Vini Barbosa has covered the crypto industry professionally since 2020, summing up to over 10,000 hours of research, writing, and editing related content for media outlets and key industry players. Vini is an active commentator and a heavy user of the technology, truly believing in its revolutionary potential. Topics of interest include blockchain, open-source software, decentralized finance, and real-world utility.

Key Notes

- Prediction markets price 15-16% odds for aggressive 50 bps Fed rate cut on September 17, up from zero chance last Friday.

- Bitcoin trades above $113,750 with 2% gains as crypto market cap reaches $3.88 trillion amid rate cut speculation and optimism.

- Interest rate cuts typically benefit risk assets like crypto by rotating capital from bonds into higher-yield opportunities.

With one week remaining until the Fed’s Federal Open Market Committee (FOMC) meeting on September 17, a 50 basis-point (bps) interest rate cut is now on the table, according to prediction markets. The repricing was fueled on September 10, following compounded data that increased the chances of a more aggressive cut, bringing crypto bulls back to the surface.

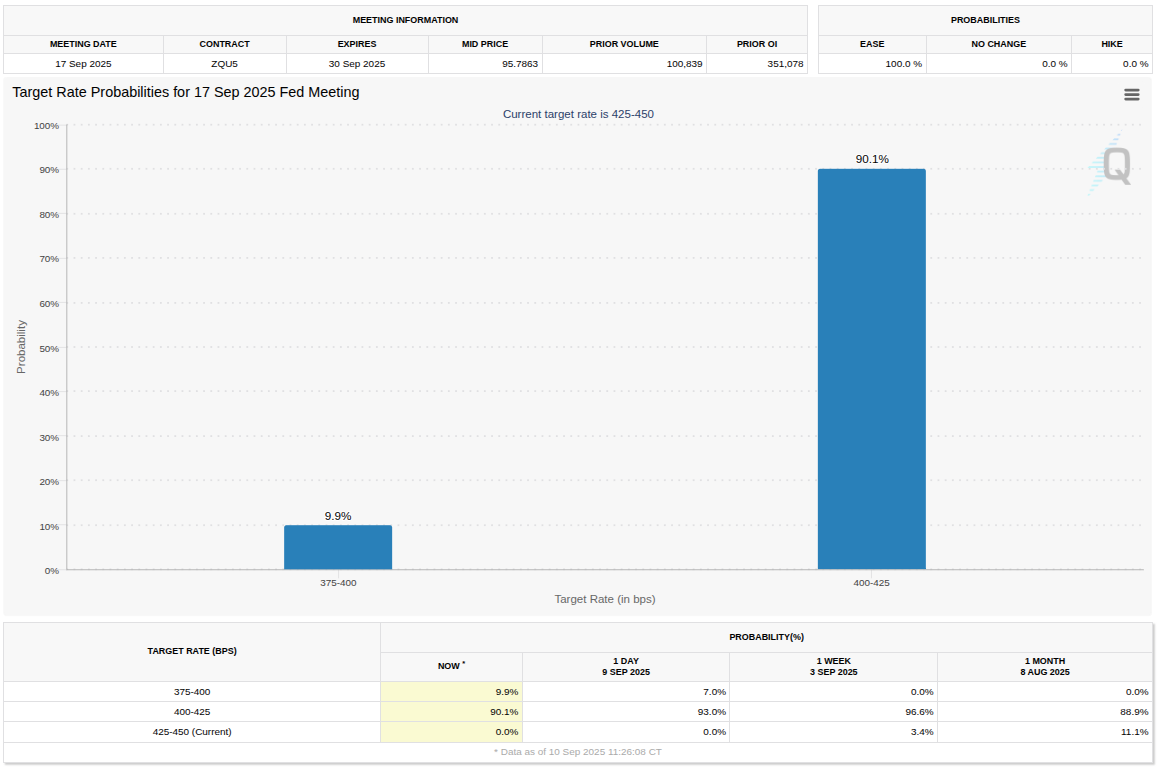

In particular, the FedWatch tool by the CME Group shows a nearly 10% chance for a new target rate of 375-400 bps post-meeting. CME’s FedWatch is one of the most direct prediction tools for these meetings, using aggregated data from interest rate trader activities.

This possibility was not on the table before last Friday, September 5, with the market pricing the highly expected 25 bps rate cut to a target range of 400-425 and a small possibility of no cuts, which are now completely off the table.

