LiquidChain is a Layer 3 blockchain project that wants to unify the liquidity of Bitcoin, Ethereum, and Solana into a single execu...

Margin allows traders to speculate on cryptocurrencies with leverage. Our beginner’s guide explores the best places to trade digital assets with margin in 2026.

Many traders use margin facilities to “long” and “short” cryptocurrencies with high leverage multipliers. Some platforms offer leverage of up to 1000x on popular assets, such as Bitcoin (BTC), XRP (XRP), and Ethereum (ETH). We tested over 25 providers and found that the best crypto margin trading exchanges are CoinFutures, MEXC, and Binance.

Read on to learn more about the top margin platforms for safety, leverage limits, supported markets, and trading fees. We also explain how crypto margin works, the pros and cons of trading with leverage, and how to mitigate liquidation risks.

Key Takeaways for Top Crypto Margin Exchanges

- CoinFutures ranks as the overall best place for crypto margin trading. It offers leverage of up to 1000x, which converts to a 0.1% upfront margin.

- MEXC and Binance suit intermediate-to-advanced margin traders who seek extensive analysis, advanced trading tools, and deep liquidity.

- The most important factors when researching platforms are supported pairs, maintenance margin requirements, security framework, and trading commissions.

- Trading with excessive leverage increases liquidation risks, which result in traders losing their initial margin.

- Traders in some regions, including the U.S. and the UK, face restrictions on crypto margin accounts. Research shows that no-KYC platforms provide a suitable workaround.

The Top 10 Best Crypto Margin Trading Exchanges

All factors considered, here are the best crypto margin trading exchanges for 2026:

- CoinFutures: The Overall Best Crypto Margin Trading Platform

- MEXC: Go Long and Short on 1,100+ Crypto Derivative Pairs

- Bitpanda: Secure Spot Margin Trading for Risk-Conscious Crypto Traders

- Binance: World-Class Trading Tools for Seasoned Crypto Margin Traders

- Kraken: Top Choice for Spot Margin Accounts in a Regulated Environment

- WEEX: Trade Dozens of Meme Coins with Affordable Margin Requirements

- Margex: User-Friendly Mobile App to Trade Crypto Futures with 100x Leverage

- BloFin: Popular Margin Provider to Earn Rewards and Airdrop Bonuses

- KCEX: Best Crypto Margin Exchange for No-KYC Trading Accounts

- PrimeXBT: Speculate on Leveraged Crypto CFDs on a Spread-Only Basis

- ByBit: Trade Options and Delivery Futures on Margin with Deep Liquidity

The 11 Best Crypto Margin Trading Platforms Reviewed

Our extensive research explored the best places to margin trade crypto. We evaluated client-fund safety, listed markets, margin requirements, payment methods, and fees. Read on to choose the best crypto margin trading exchange for you.

1. CoinFutures: Our Top Pick for Crypto Margin Trading in 2026

- Min Margin: 0.1%

- Max Leverage: 1000x

- Supported Cryptos: 11+

- Crypto Margin Trading Fees: Platform users choose between a P&L or a flat fee

- Min Deposit: No minimum

- Withdrawal Fees: 5 USDT

Overall, CoinFutures is the best place to trade cryptocurrencies with margin. The platform offers a 1000x leverage on all available markets, which include top cryptocurrencies such as BTC, XRP, ETH, Dogecoin (DOGE), and Litecoin (LTC). Users risk $10 to access up to $10,000 in crypto exposure.

CoinFutures features a beginner-friendly interface. Traders go long or short through “Up” and “Down” orders, and the platform displays liquidation prices that adjust with the leverage multiplier. Basic charting tools can help investors to make informed trading decisions, and stop-loss and take-profit orders enable a sensible risk management framework.

CoinFutures interface with a clean UI for trading DOGE/USDT at high leverage. Source: CoinFutures

CoinFutures is a global platform without know-your-customer (KYC) requirements, so it accepts users worldwide. Payment methods include cryptocurrencies, e-wallets, debit cards, and credit cards, and the margin exchange requires no account minimums. Security controls include proof of reserves (via CoinPoker, the parent company) and fund segregation via Fireblocks vaults.

Pros

- The best crypto margin trading exchange for beginners

- Get 1000x leverage on all listed markets

- Traders avoid KYC requirements and account minimums

- Mitigate risks through stop-loss and take-profit orders

- Accepts cryptocurrencies and traditional payment methods

- The platform processes most withdrawal requests instantly

Cons

- The charting dashboard lacks advanced indicators and drawing tools

- Other margin platforms offer a wider range of pairs

2. MEXC: Trade Over 1,100 Perpetual Futures with Low Margin Requirements

- Min Margin: 0.2%

- Max Leverage: 500x

- Supported Cryptos: 1,100+

- Crypto Margin Trading Fees: 0.01% (makers) and 0.04% (takers)

- Min Deposit: Varies by deposit method. Instant fiat purchases require $10

- Withdrawal Fees: Dynamically adjusted crypto withdrawals (Bitcoin: 0.00001 BTC)

MEXC suits active margin traders who want access to a huge range of derivative markets. As the exchange lists over 1,100 perpetual futures, users can discover the fastest-growing cryptocurrencies. In addition to established large-caps and popular meme coins, MEXC frequently lists new cryptocurrencies with modest market capitalizations.

