Nasdaq Composite Drops 168 Points as Market Closes Down for Second Straight Week

The downtrend in the Nasdaq Composite was sparked by the plunge in tech stocks like Tesla and Microsoft.

The downtrend in the Nasdaq Composite was sparked by the plunge in tech stocks like Tesla and Microsoft.

Despite the Dow Jones slump, it was not all bad for the global stock market on Thursday as a number of corporations that shared their earnings report helped provide the cushion the market needed.

Nevertheless, Roku through its earnings report is confident that 2022 and the years ahead will be characterized by increased revenue and global new viewerships.

The slight miss of European stocks has also trickled down in some way to Wall Street as well as other markets around the world.

Online gaming giant Roblox had a feeble Q4 report which resulted in the worst day ever performance of its stock.

In the second quarter, Cisco recorded a revenue of $12.7 billion, which is an increase of 6 percent year over year.

As revenue increased in the last quarter, hopes are high that Nvidia will also see profits in the fiscal Q1.

Tesla shares are significantly affected by Elon Musk’s daily activities, particularly those pertaining to his leadership in the EV giant.

The Russia-Ukraine tensions brew further amid a heavy buildup of the Russian military at the Ukrainian border. Money has been flowing out of the equity markets to more risk-off assets.

The stock market is always in a very polarizing state, irrespective of whether the sentiment per time is bullish or bearish.

Tesla is recalling some 2020-2022 Model S, Model X, Model Y, and 2017-2022 Model 3 vehicles.

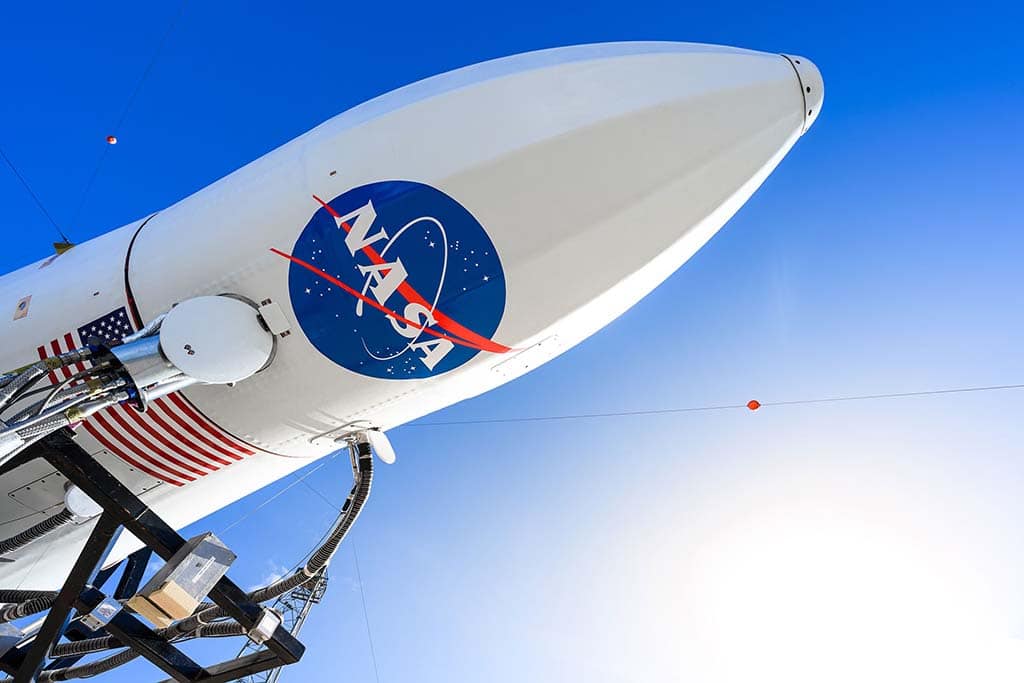

The launch was supposed to put four NASA-sponsored cubesats on a mission called Educational Launch of Nanosatellites (ELaNa) 41.

With AAA consistently surpassing market targets, the coinage will most likely last longer than FAANG did.

During the second quarter of the fiscal year 2022, Affirm reported total revenue of $361.0 million, a 77% increase compared to the same period last year.

Disney stock has lost approximately 22.88 percent, 4.95 percent, and 9.18 percent in the past year, YTD, and the last three months respectively.