Based on our research, the best short-term cryptocurrencies have deep liquidity, high volatility, and sustained positive market se...

Read our expert-led reviews for the best crypto options platforms. Learn how to trade these popular derivative products safely.

According to our research, the best crypto options trading platforms are Binance and Bybit, while CoinFutures is a popular alternative for accessing 1000x leverage. These platforms are cost-effective, secure, and ideal for short-term trading strategies.

Options traders consider a wide range of metrics when selecting a broker, including safety, commissions, available markets, and premium prices. This guide explores the best places to trade Bitcoin and altcoin options in 2026. Read on to choose the right platform for you.

Key Takeaways

- Options are derivative instruments that enable traders to speculate on cryptocurrencies without owning the underlying assets.

- Traders enter positions by paying a “premium,” which gives them the right but not the obligation to buy or sell those cryptocurrencies at a later date.

- When choosing a platform for crypto options trading, consider security, supported markets, and trading tools.

- While CoinFutures offers simulated crypto futures, it’s the best option for trading digital assets with leverage.

- Those seeking conventional options contracts may consider Binance and Bybit for their extensive chains and deep liquidity.

The Best Crypto Options Platforms Ranked

Listed below are the top crypto options exchanges in 2026:

- CoinFutures: Trade bitcoin and popular altcoins with 1000x leverage.

- Crypto.com: CFTC-regulated options for US traders with built-in profit and loss limits.

- Kraken: Veteran exchange with perpetual futures and OTC options for institutions.

- Gemini: Security-first platform with 100x leverage perpetuals for EU users.

- WEEX: High-leverage futures with copy trading for beginners.

Comparing the Top Crypto Options Exchanges

| Platform | Markets | Trading Commissions | Availability |

| CoinFutures | 14 leveraged markets | Flat upfront fee or profit reduction | Global |

| Crypto.com | BTC, ETH, BCH, LTC, DOGE, AVAX, DOT, LINK, and more | $1 exchange fee + $0.99 technology fee per contract | United States only |

| Kraken | 350+ perpetual futures; OTC options for BTC, ETH | 0.02% maker, 0.05% taker | Most countries (US available excluding ME, NY, WA) |

| Gemini | BTC, ETH, SOL, XRP, and altcoins | 0.02% maker, 0.04% taker | EU only for perpetuals (US and UK restricted) |

| WEEX | 1,700+ trading pairs | 0.02% maker, 0.08% taker | Global (restricted in US, Hong Kong, Canada, China, Singapore) |

Best Crypto Options Trading Platforms Reviewed

We tested and reviewed the best places for trading crypto options. Our methodology explored the most important factors for options traders, including available markets, strike prices, premiums, maturity dates, and fees. Let’s examine the top platforms in more detail.

1. CoinFutures: Regulated Platform With 1000x Leverage and Instant Withdrawals

CoinFutures is the overall best place to trade cryptocurrencies with high leverage. The platform, which is part of the CoinPoker group (a regulated poker site established in 2017), offers simulated crypto futures with leverage of up to 1000x. This high-leverage framework means staking just $20 provides users with $10,000 in market exposure.

CoinFutures offers the maximum leverage multiple on all supported markets, including many of the best meme coins on Binance like Dogecoin, SPX6900, and dogwifhat. Platform users can go long or short on any available crypto pair, and access risk-management tools like stop-losses and take-profits. Users can also trade manually and cash out their profits at any time.

CoinFutures offers 1000x leverage on popular meme coins like Pudgy Penguins. Source: CoinFutures

Getting started at CoinFutures is a hassle-free experience. Users download the native software for Windows, Mac, or Linux, or the Android app (iOS app is in development). New customers register with an email address and username only, as CoinFutures does not implement KYC verification.

Deposits and withdrawals are near-instant when using cryptocurrencies. Fiat payments are accepted too, including debit/credit cards and e-wallets.

In terms of drawbacks, CoinFutures does not offer traditional options contracts, meaning a lack of strike prices, premiums, and maturity dates. It also offers basic charting and analysis tools, which may not appeal to experienced technical traders.

