LiquidChain is a Layer 3 blockchain project that wants to unify the liquidity of Bitcoin, Ethereum, and Solana into a single execu...

The best shitcoins to buy in February 2026 start with Bitcoin Hyper, based on our research. It remains speculative but stands out for its Bitcoin-linked narrative and potential utility.

The alternatives are Maxi Doge for trader culture and early-stage exposure, and Dogwifhat as a more established Solana meme with deeper liquidity and recognizable branding.

We selected 9 tokens based on transparency signals, market accessibility, and narrative fit, in line with our methodology. The list may be of particular interest to high-risk retail traders looking for structured exposure to speculative meme tokens.

Top Shitcoins Key Takeaways

- Shitcoins carry extreme risk, yet they can deliver 100x–1000x gains when timed well on entry and exit.

- Our research shows that Bitcoin Hyper is the best shitcoin to buy in 2026, driven by its real L2 utility and meme-driven narrative.

- Strong alternatives include Maxi Doge and Dogwifhat, whose recognizable mascots help sustain their virality across social platforms.

- Risk control remains critical: verify audits, track unlocks, and size allocations conservatively since most shitcoins ultimately fade to zero.

Best Shitcoins to Buy in Presale

Many of the best shitcoins are presale-stage projects, as high-risk traders prefer to buy tokens early in pursuit of outsized returns. Here are several presales for those looking for new shitcoins with 100x potential:

- First Bitcoin Layer 2 enabling fast, low-cost transactions

- Fixes Bitcoin’s speed and fee limitations with near real-time performance

- Enables a Bitcoin-native DeFi ecosystem

- Degen meme coin inspired by max-leverage trading

- A tribute to high-risk hustle — fueled by sweat and conviction

- Ethereum-born, culture-driven, aiming for multichain

- Quantum-resistant security infrastructure for wallets and enterprise use

- Uses deflationary tokenonomics, including burns, tied to quantum workload execution

- Staking and governance participation expand token utility

- Shared liquidity spanning Bitcoin, Ethereum, and Solana

- Improved trade execution through faster speeds and secure cross-chain capital movement

- Opens up greater cross-ecosystem connectivity for builders and developers

- AI-Powered Virtual Influencers

- 20% APY Staking Rewards

- VIP perks: livestreams, BTS content, credits, and more.

- High-performance broker for pros and newcomers alike

- Rebates and buybacks come from VFX's own market activity

- 10% bonus on sign up and early staking access

New Shitcoin List to Watch in 2026

According to our research, this curated list reveals the best shitcoins to invest in February:

- Bitcoin Hyper (HYPER) – Layer 2 network for Bitcoin to unlock dapps and smart contracts

- Maxi Doge (MAXI) – Meme coin fusing gym culture, leverage addiction, and viral doge energy

- Dogwifhat (WIF) – Solana-based shitcoin with a peak valuation of over $4 billion

- Toshi (TOSHI) – Community-driven base chain meme coin with a Coinbase listing

- Bonk (BONK) – Flagship Solana memecoin and one of the most recognizable dog tokens

- SUBBD (SUBBD) – The world’s first AI creator platform built on the blockchain

- Popcat (POPCAT) – Solana meme coin with viral asian community traction

- Pump.fun (PUMP) – Solana token driving a hype-cycle of rapid, meme-driven price swings

- Floki (FLOKI) – Viking-themed meme coin combining charity, defi, and metaverse utility

- Mog Coin (MOG) – Ultra-pure internet memecoin with zero utility

Key Insights into Promising Shitcoins Worth Buying

A detailed analysis of the top shitcoins to watch in 2026 appears in the following sections.

Each shitcoin is evaluated in great depth, including its use case (if any), tokenomics, unique selling points, and price potential. Read on to choose the best crypto shitcoins for your portfolio.

1. Bitcoin Hyper (HYPER) – Bitcoin Layer 2 for Everyday BTC Apps and Low Fees

Bitcoin Hyper is a Bitcoin-focused Layer 2, which allows people to use BTC in apps without wrapping or swapping. The goal is to bring everyday DeFi, payments, and apps to Bitcoin at near-instant speeds and low fees.

HYPER is the network token. Holders stake it to help secure the chain and earn rewards, use it to pay transaction fees, and are expected to vote on upgrades as governance rolls out.

Our view (Julia Sakovich): Bitcoin Hyper fits perfectly into the Bitcoin L2 trend. I believe the project offers real technological value and has strong potential. However, competition in this segment is intense, so the team will need to work hard to make HYPER widely adopted.

Bitcoin Hyper allocates a significant share of its tokenomics to the treasury and marketing. Source: Bitcoin Hyper

Key Points on Bitcoin Hyper:

- Market Drivers: Bitcoin dominance at 56% (CoinGecko), 20x growth in BTCFi TVL since 2024 (DefiLlama)

- Best for: BTC holders, meme traders, L2 enthusiasts

- Risk Notes: Lack of audits and anonymity of the team

| Chain | Ethereum, but uses the Solana Virtual Machine as a settlement layer |

| Launch Date | Q1 2026 |

| Market Cap | $31.46M raised |

| Community | X (17,600), Telegram (8,526) |

| Price | $0.01367560 |

| Next Increase | Loading...

|

2. Maxi Doge (MAXI) – Meme Token for Trader Culture with Gym-Style Branding

Maxi Doge is an Ethereum-based meme coin designed for high-energy trading communities. It provides active traders with a clear rallying point and maintains high engagement through challenges and community events.

MAXI is the utility token. Holders will stake it for daily distributions, and it will also serve as access to ROI-focused contests and reward drops. A dedicated MAXI Fund is earmarked to pursue partnerships with futures platforms.

