With over 3 years of crypto writing experience, Bena strives to make crypto, blockchain, Web3, and fintech accessible to all. Beyond cryptocurrencies, Bena also enjoys reading books in her spare time.

IOSCO survey shows that nearly 60% of US investors under 35 have considered crypto investments, with over half already participating in the market.

Edited by Julia Sakovich

Updated

3 mins read

Edited by Julia Sakovich

Updated

3 mins read

The International Organization of Securities Commissions (IOSCO) has highlighted a significant rise in crypto ownership among retail investors, even as the market grapples with increased volatility and regulatory challenges. According to a report released on October 9, 2024, crypto adoption rates have surged across multiple jurisdictions since 2020.

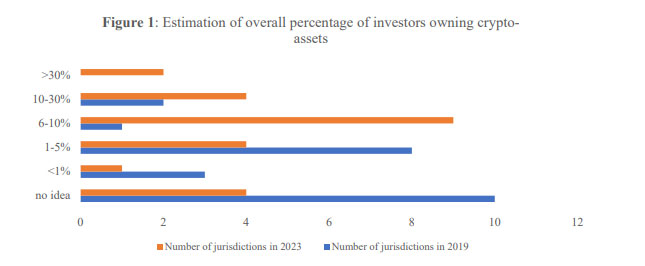

The study surveyed 24 jurisdictions, with 15 reporting that up to 10% or more of retail investors owned cryptocurrency in 2023. Six jurisdictions noted a higher adoption rate of up to 30% or more. This marks a substantial increase from 2020 when crypto ownership was reported to be between 1% and 5% among most jurisdictions.

Photo: IOSCO

“Since 2020, the crypto-asset space has continued to evolve,” IOSCO stated. This growth occurred despite major setbacks, such as the 2022 ‘crypto winter’ that saw a sharp downturn in the market. The report emphasized that investor education remains crucial, given the lack of regulatory clarity, persistent scams, and market instability.

The IOSCO report highlighted that the crypto market has faced several significant challenges over the past four years, including high-profile bankruptcies, a prolonged bear market with indexes plunging by 73% from their previous highs, and a surge in scams and hacks. Regulatory and enforcement actions have also ramped up, yet retail investors remain undeterred.

“Over the last four years, numerous surveys, studies, and reports have found increasing interest by investors, particularly new investors, in crypto-assets,” the report noted.

In the United States, nearly three out of five investors under the age of 35 considered crypto investments, and over half had already ventured into the market. About 44% of Gen Z investors in the US (aged 18 to 25) reportedly began their investment journey with cryptocurrencies.

The report highlights that most retail crypto investors are younger men, usually under 40. They are often drawn to crypto due to its low entry cost, fear of missing out (FOMO), and the influence of friends and social media. Notably, new investors are more inclined to invest in digital assets than seasoned investors, signaling the rising interest among younger groups.

“Many investors noted FOMO as a reason to invest in crypto-assets and often appear to get their information about crypto-assets from friends, family, and social media,” said the report.

However, the IOSCO stresses the need for stronger education and regulations to safeguard retail investors. Risks like market swings, scams, and weak oversight still pose threats. Therefore, the report advises a cautious yet informed approach to investing in digital assets.

Disclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article aims to deliver accurate and timely information but should not be taken as financial or investment advice. Since market conditions can change rapidly, we encourage you to verify information on your own and consult with a professional before making any decisions based on this content.

With over 3 years of crypto writing experience, Bena strives to make crypto, blockchain, Web3, and fintech accessible to all. Beyond cryptocurrencies, Bena also enjoys reading books in her spare time.