as the most valued in the world with a $415.9 billion valuation.

Royal Dutch Shell stock dropped 4% today after the company announced that it is anticipating to write down assets worth up to $22 billion in the coming quarters.

Elon Musk, CEO of Tesla, haw expressed optimism in a leaked email that the company will post a profitable Q2 figure. The nudging has sparked an increase in TSLA stock which is above $1,000 again.

Boeing (NYSE: BA) stock surged by over 14% yesterday after FAA confirmed that it will conduct many flight maneuvers and emergency procedures on the ill-fated Boeing 737 MAX.

Tesla stock closed yesterday at $1,009.35. 10 years ago, the price at the debut was $17. If we take this price, the growth is 5,900%, if we take the price at the end of the first trading day – $23.89, the growth is 4,200%.

The U.S. stock market made positive moves after major correction last week. Airline stocks lead the way as the U.S. Federal Aviation Administration starts a three-day compliance test for Boeing’s 737 Max.

Wells Fargo expects to announce the new dividends when it will report quarterly earnings on July 14. The company’s previous quarterly common stock dividends were 51 cents per share.

Companies are continuing to sign onto a Facebook advertising boycott. Ford and Adidas are among the latest. So far, none of the advertisers are in the top spenders on Facebook this year. FB stock is in the green.

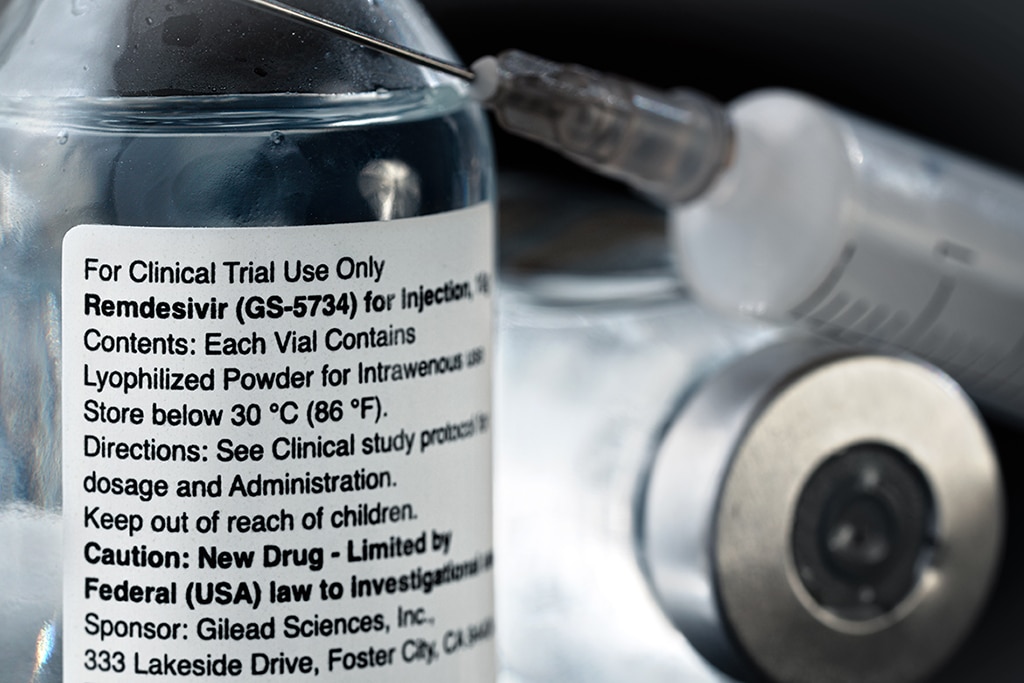

Gilead Sciences (GILD) stock is slightly down after the company set the Remdesivir price for developed countries at $390 per dose. Privately insured patients will be charged $520 per dose.

Ozon is the only retailer that Amazon has shown consistency in its interest to participate in its life.

The World Health Organization highlighted the progress of AstraZeneca seeking for the COVID-19 vaccine. UK-based company has moved to the human trial stage. Moderna is not far behind.

Due to the COVID-19 pandemic experts believe that Tesla Q2 results will be pure than in the first quarter. However, today TSLA stock is slightly up.

Despite the shutdown of Tesla’s main vehicle production facility in Fremont for the majority of the second quarter, the company stands good chances of finishing the second quarter in impressive fashion.

Microsoft has confirmed it is going to close its physical stores permanently to boost its virtual shopping store for its customers. MSFT stock is down today.

The new F-150 truck in both pure diesel and hybrid versions can be considered to be another booster for Ford stock. F stock was up yesterday and is in the green today in the pre-market.