Our view (Otar Topuria): Trends come and go, but memecoins seem to be a permanent part of the crypto industry. Dogecoin, the leader of the segment, has already proven that the audience loves dog-themed coins. In my view, Maxi Doge’s muscular dog mascot will appeal to degens, but remember that it is still just a shitcoin.

Maxi Doge assigns 40% of its tokenomics to marketing. Source: MAXI Doge

Key Points on Maxi Doge:

- Market Drivers: Memecoin sector potential recovery to $123.5B ATH, currently at $46.7B (CoinMarketCap)

- Best for: High-risk meme speculators, leverage-trading enthusiasts

- Risk Notes: Large overall supply and unconfirmed integrations

| Chain | Ethereum |

| Launch Date | Q1 2026 |

| Market Cap | $4.6M raised |

| Community | X (5,960), Telegram (3,221) |

| Price | $0.00028035 |

| Next Increase | Loading...

|

3. Dogwifhat (WIF) – Pure Solana Meme for High-Beta Trading

Dogwifhat launched on Solana in late 2023 and leans into an intentionally purposeless, tongue-in-cheek brand: “a dog wif a hat”. After a parabolic start, it has pulled back and now trades below its peak, making entries speculative and timing-sensitive.

WIF has no formal utility by design. There is no staking, governance, or promised yield. Value depends on community demand, liquidity, and brand visibility; holders mainly use it for trading, tipping, and community campaigns.

Our view (Julia Sakovich): Just look at that adorable dog. What meme-coin trader wouldn’t want to buy at least a little of this shitcoin? The crypto crowd is genuinely insane, and you never really know where the peak might be with tokens like this. I think WIF has a chance to revisit its earlier momentum, but it still carries significant risk.

Dogwifhat has launched a merch line, offering meme-inspired hats for people and pets. Source: Dogwifhat

Key Points on Dogwifhat:

- Market Drivers: Dog-themed sector potential recovery to $90B ATH, currently at $33B (CoinGecko)

- Best for: Meme-coin traders and Solana users

- Risk Notes: Sentiment-driven asset with no inherent utility

| Chain | Solana |

| Launch Date | November 2023 |

| Market Cap | $403 million (Snapshot from CoinGecko, January 7, 2026) |

| Community | X (148,900), Telegram (41,500) |

| Price | WIF $0.24 24h volatility: 2.0% Market cap: $236.85 M Vol. 24h: $122.72 M |

4. Toshi (TOSHI) – Cat Meme of the Base Network

Toshi is one of the earliest memes on Base, the Coinbase-backed Layer 2, positioned as the chain’s recognizable cat mascot. It offers straightforward exposure to the Base narrative, high activity, and growing liquidity, while leaning on simple, viral branding rather than complex roadmaps.

TOSHI has minimal formal utility by design. Holders mainly use it for trading, tipping, and community campaigns. The value is driven by brand reach and Base-native demand rather than protocol fees or governance.

Our view (Julia Sakovich): Toshi has a strong community, runs on the Base blockchain and is listed on Coinbase. In my view, the project has solid price momentum with the potential for sharp upside. However, the risk is clear: it is still just a shitcoin that could crash to the bottom at any moment.

CoinGecko chart from January 7, showing Toshi is 7166% up from its all-time low. Source: CoinGecko

Key Points on Toshi:

- Market Drivers: In 2025, Base’s TVL grew by 37% to $4.3B (DeFiLlama) and is sitting at $6.69B in January 2026

- Best for: Memes and high-speculative traders

- Risk Notes: High competition among memecoins and a lack of growth catalysts

| Chain | Base |

| Launch Date | August 2023 |

| Market Cap | $151M (Snapshot from CoinGecko, January 7, 2026) |

| Community | X (113,400), Telegram (23,300) |

| Price | TOSHI $0.00023 24h volatility: 5.2% Market cap: $96.65 M Vol. 24h: $24.07 M |

5. Bonk (BONK) – Solana’s Flagship Dog Meme with Deep Liquidity

Bonk is the leading dog-themed meme coin on Solana and one of the earliest tokens to revive the chain’s retail activity during the 2023–2024 cycle. BONK leans heavily into Solana culture, fast block times, and near-zero fees.

BONK is a pure meme coin. It doesn’t promise staking rewards or complex utilities; instead, it thrives on integrations across Solana wallets, games, and dApps. Its strength comes from community reach, CEX coverage, and constant presence across Solana-native campaigns.

Our view (Julia Sakovich): In my opinion, Bonk is one of the few meme coins that feels like it’s here to stay. However, I don’t think that’s a reason to trust the team blindly or invest large amounts. You still need to be careful with shitcoins, since they usually have no real utility and can either deliver big gains or crash to zero at any moment.

The Bonk team created an animated short telling the origin story of BONK and its mascot. Source: Bonk

Key Points on Bonk:

- Market Drivers: The market capitalization of dog-themed coins reached $33B (CoinGecko)

- Best for: Solana traders and high-beta meme speculators

- Risk Notes: No formal utility; performance depends on Solana ecosystem sentiment

| Chain | Solana |

| Launch Date | December 2022 |

| Market Cap | $1B (Snapshot from CoinGecko, January 7, 2026) |

| Community | X (452,700), Discord (33,304) |

| Price | BONK $0.000007 24h volatility: 4.1% Market cap: $593.20 M Vol. 24h: $142.24 M |

6. SUBBD (SUBBD) – AI SocialFi Platform for Direct Creator Payouts

SUBBD is a SocialFi platform with AI elements that aims to offer creators low fees and fast settlement. The SUBBD token serves as the in-app currency for tips, subscriptions, and access to paywalled content. It can also be staked for 20% APY.

