Christopher Haruna Hamman is a Freelance content developer, Crypto-Enthusiast and tech-savvy individual. He is also a Superstar Content Developer, Strategy Demigod, and Standup Guy.

Gilead Sciences Inc (GILD) stock price is going northward these days, though today it is slightly down. Will it continue moving up?

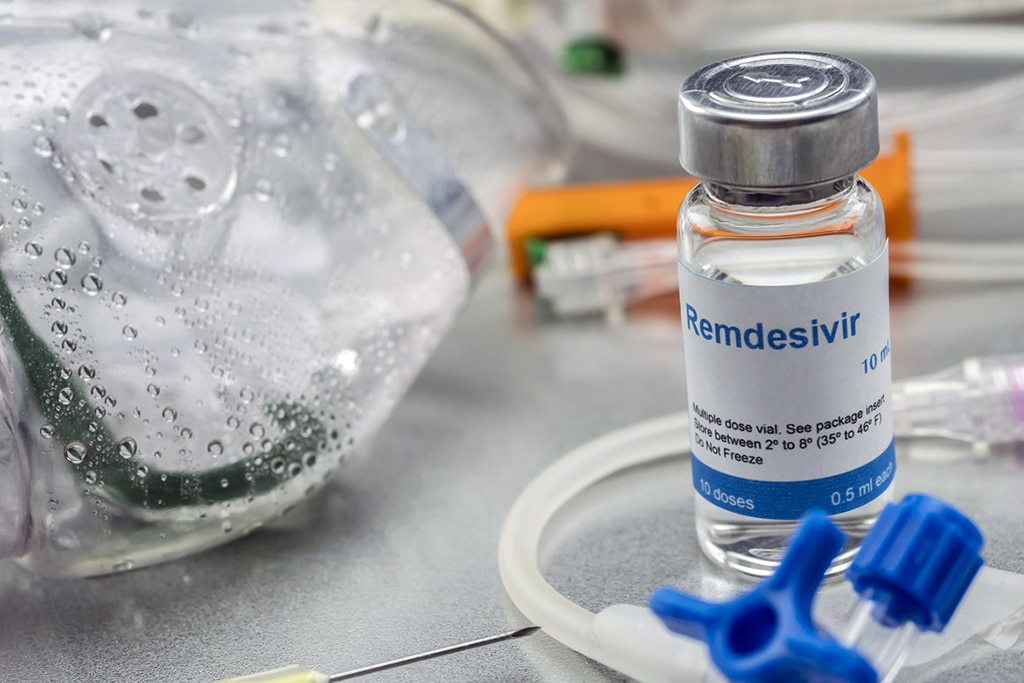

Gilead Sciences Inc (NASDAQ: GILD) stock price has been rising for the past few months. Sources say that this is due to the much-touted efficacy of its drug Remdesivir as an effective treatment for COVID-19.

As at the time of filing this report, Gilead Sciences (GILD) stock price was at $83.47 (-0.62%). However, if we compare teh price with the previous Monday, we will see that GILD is up more than 10%.

The COVID-19 pandemic has served as a driver of growth for the past few months. Many think that this is the only reason for Gilead Sciences Inc’s stock prices to rise. The biomedical company has more up its sleeve than most people realize.

Gilead’s HIV drug Biktarvy had sales volumes of up to $4.7 billion last year. This is good news. There isn’t yet any cure in sight for the HIV situation. As such, drugs that are highly effective in the management of a patient’s situations are always a welcome development.

In addition to this, Gilead’s overall HIV cachet is growing. Sales of Gilead’s HIV drugs last year went up by 12% to $16.4 billion. This development comes as the HIV drug market is expected to reach $40 billion in 2026 (according to Fortune Business Insights).

While work continues night and day for a cure to HIV, drugs from companies such as Gilead give people around the world a second chance at life.

Gilead Sciences now has some issues though. Its Hepatitis C line is on the decline. Many in the investment community expect that the biomedical company will still do very well. This is because its other lines are doing very well. They are also expected to do well over the next few years.

Gilead Sciences Inc. (GILD) is one of those companies that will always have products in research. One of those products is its Rheumatoid Arthritis drug Filgotinib. Many predict that the drug has a sales value of up to $1.3 billion.

This is expected come 2024 as the drug is expected to hit shelves. This drug and many of its kind have forced serious investors to consider the long term implications of buying Gilead stock.

The company’s stock has been trading at about four times book value for the past 24 months. This is low as compared to its ten times book value about four years plus ago. This indicates that the stock’s volatility through moderate to high could still produce great profits for al concerned.

There will be new threats to global health. And new challenges to the current health issues will always emerge. Companies such as Gilead Sciences will always rise to the top in answer to such problems.

This is where they make their mark. Solving problems that everyone else can’t solve in the time that they solve it could as well make them top the charts for as long as possible.

This might be quite a decade for Gilead Sciences Inc.

Disclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article aims to deliver accurate and timely information but should not be taken as financial or investment advice. Since market conditions can change rapidly, we encourage you to verify information on your own and consult with a professional before making any decisions based on this content.

Christopher Haruna Hamman is a Freelance content developer, Crypto-Enthusiast and tech-savvy individual. He is also a Superstar Content Developer, Strategy Demigod, and Standup Guy.