Platform traders post a minimum margin of 0.2% on major markets like BTC/USDT and ETH/USDT. This margin structure equates to 500x leverage. Although most derivative contracts offer linear settlement, MEXC lists a small selection of inverse markets, including LTC/USD and XRP/USD. Traders choose between cross or isolated margin trading, depending on their risk tolerance.

MEXC lists over 1,100 margin trading markets across linear and inverse futures contracts. Source: MEXC

Our research indicates that MEXC is also a suitable option for minimizing trading costs. It charges 0.01% or 0.04% per side to makers and takers, respectively. Holding the native exchange token, MX Token (MX), offers a 50% reduction on standard commissions. Users also incur variable funding fees every eight hours.

Pros

- The best margin trading platform for supported derivative markets

- Trade over 1,100 crypto pairs in both market directions

- Market makers pay trading commissions of just 0.01%

- Traders choose between linear and isolated margin

- Post a minimum margin of 0.2% to execute trades

Cons

- The exchange strictly prohibits U.S. clients

- Nano-cap futures trading markets attract minimal liquidity

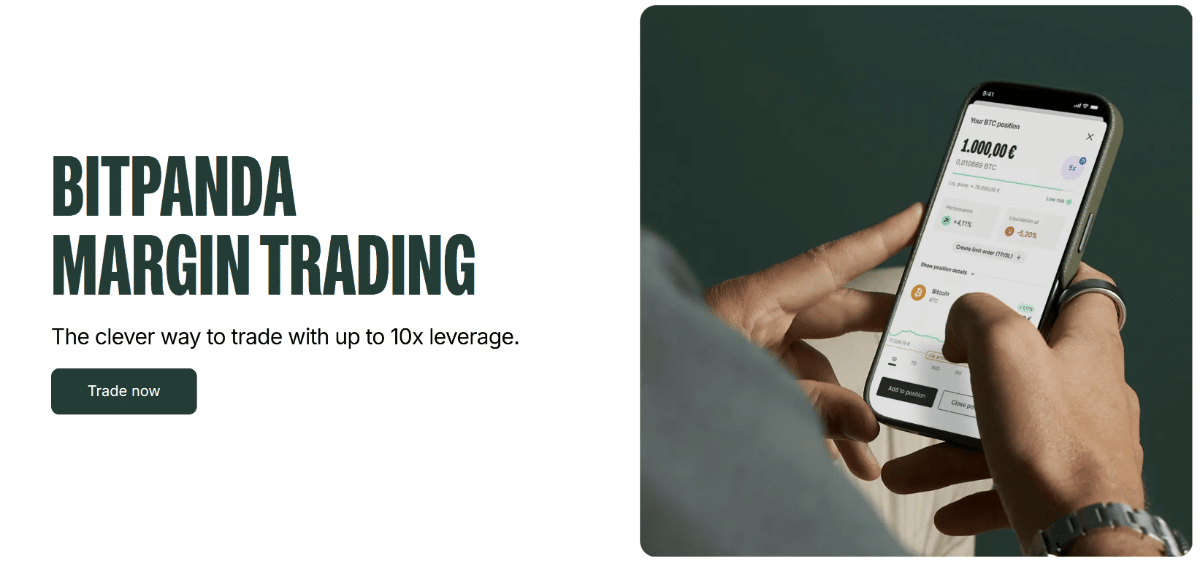

3. Bitpanda: Regulated Spot Margin Trading With Built-In Risk Controls

- Min Margin: Varies by asset (liquidation threshold ~1.03 on BTC and ETH)

- Max Leverage: Up to 10x

- Supported Cryptos: 120+

- Crypto Margin Trading Fees: 0% buy fee, 0.18% daily fee (charged every 4 hours), 0.3% sell fee

- Min Deposit: Varies by funding method

- Withdrawal Fees: None

Bitpanda is popular with traders who want to reduce the risks of margin trading. Unlike derivatives-focused exchanges, Bitpanda offers spot margin trading, meaning users trade real crypto assets with leverage rather than contracts. This structure appeals to traders who prefer clearer risk profiles and simpler position management.

Founded in 2014, Bitpanda operates under a strong European regulatory framework and has maintained a clean security record. Its margin trading product supports over 120 cryptocurrencies, with leverage options of 2x, 3x, 5x, and up to 10x depending on asset liquidity.

