Vini Barbosa has covered the crypto industry professionally since 2020, summing up to over 10,000 hours of research, writing, and editing related content for media outlets and key industry players. Vini is an active commentator and a heavy user of the technology, truly believing in its revolutionary potential. Topics of interest include blockchain, open-source software, decentralized finance, and real-world utility.

Key Notes

- Major asset managers integrate with cryptocurrency infrastructure through Ripple's dollar-pegged digital currency partnership.

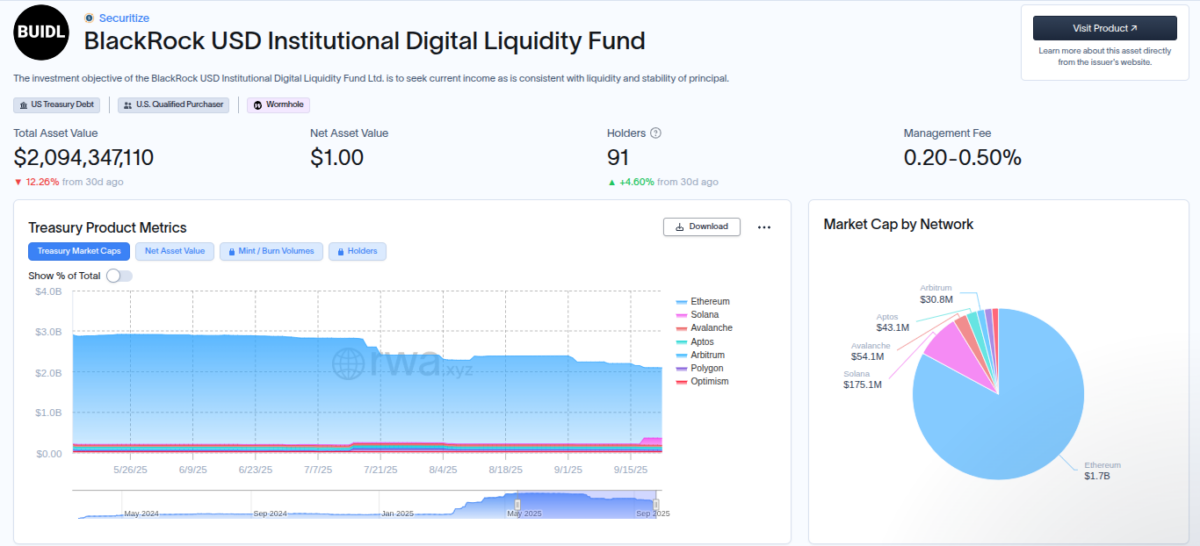

- BlackRock's BUIDL fund manages over $2 billion across seven blockchains with 91 institutional holders currently participating.

- Real-time settlement capabilities promise to automate liquidity for tokenized assets in institutional finance markets.

BlackRock BUIDL and VanEck VBILL tokenized funds shareholders will now be allowed to exchange their shares for Ripple’s RLUSD, a US dollar-pegged stablecoin, in a new partnership between Securitize and Ripple.

This new feature was announced on September 23 in a press release published on Securitize’s website. Securitize is the company behind BlackRock’s, VanEck’s, and other institutions’ tokenization activities, being a world leader in tokenizing real-world assets with over $4 billion AUM as of May 2025.

Initially, the RLUSD exchange will only be available for BlackRock’s BUIDL, with VanEck’s VBILL integration planned for the “coming days.”

“Making RLUSD available as an exchange option for tokenized funds is a natural next step as we continue to bridge traditional finance and crypto,” said Jack McDonald, SVP of Stablecoins at Ripple.

Carlos Domingo, co-founder and CEO of Securitize, also commented on the partnership, saying it is “a major step forward in automating liquidity for tokenized assets.” The company is also integrating with the XRP Ledger, going beyond a simple RLUSD exchange feature.

“Together, we’re delivering real-time settlement and programmable liquidity across a new class of compliant, on-chain investment products—bringing the full potential of blockchain to institutional finance,” Domingo added.

Tokenized Funds: BlackRock’s BUIDL and VanEck’s VBILL

BlackRock launched BUIDL in partnership with Securitize on March 20, 2024. The fund offers exposure to qualified investors to US Treasury, cash, and repurchase agreements, currently with over $2 billion AUM among 91 holders, according to data from RWA.xyz.

