Identifying the best crypto to mine in 2026 depends on your hardware, electricity costs, and risk tolerance.

Identifying the best crypto to mine in 2026 depends on your hardware, electricity costs, and risk tolerance.

Mining cryptocurrency means solving cryptographic puzzles to validate blockchain transactions. You earn newly minted coins plus transaction fees.

We evaluated 10 mineable cryptocurrencies using network difficulty, hardware compatibility, current profitability at $0.10/kWh electricity, and exchange liquidity. This list prioritizes realistic returns over hype, filtering out coins where retail miners can’t compete with industrial operations.

Bitcoin leads for revenue potential with efficient ASICs and sub-$0.05/kWh power. It is suitable for miners with capital rather than hobbyists. Monero ranks highest for accessibility, letting anyone mine with consumer CPUs.

Comparing the Best Cryptocurrencies to Mine in 2026

| Cryptocurrency | Algorithm | Best Hardware | Estimated Profitability | Difficulty | Block Reward |

| Bitcoin (BTC) | SHA-256 | ASIC (S21 Pro, KS7) | High (for cheap power) | 146.47 T | 3.125 BTC |

| Monero (XMR) | RandomX | CPU/GPU | Low to Moderate | Moderate | Variable |

| Litecoin (LTC) | Scrypt | ASIC (L7, L3+) | Moderate to High | High | 6.25 LTC |

| Dogecoin (DOGE) | Scrypt | ASIC (merged with LTC) | Moderate | Moderate | 10,000 DOGE |

| Ravencoin (RVN) | KAWPOW | GPU (NVIDIA preferred) | Low | 76.28K | 2,500 RVN |

| Ethereum Classic (ETC) | Etchash | GPU/ASIC | Moderate | 2.53P | 2.56 ETC |

| Zcash (ZEC) | Equihash | ASIC/GPU | Moderate | Moderate | Variable (halving) |

| Dash (DASH) | X11 | ASIC | Low to Moderate | Moderate | ~1.91 DASH |

| Kaspa (KAS) | kHeavyHash | ASIC (KS7, KA Box) | Moderate | 10.27M | 3.60 KAS |

| Vertcoin (VTC) | Verthash | GPU/CPU | Low | Low | Variable |

Best Crypto to Mine – Reviewed

Each cryptocurrency below is ranked by accessibility, profitability, and hardware requirements, from Bitcoin’s industrial-scale ASICs to Monero’s consumer CPUs.

1. Bitcoin (BTC)

Bitcoin remains the leader of cryptocurrency mining, but it’s become a business now; it’s no longer a hobby. With network difficulty sitting at 146.47 trillion and a global hashrate exceeding 1,000 EH/s, you’re competing against industrial mining farms with thousands of ASICs.

The April 2024 halving cut block rewards to 3.125 BTC, which means profitability now is based on three factors: strong hardware, dirt-cheap electricity (ideally under $0.05/kWh), and economies of scale. A single Antminer S21 Pro can earn $7-15 daily with cheap industrial electricity, but loses money at typical home electricity rates.

A Bitcoin Difficulty Chart tracking difficulty levels from January 2025 to January 2026, showing a peak near 150 T. Source: Coinwarz

Who it’s for: Experienced miners with access to commercial power rates and capital to invest in the latest ASICs like the Antminer S21 Pro (234 TH/s) or Whatsminer M66 (350 TH/s). Solo mining is essentially a lottery, most successful miners join pools like Foundry USA or AntPool to get consistent payouts.

Key consideration: Bitcoin mining difficulty adjusts every 2,016 blocks (roughly two weeks). As of January 2026, difficulty is projected to decrease slightly to 139.50 T, but long-term trends show continued upward pressure as more miners come online.

2. Monero (XMR)

If you believe in mining’s original promise, that anyone with a computer should be able to participate, this is the premise Monero delivers. Its RandomX algorithm is deliberately memory-hard, making it inefficient for both ASICs and GPUs. This keeps mining decentralized and accessible to CPU miners.

You can mine Monero with a high-end CPU like a Ryzen 9 or Intel i9, but don’t expect riches. Realistic returns hover around $5-15 monthly after electricity costs, mainly covering a fraction of your computer’s operational expenses.

