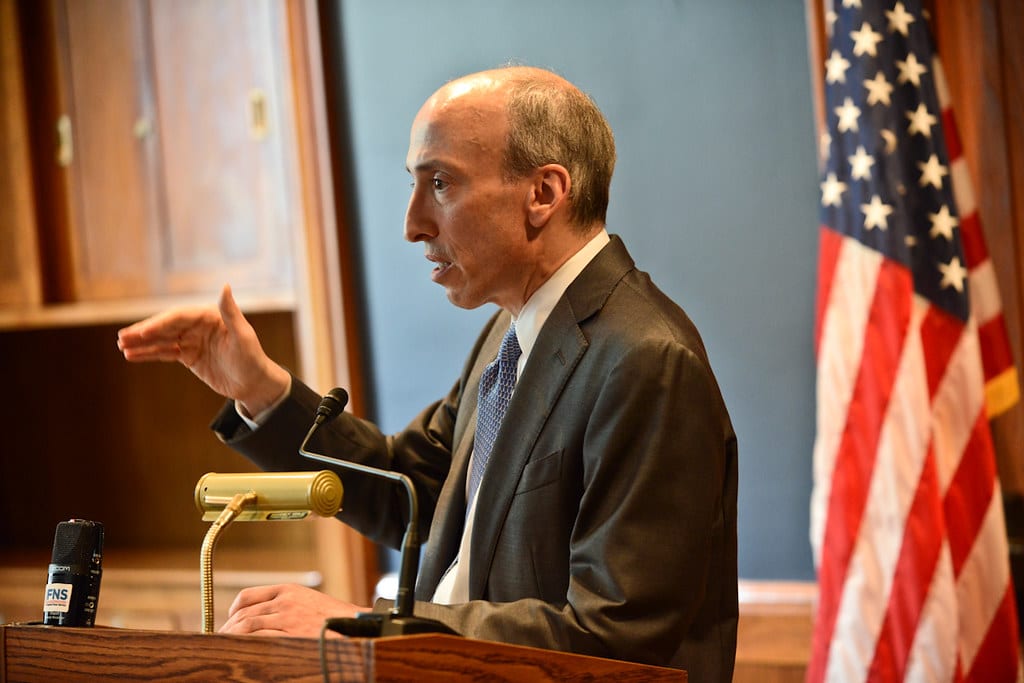

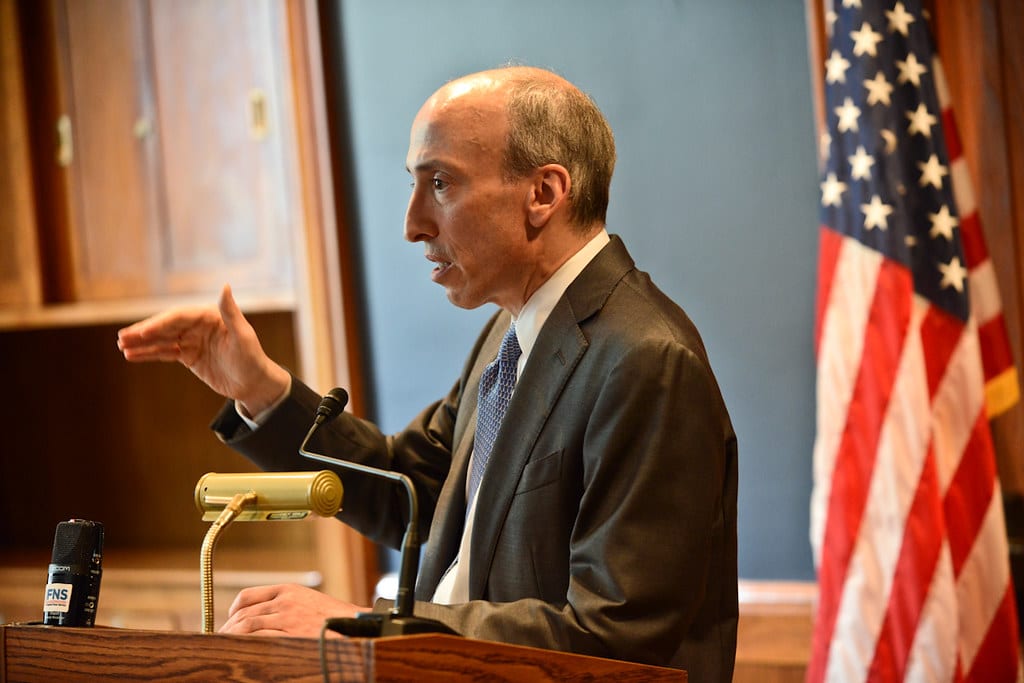

SEC Chair Gary Gensler Stresses that Proof-of-Stake (PoS) Tokens Are Securities

SEC Chair said that operators of the Proof-of-Stake protocols attract investors with a promise to offers rewards and thus they should be subjected to securities laws.

SEC Chair said that operators of the Proof-of-Stake protocols attract investors with a promise to offers rewards and thus they should be subjected to securities laws.

Leading exchange KuCoin participated in a $10 million funding exercise for CNHC to support stablecoin adoption.

As unveiled by Circle, it has started processing its redemption through a new banking partner after it was able to access the funds worth $3.3 billion locked up in Silicon Valley Bank.

The arrival of the Filecoin Virtual Machine on the mainnet presents a slew of rewarding opportunities to developers.

Euler says the hacker must return 90% of the funds that were stolen within 24 hours or face legal consequences.

High-impact news, including the CPI release and the US banking crisis, significantly contributed to Bitcoin price topping $26K.

Coinbase might be set to integrate several other protocols with Base, starting with Aave and Uniswap.

Gemini crypto exchange reassured its customers that reputable banks, including Fidelity, hold all GUSD reserves.

Coinbase also noted that users will be able to withdraw their existing BUSD assets whenever they choose.

The Fed and the FDIC have assured depositors that they could withdraw money from Silicon Valley Bank thereby instilling some confidence among crypto investors.

According to Circle, the bulk of its reserve for the USDC stablecoin is domiciled in US Treasury Bills.

Garlinghouse noted that financial systems are broken given their high susceptibility to rumors as evidenced by the current banking crisis.

Pressure continues to mount on stablecoins given the current situation that has seen three major crypto-backing banks collapse in the past few days.

USDC stablecoin issuer Circle has a staggering $3.3 billion of its total reserves with the Silicon Valley Bank. Circle has promised to cover any shortfall using corporate resources as well as external capital if required.

The whale address has liquidate all its Moonbirds NFTs incurring losses as high 32% on its investments.