Pros

- Trade Bitcoin and altcoins with 1000x leverage

- Go long or short without purchasing premiums

- Backed by the reputable CoinPoker brand

- Deposit and withdraw crypto near-instantly

- Open an account without providing KYC details

Cons

- Does not offer real crypto options

- Market prices are simulated via algorithms

- Only suitable for short-term trading strategies

2. Crypto.com: CFTC-Regulated Options for US Traders with Built-In Protection

Crypto.com is the only crypto options platform on this list that holds CFTC regulation, which makes it the top choice for US-based traders. The platform offers UpDown Options and Strike Options through Crypto.com | Derivatives North America (operated by Nadex). Both products let users profit from price predictions on major cryptocurrencies with clear risk limits.

UpDown Options support a wide range of digital assets: Bitcoin, Ethereum, Bitcoin Cash, Litecoin, Dogecoin, Avalanche, Polkadot, Chainlink, Cronos, PEPE, Hedera, and more. Each asset comes with four contract variations to match different risk appetites. Contracts run from Sunday at 6 PM ET through Friday at 4:15 PM ET, with automatic knockouts when prices hit target or stop levels.

Crypto.com offers CFTC-regulated UpDown Options with built-in profit and loss limits. Source: Crypto.com

One drawback is that Crypto.com’s options products are available to US users only. The platform also requires membership with CDNA before traders can access these markets, which adds an extra registration step.

Fees are simple and transparent. Crypto.com charges a flat $1 exchange fee plus $0.99 technology fee per contract. Users can fund their accounts through USD deposits, credit cards, or convert any of the 350+ supported tokens directly in the app.

Pros

- Only CFTC-regulated crypto options platform for US traders

- Know your maximum profit and loss before each trade

- Flat fee structure keeps costs transparent

- Supports 10+ cryptocurrencies including meme coins like DOGE and PEPE

- Fund trades with USD or crypto through the mobile app

Cons

- Available in the United States only

- Short-term contracts limit long-position strategies

- Requires separate CDNA membership to start

- App-based platform lacks advanced charting tools

3. Kraken: Veteran Exchange with Perpetual Futures and OTC Options Access

Kraken is one of the oldest crypto exchanges in the industry, founded in 2011. The platform has never lost customer funds to a hack, which is more than a good sign. While Kraken does not offer retail options contracts, it provides deep perpetual futures markets and OTC options for institutional clients.

The Kraken Pro platform supports over 350 perpetual futures contracts with leverage up to 50x. Traders can go long or short on major cryptocurrencies like Bitcoin, Ethereum, Solana, and XRP, plus dozens of altcoins. Contract timeframes include perpetual, monthly, quarterly, and semi-annual options for BTC and ETH pairs.

Kraken Pro offers perpetual futures with up to 50x leverage and advanced charting tools. Source: Kraken

For traders who want traditional options contracts, Kraken restricts this product to its OTC desk. The minimum trade size is $50,000, and the service targets institutional clients, family offices, and high-net-worth individuals. There are no additional fees for OTC options trades.

Futures fees follow a maker-taker model. Standard users pay 0.02% maker and 0.05% taker fees, with discounts available as 30-day volume increases. High-volume traders can reduce taker fees to just 0.01%. The platform also maintains an insurance fund worth over $100 million to protect against extreme market conditions.

Pros

- One of the most trusted exchanges with no history of security breaches

- Over 350 perpetual futures contracts with 50x leverage

- Available to US traders in most states under CFTC regulation

- Competitive futures fees start at 0.02% maker and 0.05% taker

- Advanced Kraken Pro platform with TradingView integration

Cons

- No retail options trading; requires OTC desk with $50,000 minimum

- Options limited to BTC and ETH through OTC only

- Lower leverage than some offshore competitors

- Futures not available in certain regions like Australia and UK (retail)

4. Gemini: Security-First Exchange with Perpetual Futures for EU Traders

Gemini is a US-based exchange founded in 2014 by Cameron and Tyler Winklevoss. The platform has built a strong reputation for regulatory compliance and security, with SOC 1 Type 2 and SOC 2 Type 2 certifications from Deloitte.

While Gemini does not currently offer retail options contracts, the platform provides perpetual futures through its ActiveTrader interface. These contracts support up to 100x leverage and cover popular assets like Bitcoin, Ethereum, Solana, XRP, and several altcoins.

Gemini ActiveTrader offers perpetual futures with up to 100x leverage and TradingView integration. Source: Gemini

The main limitation is availability. Perpetual futures are restricted to EU customers under Gemini’s MiFID II license. US and UK traders cannot access derivatives products on the platform. However, Gemini recently received CFTC approval (December 2025) to operate as a Designated Contract Market, with plans to expand into crypto futures, options, and perpetual contracts for US customers in the future.

