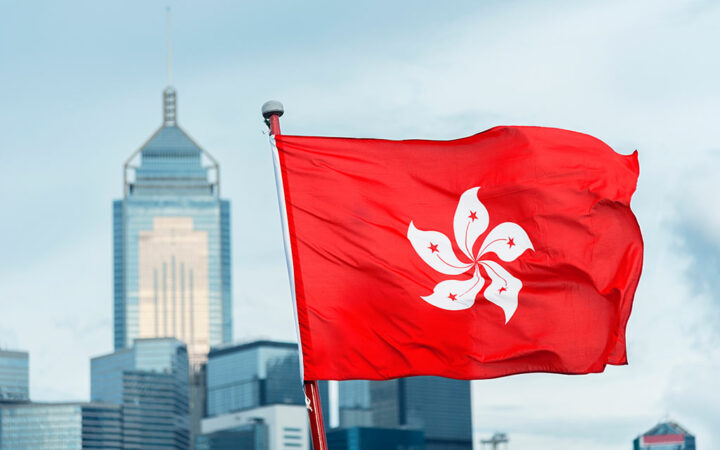

Hong Kong Advances Retail e-HKD Testing for Mortgage and Lending Transactions

The next phase will involve a deeper study of the technology, business plans, and laws needed for using e-HKD for transactions.

The next phase will involve a deeper study of the technology, business plans, and laws needed for using e-HKD for transactions.

The Architecture Community aims to enhance interoperability between wCBDC and tokenized assets, where wCBDC acts as a digital bridge to facilitate smooth interbank settlements for tokenized assets.

Hong Kong is currently pursuing an expansion of the digital yuan’s application. It is also approaching the second phase of its own CBDC pilot program and completing consultations for stablecoin issuance.

The test focused on business-to-business settlements using banks to carry out activties like payment settlements for goods and services, payments to and from institutions and merchants.

The e-HKD program has taken a three-rail approach for the potential implementation of the virtual currency: foundation layer development, industry pilots and iterative enhancements, and full launch.

The central bank of Hong Kong has charged other banks to come up with what they think the CBDC should look like.

According to the Financial Services and the Treasury Bureau, virtual assets are receiving global recognition as a form of investment by institutional and retail investors.