Solana Leads over Ethereum Layer-2s as Solaxy’s $38M Presale Nears Last 28 Days

Solaxy ($SOLX), Solana’s ($SOL) first layer-2 chain, has now reached nearly $38 million in presale funding – with just 28 days remaining before the sale officially ends. Tokens are currently priced at $0.001728, locked in for the final stretch of the presale.

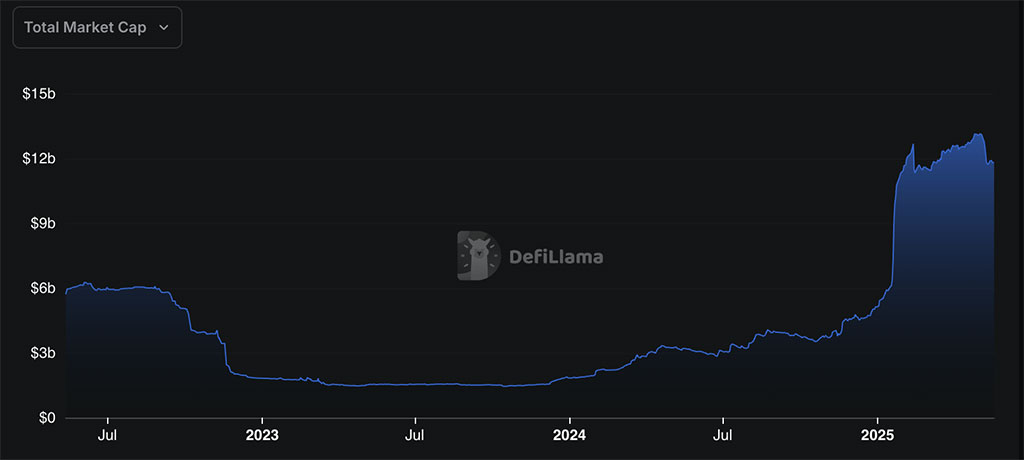

Solaxy’s fresh capital surge comes as Solana’s base layer outpaces Ethereum’s ($ETH) layer-2 stack – including Base, Arbitrum, and Optimism – now boasting over $9 billion in total value locked (TVL).

But that’s just one signal. In the past 24 hours alone, Solana generated $18 million in fees. Over the last 60 days, staking activity has also accelerated – with over $65 billion worth of $SOL now staked, signaling long-term confidence and deepening network security.

These metrics are bullish for $SOL’s price – but they also stress-test the chain’s capacity. And when demand spikes, Solana’s scalability limits have a history of showing.

That’s why having a dedicated layer-2 like Solaxy matters now more than ever. Designed to absorb heavy traffic and extend throughput, Solaxy is poised to play a central role in Solana’s next growth phase – not just keeping the chain stable, but helping it scale with demand.

🚨 28 Days Remain 🚨

In just 28 days, the Solaxy pre-sale will end, but that is not all.

Announcing for the first time is Solaxy’s Igniter Protocol, where $SOLX holders will be able to create and launch their very own Tokens.

This is just the beginning of $SOLX domination.… pic.twitter.com/3990nDdRWu

— SOLAXY (@SOLAXYTOKEN) May 19, 2025

Solana Dominates DeFi Rankings – But Is It Ready for What’s Ahead?

Solana is swinging a wrecking ball through the current hierarchy of decentralized finance. The latest activity on the network is a clear signal that it means business.

As mentioned, its TVL has now surpassed not just Base, Arbitrum, and Optimism, but even Binance Smart Chain ($BSC), which currently holds just $6 billion.

Solana’s growth has been so rapid that its 30-day TVL change is 32.2% – even edging out Ethereum’s 30% over the same period.

Source: DefiLlama

Over the past month, Solana’s fee revenue has also surged by 56.68%, driven primarily by two dApps: decentralized exchange Axiom and meme coin launchpad Pump.fun. And that momentum extends beyond TVL and fees.

Solana’s stablecoin supply peaked at $13 billion in early May – a major liquidity boost that underscores just how deep the ecosystem is getting.

Source: DefiLlama

But with explosive growth comes growing pains.

Rising activity has historically led to congestion and even network outages. And with institutions like VanEck, 21Shares, Bitwise, and Canary Capital now filing Solana ETF products, the next wave of usage could be unprecedented.

That’s why a growing segment of the Solana community is looking ahead – and turning to its first-ever layer-2 solution: Solaxy.

And why is its presale closing in on $38 million? Because more and more crypto enthusiasts are betting that Solaxy will be the scalability layer Solana needs to stay reliable when the next traffic surge arrives.