Fees on the ActiveTrader platform start at 0.02% maker and 0.04% taker for spot trades under $10,000. Instant purchases through the basic platform carry higher costs at 2.49%. The exchange supports over 70 cryptocurrencies and 300+ trading pairs, with multiple fiat options including USD, EUR, GBP, and AUD.

Pros

- Industry-leading security with SOC 1/2 Type 2 certifications

- Perpetual futures with up to 100x leverage for EU users

- Cross-collateral support and USDC settlements

- Strong regulatory framework across US, EU, and UK

- TradingView integration on ActiveTrader platform

Cons

- No options trading available; futures and options planned for future release

- Perpetual futures not available in the US or UK

- Higher fees than most competitors on instant purchases

- Limited cryptocurrency selection compared to offshore exchanges

5. WEEX: High-Leverage Futures Exchange with Copy Trading for Beginners

WEEX is a Dubai-based crypto exchange founded in 2018. The platform has grown to serve over 6.2 million users across 130+ countries, with a focus on perpetual futures and retail-friendly features.

The exchange supports over 1,700 trading pairs across spot and futures markets. Perpetual futures come with leverage up to 200x on major pairs like BTC/USDT and ETH/USDT, with the platform advertising up to 400x on select contracts. All futures are USDT-settled with no expiration dates, and traders can go long or short based on their market outlook.

WEEX offers perpetual futures with up to 200x leverage and one-click copy trading. Source: WEEX

The copy trading feature appeals to beginners who want to mirror successful traders without building their own strategies. Users can customize leverage settings, set stop-loss and take-profit ratios, and cap their maximum trade amounts.

Privacy-focused traders can use WEEX without KYC and withdraw up to 50,000 USDT per transaction. The exchange maintains a 1,000 BTC protection fund for user assets and provides TradingView charts for technical analysis.

Pros

- Over 1,700 trading pairs across spot and futures markets

- Up to 200x leverage on perpetual futures contracts

- Copy trading feature helps beginners follow expert strategies

- No KYC required for withdrawals up to 50,000 USDT

- Low futures fees at 0.02% maker and 0.08% taker

Cons

- No options trading available; futures only

- Not fully regulated; received cease-and-desist from Georgia in 2025

- Fiat deposits currently unavailable (under maintenance)

- Restricted in US states, Hong Kong, Canada, China, and Singapore

What Are Cryptocurrency Options?

Options are derivative products that let traders speculate on cryptocurrencies without owning or controlling the underlying assets. They appeal to some crypto investors due to their significant market exposure and limited financial risk.

Options traders pay an upfront premium to unlock large trade sizes, and the potential losses remain limited to that premium. This is because options offer the right but not the obligation to buy or sell the traded asset.

The best crypto options trading platforms offer deep chains on major markets like Bitcoin, Ethereum, and XRP. Traders purchase call or put contracts based on their projected price and timeframe, and the premium adjusts based on the perceived probability.

If BTC/USD is priced at $120,000 and the trader sets the strike price at $123,000 with a one-month expiry, the odds of that prediction coming true are very high. As such, the premium price is also high, due to the reduced risk. Increasing the strike price to $170,000 would vastly reduce the win probability but also the upfront premium.

The key takeaway is that crypto options offer significant upside when traders speculate correctly, and limited downside when they’re wrong. This makes them ideal for trading new cryptocurrencies with volatile pricing swings.

How Does Crypto Options Trading Work?

Read on to learn more about crypto options, including concepts like calls and puts, premiums, and expiration dates.

Calls and Puts

As an options buyer, you purchase calls or puts. These instruments simply determine the predicted market direction. Call options resemble long positions, while buying put options means you’re short.

Avoid selling calls or puts, as these increase the risk by substantial amounts. The downside risk for buyers is the premium only.

Options Premium

Options traders pay a premium for the right but not the obligation to buy or sell the underlying digital assets. The premium is a percentage of the overall market exposure, but it varies considerably depending on the trade parameters.

