LiquidChain is a Layer 3 blockchain project that wants to unify the liquidity of Bitcoin, Ethereum, and Solana into a single execu...

This guide analyzes the Best Wallet Token price forecast from 2026 to 2030. We break down expert predictions and the key factors that could shape its future value.

The BEST token is the native token of the Best Wallet ecosystem, providing utility through staking rewards, fee discounts, and other exclusive VIP benefits for its holders. The price of BEST could increase significantly as the Best Wallet platform’s adoption grows.

In this article, we’ll examine a range of BEST price forecasts, along with the Best Wallet project’s roadmap and the factors that could influence the Best Wallet Token price.

- MPC wallet, no seed phrase needed.

- Built-in presale launchpad access.

- Multi-chain support with swaps & staking.

Key Takeaways: Best Wallet Token Price Forecast

| Year | Low | Average | High |

| 2026 | $0.055 | $0.086 | $0.156 |

| 2030 | $0.235 | $0.426 | $0.624 |

- Our long-term projections place BEST at around $0.624 in 2030, provided the project’s roadmap goals are met and global crypto adoption continues to rise.

- BEST provides Best Wallet users with lower fees, high staking yields (including a 77% APY for staking BEST), early access to in-app presales, and more.

- Best Wallet taps into the booming self-custody and DeFi trends, attracting over 500,000 users globally.

Best Wallet Token Price Overview

The Best Wallet Token presale was a strong success, with $16.85M raised. Although buyers have the option of simply holding their BEST as a long-term investment, it also provides benefits like lower transaction fees, early access to trending crypto presales, and optimal staking yields within the Best Wallet app and ecosystem. Here’s a quick overview of our Best Wallet Token price prediction:

| Current Price | $0.003 |

| Blockchain | Ethereum |

| Use Case | Best Wallet ecosystem utility token |

| Token Supply | 10,000,000,000 BEST |

| Incentives | Up to 77% APY staking rewards and Best Wallet VIP user perks. |

What Is Best Wallet Token?

