October 22nd, 2025

The ProShares Bitcoin ETF becomes the second-most heavily traded fund with BITO surging 5% on debut and registering a record turnover of $1 billion on Day 1.

Users in the enlisted areas would be able to send and receive USDP in their Facebook Novi wallets, with Coinbase providing custody.

All the three Ethereum tokens will start trading on Coinbase Pro later today subject to enough liquidity on the platform.

Payment platform Strike says US users can now convert their salaries to Bitcoin. The new feature allows access regardless of the employer’s adoption.

Because of the SEC’s continuous witch hunt targeted at the crypto sector, Coinbase believes a separate regulator will be better. However, the SEC disagrees.

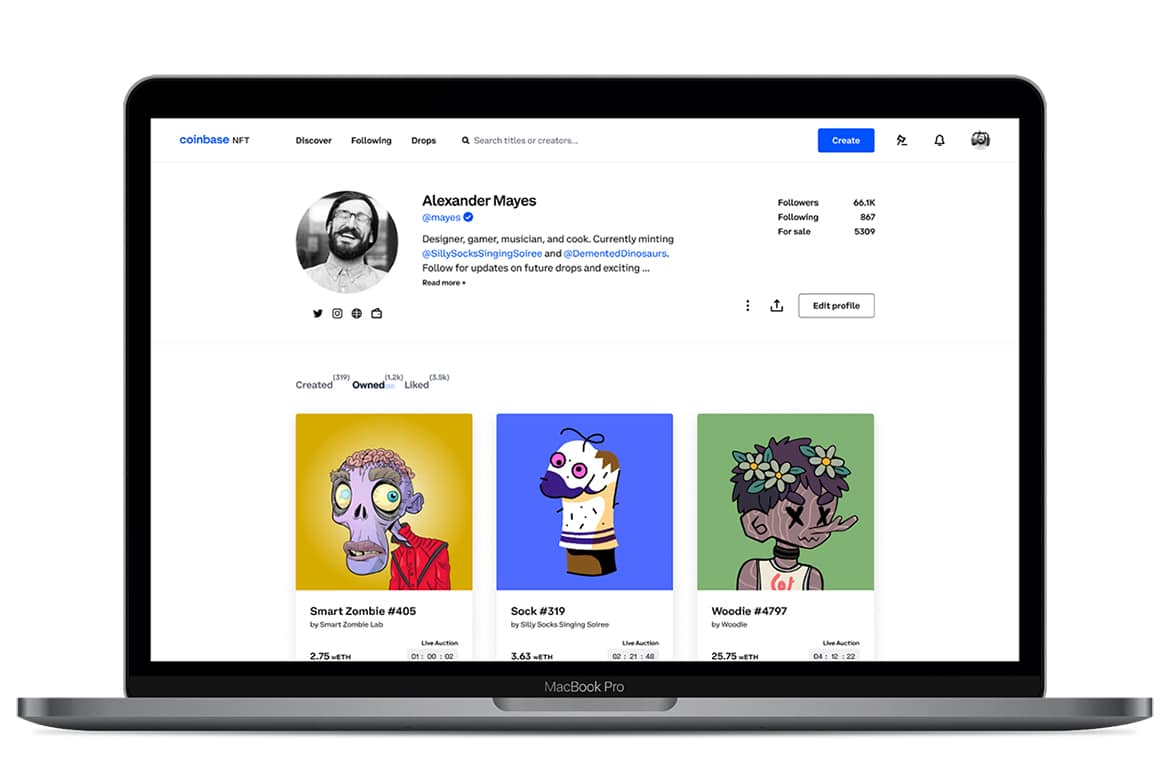

The Coinbase NFT platform will be initially available to users from the United States who are at least eighteen years old.

With the exchange’s large customer base, Coinbase NFT can be positioned as a competitor for established marketplaces like OpenSea.

Elliptic said that it will use these funds for scalability, research, and platform development. It plans to increase its US team by 50% and make global expansion.

Coinbase Pro says that these new tokens will launch if certain liquidity conditions are met and there is sufficient supply.

Bitcoin recorded a nearly five-month high above $55,000 on the 6th of October as it is continuing to gather gains from the previous day.

While the reason for the investigation remains blurry, it might be tied to its announcement of going public.

The SEC boss has doubled down on support for a Bitcoin futures ETF despite not yet approving multiple applications that had been already submitted.

The report attributed a large part of growth to the launch of VC and crypto hedge funds between 2017 and 2018 which subsequently saw the total AUM of crypto funds nearly double year-over-year from 2019 to 2020.

Coinbase is also expanding the app’s capabilities by adding four new tabs to its mobile version. The new tabs are “Assets”, “Trade”, “Pay” and “For You”.

On Friday, the Chinese Central Bank declared cryptocurrency activities illegal in the country and vowed to crack down on all cryptocurrency activities within its boundaries yet again.