Our view (Otar Topuria): SUBBD aims to secure its place in the AI-creator economy through tokenized models. The concept sounds promising, but it’s important to keep the risks in mind: strong competition and the challenge of convincing users to migrate from Web2 into the Web3 space.

SUBBD roadmap showing progress into phase 2. Source: SUBBD

Key Points on SUBBD:

- Market Drivers: The SocialFi sector has reached a $2.6B market cap (CoinGecko)

- Best for: Self-made creators and AI enthusiasts

- Risk Notes: An anonymous team and insufficient audits

| Chain | Ethereum |

| Launch Date | Q1-Q2 2026 |

| Market Cap | $1.48M raised |

| Community | X (38,400), Telegram (6,400), Instagram (35,500) |

| Price | $0.05747500 |

| Increases in | Loading...

|

7. Popcat (POPCAT) – Solana Cat Meme with Cultural Reach

Popcat is intentionally utility-free and built around internet culture and its iconic visual identity. Traders get a simple, recognizable brand for high-risk speculation. Some users treat the token as a tipping tool, but its value is driven almost entirely by community popularity.

Our view (Otar Topuria): Asian crypto degens can pump any shitcoin, and Popcat has become yet another example of that. Traders are drawn to stories like this: a recognizable brand, a funny mascot, and a strong community. However, once the wave of popularity fades, liquidity disappears, and late entrants are the ones who take the losses.

CoinGecko chart from December 10, showing Popcat is 744% up from its all-time low. Source: CoinGecko

Key Points on Popcat:

- Market Drivers: Potential recovery to November 2024 ATH, currently trading 95% below (CoinGecko)

- Best for: Meme traders and Solana users

- Risk Notes: No utility, high dependence on waves of popularity

| Chain | Solana |

| Launch Date | Q1 2024 |

| Market Cap | $101 million (Snapshot from CoinGecko, January 7, 2026) |

| Community | X (99,000), Telegram (19,200) |

| Price | POPCAT $0.0546 24h volatility: 2.1% Market cap: $53.59 M Vol. 24h: $31.57 M |

8. Pump.fun (PUMP) – Viral Pump.fun Token Turned High-Velocity Meme Trade

PUMP is one of the standout tokens that emerged from Pump.fun, the Solana-based meme-launchpad responsible for thousands of hyper-speculative drops. Unlike the average launchpad meme, PUMP achieved wider recognition, rapid liquidity formation, and sustained trading volume.

PUMP carries no fundamental utility; its value lives entirely in social momentum, influencer rotations, and the reflexive “pump the pump token” narrative.

Our view (Julia Sakovich): Note that even a $1.9B market cap doesn’t change the fact that PUMP is still just a shitcoin with no utility, fully driven by market sentiment. Always do your own research before investing, because tokens like this can surge 60% in a few hours and then crash 80% within minutes.

The Pump.fun platform offers shitcoins for every type of audience, from Pokémon to cartoons. Source: Pump.fun

Key Points on Pump.fun:

- Market Drivers: The market capitalization of launchpad coins reached $5.3B (CoinGecko)

- Best for: Solana meme chasers, high-risk degens

- Risk Notes: No utility, extremely aggressive price cycles

| Chain | Solana |

| Launch Date | July 2024 |

| Market Cap | $1.43 billion (Snapshot from CoinGecko, January 7, 2026) |

| Community | X (615,500) |

| Price | $0.002436 |

9. Floki (FLOKI) – Viking-Themed Meme Coin with Expanding Utility

Floki began as a community-driven Dogecoin spin-off named after Elon Musk’s dog, but it has evolved into a broader ecosystem that combines meme culture with real-world products. The project funds education initiatives and partners with charitable causes.

FLOKI is the utility and governance token. It powers FlokiFi (DeFi suite), Valhalla (metaverse game), and the TokenFi launch platform for new crypto assets. Holders can stake or use it for in-app transactions across these products.

Our view (Otar Topuria): It’s hard to believe, but the Floki team has managed to make a shitcoin genuinely useful and even give it a meaningful mission. The token is used in Valhalla and FlokiFi, and the team is actively involved in charitable initiatives. This makes the project more resilient, but its long-term success depends on roadmap execution and the commitment of its community.

Charity is central to Floki’s mission, with schools built in Guatemala, Ghana, Laos, and Nigeria. Source: Floki

Key Points on Floki:

- Market Drivers: Potential recovery to June 2024 ATH, currently trading 88% below (CoinGecko)

- Best for: Meme traders, high-risk speculators

- Risk Notes: Large token supply, limited utility

| Chain | Ethereum & BNB Chain |

| Launch Date | 2021 |

| Market Cap | $542 million (Snapshot from CoinGecko, January 7, 2026) |

| Community | X (710,700), Telegram (74,790) |

| Price | FLOKI $0.000033 24h volatility: 5.5% Market cap: $317.73 M Vol. 24h: $68.59 M |

10. Mog Coin (MOG) – Internet Brainrot Meme with Zero Utility

Mog Coin is a meme coin built around absurd internet humor, irony, and deliberately low-effort branding. It does not try to explain itself, promise features, or solve problems: if you get the joke, you get the coin.

MOG has no utility by design. There is no staking, no roadmap, no yield, and no governance. People mainly trade it, tip with it, or hold it as a pure meme bet. Its price moves almost entirely on social media attention, community energy, and short-term hype waves.