Bitpanda offers up to 10x leverage on margin trading. Source: Bitpanda

Bitpanda supports the full 10x leverage on top assets like Bitcoin and Ethereum, with a clearly defined liquidation threshold. Risk management is where Bitpanda stands out. Traders can manage the risks of margin trading with its real-time monitoring and notification alerts before liquidation. These features are vital in such a volatile market, where seconds can mean the difference between moderate losses and full liquidation. Bitpanda also supports margin limit orders, including stop-loss and take-profit, giving traders more control over their trades.

For traders prioritizing safety and clarity over extreme leverage, Bitpanda offers a balanced margin trading environment.

Pros

- Strong European regulation and security track record

- Spot margin trading avoids complex derivatives

- Up to 10x leverage on major assets like BTC and ETH

- Built-in risk alerts before liquidation

- Supports over 120 crypto assets

Cons

- Lower leverage compared to futures exchanges

- Fees are higher than perpetual-focused platforms

4. Binance: A Great Option for Experienced Margin Traders Seeking Advanced Charting Tools

- Min Margin: 0.67%

- Max Leverage: 150x

- Supported Cryptos: 660+

- Crypto Margin Trading Fees: 0.02% (makers) and 0.05% (takers)

- Min Deposit: Usually about $10 on debit/credit card, depending on the currency

- Withdrawal Fees: Dynamically adjusted crypto withdrawals (Bitcoin: 0.00003 BTC)

Binance is our top pick for seasoned crypto margin traders. The exchange offers proprietary charting software on browsers, Mac, Windows, iOS, and Android. It provides high-level drawing tools, technical indicators like Bollinger Bands and Fibonacci Retracements, and deep order books with custom filters.

Binance is the largest crypto margin trading exchange for liquidity. Source: Binance

Our research shows that Binance is also one of the best crypto margin trading exchanges for product diversity. It offers over 660 perpetual futures markets with a maximum leverage of 150x. These markets settle in USDT or the underlying asset. Traders also access delivery futures with quarterly and bi-quarterly settlement, although Binance limits markets to BTC and ETH.

Besides perpetual and delivery futures, other leverage instruments include options and spot margin trading. Fees vary by trading market. Binance charges up to 0.05% per side on futures, and 0.024% on call and put options. Eligible users pay an average debit/credit card deposit fee of 2%. No deposit charges apply to crypto or peer-to-peer (P2P) payments.

Pros

- The largest crypto margin trading platform for liquidity and volume

- Leverage products include futures, options, and spot margin accounts

- The derivative platform lists over 660 cryptocurrencies

- Trade on web browsers, desktop software, or mobile apps

- Upfront margin requirements start at just 0.67%

Cons

- Direct debit/credit deposits are available in limited countries

- A KYC process is required before users trade

5. Kraken: Regulated Spot Margin Accounts with 10x Leverage on Existing Holdings

- Min Margin: 10% (spot margin), 2% (perpetuals)

- Max Leverage: 10x (spot margin), 50x (perpetuals)

- Supported Cryptos: 350+

- Crypto Margin Trading Fees: 0.02% (makers) and 0.04% (takers)

- Min Deposit: $1

- Withdrawal Fees: Free bank transfers in most countries. Dynamically adjusted crypto withdrawals

Kraken is the best option for traditional spot margin accounts. It allows eligible traders to amplify existing spot positions by 10x. This dynamic provides access to over 350 cryptocurrencies without needing to deposit additional funds. Since Kraken is a regulated provider, platform users trade fiat margin pairs like BTC/USD, DOGE/USD, and ETH/EUR.

One drawback is fees. The exchange charges a variable commission of 0.02% or 0.04% depending on the order type. Users incur the same commission every four hours via rollover fees, which makes long-term positions costly. To offset these high trading charges, users deposit funds fee-free via ACH, SEPA, and other banking methods.

Kraken offers spot margin accounts with 10x leverage on existing asset holdings. Source: Kraken

Besides margin accounts, Kraken also offers perpetual futures markets in select countries. These derivative products offer long and short trading with 50x leverage. All margin products are available on the Kraken Pro platform, which provides institutional-grade liquidity, extensive charting tools, and desktop software for Windows, Mac, and Linux.

Pros

- Spot margin accounts unlock additional capital of up to 10x

- Gain access to over 350 leveraged markets

- One of the safest exchanges in crypto with a robust regulatory framework

- A great choice for seasoned pros who seek powerful analysis tools

Cons

- Margin rollover fees apply every four hours

- Customer service replies often take several business days

6. WEEX: Gain Exposure to a Wide Range of Meme Coin Markets on Leverage

- Min Margin: 0.5%

- Max Leverage: 200x

- Supported Cryptos: 890+

- Crypto Margin Trading Fees: 0.02% (makers) and 0.08% (takers)

- Min Deposit: $15 on debit/credit cards. No minimums for crypto deposits

- Withdrawal Fees: Dynamically adjusted crypto withdrawals (Bitcoin: 0.00016 BTC)

WEEX is a global exchange that lists over 890 perpetual futures markets. We found that the platform appeals to traders who want exposure to the meme coin space. It lists over 45 of the top meme coins in 2026, including Pepe (PEPE), Shiba Inu (SHIB), Floki (FLOKI), Bonk (BONK), and OFFICIAL TRUMP (TRUMP).

