October 25th, 2025

According to the case filed on April 5 in a Texas District Court, the plaintiffs, with support from Coinbase, want the OFAC to settle the first two counts from its original complaint, which was filed last September.

In a podcast, the Coinbase Institutional team delved into bullish and bearish scenarios for Ethereum and Bitcoin as ‘Shapella’ approaches.

Coinbase reported that crypto assets like BTC and ETH could help Americans cut the cost of sending money internally, which contributes to the high remittance fees.

As the growing liquidity strain in the price of Bitcoin is a major concern, American banks are likely to start exploring new avenues to rebuild that part of the industry.

Though the Coinbase CEO is very clear in his support for ChatGPT, many other tech leaders blatantly disagree with him.

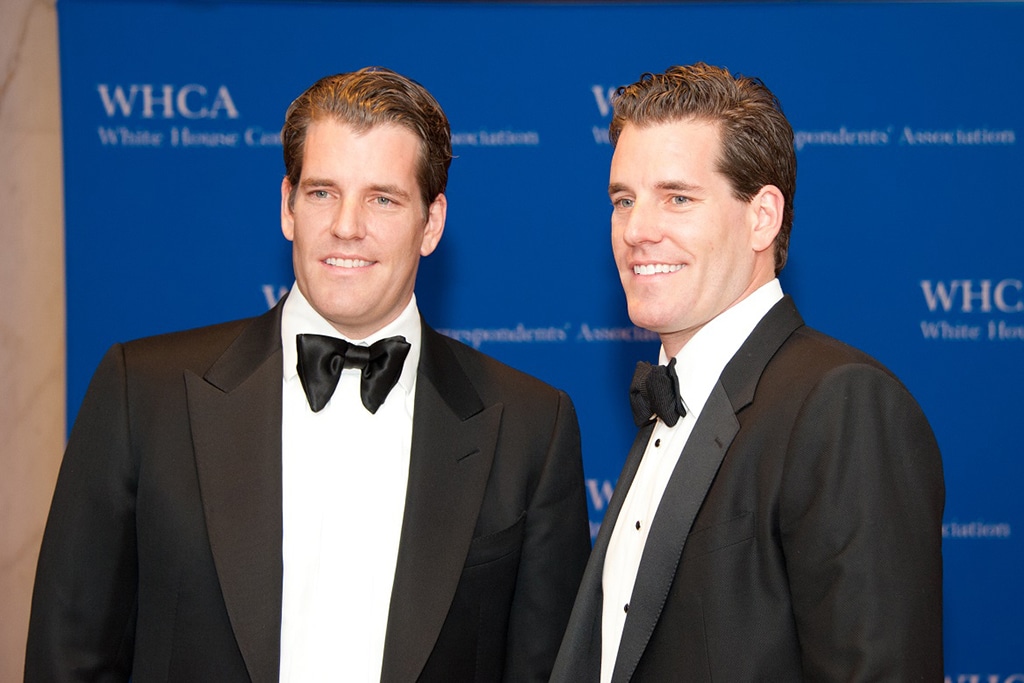

The collapse of FTX in November might have played a major role in the decision of Gemini to foray into derivatives trading.

Amid the tightening of regulatory rules in Canada, crypto exchanges are contemplating whether to continue their operations or exit from the country.

The Chinese authorities froze the Alameda Research trading account in 2021 as part of an ongoing investigation of a particular counterparty.

Binance reportedly assisted United States law enforcement in freezing and seizing over $125 million in 2022 and more than $160 million YTD.

The regulatory crackdown was highly anticipated based on the recent White House report to Congress, which called crypto volatile for investment.

Coinbase asked developers to work on an inflation-tracking stablecoin that can serve as a hedge to the poor monetary policy decisions of the central bank.

Ark Invest is also interested in Jack Dorsey’s payment firm Block after short-seller Hindenburg Research published a damning report on the company.

Despite the high-handed regulatory action in the United States, Nasdaq is optimistic about securing regulatory approval in the first half of 2023 for offering crypto custodial services.

Armstrong believes the future of crypto can best be moved forward when more pro-crypto lawmakers are at the helm of affairs.

Amid its ongoing crackdown on crypto entities, the SEC issued an enforcement action Wells notice to Coinbase.