Keep in mind that Monero’s ASIC resistance comes at a cost, and profitability is pretty low.

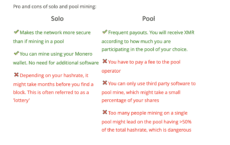

A comparison chart outlines the pros and cons of mining Monero solo versus pool mining, showing the security benefits of solo mining and the more frequent payouts for pool participants. Source: Monero

Who it’s for: Privacy advocates, beginners testing the waters, or miners with “free” electricity (like already-running home servers). It’s also popular for spec mining, accumulating coins now in hopes of future price appreciation.

Hardware requirements: Any modern CPU works, but mining profitability scales with core count and L3 cache. Software like XMRig is the industry standard, and pools like SupportXMR and MineXMR handle payouts.

3. Litecoin (LTC)

Litecoin is mature enough to be liquid and stable, but the Scrypt algorithm is still accessible compared to Bitcoin’s SHA-256. The real game-changer is merged mining with Dogecoin, which lets you mine both coins simultaneously without extra electricity or hardware costs.

Block rewards halved to 6.25 LTC in 2023, and difficulty has increased as more miners joined, but profitability remains solid for those with efficient ASICs like the Bitmain L7 (9.5 GH/s) or older L3+ models. Solo mining is impractical due to high network difficulty; pools are essential.

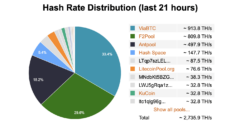

Litecoin’s hash rate distribution across mining pools (last 21 hours). Source: Litecoinpool

Who it’s for: Miners ready to invest in dedicated Scrypt ASICs who want exposure to two coins (LTC + DOGE) from a single setup. The merged mining benefit significantly boosts overall profitability compared to mining either coin alone.

Mining pools: Popular options include F2Pool, Prohashing, and LitecoinPool.org, with most charging 1-3% fees.

4. Dogecoin (DOGE)

What started as a joke and remains one of the most popular meme coins has become a serious mining option, largely thanks to its merged mining relationship with Litecoin. Because DOGE uses the same Scrypt algorithm, your Litecoin ASIC automatically mines Dogecoin at no additional cost.

Unlike Bitcoin and Litecoin, Dogecoin has no maximum supply and no halving events. Block rewards remain fixed at 10,000 DOGE, which creates consistent inflation but also ensures miners always have motivation to secure the network. Current difficulty tracks closely with Litecoin due to the merged mining setup.

A list outlines the essential hardware and infrastructure needed to mine Dogecoin profitably, including ASIC miners, power supplies, and access to cheap electricity. Source: Dogecoin

Who it’s for: Anyone mining Litecoin already gets Dogecoin “for free”. Solo DOGE miners should seriously reconsider; merged mining with LTC makes far more economic sense.

Community factor: DOGE’s price volatility is heavily influenced by social media and celebrity endorsements, which can create sudden profitability spikes. This becomes attractive for miners comfortable with short-term price speculation.

5. Ravencoin (RVN)

Ravencoin is the GPU miner’s refuge. The KAWPOW algorithm was specifically designed to resist ASICs, giving consumer-grade graphics cards a fighting chance. It’s community-centric, with a focus on asset creation and transfer.

Profitability just got tighter. Ravencoin’s second halving occurred on January 11, 2026, cutting block rewards from 2,500 RVN to 1,250 RVN. A mid-range GPU like an RTX 3070 now earns roughly $0.03-$0.06 daily at $0.10/kWh electricity, essentially breakeven or slightly negative at higher power costs. NVIDIA GPUs generally outperform AMD on KAWPOW, with the RTX series delivering the best efficiency.

A list shows major mining pools that support Ravencoin (RVN) for distributed network security, including popular options like WoolyPooly, 2Miners, and Nanopool. Source: Ravencoin

Who it’s for: Hobby miners with existing gaming rigs, believers in decentralization, or those accumulating RVN for long-term holds.