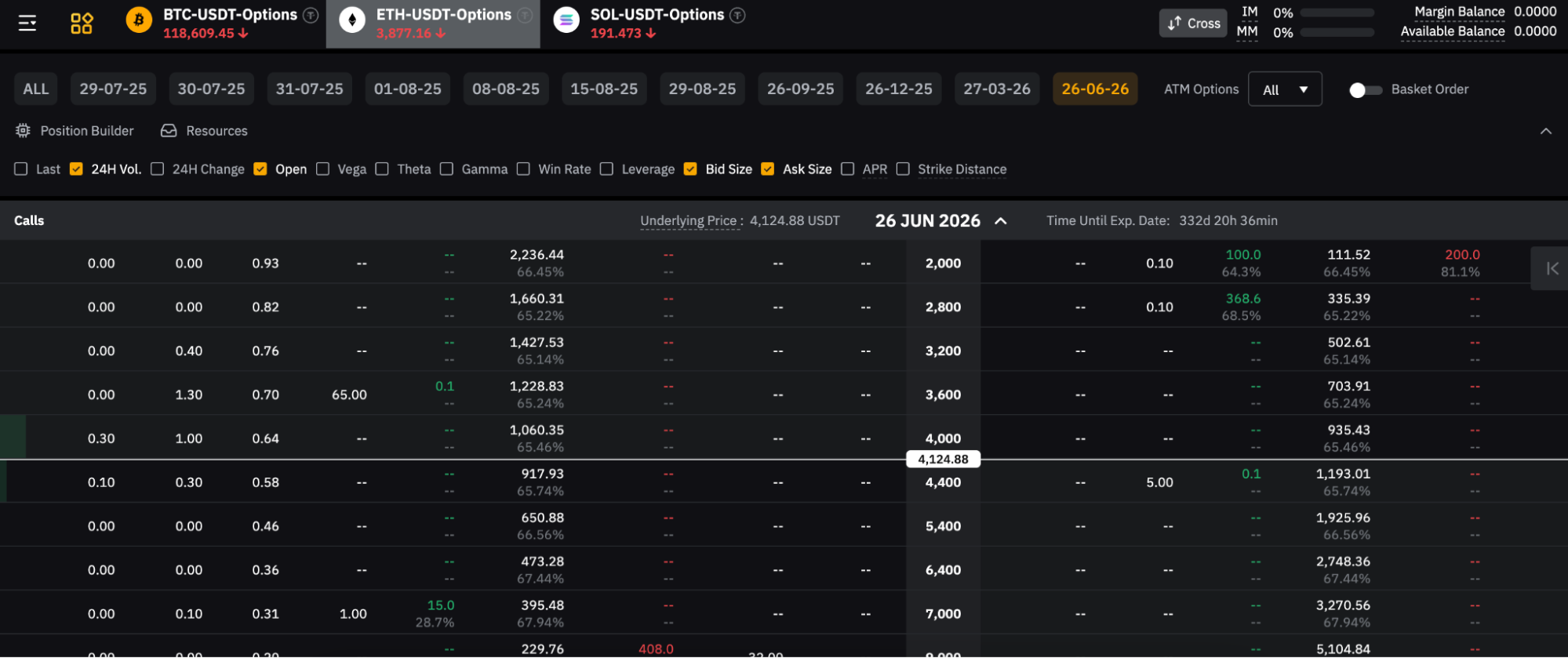

Binance premiums rise and fall based on various factors, including spot prices and time to decay. Source: Binance

Premiums increase as the probability of the trade winning grows. Importantly, you can never lose more than the options premium, as long as you purchase calls or puts. Selling them would make you a market maker and remove the risk barrier.

Strike Prices

There is a direct correlation between strike prices and premiums, as these metrics determine the risk-reward of the crypto options trade.

If you’re going long via calls, you need the contracts to expire above the strike price. And vice versa when purchasing put options.

The best crypto options trading platforms offer an extensive selection of strike prices, allowing both bullish and bearish traders to enter trades based on their predictions.

Suppose the current ETH/USD price is $3,000. The premium on a $7,000 strike price could be just 3% of the contract value. Yet, a $3,500 strike price may amount to 60%, as the probability of ETH/USD surpassing $3,500 is much higher.

Expiration Date

Crypto options contracts always include an expiry date, unlike perpetual futures, which remain open indefinitely.

Depending on the platform, contracts are often available from just one day to over 12 months. Longer-term contracts are more expensive, as traders have more time to hit their strike price target (and vice versa for short-term markets).