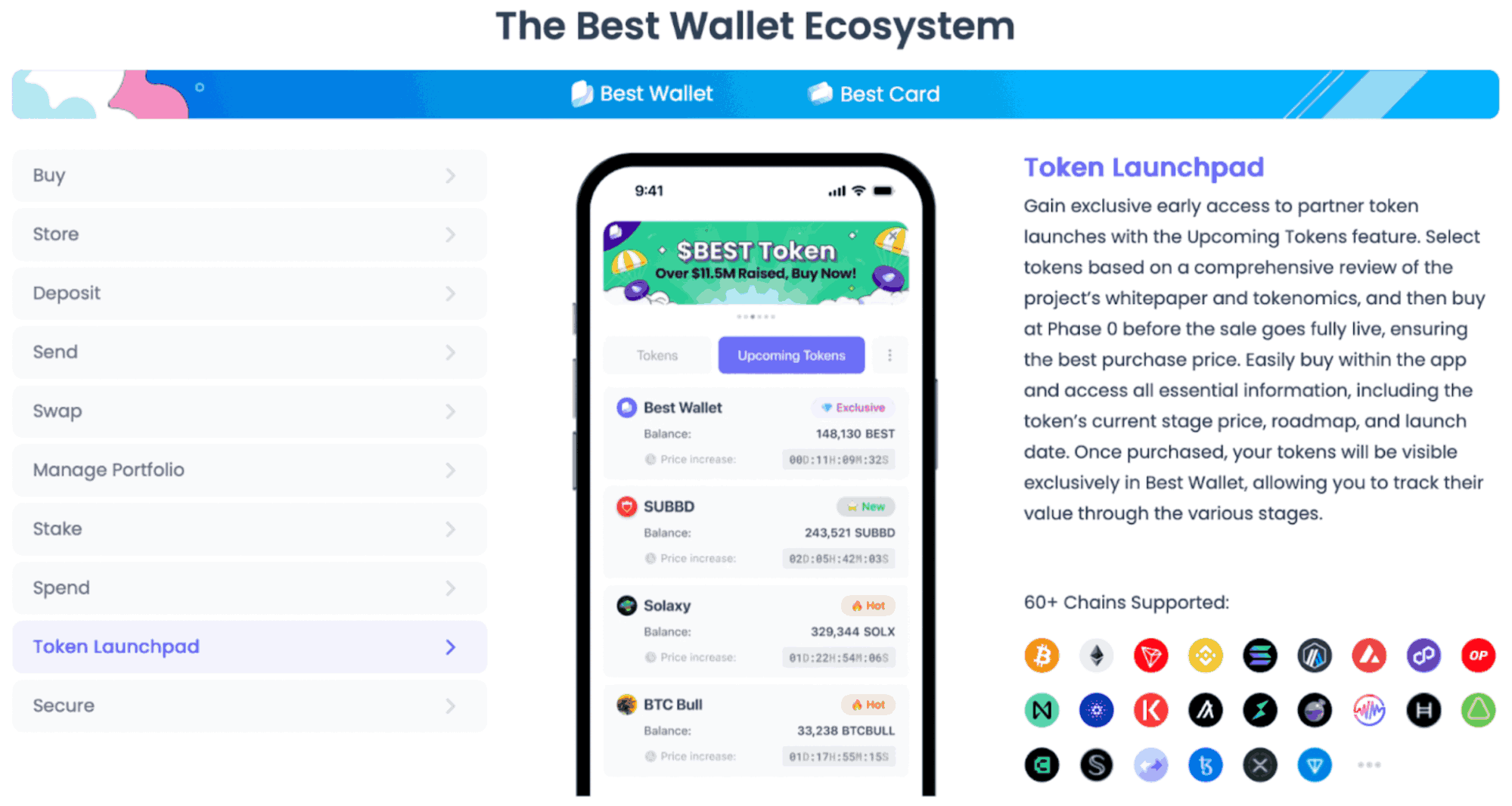

Best Wallet Token (BEST) is the utility token of Best Wallet, a rapidly growing non-custodial Web3 crypto wallet platform that supports buying, selling, and storing over 1,000 cryptocurrencies across multiple blockchains using a single mobile app.

Users can swap tokens across different chains with an integrated DEX aggregator, accessing over 330 DEXs and 30 bridges for the best rates. They can also buy crypto with fiat currencies via partners like MoonPay and Alchemy Pay, and manage multiple wallets in the Best Wallet app. This positions Best Wallet among the market’s top crypto wallet solutions for convenience and breadth of support.

Best Wallet is the first wallet app to feature an “Upcoming Tokens” launchpad for crypto presale investors. Holding BEST will grant early access to new crypto presales before other Best Wallet users, providing an exclusive first-mover advantage for investors to buy new coins long before they get listed on mainstream exchanges.

Best Wallet Ecosystem Overview: Source: Best Wallet

Best Wallet Token will also reduce transaction fees for holders within the Best Wallet app, provide project governance votes, and unlock the highest possible staking yields across a range of crypto tokens.

Best Wallet is capitalizing on the trend of users preferring non-custodial wallets for better security, especially after a string of high-profile exchange hacks (such as the theft of $1.5 billion in ETH from Bybit), which have drawn attention to the risks of keeping funds on centralized platforms.

Why Are Investors Watching Best Wallet Token?

BEST has been gaining attention among retail crypto investors and whales for several reasons:

- Potential Market Size: The Web3 wallet sector could be worth almost $101 billion by 2033 (up from $12.59 billion last year), and Best Wallet has already stated that it plans to claim 40% of that market by 2026. If it succeeds, the price of Best Wallet Token would organically appreciate over the next several years.

- Large and Active Community: Best Wallet is already an operational product with over 250,000 monthly active users. The project’s X account has over 72,000 followers, and thousands of users have participated in its airdrop campaigns. This loyal audience has already translated into sustained demand for BEST tokens, which will be used for staking, fee discounts, project governance, and other purposes.

- Innovative Tech and Security: The Best Wallet app has integrated Fireblocks’ multi-party computation technology (a cutting-edge security standard typically used by institutions) for private key management, thereby eliminating the risks associated with seed phrases.

- Packed Roadmap and Creative Use Cases: Over the next few years, Best Wallet plans to complete its extensive roadmap, which includes a crypto debit card called Best Card, a browser extension, advanced trading tools, an NFT gallery, and even derivatives trading within the app. Many of these features will be industry firsts for a mobile wallet and could help Best Wallet attract millions of new users.

In short, Best Wallet Token checks many important boxes for savvy investors, from strong initial traction in a high-growth Web3 sector to genuine utility and an active roadmap backed up by the team’s previous successes.