Our view (Julia Sakovich): In my view, the crypto community likes this kind of pure meme coins. Mog Coin offers literally zero utility and looks like it shouldn’t attract investment, yet it still does. It is stupid and chaotic, but very much in internet style. Just keep in mind that this is total speculation, so timing matters a lot and there are no guarantees.

More than 7% of MOG’s initial supply has been burned. Source: Mog Coin

Key Points on Mog Coin:

- Market Drivers: Memecoin sector potential recovery to $123.5B ATH, currently at $43.8B (CoinGecko)

- Best for: Meme traders, short-term speculators

- Risk Notes: No utility, no roadmap, sentiment can disappear fast

| Chain | Ethereum |

| Launch Date | 2023 |

| Market Cap | $99 million (Snapshot from CoinGecko, January 23, 2026) |

| Community | X (129,600), Telegram (15,300) |

| Price | MOG $0.000000 24h volatility: 7.8% Market cap: $72.02 M Vol. 24h: $8.47 M |

Tested by Editors

The Coinspeaker editorial team compared the best shitcoins featured in this guide across three core parameters: narrative strength, utility, and market accessibility.

Maxi Doge attracts a wider audience than Toshi or Popcat because it is built on long-established Doge memes that crypto users have embraced for years.

Bitcoin Hyper offers stronger utility thanks to its Bitcoin L2 positioning, unlike Dogwifhat and Popcat, which stand out mainly for their visual identity and function purely as meme shitcoins.

In terms of accessibility, presale tokens like HYPER and MAXI provide lower market caps and easier entry points than most others. However, they require more caution due to the lack of security audits and the presence of anonymous teams.

| Project | Narrative | Utility | Market Accessibility |

| Bitcoin Hyper | BTC L2 narrative | High | Medium (presale) |

| Maxi Doge | Trader-meme Doge | Low | Medium (presale) |

| Dogwifhat | Strong Solana meme | Low | High |

| Toshi | Base chain mascot | Low | High |

| Bonk | Solana flagship meme | Low | High |

| SUBBD | AI-creator economy | Medium | Medium (presale) |

| Popcat | Cultural cat meme | Low | High |

| Pump.fun | Solana hype-cycle token | Low | High |

| Floki | Meme + ecosystem | Medium | High |

| Mog Coin | Ultra-pure meme | Low | High |

Overall, each project offers a distinct blend of narrative and risk, making disciplined sizing and ongoing research essential.

Strong Penny Crypto Alternatives

If you want a few more cheap coins to look at outside our main list, these are names people often keep an eye on.

- Pepe (PEPE) – A memecoin on Ethereum that many traders already know. It usually has decent liquidity, so it is easier to buy and sell. It can move up when meme hype comes back, but it is still fully driven by market mood.

- Shiba Inu (SHIB) – One of the oldest and most famous meme coins. It is listed on many exchanges and has a large community. Price growth mostly depends on renewed interest in memes, not on fundamentals.

- Brett (BRETT) – A meme coin linked to the Base network. It can perform well when Base gets more attention and activity. In simple terms, it moves with hype around the chain.

All of these shitcoins are very speculative. Prices can jump quickly, but they can fall just as fast, so it makes sense to be careful with position size.

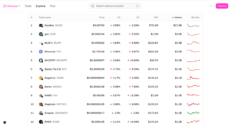

Best Performing Shitcoins Compared: Summary Table for 2026

Choosing the top shittcoins is a complex process, considering the vast number of tokens in the market.

This table summarizes the best-performing shitcoins in 2026, according to analysts:

| Token | Price | Market Cap | Category | Investor Fit |

| Bitcoin Hyper | $0.01367560 | $330 million (estimated) | Layer 2 (Bitcoin) | Backing Bitcoin’s entrance to the trillion-dollar DeFi sector |

| MAXI Doge | $0.00028035 | $184 million (estimated) | Meme Coin, Trading Lifestyle, Satire | High-leverage degens, gymmaxxed traders, and meme coin addicts chasing 1000x |

| Dogwifhat | WIF $0.24 24h volatility: 2.0% Market cap: $236.85 M Vol. 24h: $122.72 M | $325 million | Pure Solana meme coin | High-beta meme traders seeking liquidity and strong branding |

| Toshi | TOSHI $0.00023 24h volatility: 5.2% Market cap: $96.65 M Vol. 24h: $24.07 M | $133 million | Base network and cat-theme | Investing in the Base ecosystem narrative |

| Bonk | BONK $0.000007 24h volatility: 4.1% Market cap: $593.20 M Vol. 24h: $142.24 M | $667 million | Solana’s flagship dog-themed memecoin | Traders seeking the most liquid and recognized Solana meme asset |

| SUBBD | $0.05747500 | $69 million (estimated) | AI and content subscription | Those who want exposure to AI cryptocurrencies |

| POPCAT | POPCAT $0.0546 24h volatility: 2.1% Market cap: $53.59 M Vol. 24h: $31.57 M | $78 million | Solana meme coin with Asian virality | Meme traders who value regional momentum and cultural relevance |

| Pump.fun | $0.003266 | $1.02 billion | Solana hype-driven meme coin | High-risk momentum traders riding short-cycle meme rotations |

| Floki | FLOKI $0.000033 24h volatility: 5.5% Market cap: $317.73 M Vol. 24h: $68.59 M | $389 million | Meme + DeFi + Metaverse | Meme investors seeking projects that blend strong branding with real ecosystem utility |

| Mog Coin | MOG $0.000000 24h volatility: 7.8% Market cap: $72.02 M Vol. 24h: $8.47 M | $99 million | Ultra-pure internet memecoin | Degens betting on chaos, timing, and raw meme culture |

Best Shitcoins Trends to Watch in 2026

In the first half of November, Bitcoin traded above $100,000, but on November 14, it fell below the psychological level. On November 20, Bitcoin dropped below $90,000. Since the start of January 2026, the leading cryptocurrency has been trading between $87,000 and $94,000 (CoinGecko).