Crypto Options Example

Here is a simplified example of how crypto options work:

- A trader purchases Solana call options at a $190 strike price and a one-month expiration. They pay a $19 premium per contract and buy 10 contracts ($190 outlay).

- The Solana price reaches $250 when the contract expiration date arrives. With the premium ($19) and strike price ($190), the trader makes $41 per contract. They purchased 10 contracts, so their profit is $410, less fees.

In the above example, had Solana closed below the break-even price ($190 + $19), the trader would have lost the $19 premium only (per contract).

Crypto Options vs Futures

Options and futures share some similarities. They support long and short trading, allowing investors to speculate on rising and falling crypto prices. Both trading products are derivative products, so the contract holder does not own the underlying coins or tokens.

The key difference between them is that options offer the right but not the obligation to buy or sell the respective digital asset on the settlement date. Therefore, if the trader speculates unsuccessfully, they simply lose the initial upfront premium paid, choosing not to exercise their contract rights.

Futures, on the other hand, require the holder to buy or sell the contracts. This is why during COVID-19, WTI Oil Futures were traded negatively. Global storage facilities were at maximum capacity, so contract holders were willing to pay people to take delivery of the oil.

Another core difference is liquidation risk. Options buyers do not face margin calls or brokerage liquidation, since they hold the contracts until they expire. Perpetual crypto futures, which are heavily traded by retail clients, incur substantial liquidation threats, especially when high leverage is used.

However, due to their complexity and thinner liquidity, options markets are more limited compared to futures. Options rarely track penny cryptocurrencies, so they are a better fit for large-cap investors.

Key Things to Know About Crypto Options Trading

Options trading crypto can be a low-risk, high-reward strategy, yet so many traders incur consistent losses. Here are some key considerations and best practices to explore before getting involved.

Never “Sell” Calls or Puts as a Beginner

Selling calls or puts makes you an options underwriter. You bear the full market exposure, depending on the market direction.

Selling a call option, for instance, means substantial losses if the digital asset blows up. This is because the other trader’s profit is yours to deliver. If the same asset crashed, you would only make that trader’s premium.

While selling calls and puts can be a smart strategy for experienced options traders, beginners should stick with traditional options buying. The financial risk is capped at the upfront premium only.

Evaluate the Break Even

Beginners often make the mistake of thinking the strike price is their break-even level. However, the premium should be added, increasing or decreasing the break-even point depending on the market direction.

Start With Longer-Term Contracts

Active options traders may prefer short-term contracts with daily or weekly expirations. Prices are more volatile, so they present additional trading opportunities. These options markets can be hard to predict, as crypto price movements are less predictable in the near term.

Bybit offers 12-month options contracts on ETH/USDT. Source: Bybit

As a beginner, consider trading longer-term options like the six or 12-month contracts at Binance or Bybit. These are available for BTC and ETH only, yet they provide inexperienced traders more time and flexibility.

You Don’t Need to Hold Until Expiry

Some options traders hold until their contracts expire, yet this isn’t mandatory. Traders can exit positions before the options mature, potentially allowing them to lock in profits early. They may also limit losses, meaning they get some of their premium back.

The real-time value of outstanding options trades is driven by various factors, including the digital asset’s spot price, implied volatility, and time remaining until expiration. The simple explanation is that the cash out yield reflects the probability of the options contract closing in the money.

What Are the Benefits of Trading Crypto Options?

Crypto options provide traders with several advantages over traditional spot markets.

The premium allows traders to enter positions worth much more than the upfront risk. If the premium amounts to 4% of the overall contract value, the trader gets 25 times more market exposure than the balance permits.

Despite their high-leverage capabilities, the potential financial losses are capped. Options buyers can lose no more than the initial margin, eliminating liquidation and negative balance risks.

Options, like most derivative products, support both market directions. Traders may purchase call options to go long or put options to speculate short. This makes crypto options suitable for bull, bear, and sideways markets.

An often understated benefit is that options are more flexible than perpetual futures. Traders can keep perpetual positions open indefinitely, yet this would not make sense considering the typical eight-hour funding cycle. The best crypto options trading platforms offer 12-month contracts, which remain open until the settlement date without incurring daily fees.