Unlike many margin trading crypto exchanges, WEEX offers its top leverage multiplier of 200x on all available pairs. This perk lets users trade $20,000 meme coins for every $100 in posted margin. Note that the minimum margin requirement increases at certain volume thresholds to mitigate platform risk.

WEEX is a margin trading platform with meme coins like TRUMP. Source: WEEX

The exchange also suits crypto traders seeking a passive investment experience. It offers a popular copy trading tool that mimics professional margin traders. Users choose a trader and investment size, and WEEX executes the same positions thereafter. Copy trading services use a profit-sharing system, so followers pay fees on profitable positions only.

Pros

- One of the best crypto margin trading exchanges for meme coins

- Trade PEPE, FLOKI, TRUMP, and other speculative tokens

- Minimum margin requirements of just 0.5% on all listed markets

- Fund margin accounts instantly with debit/credit cards

Cons

- The platform charges a massive taker fee of 0.08%

- Exchange data shows limited volume on small-cap pairs

- WEEX holds no licenses in major jurisdictions like the U.S.

7. Margex: Top-Rated iOS and Android App with 55+ Crypto Futures Markets

- Min Margin: 1%

- Max Leverage: 100x

- Supported Cryptos: 55+

- Crypto Margin Trading Fees: 0.019% (makers) and 0.06% (takers)

- Min Deposit: $10 on debit/credit cards and e-wallets. No minimums for crypto deposits

- Withdrawal Fees: Dynamically adjusted crypto withdrawals

Margex offers a user-friendly trading app for iOS and Android. The app supports over 55 perpetual futures, including top altcoins like DOGE, ETH, and Solana (SOL). Users post a minimum margin of 1% on major markets, and up to 4% on more volatile trading pairs. This margin framework converts to leverage multipliers of 25x to 100x.

Margex offers a liquid staking program. Platform users deposit cryptocurrencies to earn passive rewards and fund margin positions with the same assets. Staking rewards of up to 7% APY are available, and Margex provides daily payouts without limits.

The Margex app for iOS and Android offers a clean UI for margin trading. Source: Margex

Regarding payments, the exchange supports over 150 traditional deposit types, including Visa, MasterCard, and Google Pay and Apple Pay. The minimum deposit requirement is $10, and third-party gateways determine payment charges. To cash out a specific crypto, beginners use Margex’s instant conversion tool, which eliminates trading commissions.

Pros

- Margin trade cryptocurrencies on an intuitive mobile app

- Access leverage multipliers of up to 100x on the move

- Use staking balances as margin collateral and earn up to 7% APY

- Deposit fiat money with over 150 payment methods

Cons

- The exchange increases margin requirements to 4% on smaller-cap pairs

- Users need a separate mobile app to use the copy trading feature

- Traders incur a 0.06% commission when they place market orders

8. BloFin: Earn Free Crypto Margin Funds by Completing Tasks

- Min Margin: 0.67%

- Max Leverage: 150x

- Supported Cryptos: 590+

- Crypto Margin Trading Fees: 0.02% (makers) and 0.06% (takers). 0.2% on high-risk pairs

- Min Deposit: $15 on debit/credit cards and e-wallets. No minimums for crypto deposits

- Withdrawal Fees: Dynamically adjusted crypto withdrawals

Founded in 2020, BloFin is a mid-tier exchange with over 590 margin trading pairs. It allows account holders to earn free cryptocurrencies when they complete tasks. Users allocate those digital assets to margin collateral, which enables a maximum leverage multiplier of 150x.

New users earn up to 5,000 USDT in rewards for basic challenges, such as making an initial deposit, placing an order, and using the staking tool. Existing clients earn rewards for volume-related tasks. Trading over 10,000 USDT in perpetual futures, for instance, earns users 10 USDT.

BloFin users receive up to 5,000 USDT in free crypto rewards. Source: BloFin

In-house airdrop promotions offer additional earning opportunities. Traders deposit USDT into BloFin’s airdrop wallet and receive select cryptocurrencies when the event ends. Note that BloFin also offers bonuses for KYC-verified users, although those who prefer anonymity can withdraw up to 20,000 USDT daily without ID verification.