U.S. spot Bitcoin ETFs recorded outflows of more than $497 million for the week ending December 19, according to SoSoValue.

Сasual traders hunting for penny crypto with 1000x potential typically focus on new shitcoins to buy, as these projects trade with small valuations.

The most common way to invest in low-cap shitcoins is via presale events, which you can follow on our ICO calendar. Participants buy tokens like Bitcoin Hyper before they’re added to exchanges, allowing them to get in from the ground up.

If an “alt season” develops, expect the usual order of operations: BTC strength → ETH and large caps → mid/small caps and memes. Narratives with current mindshare include ecosystem plays (Base/Linea/BNB), pet-themed memes, and utility-led buckets such as L2s, AI, and DeFi. Consider this when deciding on the best crypto to buy.

What Users Say

Retail traders on Reddit and X describe shitcoins as high-risk assets, capable of explosive upside but equally capable of going to zero. Community sentiment often shifts quickly, and expectations tend to rely more on narratives than fundamentals.

- Dogwifhat (WIF): According to Reddit discussions, investors expect a 5x–10x increase for WIF from current prices. Some plan to sell around $5, which is close to its all-time high of $4.83 recorded on March 31, 2024 (Snapshot from CoinGecko, January 7, 2026).

- Toshi (TOSHI): Reddit users believe Toshi will never reach $0.20 “without a massive catalyst”. Others describe the token as “the mascot of Base”, highlighting its recognizable branding and active community.

- Popcat (POPCAT): Some Reddit users were confident that POPCAT would reach $5 in 2025. Others argued that “it’s a gamble, it could be more than $5 or it could be a zero.”

- Floki (FLOKI): According to Reddit crypto investors, Floki stands out thanks to its active team and community. They call it “an extremely rare project” and “far more credible than most tokens in this space”.

While сommunity sentiment plays a major role in shaping expectations for shitcoins, it does not guarantee outcomes. Even strong narratives can shift quickly, making actual price performance far less predictable than online discussions suggest.

What Are Shitcoins and Why Do People Buy Them?

Shitcoins are cryptocurrencies that typically have little to no use cases. They’re created to generate hype and FOMO rather than provide utility-driven value.

Shitcoin creators are usually anonymous, and they’re known to promote their tokens using speculative and price-centric language. Most traders buy shitcoins to make financial gains in the shortest time frame possible.

What Makes a Shitcoin?

Shitcoins are digital assets without fundamental value or long-term potential. The most common traits are a lack of token use cases, anonymous teams, and a nonexistent roadmap.

While most shitcoin projects fail to deliver returns, a small percentage of tokens produce unprecedented gains, often in a short period. For this reason, shitcoins attract billions of dollars in daily trading volume, with retail traders hoping to find that next 1000x gem.

Meme Coins vs Shitcoins

Meme coins and shitcoins are often used interchangeably to describe cryptocurrencies that lack inherent value, yet there are some subtle differences.

Meme coins often have massive communities, they hold tokens through bullish and bearish markets, actively promoting their projects, and catching social media trends. Meme cryptocurrencies are also longer-term initiatives built to last, and some develop use cases as their communities mature.

Shiba Inu is a good example. While the project started as a speculative dog-themed token, its ecosystem now contains DeFi and metaverse features.

Shiba Inu ecosystem details indicating how shitcoins can develop into something bigger. Source: Shiba

Shitcoins are generally low-quality projects created around a specific, short-term theme that quickly becomes irrelevant. The sole purpose is price speculation, and very few projects offer anything unique. However, shitcoins can produce explosive short-term growth, with early entry often delivering the highest returns.

Why Do Shitcoins Attract Buyers

Shitcoins attract significant investment because of the price potential they offer. High-risk, high-return traders seek much larger gains than Bitcoin and other large-cap cryptocurrencies can deliver. This is because the best shitcoins to buy have small valuations, allowing the token price to rise significantly over short time frames.

Shitcoins are also highly accessible, as most trade on DEXs like Uniswap and PancakeSwap. These platforms are inclusive, with no accounts or KYC verification needed.

Research shows that most shitcoin tokens also have huge token supplies. This dynamic often lets investors buy millions of tokens with a small purchase, giving the illusion of affordability.

That raises the question: Are shitcoins a good investment? The simple answer is that some shitcoin projects deliver rapid growth, but the key requirement is to invest long before the tokens achieve virality. This is why new presale events are often the best option when exploring profitable shitcoins.

How to Pick the Best Shitcoins in 2026

According to Coinbase CEO Brian Armstrong, more than a million new cryptocurrencies launch every week. With that many tokens, picking good shitcoins is hard. To deal with this, we look through thousands of cheap tokens using a simple scoring system. It helps us stay consistent and focus on things that really affect price.

Market Cap

We start with size and how easy the token is to trade. A low market cap matters, but only if there is real liquidity. We check how many tokens are in circulation, how many are still locked, how deep the liquidity pools are, and how much the price moves on normal trades. The idea is upside without users getting stuck.

Audits and Contract Health

No contract means no token. We look for audits from known firms like Coinsult or CertiK, and then check the basics ourselves. This includes minting rights, hidden taxes, blacklist options, trading pauses, team wallets, multisig setups, and whether liquidity is locked or burned. If the code looks risky, we drop it.