FedWatch: Target rate probabilities for 17 Sep 2025 Fed meeting | Source: CME Group

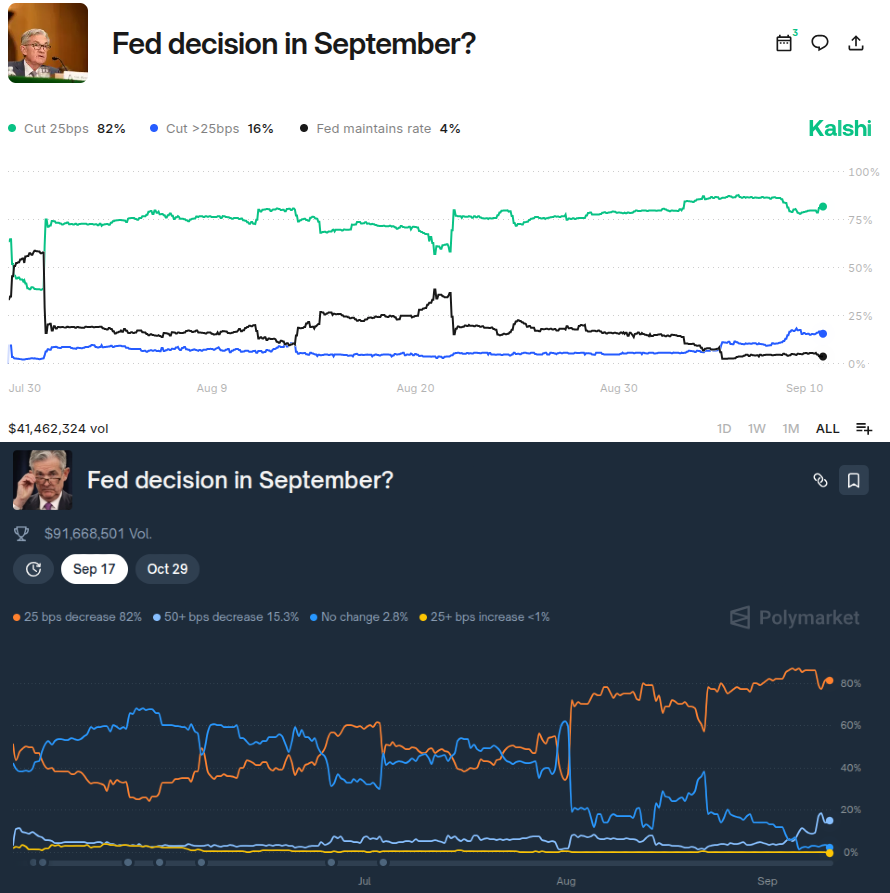

A similar, although more aggressive, pricing can be seen on leading prediction markets such as Kalshi and the crypto-native Polymarket.

First, Kalshi traders are pricing a 16% chance of a cut higher than 25 bps, with over $41 million in volume for this bet. Similarly, Polymarket traders are pricing a 15.3% chance of a 50 bps interest rate cut, with more than double Kalshi’s volume, at $91 million of accumulated bets.

Prediction market bets: Fed decision in September | Source: Kalshi (top), Polymarket (bottom)

Interest rate cuts are usually seen as positive for risk-on assets like cryptocurrencies and stocks, as they rotate big-money capital and liquidity away from treasury bonds into these better opportunities with higher risk-reward ratios.

The Federal Reserve, under Jerome Powell‘s presidency, has shown strong reluctance to cut interest rates since December 2024, when a cut happened for the last time. Current PPI data coming in at 2.6% against a previous and expected 3.3%, together with jobs reports and adjustments, contributes to the sudden change in the market’s expectations.

Bitcoin BTC $89 476 24h volatility: 0.6% Market cap: $1.79 T Vol. 24h: $36.73 B , Ethereum ETH $2 956 24h volatility: 1.1% Market cap: $356.81 B Vol. 24h: $19.27 B , and other cryptocurrencies are already responding to these changes.

Crypto Index and Bitcoin Price Analysis

As of this writing, BTC is trading at above $113,750, accumulating 2% gains from its closing price on September 8, at $111,500. TradingView’s Crypto Market Cap Index (TOTAL) marks $3.88 trillion among all cryptocurrencies, up 1.5% from the $3.82 trillion at yesterday’s close on the daily chart.

Crypto market cap index (TOTAL) and Bitcoin (BTC) daily (1D) chart | Source: TradingView

Interestingly, Bitcoin has seen a strong correlation to TOTAL, being the main driving force for the index in the past few years. Nevertheless, recent price action shows the index slightly decoupling from the leader, as BTC’s market dominance falls and the so-called altcoins gain market territory and interest.

Experts expect this decoupling to intensify in a bull market, giving space to an altseason, which could be triggered by an aggressive interest rate cut by the Federal Reserve on September 17. Some other signals adding to this data were an unusual 2 billion USDT mint by Tether, done for the last time in December 2024, together with the last rate cut, and Nasdaq movements related to facilitating tokenized securities trades in the United States.

Disclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article aims to deliver accurate and timely information but should not be taken as financial or investment advice. Since market conditions can change rapidly, we encourage you to verify information on your own and consult with a professional before making any decisions based on this content.