Pros & Cons of Crypto Options Trading

Consider these pros and cons of trading Bitcoin and altcoin options:

Pros

- Risk is a small fraction of the overall market exposure

- The potential financial loss is capped at the upfront premium

- Speculate on rising and falling crypto prices

- Successful options trades can yield substantial returns

- Contract maturities often range from one day to 12 months

- No liquidation risks for options buyers

Cons

- Limited market available compared to perpetual futures

- Options platforms often only support large-cap cryptocurrencies

- Beginners may find options chains complex and intimidating

- While losses are limited, consistently losing can lead to consequential amounts

How to Trade Crypto Options

This section explains how to trade cryptocurrencies on CoinFutures. Although CoinFutures offers simulated crypto futures, these share the same characteristics as conventional options. Platform users go long or short and can access leverage of up to 1,000x.

Read on to get started in under 10 minutes.

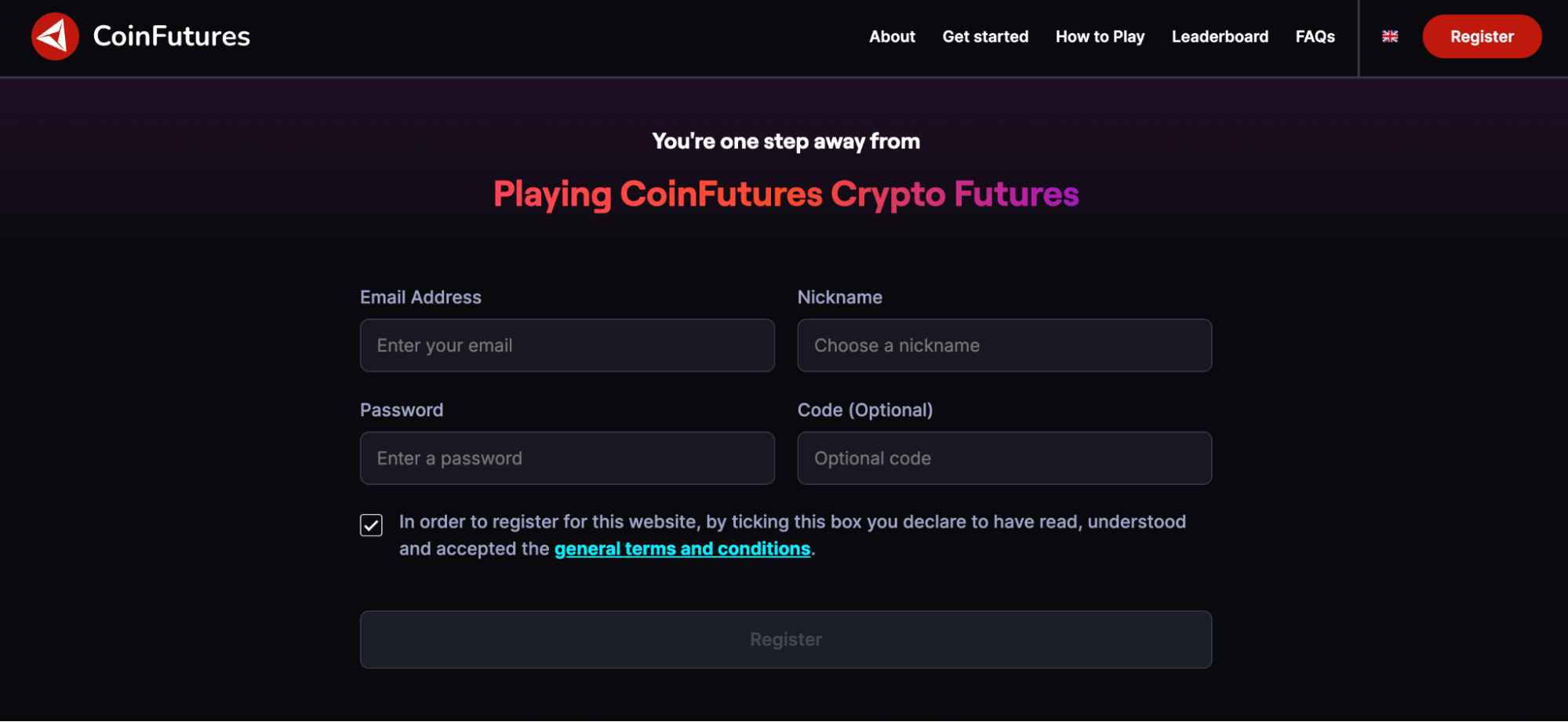

Step 1: Open an Account

Visit the CoinFutures website to register a new account. Click “Register”, enter an email address, and choose a nickname and password.