Below, we’ve summarized our forecasted low, average, and high price levels for the next few years, based on the project’s fundamentals and expected market conditions during those years:

| Year | Low | Average | High |

| 2026 | $0.055 | $0.086 | $0.156 |

| 2030 | $0.235 | $0.426 | $0.624 |

Best Wallet Token Price Forecast 2026

2026 will test whether BEST can transition from its post-launch volatility phase to a steady growth trajectory based on real adoption.

Many of Best Wallet’s most anticipated features are expected to roll out during 2026. According to the project’s roadmap, users can look forward to the Best Card launch, an NFT gallery, in-app news feeds, derivatives trading, enhanced staking capabilities, market analytics, MEV protection, and even a browser extension for extra convenience.

The successful implementation of the above will significantly expand Best Wallet Token’s utility, as it will most likely be integrated into new features as a way to add even more VIP perks for holders. For example, users might need to stake or hold BEST to get the highest cashback tier on the Best Card, or unlock premium NFT and market analysis features. Each new use case could drive additional token demand among the wallet’s user base, as well as wallet-focused crypto investors.

Best Debit Card Announcement: Source: Best Wallet

The Best Wallet team has publicly stated an ambitious goal of capturing nearly 40% of the Web3 wallet market by next year. Even if that target is optimistic, there’s no doubt the overall value of the market is growing (including a long-term target of $101 billion in 2033, according to Grand View Research). As more institutional investors plan to increase their crypto exposure, and retail adoption keeps rising, demand for secure multichain wallets is also growing in parallel.

Bearing the above points in mind, Best Wallet could reach 1 million or 2 million users in 2026, up from its current user base of 500,000 crypto enthusiasts. Demand for BEST as an investment and utility token would likely rise in line with the growth of Best Wallet’s community and brand awareness, creating a strong floor of organic demand that could support the Best Wallet Token price even during challenging market conditions.

Therefore, our 2026 average prediction for BEST sits around $0.086, with a potential high of $0.156, which would make BEST one of the next cryptocurrencies to blow up. The latter scenario assumes that Best Wallet’s platform will grow substantially and that the altcoin market climate will remain favorable.

Best Wallet Token Price Prediction 2030

The crypto industry and community could be dramatically larger by 2030, with Web3 thought leaders such as Coinbase CEO Brian Armstrong predicting that billions of people could start using cryptocurrencies by 2030. If that expectation holds, infrastructure and wallet providers catering to those users would see massive demand and sustainable growth.

As cryptocurrency continues to expand into the mainstream, the average user will need simple and secure wallet interfaces to help manage their assets safely. Best Wallet has already positioned itself as a beginner-friendly solution that supports fiat on-ramps while also offering an intuitive UI. If it captures even a single-digit percentage of a multi-billion overall crypto user base, that’s tens of millions of users.

By 2030, we anticipate that a massive portion of the 10 billion BEST token supply will be locked in the project’s staking protocols, which could help Best Wallet Token maintain its supply-demand balance over the long term.

Best Wallet Project Roadmap: Source: Best Wallet

Moreover, if Best Wallet continues to innovate and launch new features, it could justify a valuation on par with or higher than its competitors, like the Trust Wallet (TWT).

The overall growth of the crypto wallet sector over the next five years will serve as yet another tailwind for BEST token’s growth. That’s why our analysis suggests that BEST could reach $0.624 by 2030 in a bullish scenario where it achieves widespread adoption and maintains its competitive advantages.

To reach this valuation, Best Wallet must become a dominant Web3 wallet platform, particularly if it expands into institutional services or global payments with its card. This growth would also likely require a continued pro-crypto environment globally, as well as the integration of crypto into everyday finance, which is plausible by 2030.

What Could Drive Best Wallet Token Higher?

The most fundamental driver of the BEST token price is user growth and activity in the Best Wallet app. If the wallet’s monthly active users jump from the hundreds of thousands to the millions, demand for BEST will likely grow in tandem. More users mean more people needing the token for staking to earn rewards, holding it for fee discounts, or simply buying it out of loyalty to the ecosystem.

Best Wallet has set aside 35% of its token supply for marketing and referral incentives, which could supercharge its long-term adoption. Each time the wallet’s user base hits a new milestone, it could create a positive feedback loop for the BEST token. Essentially, the token’s value could scale with the network effect of the wallet itself.

On a macro level, Best Wallet is capitalizing on two significant crypto trends: the shift to self-custody and the integration of DeFi with everyday finance. Every time a news event highlights the risks of centralized exchanges, such as the recent ByBit hack, users flock to self-custodial wallets like Best Wallet. Tokens like BEST then receive positive attention as part of the solution for crypto safety.