Hardware notes: You need at least 4GB VRAM, though 6GB+ is recommended. Popular mining software includes T-Rex Miner, TeamRedMiner (for AMD), and GMiner. Heat management is crucial, KAWPOW runs hot and can stress GPU cooling systems.

6. Ethereum Classic (ETC)

When Ethereum switched to Proof-of-Stake in 2022, Ethereum Classic became the go-to destination for displaced ETH miners. It uses the Etchash algorithm, which is nearly identical to Ethereum’s old Ethash. This is a familiar territory for experienced GPU miners.

ETC currently offers moderate profitability for GPU miners. A typical 6-GPU rig with RTX 3070s might earn $3-6 daily after electricity at $0.10/kWh. ASICs are also available, though GPUs remain competitive. The DAG file (required for mining) is currently 4.054 GB, so you need GPUs with at least 5GB of VRAM.

The Ethereum Classic (ETC) mining dashboard features a list of supported pools, highlighting options like 2Miners, Binance Pool, and Hiveon to help users select their preferred provider. Source: Ethereum Classic

Who it’s for: GPU miners with 6GB+ VRAM cards looking for a relatively stable, liquid coin. ETC is traded on major exchanges, making it easy to convert to fiat or other cryptocurrencies.

Concerns: ETC has experienced 51% attacks in the past, raising security questions. However, the network has implemented additional protections, and mining activity has remained strong.

Software and pools: Popular miners include T-Rex, GMiner, and NBMiner. Top pools include Ethermine ETC, 2Miners, and Nanopool.

7. Zcash (ZEC)

Having built its reputation on optional privacy, Zcash users can choose between transparent and shielded (private) transactions using zero-knowledge proofs. For miners, it’s been a solid mid-tier option with a well-established project and consistent network activity.

The Equihash algorithm is technically GPU-mineable, but the community voted against prioritizing ASIC resistance in 2021. Today, ASICs dominate, and GPU mining profitability is marginal at best. Zcash also features halving events like Bitcoin, adding long-term scarcity.

A comparison table evaluates various Zcash ASIC miners, such as the Antminer Z15 and Innosilicon A9. Source: Zcash

Who it’s for: Miners with Equihash ASICs or those who believe in privacy-focused cryptocurrencies and can access low electricity rates. It’s not ideal for casual GPU miners anymore.

Regulatory note: Privacy coins face increased scrutiny in some jurisdictions. Some exchanges have delisted ZEC and other privacy coins, which can affect liquidity and ease of selling mined coins.

8. Dash (DASH)

Dash emerged from a Bitcoin fork with a focus on faster transactions and optional privacy features. It uses the X11 algorithm, which chains 11 different hashing functions together, a design originally intended to resist ASICs.

ASICs eventually conquered X11, and today, GPU mining DASH is largely unprofitable. Block rewards halve roughly every 380 days (210,240 blocks), and the next halving will reduce rewards from the current ~1.91 DASH. Solo mining is impractical. You need specialized ASICs and pool mining to see any returns.

The page explains that Dash network transactions are secured through Proof of Work (PoW) mining using the X11 hashing algorithm. Source: Dash

Who it’s for: Miners with X11-compatible ASICs who can secure electricity rates below $0.08/kWh. It’s a niche option that works better as part of a diversified mining portfolio.

9. Kaspa (KAS)

Kaspa is the new kid generating buzz, as a relatively new cryptocurrency launched in 2022, it uses the GHOSTDAG protocol to achieve near-instant transaction finality with block times of just one second. For miners, the kHeavyHash algorithm was designed with GPUs in mind, though ASICs have already arrived.

Profitability fell too much from its peak, down about 87% as hashrate surged, but it still outperforms Bitcoin mining for many setups. The Bitmain Antminer KS7 (40 TH/s) dominates, but GPU miners with high-end cards can still participate.

Kaspa offers various mining options, including solo mining or joining established pools like Antpool, WoolyPooly, and 2Miners. Source: Kaspa

Who it’s for: Early adopters willing to bet on a newer project with growth potential. Kaspa’s innovative technology and fast block times attract miners who believe the coin is undervalued relative to its technical capabilities.