Pros

- New users receive up to 5,000 USDT in welcome bonus rewards

- Earn additional cryptocurrencies for completing basic tasks

- Margin traders get leverage of up to 150x on an extensive range of pairs

Cons

- The platform charges 0.2% per side on select high-risk markets

- Users must sign in to view the exchange’s proof of reserves

- BloFin operates without a regulatory framework

9. KCEX: Withdraw up to 30 BTC Daily without Personal Information or KYC Documents

- Min Margin: 0.8%

- Max Leverage: 125x

- Supported Cryptos: 860+

- Crypto Margin Trading Fees: 0% (makers) and 0.01% (takers)

- Min Deposit: No minimums (crypto only)

- Withdrawal Fees: None

KCEX allows margin traders to register an account with an email or mobile number only. As one of the best no-KYC crypto exchanges, users remain anonymous when they withdraw less than 30 BTC per day. Our research shows that these are the highest no-KYC limits in the crypto margin market.

The exchange also ranks highly for its competitive fee schedule. Makers get 0% commissions, while takers pay just 0.01% per side. Users avoid withdrawal fees, too. The downside is that KCEX does not accept traditional payment methods, so users must deposit cryptocurrencies from a private wallet or exchange account.

KCEX advertising low trading fees and its ‘Altcoin Future Trading Platform’. Source: KCEX

In terms of margin markets, KCEX specializes in perpetual futures contracts. It lists over 860 pairs, and most settle in USDT. Margin requirements vary by market, although BTC and major altcoins have low minimums of 0.8%. The platform is available on standard web browsers and a proprietary app for iOS and Android. Both versions offer a smooth trading experience.

Pros

- Makers avoid trading commissions on all futures markets

- No fees to withdraw cryptocurrencies to a private wallet

- Trade anonymously when you withdraw under 30 BTC daily

Cons

- The platform accepts crypto deposits only

- Users face wide spreads on less popular trading pairs

- No licensing bodies regulate the exchange

10. PrimeXBT: Licensed Crypto CFD Trading Platform with 0% Commissions

- Min Margin: 0.5%

- Max Leverage: 200x

- Supported Cryptos: 100+

- Crypto Margin Trading Fees: 0.01% (makers) and 0.045% (takers). Spread-only on crypto CFDs

- Min Deposit: Varies by payment method, starts at $5

- Withdrawal Fees: None

PrimeXBT is an established trading platform that supports contracts-for-differences (CFDs). These derivative instruments track digital asset prices in real-time and allow both long and short trading. Similar to perpetual futures, CFDs provide exposure to cryptocurrencies with low margin requirements, yet they provide no asset ownership.

On PrimeXBT, traders post a minimum margin of 0.5% on BTC and ETH, and more on other markets. Platform users place CFD orders on a spread-only basis, which enables them to avoid commissions. Spreads fluctuate based on trading pairs and broader market conditions. BTC averages 700 pips, which we found to be competitive.

On PrimeXBT, CFD instruments track real-time crypto prices. Source: PrimeXBT

Traders also like PrimeXBT for its cost-effective and fast payments. It processes most deposit methods instantly without fees. Popular deposit types include Skrill, PayPal, and Neteller, as well as Visa and MasterCard. According to the platform, PrimeXBT approves 95% withdrawal requests immediately.

Pros

- An established platform that offers regulated CFDs

- BTC and ETH markets allow 200x leverage

- Most users get instant and free deposits

Cons

- Crypto CFDs remain banned in the U.S. and the UK

- Does not offer delivery futures or options

- Spread volatility increases significantly during weekends

- Stakeholders cannot verify proof of reserves

11. ByBit: A Top Option to Trade Crypto Options and Delivery Futures

- Min Margin: 0.5%

- Max Leverage: 200x

- Supported Cryptos: 850+

- Crypto Margin Trading Fees: Futures: 0.02% (makers) and 0.055% (takers). Options: 0.02% (makers) and 0.03% (takers)

- Min Deposit: $2 on debit/credit cards. No minimums for crypto deposits

- Withdrawal Fees: SEPA withdrawals cost under €1. Dynamically adjusted crypto withdrawals

Bybit is a Tier 1 exchange that attracts significant trading volume and deep liquidity. It offers an extensive range of margin trading products, including comprehensive options chains for six markets: BTC, ETH, SOL, DOGE, XRP, and Mantle (MNT). Bybit options cover various strike prices and contract expiration dates with affordable upfront premiums.

The exchange also supports delivery futures with short and long-term settlement. These contracts help margin traders avoid ongoing funding fees. Bybit supports hundreds of perpetual futures, too, although these products incur funding every eight hours. Platform users also access SOL liquid staking, where they allocate locked funds to margin positions.

Bybit traders access margin products via options, delivery futures, and perpetuals. Source: Bybit

Bybit’s fee structure uses the maker-taker system with discounts for large monthly trading volumes. Entry-level futures traders pay 0.02% or 0.055% on limit and market orders, respectively. Purchasing call or put options costs 0.02% or 0.03%. Bybit traders buy margin collateral instantly with debit/credit cards or bank transfers. The minimum deposit is $2.