CoinFutures requires an email address, nickname, and password when opening a new account. Source: CoinFutures

Select “Register” again to complete the registration process. You will notice that, unlike many options trading platforms, CoinFutures supports privacy and anonymity.

Step 2: Download CoinPoker Client

CoinFutures is backed by the trusted CoinPoker brand, an established poker platform with casino and sports betting.

You need the CoinPoker client to trade simulated markets. The provider offers free desktop software and mobile applications. Select your preferred operating system to begin the download and installation.

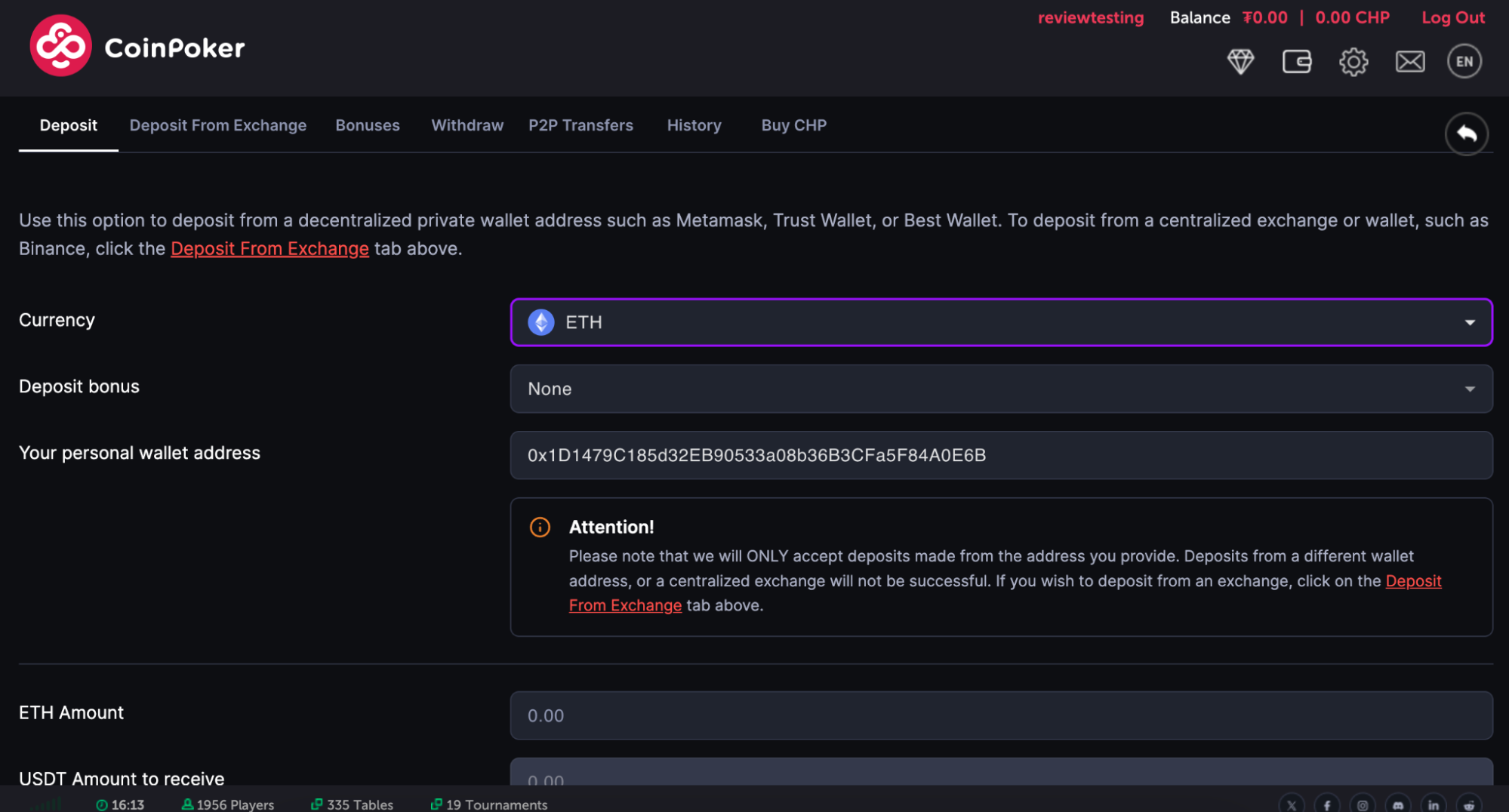

Step 3: Log In and Deposit Funds

Open the CoinPoker client and sign in with your email address and chosen password. Then click the “Wallet” icon to make a deposit.