Risk factor: Newer coins carry a higher risk. Kaspa’s price volatility and relatively short track record mean you’re speculating on both mining rewards and future price appreciation.

Hardware evolution: As Kaspa ASICs become more prevalent (Iceriver KS7 Lite, Goldshell KA Box Pro), GPU profitability continues to decline. If you’re buying hardware specifically for Kaspa, ASICs are now the safer bet.

10. Vertcoin (VTC)

Vertcoin is the decentralization purist’s choice. The Verthash algorithm is aggressively ASIC-resistant, keeping mining accessible to ordinary users with consumer hardware. It’s a Bitcoin variant with a hardcore commitment to fighting centralization.

Profitability is low, even lower than Monero or Ravencoin. This isn’t a coin you mine for immediate income; it’s for supporting the principle that mining should be accessible to everyone, not just industrial operations.

Who it’s for: Ideological miners who prioritize ASIC resistance and network decentralization over profits. Those with spare GPU/CPU capacity and very cheap (or solar) electricity.

Community size: Vertcoin has a smaller but dedicated community. Liquidity is lower than that of major coins, so selling large amounts might require patience or using specific exchanges.

What Is Crypto Mining?

Crypto mining is how new coins enter circulation and how Proof-of-Work (PoW) blockchains stay secure. Miners compete to solve complex mathematical puzzles, and whoever solves it first gets to add the next block of transactions to the blockchaiნ, and collect the reward.

How miners earn:

- Block rewards: Newly created cryptocurrency (like 3.125 BTC per Bitcoin block).

- Transaction fees: Small amounts that users pay to have their transactions processed.

The “difficulty” of these puzzles adjusts automatically. When more miners join, difficulty increases to keep block times consistent (10 minutes for Bitcoin, ~2.5 minutes for Litecoin, 1 second for Kaspa).

Here are the types of mining hardware:

- ASICs (Application-Specific Integrated Circuits): Purpose-built chips designed for one algorithm. Highly efficient but expensive ($2,000-$15,000+) and useless if the algorithm changes or the coin becomes unprofitable. Dominates Bitcoin, Litecoin, and increasingly Kaspa mining.

- GPUs (Graphics Processing Units): Graphics cards that can switch between different algorithms. Popular for Ethereum Classic, Ravencoin, and smaller coins. More accessible (existing gaming rigs work) but less efficient than ASICs for established coins.

- CPUs (Central Processing Units): Your computer’s processor. Only competitive for ASIC-resistant coins like Monero. Lowest barrier to entry, but also lowest profitability.

Are There Different Methods of Mining Crypto?

Mining methods can vary; you can choose to do it alone or join forces with others.

- Pool mining: Mine with other miners. When the pool finds a block, rewards are split proportionally based on your contributed hashrate. This provides consistent, predictable income. Pools typically charge 1-3% fees.

- Solo mining: Mine alone and keep the entire block reward if you find one. Sounds great until you realize your odds of finding a block might be once every several years (or never), depending on your hashrate. Only viable if you have significant computational power.

- Merged mining: Mine two cryptocurrencies simultaneously using the same hardware and electricity (Litecoin + Dogecoin is the classic example). This is the closest thing to “free money” in mining; you get two block rewards for the same work.

The obvious question is – why are some coins easier to mine? We can find several answers:

- Lower network difficulty: Fewer miners = easier puzzles = more blocks found.

- ASIC resistance: Algorithms designed to work well on consumer hardware.

- Higher block rewards: More coins per block can offset more difficulty.

- Faster block times: More frequent opportunities to find blocks.

How We Evaluate the Best Crypto to Mine

We ranked these cryptocurrencies by analyzing live network data from blockchain explorers, mining pool statistics, and profitability calculators, including WhatToMine, minerstat, and CoinWarz.

Our research covered 47 actively mineable coins, narrowing to the 10 that balance accessibility, profitability, and long-term viability based on current market conditions.

Profitability (35%)

Expected daily/monthly earnings minus electricity and pool fees. We calculated this assuming $0.10/kWh power costs and mid-range hardware for each category.

Algorithm Type & Hardware Compatibility (25%)

Does it require expensive ASICs or work with consumer GPUs/CPUs? ASIC resistance scores higher for accessibility, but established ASIC coins score higher for proven profitability.

