Kiguru is a fine writer with a preference for innovation, finance, and the convergence of the two. A firm adherent to the groundbreaking capability of cryptographic forms of money and the blockchain. When not in his office, he is tuned in to Nas, Eminem, and The Beatles.

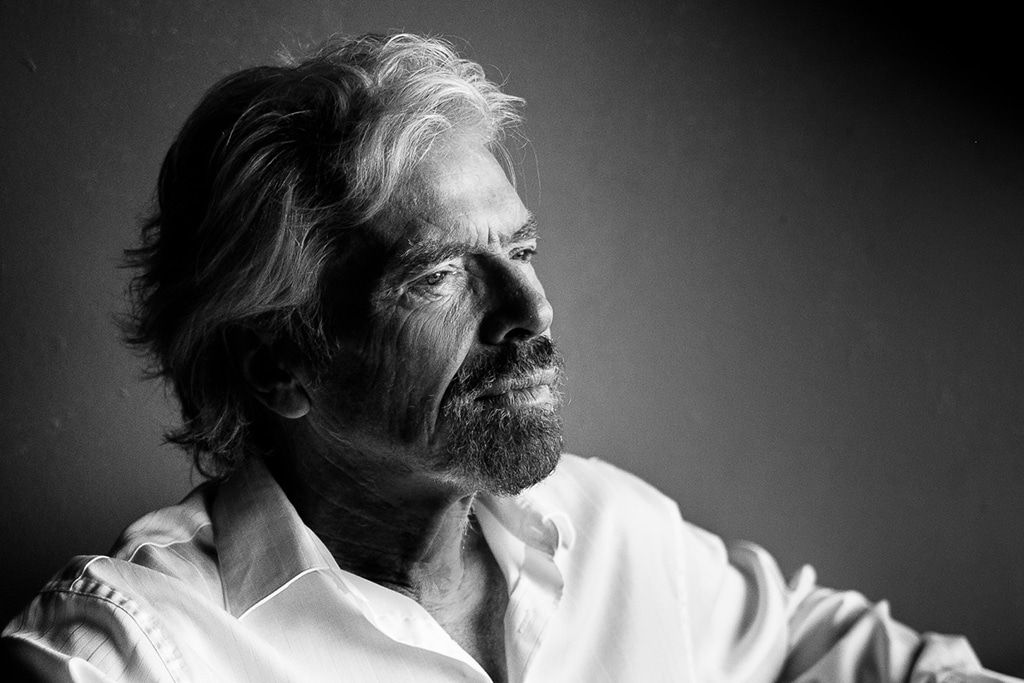

Richard Branson has in the last couple of days sold over $150 million worth of Virgin Galactic Holdings Inc (NYSE: SPCE) stock. This has alarmed investors, with his withdrawal coming ahead of the company’s space travel plans in what is an emerging age of space tourism.

Branson the founder of Virgin Galactic took his company public in 2019 through a special purpose acquisition company (SPAC). The SPAC is associated with Chamath Palihapitiya, who last month sold roughly $213 million of Virgin Galactic stock. With this sale, Palihapitiya has now sold his remaining personal stake in Virgin Galactic.

In the last couple of days, the company founder Richard Branson has also been selling his shares. According to filings seen by the media, Branson has cashed in $150 million. It is revealed that between April 12th and 14th, Branson through four of his entities including Virgin Group has sold 5,584,000 shares for $26.85 and $28.73 bringing the total to roughly $150M. Should this be worrying investors?

As we reported, last year Branson sold $500 million worth of stock. This was at a time when the company was struggling with a large part of its leisure and travel businesses triggered by closing due to the COVID- 19 pandemic.

The large sales have had an effect on prices. Closing at $26.68 on Wednesday, the stock is down by 17% from last month. But there is still some optimism in the leisure and travel business as the world opens up.

Virgin Galactic Space Tourism Struggling

It is an exciting time for space tourism. A number of companies including Virgin Galactic aim to take ordinary people to space. But Virgin does not expect to achieve this until early 2022. This especially after a major setback last December when electromagnetic interference led to a failed spaceflight test. The next test is set for May with four more on schedule. Another major setback for the company has come in the form of chief space officer George Whitesides’ resignation. A former chief of staff at NASA, he will be a big miss in the project.

The company currently has hundreds of orders of $250,000 tickets to travel into space. On the International Day of Human Spaceflight, the same day he began selling his shares, Richard Branson reiterated his commitment to commercial space travel. He said:

“This is the dawn of a new space age and I feel even more passionate about the future of space travel now than I did when Neil Armstrong first walked on the Moon.”

Investors will be cautious about the next space launch test. If the company suffers another setback, it is likely to suffer a sell-off. But if the project can reassure investors with a successful launch, it is set to rebound this year and go into 2021 stronger.

Disclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article aims to deliver accurate and timely information but should not be taken as financial or investment advice. Since market conditions can change rapidly, we encourage you to verify information on your own and consult with a professional before making any decisions based on this content.