BUIDL is available on seven blockchains: Ethereum ETH $2 086 24h volatility: 6.4% Market cap: $251.21 B Vol. 24h: $54.88 B , Solana SOL $87.92 24h volatility: 8.2% Market cap: $49.78 B Vol. 24h: $8.87 B , Avalanche AVAX $9.28 24h volatility: 7.9% Market cap: $3.99 B Vol. 24h: $469.58 M , Aptos APT $1.14 24h volatility: 6.6% Market cap: $867.28 M Vol. 24h: $129.84 M , Arbitrum ARB $0.12 24h volatility: 7.9% Market cap: $698.46 M Vol. 24h: $152.30 M , Polygon, and Optimism OP $0.20 24h volatility: 9.2% Market cap: $413.58 M Vol. 24h: $98.66 M . The fund distributes income daily, charges a management fee of 0.20-0.50%, and has seen monthly transfer volumes of around $425 million, underscoring its appeal for DeFi integrations and stable yield generation.

BlackRock USD Institutional Digital Liquidity Fund | Source: RWAxyz

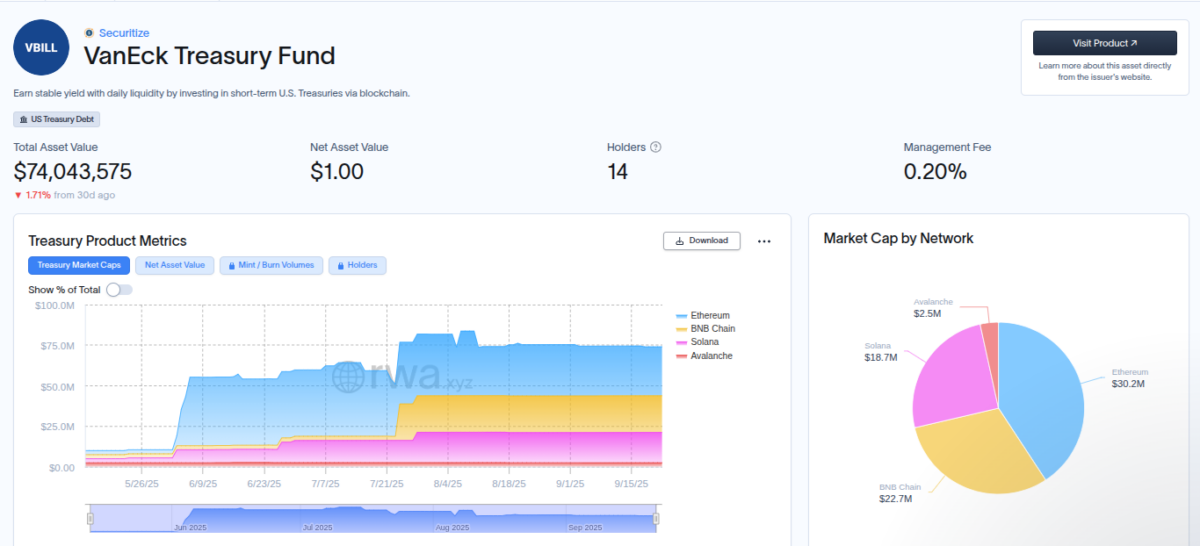

Building on this momentum, VanEck entered the tokenized fund space with its Treasury Fund, VBILL, launched on May 13, 2025, also in collaboration with Securitize. As VanEck’s inaugural tokenized offering, VBILL provides blockchain-based access to short-term US Treasuries, targeting qualified investors with a lower entry point of $100,000.

VBILL currently has 14 holders and a $74 million AUM, available on four blockchains: Ethereum, BNB Chain BNB $655.0 24h volatility: 2.4% Market cap: $89.17 B Vol. 24h: $2.51 B , Solana, and Avalanche.

VanEck Treasury Fund | Source: RWAxyz

The recently added liquidity against RLUSD, promised to work 24 hours a day, seven days a week, could increase the accessibility and demand for both tokenized products—boosting the market’s interest in these real-world asset tokens. Tokenization has become a popular topic on Wall Street and among institutional investors, with Nasdaq already moving to facilitate tokenized stock trading with the Securities and Exchange Commission (SEC), as Coinspeaker reported.

Disclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article aims to deliver accurate and timely information but should not be taken as financial or investment advice. Since market conditions can change rapidly, we encourage you to verify information on your own and consult with a professional before making any decisions based on this content.