Network Difficulty & Competition (20%)

Lower difficulty means more blocks found per unit of hashrate. But we also considered whether difficulty is stable or volatile.

Market Liquidity & Long-term Viability (15%)

Can you actually sell the coins you mine? Major exchange listings, trading volume, and development activity all factor in.

Accessibility for Beginners vs Professionals (5%)

Ease of setup, availability of mining software, quality of documentation, and community support.

How to Calculate Mining Profitability

Mining profitability isn’t just about hashrate. You should find a balance of multiple variables:

The formula:

Daily Profit = (Block Reward × Blocks Found × Coin Price) – (Power Consumption × 24 × Electricity Cost) – Pool Fees

Your hashrate determines how many calculations your hardware performs per second. ASICs measure in terahashes (TH/s), GPUs in megahashes or gigahashes (MH/s or GH/s), and CPUs in hashes or kilohashes (H/s or KH/s).

Network difficulty changes regularly, every two weeks for Bitcoin, continuously for others. When difficulty rises, you find fewer blocks with the same hashrate.

Coin price fluctuates constantly. A 20% drop can turn profitable mining into losses overnight, making timing crucial for when you sell mined coins.

Electricity cost is arguably the most critical factor. Many setups profit at $0.05/kWh but lose money at $0.20/kW – the difference between industrial and residential rates.

Hardware efficiency matters significantly. The Antminer S21 Pro uses 15 J/TH compared to older S19 models at 30+ J/TH, meaning newer hardware mines the same amount while consuming half the power.

Use these calculators:

- WhatToMine: Best for GPU mining, shows real-time profitability for dozens of coins.

- NiceHash Calculator: Good for quick estimates across multiple algorithms.

- ASIC Miner Value: Specific ASIC model comparisons.

- CoinWarz: Comprehensive calculator supporting most major coins.

On this screen, you can see a real-time profitability calculator that ranks different cryptocurrencies based on their mining potential and current market performance.

The WhatToMine dashboard compares various GPU-minable coins like Grin, Quai, and Zano by analyzing real-time profitability, difficulty, and estimated 24-hour rewards. Source: WhatToMine

Here’s an example using an Antminer S21 Pro mining Bitcoin at the current difficulty. With 234 TH/s of hashrate consuming 3,510 watts and electricity at $0.05/kWh, you’d mine about 0.00017 BTC daily, worth roughly $17.85 if, let’s say, BTC were worth $105,000.

Power costs run $4.21 daily, leaving $13.64 profit per day or about $409 monthly. At typical hardware costs around $5,000-6,000, you’re looking at 12-15 months to break even, assuming difficulty and price stay stable, which they rarely do.

What Hardware Do You Need to Mine Crypto?

Let’s start with ASIC mining for Bitcoin and Litecoin. Obviously, you need specialized hardware. The latest generation ASICs offer better efficiency than older models.

Bitcoin miners use SHA-256 ASICs. The Antminer S21 Pro delivers 234 TH/s at 3,510W with 15 J/TH efficiency, costing $4,500-$6,000. The Whatsminer M66 offers even more power at 350 TH/s but consumes 6,800W and costs $8,000-$10,000. If you’re on a budget, older Antminer S19 XP models run $1,500-$2,500 but use twice the power per terahash at 21.5 J/TH.

Litecoin miners use Scrypt ASICs. The Antminer L7 produces 9.5 GH/s at 3,425W for $5,000-$7,000. For a compact home option, the Goldshell Mini-DOGE Pro delivers 185 MH/s at just 220W for $400-$600, though it’s far less powerful.

For GPU mining (Ethereum Classic, Ravencoin, Kaspa)

Consumer graphics cards work, but efficiency varies wildly between models.

High-end cards offer the best efficiency. The RTX 4090 delivers 122 MH/s on Etchash at 285W for $1,600-$2,000. The RTX 4070 provides 62 MH/s at 120W for $550-$650, while AMD’s RX 7900 XTX hits 108 MH/s at 300W for $900-$1,100.