Tokenomics and Supply Design

We prefer a fixed supply and clear token allocations. There should be enough tokens set aside for liquidity, listings, and growth. Vesting, emissions, and rewards need to make sense on-chain, not just in a document. We compare the whitepaper with what the contract actually does.

Narrative Fit

Money usually follows stories. We focus on areas getting attention right now, like Solana, Base, Bitcoin L2s, AI, and culture coins. Timing matters a lot. Projects that connect two strong ideas tend to stand out more than copies of old trends.

Social Velocity

We look for real interest, not fake hype. That means organic growth on X, Telegram, and Discord, memes spreading naturally, and different people talking about the project in their own words. We use tools, but always double-check to avoid bots.

Price Momentum and Market Structure

Clean price action is better than messy charts. We like steady moves up, normal pullbacks, and solid liquidity. One huge pump on low volume is usually a bad sign.

Early Utility and Product Signals

Most shitcoins are just memes. If a project has anything that actually works, like a live staking page, a simple bridge, or basic tools people use, it stands out. We also watch how often the team ships updates and whether anything is public.

Using this method, we score each token, weigh the results, and highlight the ones that show the best mix of upside, execution, and real attention.

Where to Buy Shitcoins

The best platform to buy shitcoins depends on various factors, such as whether the project is a presale or live crypto, the token standard (e.g., ERC-20 or BEP-20), and the team’s success in securing exchange listing approvals.

Presales

When you buy presale shitcoins, you make investments directly on the project’s website. The process is non-custodial, as participants connect a self-custody wallet (we have previously explored the best crypto wallets) and swap an accepted payment coin like USDT or ETH. The presale project sends your purchased tokens when the event ends.

DEXs

Post presale tokens, as well as shitcoins that creators launch via third-party platforms like Pump.Fun, almost always trade on DEXs. These exchanges are decentralized, so anyone can launch cryptocurrencies by adding funds to a liquidity pool.

Uniswap interface showing coins on their ‘explore’ page. Source: Uniswap

The token standard determines the chosen DEX; ERC-20 tokens generally trade on Uniswap, while BEP-20 tokens are listed on PancakeSwap. SPL tokens have access to a wider range of Solana DEXs, including Raydium, Orca, Jupiter, and Meteora.

CEXs

A small percentage of shitcoins secure listings with major centralized exchanges (CEXs), often because they’ve achieved virality, active communities, and significant trading volumes (which translates to large commissions for exchanges). Popular CEXs like MEXC streamline shitcoin purchases for retail clients by accepting credit cards and other traditional payment methods. CEXs also offer much higher liquidity compared to DEXs, helping traders buy and sell shitcoins at competitive prices.

The Importance of Crypto Wallets

Crypto wallets are fundamental when investing in shitcoin presales and DEX tokens. Investors need a non-custodial wallet to perform on-chain transactions and store their purchased assets. The top wallets offer a user-friendly experience and robust security features across multiple device types, including mobile apps and browser extensions.

The best wallet for shitcoins also depends on the token standard. Phantom is popular for investing in and storing Solana-based shitcoins, while MetaMask is preferred for Ethereum and EVM-compatible tokens like Base and BNB Chain.

However, managing several crypto wallets is cumbersome, so a better option is to use a provider that supports multiple networks. Best Wallet supports Ethereum, BNB Chain, Solana, Polygon, and other blockchains. Users can invest in shitcoins via approved presales, and the app also supports third-party DEX connections.

Best Wallet doesn’t require KYC, making it a good choice for crypto buyers who wish to remain anonymous. Source: Best Wallet

Here’s a summary of the best places to buy and store shitcoin tokens:

- MEXC: Supports over 4,000 tokens, and commissions start from 0%. The CEX accepts fiat payments, and it approves withdrawals almost instantly. No KYC requirements are needed for daily withdrawals of under 10 BTC.

- Best Wallet: The Best Wallet app for iOS and Android comes with a built-in launchpad for vetted presale events. The free wallet offers non-custodial storage and access to dApps via WalletConnect.

- Uniswap: Many of the best shitcoins trade on Uniswap, the biggest DEX for Ethereum tokens. It usually handles more than $1 billion in trades every day.

How to Buy Shitcoins: A Step-by-Step Guide

Shitcoins are very small tokens with high risk and big price swings. They are often not listed on centralized exchanges, so you need to use decentralized tools. These steps help you do it in a safer way.

Step 1: Set Up a Non-Custodial Wallet

First, you need a wallet that works with Web3 and can connect to DEX. Popular options include Best Wallet, MetaMask, and Trust Wallet.

Write down your seed phrase and store it somewhere safe. If you lose it, there is no way to recover your money.

Step 2: Fund Your Wallet with a Base Token

Most shitcoins are traded against popular base tokens like:

- ETH on Ethereum

- BNB on BNB Chain

- SOL on Solana

- MATIC on Polygon

Use a centralized exchange (e.g., Binance, Coinbase, Kraken) to buy the base token and withdraw it to your wallet.

Step 3: Find the Token Contract Address

Do not search for the token name on a DEX. Fake copies are very common. Instead, get the contract address from a trusted place. Check the official project website or a verified post on X.

You can also confirm the address on sites like CoinGecko, CoinMarketCap, or DexTools. If you want to be extra careful, look it up on a block explorer like Etherscan or BscScan and make sure the token is real and active.

Step 4: Use a DEX to Swap

Connect your wallet to a DEX that works on the same blockchain as the token. For Ethereum, people usually use Uniswap. For BNB Chain, there is PancakeSwap. For Solana, Raydium or Jupiter. For Polygon, QuickSwap.