Pros

- One of the best crypto margin trading platforms for options

- The platform also lists delivery futures and perpetuals

- Deposit just $2 with a debit/credit card or bank transfer

Cons

- European clients must complete KYC before they trade

- Beginners may find the trading interface intimidating

- Restricted countries include the U.S. and the UK

- Takers incur a 0.055% commission to trade futures products

How We Ranked the Best Crypto Margin Trading Platforms in 2026

CoinMarketCap data shows that over 100 crypto platforms offer margin trading services. The following research methodology enabled us to rank the best crypto exchanges for margin trading in 2026:

- Minimum Margin Requirements: Exchanges with the lowest margin requirements offer substantial market exposure at affordable rates. Since CoinFutures and MEXC offer 1000x and 500x leverage, traders post a small upfront margin of just 0.1% and 0.2%, respectively. Keep in mind that some platforms require a higher initial margin for more volatile markets.

- Supported Margin Products: Crypto traders access margin facilities across various financial instruments. Spot margin accounts allow users to borrow funds directly from exchanges, whereas delivery and perpetual futures provide leverage through derivative products. Options are also popular, as they limit margin risk to the initial contract premium.

- Listed Markets: The research team evaluated margin platforms based on the available cryptocurrencies and trading pairs. MEXC lists over 1,100 leveraged trading markets, including new small-cap projects and speculative meme coins. Having access to a broad selection of coins and tokens from a unified exchange account enables traders to diversify and capitalize on emerging trends.

- Licensing and Security: The best crypto margin trading platforms offer a safe investment experience. Tier 1 bodies from the U.S. and Europe regulate Kraken, which also boasts institutional-grade security controls like cold storage with 24/7 armed surveillance. We evaluated whether platforms publish audited proof of reserves and offer account security tools like two-factor authentication and device whitelisting.

- Tools and Features: Experienced traders use Binance for its comprehensive trading tools, such as proprietary charting software and technical indicators. The platform also supports automated bots that trade margin products autonomously. Investors who are learning to begin margin trading prefer WEEX and BloFin for their simple copy trading feature, as it enables them to buy and sell leveraged futures passively.

- User Experience: We prioritized platforms with the overall best user experience, which includes onboarding, payments, and trading. Our research shows that CoinFutures delivers a superb customer journey. Its simplified dashboard suits inexperienced margin traders, and instant payouts ensure users receive withdrawals in minutes.

- KYC Requirements: Some exchanges, including Kraken and Binance, have strict KYC procedures. New customers provide personal information, government-issued ID, and proof of address before they can deposit funds. In contrast, CoinFutures and KCEX collect email addresses or mobile numbers only, so users trade anonymously.

Margin platforms typically excel in several key areas and fall short in others. Assess your main priorities to choose the right exchange.

What Is Crypto Margin Trading?

Margin trading allows crypto investors to enter positions with more capital than their account balance allows. As traders use existing exchange funds to boost market exposure, they borrow capital from the platform.

Traditional margin accounts support spot exchange markets, so investors buy cryptocurrencies from in-house liquidity pools. However, they cannot withdraw borrowed coins or tokens, so exposure remains on the platform exclusively.

Margin products also include derivative instruments. Perpetual futures, which track crypto prices without expiration dates, remain the most popular way to access margin. Options and delivery futures, while less common, provide alternative margin solutions.

How Does Crypto Margin Trading Work?

The margin trading process varies depending on the financial product.

Investors who open conventional spot margin accounts use existing asset holdings as collateral. Consider an exchange trader who holds $5,000 in ETH. Since the platform offers a maximum leverage of 10x on that balance, the trader unlocks $50,000 in additional market exposure. They can use that $50,000 to buy extra ETH or diversify into other markets.

Trading ETH futures on CoinFutures in the interface with a choice of leverage. Source: CoinFutures

Another aspect of crypto margin is that traders can speculate in both market directions. Traders enter positions with a buy or sell order depending on whether they predict rising or falling prices. Options differ slightly, as margin traders purchase call or put contracts, which resemble buy and sell orders.

Although crypto margin magnifies trading balances by significant multiples, traders must understand liquidation risks. If the position value falls below the minimum maintenance margin, the platform closes the trade, and the trader loses their collateral. Isolated margin limits downside risk, yet unsuccessful cross margin trading can liquidate the entire account.

Crypto Margin Trading vs Regular Crypto Trading

The core factors that separate margin and regular crypto trading include leverage facilities, liquidation risks, the ability to short-sell, and asset ownership.

This section explains these differences in more detail.

Leverage Facilities

When you trade crypto on margin, the platform enables you to apply leverage. As this trading tool amplifies exchange balances, traders target much higher profits than the account initially allows.

On CoinFutures, platform users apply leverage multipliers on BTC, ETH, and other popular cryptocurrencies. A small $50 position magnifies to $50,000 in market exposure, so even a modest 1% asset increase yields a $500 profit.

Regular spot trading platforms lack leverage capabilities, so users cannot invest more than they have in the account.