Additionally, as DeFi and Web3 go mainstream, having a comprehensive wallet that offers everything from swaps, yield, NFTs, a launchpad, and payments positions Best Wallet to capitalize on multiple booming sub-sectors.

What’s worth noting is that Best Wallet has plans to support over 60 chains, including Solana, Base, TON, and more. For example, if Layer 2 networks or new blockchains emerge, being chain-agnostic means it can onboard users from any blockchain.

The team’s ability to adapt and list new trending tokens in its launchpad could also keep it relevant. All these trends essentially drive the demand for the BEST token by increasing usage.

Risks to Consider Before Investing in Best Wallet Token

While the upside potential of BEST l is exciting, prospective investors also should weigh the risks and challenges associated with this project:

Competition

The crypto wallet space is getting increasingly competitive. While Best Wallet is relatively early in launching its BEST token, there is always the possibility that established players may do the same. For example, if MetaMask or Coinbase Wallet were to launch their own tokens, it could temporarily draw attention and funds away from projects like Best Wallet.

In a scenario where the market is saturated, BEST will need to work harder to attract users and secure listings on exchanges. There’s also the possibility of tech giants integrating crypto wallets into their products. Imagine if Google or Apple enable crypto storage natively, standalone wallet apps would face a significant challenge.

Regulatory and Market Risks

Broader regulatory developments can impact BEST. Although it’s less likely to be deemed a security by regulators, changing regulations on crypto services could impose constraints on Best Wallet’s operations in certain countries.

Macroeconomic conditions also typically play a massive role in the overall growth of crypto tokens. A severe crypto bear market could significantly impact the value of all altcoins, including BEST. Other external events, such as a major exchange collapse, could indirectly affect BEST’s price. But one could argue that a CEX collapse could drive more users to Best Wallet due to its laser focus on security through its MPC-CMP integration.

Where to Buy the Best Wallet Token?

Best Wallet Token (BEST) is available on exchanges such as MEXC, KuCoin and UniSwap.

Conclusion — Is Best Wallet Token a Good Investment?

Best Wallet Token is a top-trending Web3 platform with a working and evolving product in the crypto wallet space. The project combines multiple value drivers: the benefits of a large and active user base, tangible utility, and a roadmap that leverages trends such as DeFi, NFTs, and Web3 payments.

These elements give BEST a stronger fundamental profile than many other speculative altcoins. If the team continues to launch features on the roadmap promptly, BEST could deliver attractive returns in the years to come. Our Best Wallet Token crypto price outlook suggests that it could surpass $0.60 by 2030, reaffirming the significant upside potential of Best Wallet and its user base.

FAQ

What will Best Wallet Token be worth in 2030?

Is Best Wallet Token a good investment?

How high can Best Wallet Token go?

Where can I buy Best Wallet Token crypto?

References

Coinspeaker in Numbers

Monthly Users

Articles & Guides

Research Hours

Authors

The team behind IPO Genie has not yet announced an end date for the presale.

AI cryptocurrencies combine blockchain with artificial intelligence to power decentralized machine learning networks, GPU computin...

Fact-Checked by:

Fact-Checked by:

12 mins

12 mins

Otar Topuria

Crypto Editor, 39 postsI’m a crypto writer and analyst at Coinspeaker with over three years of experience covering fintech and the rapidly evolving cryptocurrency landscape. My work focuses on market movements, investment trends, and the narratives driving them, helping readers what is happening in the markets and why. In addition to Coinspeaker, my insights and analyses have been featured in other leading crypto and fintech publications, where I’ve built a reputation as a thoughtful and reliable voice in the industry.

My mission is to demystify the crypto markets and help readers navigate the noise, highlighting the stories and trends that truly matter. Before specializing in crypto, I worked in the IT sector, writing technical content on software development, digital innovation, and emerging technologies. That made me something of an expert in breaking down complex systems and explaining them in a clear, accessible way, skills I now find very useful when it comes to unpacking the intricate world of blockchain and digital assets.

I hold a Master’s degree in Comparative Literature, which sharpened my ability to analyze patterns, draw connections across disciplines, and communicate nuanced ideas. I’m particularly passionate about early-stage project discovery and crypto trading, areas where innovation meets opportunity. I enjoy exploring how new protocols, tokens, and DeFi projects aim to disrupt traditional systems, while also evaluating their potential risks and rewards. By combining market analysis with forward-looking research, I strive to provide readers with content that is both informative and actionable.