Once connected, paste the contract address to load the token. Set the slippage higher if needed, since many shitcoins require 5-10%. Check the price impact, and only confirm the swap if everything looks normal.

Step 5: Add the Token to Your Wallet (Optional)

Many wallets do not show new or custom tokens by default. To see it, you may need to add it manually. In MetaMask, use the “Import Tokens” option and paste the contract address. On mobile wallets, look for “Add Custom Token”.

This does not change anything on-chain. It only helps your wallet show the correct balance.

Final Reminders Before You Buy

- Gas fees can vary widely depending on the network. Ethereum is often expensive; BNB Chain and Solana are cheaper.

- Always test with a small amount first, especially for brand-new tokens.

- Watch out for “honeypots”: tokens you can buy but not sell (see risk section above).

Buying shitcoins isn’t technically hard; the real challenge is navigating scams and extreme volatility. If you treat every step with caution and verify everything twice, you’ll at least avoid the most common traps.

Are Shitcoins a Good Investment? Pros and Cons

Here’s a summary of the key advantages and drawbacks when exploring new shitcoins to buy:

Pros:

- Shitcoins can explode by thousands of percent when they surge

- Investors can achieve significant growth over short time frames

- The shitcoin market offers millions of tokens, supporting portfolio diversification

- Shitcoin investments can be made without minimum trade requirements

- Even small shitcoin positions can yield life-changing returns

Cons:

- The majority of shitcoins crash in value

- Investors must navigate shitcoin scams like honeypots and pumps and dumps

- Shitcoin founders are usually anonymous, which lacks accountability

- Most shitcoins are traded on DEXs, which can be confusing for beginners

- Prices usually move fast, and gains often do not last long, so traders need to watch the market closely

Shitcoin Investment Risks and How to Stay Safe

Shitcoins can go up very fast, but they can also wipe out your money just as quickly. Many people lose funds because they do not understand the risks. Knowing what can go wrong helps you avoid common mistakes.

Scams and Rug Pulls

Many shitcoins are made to scam buyers. The most common case is when the team removes the liquidity, and the token becomes worthless.

How to avoid it: Only buy tokens with locked or burned liquidity and always start with a very small amount.

Extreme Volatility

Shitcoin prices change very fast. A token can rise a lot and then crash within minutes. This happens often with small projects.

How to avoid it: Use small positions and never put all your money into one token.

Anonymous or Unaccountable Teams

Most shitcoin teams are anonymous. If the project fails or disappears, there is no one to blame or contact.

How to avoid it: Be careful with anonymous teams and avoid projects that refuse audits or basic transparency.

Low Liquidity

Many shitcoins are hard to sell. When liquidity is low, selling can push the price down fast, and you may get a bad price.

How to avoid it: Check trading volume and liquidity before buying and avoid tokens with very small pools.

Smart Contract Risks

Some tokens have hidden rules in the code. These rules can block selling or allow the team to create more tokens.

How to avoid it: Use simple contract check tools and stay away from tokens with unclear or risky settings.

In the end, shitcoins are very risky. Most of them fail, and only a few ever grow long-term. Always do your own research and never invest money you cannot afford to lose.

Is It Legal to Invest in Shitcoins in 2026

In most places, buying shitcoins is legal, but the rules depend on where you live.

United States

Crypto ownership is lawful, though certain tokens may be classified as securities under the SEC’s Howey Test. The CFTC also classifies virtual currencies as commodities. Gains are taxable, and some states (like New York) require licenses for crypto businesses, but not for individual investors.

United Kingdom

Buying is allowed, but promotions are heavily regulated. Since October 2023, the FCA has required clear risk warnings, investor checks, and formal marketing authorization for crypto promotions.

Europe

The MiCA framework now governs crypto markets across all EU member states, setting disclosure and conduct rules for issuers and service providers. Stablecoin regulations took effect in June 2024, and the full Crypto-Asset Service Provider regime began that December.

Asia

- China: Crypto trading and related business activities remain illegal under the 2021 central bank ban

- India: Investing is permitted but taxed at 30% with a 1% TDS; exchanges must register with the FIU and comply with AML requirements

- Singapore: Retail trading allowed through licensed DPT providers operating under MAS consumer-protection standards

This list is not exhaustive. Traders should stay updated on local regulations and seek legal advice where appropriate.

Do You Pay Taxes on Shitcoins in 2026?

Yes, in most countries, shitcoin profits are taxable because crypto is treated as property or an investment. Taxes apply when you sell crypto for fiat currency (e.g., USD or EUR), swap one crypto for another, spend crypto on goods or services, and earn coins via staking, mining, or airdrops.

Regional Tax Differences

- USA: Treated as property; long-term capital gains taxed at 0%, 15%, or 20%, depending on income

- UK: Crypto disposals taxed under CGT; 2024/25 tax-free allowance of £3,000, rates 18-24% (HMRC)

- Europe: Germany exempts holdings over 12 months; Portugal taxes <365 days at 28%

- Asia: Japan taxes crypto as income (up to ~55%); Singapore and Hong Kong generally do not levy capital gains tax

- UAE: 0% capital gains tax for individuals

This overview is not tax advice, and crypto tax rules differ by jurisdiction. Always verify the latest regulations in your country and consult a qualified tax professional before making any decisions.

Our Methodology – How We Picked the Best Shitcoins for 2026

Our approach to identifying the most promising shitcoins of 2025 combines on-chain data, community metrics, and speculative potential. Unlike traditional crypto rankings, we embrace volatility and lean into early-stage narratives with high-risk, high-reward upside.