Liquidation Risks

While spot traders cannot access leverage, they avoid liquidation risks. This dynamic makes regular crypto investing considerably less risky than margin trading.

Liquidation occurs when the trade value drops by a certain percentage. The liquidation probability rises as traders increase the leverage multiplier. A 10x position must decline by approximately 10% to face liquidation. Yet a drop of just 1% liquidates a 100x trade.

Trading SOL and checking positions on MEXC. Source: MEXC

If the position liquidates, the trader forfeits their initial margin. Frequent liquidations can result in significant financial losses.

Short-Selling

Regular spot trading platforms let users buy digital assets outright. The investor makes money only if the cryptocurrency’s price increases. This framework encompasses traditional investments, such as ETFs and stocks.

The best crypto margin trading exchanges support long and short positions. Traders go long to profit from rising prices, and short to capitalize on falling prices. As such, crypto margin trading suits active traders who attempt to profit during both bullish and bearish cycles.

Asset Ownership

A lack of real asset ownership is one of the main downsides of crypto margin trading. Whether traders use margin accounts, futures, or options, they speculate on price movements only.

Regular trading ensures investors own cryptocurrencies outright. Once they complete a trade, they can withdraw coins or tokens to a private wallet.

What Are the Pros & Cons of Crypto Margin Trading?

Here are the advantages and disadvantages of trading cryptocurrencies on margin:

Benefits of Crypto Margin Trading

- Amplify Market Exposure: Margin traders control a much larger amount of cryptocurrencies than they can initially afford. This perk enables traders to target substantial profits without requiring a large initial deposit.

- Flexible Trading: Margin accounts support long and short trading, so users speculate in both market directions. This benefit lets traders profit from overvalued projects or extended bear markets.

- Increased Diversification: Traders increase their purchasing power when they use margin, which enables them to diversify into additional markets without depositing additional capital.

- Capital Efficiency: Since margin traders allocate a small percentage of the overall trade size, they become capital efficient. This advantage allows traders to explore other investment opportunities.

Drawbacks of Crypto Margin Trading

- Liquidation Risks: Margin trading carries liquidation risks. If a trade becomes liquidated, the exchange immediately closes it and retains the user’s upfront margin.

- Ongoing Fees: Most margin products incur ongoing fees, making long-term strategies less viable. Platforms typically charge funding fees every 4-8 hours.

- Speculation Over Ownership: Margin accounts let traders speculate on price fluctuations only. They provide no asset ownership, so exchange users cannot withdraw or control cryptocurrencies.

Understanding Crypto Margin Trading Exchange Fees

Crypto margin fees are considerably more expensive than traditional spot trading. This drawback increases trading costs and reduces potential profits.

Here are the most common fees that margin traders incur.

Trading Commission

Crypto margin trading exchanges charge commissions when users enter and exit the market. Similar to spot trading, platforms calculate commissions in percentage terms against the total trade value.

Trading with excessive leverage leads to large trading costs, as exchanges charge fees against the full position value. For example, Kraken charges a 0.04% commission on market orders. A $1,000 upfront margin with 50x leverage converts to a $50,000 trade size, which amounts to a $20 commission.

Margin Interest Fees

Margin platforms charge interest rates on borrowed funds. These fees correlate with initial margin and the amount of leverage applied.

Binance has a large range of crypto available for trading. Source: Binance

We found that interest rates vary by trading pair, as more volatile markets attract higher APRs. While Binance charges a competitive annual rate of 0.37% to borrow BTC, Bitcoin Cash (BCH) incurs a 11.46% APR. The exchange implements these fees hourly.

Funding Fees

Perpetual futures use the funding system instead of traditional margin interest.

Typically every eight hours, platforms charge long or short traders depending on the imbalance between buy and sell orders. This framework ensures derivative prices align with spot exchange prices.

Securing Low Margin Fees

Some margin exchanges incentivize active traders with lower fees, which include reduced commissions and more competitive interest rates. Discounts often depend on the trader’s 30-day trading volume, or whether they hold the exchange’s native token.

Best Practices for Risk Management

Trading cryptocurrencies on margin increases the risk-reward spectrum. Follow these best practices to mitigate risk.

- Use Leverage Wisely: A direct relationship between leverage multipliers and liquidation risks exists. Increasing the leverage size lowers the margin buffer, so liquidation occurs more easily. Trading with sensible leverage amounts helps traders reduce the liquidation probability.

- Use Stop-Loss Orders: To protect your margin position against liquidation, ensure you place stop-loss orders. Exchanges close losing trades automatically based on the trader’s stop-loss price. While traders still face losses, avoiding liquidation cuts those losses to manageable amounts.

- Choose the Right Margin Product: Research different crypto margin products to find the right instrument for your strategy and risk tolerance. Delivery futures suit long-term strategies, as they eliminate funding and margin fees. Options offer limited downside, while spot margin accounts improve capital efficiency. Perpetual futures offer the highest leverage limits, so they appeal to high-risk traders.