Why Solana Must Strengthen Its Infrastructure Ahead of the Next Surge

What savvy investors understand is this: soaring network activity is great for $SOL’s price – but only if the chain can actually handle it. And that’s been Solana’s Achilles’ heel.

For all its speed and low fees, Solana has a history of buckling under pressure. More traffic often means more congestion – and at worst, full-on outages. That’s millions in lost transactions, validator income, and dApp revenue – gone in hours.

This is a big reason Solana hasn’t yet claimed the DeFi crown. No matter how promising the metrics look, reliability remains its most significant bottleneck.

And yet, parts of the Solana community still resist the idea of a layer-2. They see Solana’s monolithic design as self-sufficient. But the past tells a different story. Each growth wave has exposed the same vulnerabilities.

That’s why developers began building Solaxy – a scaling layer designed not to sidestep Solana’s issues, but instead to strengthen its foundation.

Solaxy processes transactions off-chain and settles them directly to Solana’s mainnet – much like Arbitrum or Optimism do for Ethereum. But unlike those solutions, it doesn’t sacrifice speed. In fact, Solaxy runs at the same velocity as Solana, with the added capacity to handle traffic spikes without compromising finality or security.

Source: Solaxy

It’s a parallel infrastructure built to keep the engine running smoothly when the pressure hits.

For investors watching Solana’s numbers soar, that’s the missing piece – the layer that ensures the growth doesn’t outpace the chain.

Solaxy’s Live Bridge Pushes Solana Toward Modular, Cross-Chain Scaling

On May 15, Solaxy’s Testnet Bridge went live and connected to the Solana Devnet, clearly demonstrating that its technology is already working in practice.

🛸 Solaxy Testnet Bridge is LIVE! 🛸

You can now bridge native SOL between Solana Devnet and Solaxy Testnet at https://t.co/BFMV1G9v4c 🔥🚀

Built with Hyperlane, this is the first step toward full cross-chain interoperability.

Ethereum bridging is coming for mainnet — stay… pic.twitter.com/8NVoPaqaoV

— SOLAXY (@SOLAXYTOKEN) May 15, 2025

Built in collaboration with Hyperlane, a leading permissionless interoperability protocol, the bridge enables native SOL transfers using a validator-driven architecture designed to mirror production-grade standards.

Hyperlane currently connects over 150 blockchains and has facilitated more than $5 billion in bridged value, making it one of the most trusted teams in cross-chain infrastructure.

The system is tuned to match Solana layer-1 behavior, delivering a fast, secure, and native-feeling experience across chains. With mainnet support for Ethereum on the way, the bridge marks a major interoperability milestone – positioning Solaxy as a modular hub for seamless, multichain interaction.

In a world where cross-chain compatibility is becoming essential, this tooling will help Solana stay connected, competitive, and future-ready.

28 Days Remaining: Don’t Miss Your Chance Before Solaxy Launches

Solaxy isn’t just a concept – it’s already in motion. But for those still watching from the sidelines, the window to get in early is closing fast.

As mentioned, the team has confirmed that the presale will officially end in 28 days. That confirms that Solaxy now has more than enough funding to activate Solana’s first operational layer-2.

There’s still time to secure $SOLX at a significantly lower price and front-run what could become the foundation of a new ecosystem for Solana – DeFi’s most scalable chain.

To join before the presale ends, head to the Solaxy website and connect a supported wallet.

Newly acquired $SOLX tokens can be staked right away, earning a dynamic 107% APY that adjusts based on pool activity and total participation.

For the smoothest experience, use Best Wallet – the recommended self-custody option with full visibility on your $SOLX allocations and seamless multichain support.

Follow Solaxy on Telegram and X for the latest updates.

Disclaimer: This publication is sponsored. Coinspeaker does not endorse or assume responsibility for the content, accuracy, quality, advertising, products, or other materials on this web page. Readers are advised to conduct their own research before engaging with any company mentioned. Please note that the featured information is not intended as, and shall not be understood or construed as legal, tax, investment, financial, or other advice. Nothing contained on this web page constitutes a solicitation, recommendation, endorsement, or offer by Coinspeaker or any third party service provider to buy or sell any cryptoassets or other financial instruments. Crypto assets are a high-risk investment. You should consider whether you understand the possibility of losing money due to leverage. None of the material should be considered as investment advice. Coinspeaker shall not be held liable, directly or indirectly, for any damages or losses arising from the use or reliance on any content, goods, or services featured on this web page.