SPCE Stock Up 4% in Pre-market, Virgin Galactic Publishes Q4 2021 Results, Recommences Ticket Sales

Virgin Galactic said earlier that the ramp-up of astronaut service would determine a favorable profit.

Virgin Galactic said earlier that the ramp-up of astronaut service would determine a favorable profit.

Virgin Galactic is planning to raise an additional $500 million in debt for reasons unclear. However, the news had a negative impact on the SPCE stock.

Virgin Galactic stock has gained approximately 7.22% in the past year but has dropped approximately 20% and 8.9% in the past three months and one month respectively.

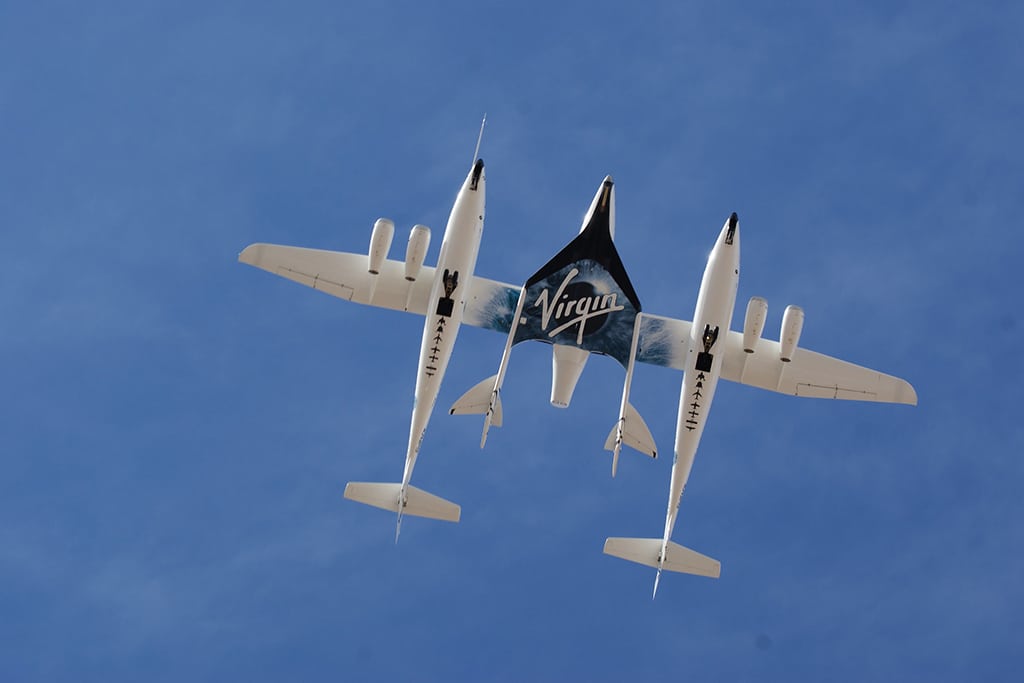

The move to delay the proposed spaceflight test by Virgin Galactic (SPCE) was rooted in its culture of putting its crew and passenger’s safety first.

In the second quarter of 2021, Virgin Galactic reported a net loss of $94 million compared to $72 million reported during the second quarter of 2020.

Further advancement into commercial space service is highly anticipated, a fact that has made the company’s stock gain 71.47% year-to-date and 124.81% in 1 year.

The launch of Richard Branson into space has made the financial market buzzing with excitement around Virgin Galactic shares.

Shares of Virgin Galactic (SPCE) climbed about 28.50% during pre-market trading after the announcement and reached the level of $55.50.

In the pre-market today, SPCE stock is up 6%, trading close to $60. Virgin Galactic shares are expected to grow further and reach new levels.

Notably, Virgin Group owns 80% of Virgin Orbit shares, with Mubadala Development Company owning 20%.

The IIAS is expected to explore the space using the Virgin Galactic’s new scientific research benefits and applications that are available for human-tended research experiments.

Virgin Galactic has already sold about 600 reservations for tickets on future tourist flights, at prices between $200,000 and $250,000 each.

SPCE stock has now lost over 50% of its value since ARKX began trading back in the latter stages of March when it debuted on the market with a total stake of almost 672,000 shares of Virgin Galactic which was worth $20 million at that time.

Earlier this week, Branson sold 5,584,000 shares of his company between April 12 and 14. According to SEC filing, the shares were worth approximately $150.3 million.

Investors will be cautious about the next space launch test. If Virgin Galactic suffers another setback, it is likely to lead to a sell-off.