Mid-range cards offer the best value. A used RTX 3070 delivers 62 MH/s at 120W for $350-$500. The RX 6800 provides similar performance at 64 MH/s for $300-$400 used.

Entry-level options work for beginners. The RTX 3060 manages 49 MH/s at 120W for $200-$300, while the RX 6600 delivers 32 MH/s at just 68W for $180-$250.

VRAM requirements matter. Ethereum Classic needs 5GB minimum since the DAG file is 4.05GB and growing. Ravencoin requires 4GB minimum, though 6GB+ is recommended. For most algorithms, 6-8GB is the sweet spot.

For CPU mining (Monero)

Any modern processor works, but high core counts and large L3 cache deliver better results. The AMD Ryzen 9 7950X produces around 19 KH/s on RandomX. Intel’s Core i9-13900K delivers roughly 17 KH/s. AMD Threadripper chips can exceed 30 KH/s but cost significantly more.

ASIC vs GPU: What’s Right for You?

ASICs maximize efficiency for their specific algorithm, running 10-100x more efficiently than GPUs. They’re simpler to set up, just plug in, point at a pool, and start mining. But they’re expensive upfront at $2,000-$15,000+, and if that coin dies or switches to Proof-of-Stake, your hardware becomes worthless. They’re also loud (60-75 dB) and generate enormous heat, requiring serious cooling.

GPUs offer flexibility. You can switch between algorithms and coins as profitability changes. They hold resale value since gamers buy used cards. They’re quieter and easier to cool at home, and you can use them for gaming when not mining. The downsides are lower efficiency per watt, a more complex setup with drivers and tuning, and higher electricity costs that eat into profits.

Tips for Buying Mining Hardware

New hardware comes with better warranties, latest efficiency, and longer usable life, but it’s expensive with long ROI timelines. Used hardware offers cheaper entry points and faster ROI potential, but carries risks of damage, no warranty, and potentially worn-out components.

For ASICs, buy directly from manufacturers like Bitmain or Whatsminer, through authorized resellers, or mining-specific retailers. For GPUs, check electronics retailers, used markets like eBay or Facebook Marketplace, and mining forums.

Watch for red flags when buying used. Avoid sellers who can’t provide proof of working condition, show damaged ports or visible physical damage, have modified BIOS without documentation, can’t demonstrate it running, or offer prices that seem too good to be true.

Power and Cooling Considerations

Most ASICs need 220-240V power, not the standard 110-120V household outlets in the US. Calculate your circuit capacity using Amps × Volts = Max Watts, and never run circuits above 80% capacity. Consider hiring an electrician for safe installation.

ASICs produce enormous heat. Plan for exhaust fans and intake ventilation. GPU rigs need cooler ambient temperatures, ideally below 70°F/21°C. Some miners use immersion cooling by submerging hardware in non-conductive fluid. If you’re mining at home, remember that ASICs are datacenter-loud, which matters for residential setups.

Step-by-Step Beginner Mining Setup

The first step is to choose your coin. Match your hardware to the right algorithm:

- Have a modern CPU? → Monero

- Have a GPU with 6GB+ VRAM? → Ethereum Classic or Ravencoin

- Willing to invest in an ASIC? → Bitcoin or Litecoin

The next step is to select the hardware. If buying new:

- Calculate ROI: Hardware Cost ÷ Monthly Profit = Months to break even

- Target 12-18 months maximum (anything longer is too risky, given the difficulty increases)

- Check power requirements – do you need electrical work done?

If you’re using existing hardware, first check your GPU’s VRAM, you need 5GB or more for Ethereum Classic and at least 4GB for Ravencoin. For CPU mining Monero, core count matters more than clock speed. Most importantly, calculate whether your electricity costs will exceed potential earnings before you start mining. You can do it on the profitability calculator page.

The Profitability Calculator allows users to select a mining algorithm and enter their hashrate to generate real-time estimates of potential crypto earnings. Source: Nicehash

Next, you have to get a wallet. Never mine directly to an exchange, it’s a security risk. Download an official wallet for your chosen coin. Bitcoin miners can use Electrum, Bitcoin Core, or hardware wallets like Ledger and Trezor.