Traditional deposit methods include Google/Apple Pay, debit/credit cards from Visa and MasterCard, and PIX.

Most traders fund their accounts with cryptocurrencies, as payments are private, near-instant, and hassle-free.

CoinFutures users get near-instant payments when they deposit crypto. Source: CoinFutures

CoinFutures accepts Bitcoin and the best altcoins like USDT, USDC, and Ethereum. Crypto payments function similarly to depositing funds into an online exchange. Copy the unique deposit address and complete the payment from a private wallet.

Note: If you deposit cryptocurrencies, ensure you enter your private wallet address correctly. Sending assets from a different address may result in delays or returned funds. This is a security procedure to protect CoinFutures customers from potential threats.

Step 4: Choose a Crypto Leverage Market

Click the “Crypto Futures” button and choose a suitable trading market. 14 leveraged cryptocurrencies are available, from Bitcoin, Dogecoin, and Shiba Inu to Ethereum and Cardano.

Step 5: Place a Leveraged Crypto Trade

CoinFutures offers a user-friendly experience, even for first-time traders. There is no requirement to research options chains, strike prices, premiums, or maturity dates. Instead, start by choosing between “Up” or “Down”. The decision is based on whether you believe prices will rise or fall.

The CoinFutures trading dashboard is beginner-friendly. Source: CoinFutures

Now enter the wager amount. Similar to a premium, this represents the maximum amount you will risk on the leverage trade. If you speculate incorrectly, the wager amount is kept by the platform.

If you wish to trade with leverage, set your multiple from 2x to 1000x. Notice the “Bust” price update, which is effectively the liquidation price to avoid.

Click “Place Bet” to complete the trade.

Note: Switch to “Auto” to place stop-losses and take-profits. Otherwise, in “Manual” mode, traders open and close positions manually.

Conclusion

Crypto options offer the ideal balance between profit maximization and risk management. By paying a small premium, traders increase their position sizes while the potential financial loss is capped.

That said, inexperienced traders may find options chains, strategies, and principles intimidating. A more beginner-friendly option is trading simulated futures at CoinFutures. It offers 1000x leverage, a minimum trade size of $1, and the ability to go long or short.

FAQ

What are options in crypto?

Why do people trade crypto options?

Are crypto options more risky?

What’s the minimum amount you need to trade crypto options?

What is the best crypto options trading platform?

References

- FBI Says North Korea Was Responsible for $1.5 Billion ByBit Hack (Reuters)

- Perpetual Futures Contracts and Cryptocurrency Market Quality: Insights from Emerging Markets (Cornell SC Johnson College of Business)

- Options Pricing (Merrill Lynch)

- Options Premium and the Greeks (CME Group)

Coinspeaker in Numbers

Monthly Users

Articles & Guides

Research Hours

Authors

VerifiedX (VFX) has officially launched, offering a Bitcoin-inspired decentralized network with unique on-chain features. Learn wh...

BMIC doesn't have a fixed presale end date yet. The team said they want to keep things flexible and let demand dictate when it wra...

Fact-Checked By:

Fact-Checked By:

22 mins

22 mins

Ibrahim Ajibade

, 373 postsI’m a research analyst with experience supporting Web3 startups and financial organizations through data-driven insights and strategic analysis. My goal is to help organizations make smarter decisions by bridging the gap between traditional finance and blockchain innovation.

With a background in Economics, I bring a solid understanding of market dynamics, financial systems, and the broader economic forces shaping the crypto industry. I’m currently pursuing a Master’s degree in Blockchain and Distributed Ledger Technologies at the University of Malta, where I’m expanding my expertise in decentralized systems, smart contracts, and real-world blockchain applications.

I’m especially interested in project evaluation, tokenomics, and ecosystem growth strategies, as these are areas where innovation can drive lasting impact. By combining my academic foundation with hands-on experience, I aim to provide meaningful insights that add value to both the financial and blockchain sectors.