Low-Cap Screening – Foundational Filter (30%)

We focused mainly on tokens with low market capitalizations. Low caps offer the asymmetric upside that defines true shitcoin plays. Projects must still show potential for liquidity growth and exchange exposure to be considered viable.

Community Virality and Meme Strength – Core Metric (20%)

In the shitcoin arena, community hype often outweighs fundamentals. We tracked Telegram and X (Twitter) velocity, meme propagation, influencer engagement, and bot activity. Tokens with rapidly expanding meme cultures or cult-like communities ranked higher.

Tokenomics Degeneracy vs Creativity – Balanced Evaluation (15%)

We looked at how tokens are split, burned, and rewarded. Not just to see if it makes sense, but also if it is fun or clever. Some projects use jokes or irony in their token design, and that can work if the community likes it and plays along. If the meme and the token rules fit well together, the project scored higher.

Development Signals – Secondary but Considered (10%)

Most shitcoins do not have strong tech teams, but we still checked for signs of work being done. This included GitHub activity, original contracts, or any real plans for utility. Even light development, or at least the appearance of it, earned points when paired with an active community.

Narrative Fit and Trend Hijacking – Opportunistic Factor (15%)

We gave higher scores to projects that clearly ride current trends. This includes things like AI, RWAs, L2s, popular memes, or political themes. Shitcoins do best when they match what people are already talking about, and our picks reflect that.

Risk-to-Reward Profile – Final Gate (10%)

We ran basic risk checks, such as looking at audits when available, tracking dev wallets, and watching how the community behaved in the past. Projects with obvious red flags were dropped, unless the short-term upside looked much bigger than the risk. The goal is not safety, but finding tokens with the biggest possible upside for the risk taken.

Conclusion

Shitcoins are still one of the few parts of crypto where small bets can sometimes turn into big wins. They usually run when money moves into riskier assets, for example when Bitcoin and Ethereum are near cycle highs, and hype spreads fast on social media.

From our analysis, Bitcoin Hyper stands out among presales thanks to its Bitcoin Layer 2 idea and a working beta. Dogwifhat is different but also strong, with solid liquidity, big exchange listings, and a meme brand that has held up over time. Together, they cover both early-stage hype and more established meme demand.

That said, shitcoins are extremely risky. Prices can jump fast and crash just as quickly, and many end up worthless. Because of this, risk control matters: use small amounts, check the basics, and never put in money you cannot afford to lose.

FAQ

What are the best shitcoins to buy in 2026?

Are shitcoins a good investment?

Which shitcoin will explode next?

Where can I find information about new shitcoins launching?

How do I buy new shitcoins?

What is the best platform to buy shitcoins?

Are shitcoins safe to invest in?

What is the difference between shitcoins and meme coins?

What are the risks of investing in shitcoins?

Where can I find shitcoin price predictions?

How can I buy shitcoins on Solana or BSC?

Why do people invest in shitcoins despite the risks?

References

- DEX Metrics (Dune Analytics)

- DeFi Fans Are Courting Traders in $7.2 Trillion Currency Market (Bloomberg)

- The AI Trade Has Blown Up in Crypto (Bloomberg)

- Hedge Funds Are Succumbing to Mind-Boggling Returns of Memecoins (Bloomberg)

- Trump’s Meme Coin Sparks More Than 700 Copycats Posing as Official Crypto (The Guardian)

- Staying the Course: Institutional Investor Outlook on Digital Assets (Ernst & Young)

- Shitcoins: are Pointless Cryptocurrencies a Scam or a Gamble? (The Guardian)

- Coinbase CEO Brian Armstrong says There are 1 million New Cryptocurrencies Created Every Week (Business Insider)

- Crypto Investment Scams (UK Financial Conduct Authority)

- Messari Research Reports (Messari)

- Altcoin Rally: This Time the Data’s Different (Kaiko)

- Solana Price (CoinGecko)

- 15 Crypto Tax Haven Countries in 2025 (Global Citizen Solutions)

Coinspeaker in Numbers

Monthly Users

Articles & Guides

Research Hours

Authors

The team behind IPO Genie has not yet announced an end date for the presale.

AI cryptocurrencies combine blockchain with artificial intelligence to power decentralized machine learning networks, GPU computin...

Fact-Checked by:

Fact-Checked by:

40 mins

40 mins

Otar Topuria

Crypto Editor, 39 postsI’m a crypto writer and analyst at Coinspeaker with over three years of experience covering fintech and the rapidly evolving cryptocurrency landscape. My work focuses on market movements, investment trends, and the narratives driving them, helping readers what is happening in the markets and why. In addition to Coinspeaker, my insights and analyses have been featured in other leading crypto and fintech publications, where I’ve built a reputation as a thoughtful and reliable voice in the industry.

My mission is to demystify the crypto markets and help readers navigate the noise, highlighting the stories and trends that truly matter. Before specializing in crypto, I worked in the IT sector, writing technical content on software development, digital innovation, and emerging technologies. That made me something of an expert in breaking down complex systems and explaining them in a clear, accessible way, skills I now find very useful when it comes to unpacking the intricate world of blockchain and digital assets.

I hold a Master’s degree in Comparative Literature, which sharpened my ability to analyze patterns, draw connections across disciplines, and communicate nuanced ideas. I’m particularly passionate about early-stage project discovery and crypto trading, areas where innovation meets opportunity. I enjoy exploring how new protocols, tokens, and DeFi projects aim to disrupt traditional systems, while also evaluating their potential risks and rewards. By combining market analysis with forward-looking research, I strive to provide readers with content that is both informative and actionable.