Monero miners should get the official GUI wallet, Cake Wallet, or Monerujo for mobile. Ethereum Classic works with MetaMask (set to the ETC network) or Exodus. Ravencoin miners can use Ravencoin Core or Trust Wallet. Generate your receiving address, this is where mining pool payouts arrive. For more wallet options, check our guide on the best crypto wallets.

After that, choose Mining Software & Pool. Mining software connects your hardware to the pool. Bitcoin ASICs come with software pre-installed, so you just configure pool settings via the web interface. NVIDIA GPU miners typically use T-Rex Miner, GMiner, or lolMiner. AMD GPU miners work best with TeamRedMiner or lolMiner. Monero CPU miners use XMRig.

Mining pools let you join forces with other miners for consistent payouts. Bitcoin miners choose from Foundry USA, AntPool, or F2Pool. Ethereum Classic miners use Ethermine ETC or 2Miners. Ravencoin miners go with 2Miners, Flypool, or RavenMiner. Monero miners join SupportXMR or MineXMR.

When selecting a pool, check the fee (1-3% is normal), payout threshold (lower is better for small miners), server location (closer means lower latency), and pool hashrate (larger pools find blocks more consistently).

After concluding all the processes above, configure and start Mining:

For ASICs:

- Connect via Ethernet cable.

- Access the miner’s web interface (usually http://192.168.x.x in your browser).

- Enter pool URL, your wallet address, and worker name.

- Save settings and start hashing.

For GPUs/CPUs:

- Download mining software.

- Create a .bat file (Windows) or shell script (Linux) with pool settings:

t-rex.exe -a etchash -o stratum+tcp://etc.2miners.com:1010 -u YOUR_WALLET_ADDRESS -w WORKER_NAME

- Run the file.

- Monitor the hashrate and temperatures.

The final step is to monitor and optimize. Check your pool dashboard on the pool’s website to track current hashrate, unpaid balance, estimated earnings, and worker status.

For GPUs, underclock the core and overclock the memory for memory-intensive algorithms. ASICs need proper cooling since higher temperatures reduce hashrate. Monitor power draw using a Kill-A-Watt meter or similar device to track actual electricity costs.

Keep a simple maintenance schedule. Weekly, check temperatures, hashrate, and pool stats. Monthly, clean dust filters and verify payouts arrived correctly. Quarterly, do a deep clean of your hardware and update mining software to the latest versions.

Why Doesn’t Everyone Mine Crypto?

If mining is profitable, why isn’t everyone doing it? Several barriers keep it from being a universal side hustle:

Electricity costs kill most home mining operations. At residential rates of $0.12-$0.20/kWh, most setups lose money. You need industrial rates below $0.08/kWh to actually profit.

The upfront investment is too high. Bitcoin ASICs cost $4,000-$10,000, and profitable GPU rigs need $2,000-$5,000 minimum. That’s a lot to risk on uncertain returns.

Network difficulty constantly increases as more miners join, eroding your margins. What’s profitable today might not be in three months. Bitcoin’s difficulty jumped 5-10% monthly during some periods in 2025.

ASICs are impractically loud and hot for home use. They sound like jet engines at 60-75 dB and output heat like multiple space heaters running simultaneously.

Mining requires technical skills. You need comfort with hardware configuration, troubleshooting, command-line interfaces, and basic networking. It’s not plug-and-play.

Regulatory and tax issues complicate things. Some jurisdictions ban or heavily restrict mining. Mining income is taxable when received, and selling creates additional capital gains obligations.

Industrial mining farms dominate. With cheap electricity, bulk hardware pricing, and economies of scale, large operations can profit even when difficulty rises. Individual miners can’t compete on these terms.

Market volatility remains the biggest wildcard. A 30-50% price drop instantly turns profits to losses, and unlike buying crypto, you can’t quickly exit, you’re locked into hardware and electricity costs.

Is Crypto Mining Still Worth it?

It is hard to answer, because it depends entirely on your circumstances, goals, and expectations.

When mining makes sense:

- You have access to cheap electricity. Below $0.08/kWh, many setups remain profitable even after accounting for difficulty increases and price volatility.