- Trade Major Markets Only: Another best practice is to stick with large-cap cryptocurrencies. As these markets are less volatile, traders reduce liquidation risks. They also provide more competitive funding/interest rates, and deeper liquidity ensures traders enter and exit positions without adverse slippage.

- Create an Exit Strategy: Successful margin trades can yield substantial gains, especially when traders use high leverage. Experts recommend setting an exit target through take-profit orders. Platforms close positions if the target price triggers, which ensures traders secure their gains.

How to Trade Crypto Margin Safely

The following step-by-step guide explains how to margin trade crypto. We use the beginner-friendly CoinFutures platform for this walkthrough.

Step 1: Open a Margin Trading Account

Visit the CoinFutures website and click “Register” to open an account. CoinFutures is a no-KYC provider, so new customers require an email address, nickname, and password only.

Signing up to CoinFutures crypto futures. Source: CoinFutures

Verify your email address, then download the CoinPoker desktop software or mobile app. Note that CoinPoker runs the CoinFutures platform, which is why users trade on its interface.

Step 2: Deposit Funds for Margin Collateral

CoinFutures traders deposit funds on the CoinPoker dashboard. Tap the “Wallet” icon and choose the deposit asset. The platform accepts multiple cryptocurrencies, including USDT, BTC, ETH, and BNB.

Copy or scan the deposit address and complete the transfer from a private wallet or exchange account.

Depositing trading funds on CoinFutures. Source: CoinFutures

To deposit fiat money, click the “Deposit with Card” option. CoinFutures supports popular payment methods such as Visa, MasterCard, and Google/Apple Pay.

The provider converts both crypto and fiat payments to USDT, as all listed trading pairs contain the stablecoin.

Step 3: Explore Margin Trading Markets

Exit the cashier page and select “Crypto Futures”. To view available markets, tap the “BTC/USDT” icon.

Placing trades and deciding whether prices go up or down. Source: CoinFutures

We suggest BTC or ETH for first-time margin traders, as these markets offer reduced volatility and more competitive spreads. Higher-risk traders may prefer lower-cap assets like Chainlink (LINK) or Litecoin (LTC).

Step 4: Set up a Margin Trading Order

Click “Up” or “Down” to go long or short on the crypto trading pair. Then enter the initial margin (wager), which resembles the maximum loss potential.

The BTC/USDT chart and entering wagers. Source: CoinFutures

Enter the required leverage (multiplier). The selected multiplier determines the total market exposure. In the example above, the trader’s $300 wager at 200x converts to a $60,000 position size.

Step 5: Set Risk Management Levels and Place Order

We recommend setting a stop-loss order before you place a margin trade. Tap “Auto” and scroll down to “Close Bet at Price”.

Placing a stop-loss and confirming your bet. Source: CoinFutures

Enter the maximum amount you wish to risk in USD, or set a specific asset price. If the market price aligns with the stop-loss target, CoinFutures closes the trade immediately.

Finally, confirm the order. The platform executes the position right away.

Conclusion

Margin boosts trading balances, which can enable traders to bet on falling crypto prices, improve capital efficiency, and increase their purchasing power. However, it also comes with a much higher risk of capital loss. Traders should start small and ensure they follow risk management strategies.

While many platforms offer high crypto margins, we rate CoinFutures as the overall best option. The platform has a beginner-friendly interface and high leverage. Traders avoid KYC requirements and account minimums, and can use built-in tools like stop-loss orders to mitigate risk. The platform offers exposure to BTC, ETH, SOL, and other top altcoins.

FAQ

Which crypto exchange is best for margin trading?

Is crypto margin trading profitable?

What is margin vs leverage in crypto?

References

Coinspeaker in Numbers

Monthly Users

Articles & Guides

Research Hours

Authors

The team behind IPO Genie has not yet announced an end date for the presale.

AI cryptocurrencies combine blockchain with artificial intelligence to power decentralized machine learning networks, GPU computin...

Fact-Checked by:

Fact-Checked by:

32 mins

32 mins

Ibrahim Ajibade

, 373 postsI’m a research analyst with experience supporting Web3 startups and financial organizations through data-driven insights and strategic analysis. My goal is to help organizations make smarter decisions by bridging the gap between traditional finance and blockchain innovation.

With a background in Economics, I bring a solid understanding of market dynamics, financial systems, and the broader economic forces shaping the crypto industry. I’m currently pursuing a Master’s degree in Blockchain and Distributed Ledger Technologies at the University of Malta, where I’m expanding my expertise in decentralized systems, smart contracts, and real-world blockchain applications.

I’m especially interested in project evaluation, tokenomics, and ecosystem growth strategies, as these are areas where innovation can drive lasting impact. By combining my academic foundation with hands-on experience, I aim to provide meaningful insights that add value to both the financial and blockchain sectors.