- You own suitable hardware already. A gaming PC with a capable GPU can mine part-time, earning $20-50 monthly. Not life-changing, but covers some electricity costs.

- You believe in long-term price appreciation. Many miners operate at break-even or small losses, treating mining as a way to accumulate the best crypto to invest in for future gains.

- You can treat it as a business. Buying mining equipment in bulk, negotiating commercial electricity rates, and potentially hosting equipment in facilities with optimal cooling and power deliver genuine profitability.

- You want to support specific networks. Mining Monero or Vertcoin is about supporting ASIC-resistant, decentralized networks.

When mining doesn’t make sense:

- You’re paying $0.15+/kWh electricity. At these rates, most consumer-grade mining (especially GPUs) loses money after electricity costs.

- You’re trying to “get rich quick”. Mining is a slow, grinding business. Even profitable setups might take 12-24 months to recoup hardware costs.

- You don’t have proper cooling/ventilation. Running ASICs or GPU rigs in inadequate conditions damages hardware and reduces hashrate.

- You can’t handle volatility. If a 30% price drop makes you panic-sell hardware at a loss, mining isn’t for you.

Realistic expectations for different miner types:

Hobbyists using an existing gaming PC invest nothing upfront and might earn $10-30 monthly after electricity. The goal isn’t profit, it’s offsetting power costs, learning how mining works, and accumulating small amounts of crypto.

Part-time miners building a dedicated 4-6 GPU rig invest $2,000-$4,000 and earn $100-200 monthly at $0.10/kWh electricity. Break-even takes 12-20 months. This works as side income with potential long-term profit if coin prices rise.

Serious ASIC miners investing $5,000-$15,000 in 1-3 units can earn $300-800 monthly, though this heavily depends on electricity rates. Break-even takes 8-18 months. The goal is to generate a consistent income stream and build mining expertise.

Mining can work, but it’s not passive income. It requires ongoing monitoring, optimization, hardware maintenance, and the ability to handle price volatility. Treat it as a business venture, not a hobby, and always calculate profitability based on your actual electricity costs before investing.

FAQ

What’s the easiest crypto to mine at home?

Is crypto mining still profitable in 2026?

What is the easiest crypto to mine for beginners?

Do I need to join a mining pool?

How much electricity does crypto mining use?

Is crypto mining legal?

Is mining bad for my hardware?

Can I mine crypto on a laptop?

References

Coinspeaker in Numbers

Monthly Users

Articles & Guides

Research Hours

Authors

Based on our research, the best short-term cryptocurrencies have deep liquidity, high volatility, and sustained positive market se...

VerifiedX (VFX) has officially launched, offering a Bitcoin-inspired decentralized network with unique on-chain features. Learn wh...

Fact-Checked by:

Fact-Checked by:

26 mins

26 mins

Otar Topuria

Crypto Editor, 37 postsI’m a crypto writer and analyst at Coinspeaker with over three years of experience covering fintech and the rapidly evolving cryptocurrency landscape. My work focuses on market movements, investment trends, and the narratives driving them, helping readers what is happening in the markets and why. In addition to Coinspeaker, my insights and analyses have been featured in other leading crypto and fintech publications, where I’ve built a reputation as a thoughtful and reliable voice in the industry.

My mission is to demystify the crypto markets and help readers navigate the noise, highlighting the stories and trends that truly matter. Before specializing in crypto, I worked in the IT sector, writing technical content on software development, digital innovation, and emerging technologies. That made me something of an expert in breaking down complex systems and explaining them in a clear, accessible way, skills I now find very useful when it comes to unpacking the intricate world of blockchain and digital assets.

I hold a Master’s degree in Comparative Literature, which sharpened my ability to analyze patterns, draw connections across disciplines, and communicate nuanced ideas. I’m particularly passionate about early-stage project discovery and crypto trading, areas where innovation meets opportunity. I enjoy exploring how new protocols, tokens, and DeFi projects aim to disrupt traditional systems, while also evaluating their potential risks and rewards. By combining market analysis with forward-looking research, I strive to provide readers with content that is both informative and actionable.