This Vortex FX (VFX) price prediction guide explores prices predicted through 2026, 2030, and 2036, looking at the potential heigh...

Dogecoin Price Prediction: Analyzing Future Trends and Market Dynamics

11 mins

11 mins A look at Dogecoin’s price outlook, technicals, and investment potential.

Dogecoin remains a highly speculative yet resilient cryptocurrency, driven more by memes and community engagement than by technical fundamentals. It shows moderate short-term stability but remains volatile. While it’s not for every investor, DOGE continues to attract attention as a high-risk, high-reward play.

Key Takeaways:

- Dogecoin began as a meme coin but has since evolved into a top-10 cryptocurrency with a strong community backing.

- The current price is approximately $0.186, with a stable trading volume and a high market cap.

- Technical indicators suggest neutral momentum, which is likely to lead to consolidation before a breakout.

- Social media and influencer activity continue to be the primary drivers of price action.

- Risks include high volatility and limited development, while upside potential lies in cultural relevance and retail accessibility.

- DOGE may suit short-term traders and high-risk investors, but it offers limited appeal for conservative or fundamentals-focused portfolios.

Dogecoin’s journey from an internet joke to a top-10 cryptocurrency is one of the most unexpected success stories in the digital asset space. Initially launched as a parody, Dogecoin has evolved into a widely traded token supported by a passionate online community and amplified by high-profile endorsements. In the end, Dogecoin became one of the best meme coins to buy in the history of the crypto market year after year.

As market participants continue to debate its long-term value, DOGE remains highly visible – and volatile – within the broader crypto ecosystem.

This article offers a comprehensive analysis of Dogecoin’s current market standing, technical indicators, and future price outlook. By examining both short-term signals and long-term projections, as well as the social and psychological forces driving DOGE’s price action, we aim to help traders and investors assess whether Dogecoin deserves a place in their portfolio.

Introduction to Dogecoin (DOGE) and Its Role in the Crypto Market

Dogecoin (DOGE) began as a lighthearted experiment – a meme-inspired digital currency launched in 2013 by software engineers Billy Markus and Jackson Palmer.

Initially created as a parody of the cryptocurrency craze, Dogecoin was based on the popular Shiba Inu “Doge” meme and built on a codebase derived from Litecoin. Despite its humorous origins, Dogecoin quickly cultivated a loyal community and carved out a niche in the crypto world.

What set Dogecoin apart early on was its tipping culture. Users on platforms like Reddit and Twitter (now X) began using DOGE to reward content creators and contributors, fostering a unique ecosystem of microtransactions and community-driven support. This use case helped Dogecoin become one of the first digital currencies to see organic utility beyond speculative trading.

Dogecoin Logo. Source: Dogecoin Official Website

Over the years, Dogecoin has maintained its relevance, buoyed by grassroots enthusiasm, viral social media campaigns, and high-profile endorsements, most notably from Elon Musk.

Although often dismissed by some as a “joke coin”, Dogecoin has proven remarkably resilient. It remains one of the top 10 cryptocurrencies by market capitalization, with active development and a broad base of holders.

Among crypto enthusiasts and early adopters, Dogecoin continues to symbolize the playful yet revolutionary spirit of decentralized finance. It demonstrates how strong community support and cultural relevance can sustain a crypto asset, even in a market driven by complex utility and innovation.

Current Dogecoin (DOGE) Price and Market Cap

As of June 9, 2025, Dogecoin (DOGE) continues to hold a firm position in the global crypto market. Currently trading at approximately $0.186, DOGE has shown modest intraday movement, fluctuating between $0.180 and $0.187 over the past 24 hours.

Current price of DOGE is DOGE $0.15 24h volatility: 1.5% Market cap: $24.95 B Vol. 24h: $2.20 B . Despite short-term volatility, the asset remains relatively stable, posting a roughly 1% gain in daily trading.

DOGE Price Chart. Source: TradingView

Dogecoin’s market capitalization stands around $27 to $28 billion, placing it consistently among the top 10 cryptocurrencies by market cap, typically at position #8 on platforms like CoinMarketCap and CoinGecko. Its 24-hour trading volume ranges between $750 million and $1.96 billion, reflecting sustained interest and liquidity across major exchanges.

Over the past week, Dogecoin has experienced a gradual decline from late-May highs near $0.23, representing an approximate 18% drop. Nevertheless, it remains the leading token in the meme coin category, outperforming many of its imitators and maintaining a robust community-driven presence in the market.

Dogecoin’s resilience continues to stem from its strong social media support, viral momentum, and longstanding reputation among crypto enthusiasts. Despite its origins as a joke, DOGE has proven itself to be a serious market contender, widely adopted for both trading and cultural relevance within the broader crypto landscape.

Technical Analysis of Dogecoin

Technical indicators continue to play a central role in evaluating Dogecoin’s short- and medium-term price trends. Among the most commonly used tools are moving averages, Relative Strength Index (RSI), and momentum indicators, all of which help traders assess market sentiment and potential reversal points.

Currently, Dogecoin’s 50-day and 200-day moving averages are offering mixed signals. While the 50-day MA remains above the 200-day in some timeframes, suggesting a lingering bullish trend, the narrowing gap between them may indicate a potential shift in momentum. A confirmed golden cross or death cross in the coming weeks could set the tone for broader market movement.

The Relative Strength Index (RSI) for DOGE has hovered between 45 and 55, placing it in a neutral zone. This suggests that Dogecoin is neither overbought nor oversold, leaving room for movement in either direction. A break above 70 would indicate growing upward pressure, while a drop below 30 could signal a potential sell-off.

Momentum indicators like Moving Average Convergence Divergence (MACD) are currently reflecting a modest bullish divergence, with histogram bars trending higher despite flat price action. This can often precede a breakout, especially if accompanied by increasing trading volume.

Together, these technical tools suggest that Dogecoin is in a consolidation phase. While not yet signaling a strong breakout, the indicators highlight a market waiting for a catalyst. Traders and analysts will be closely watching for volume spikes and RSI shifts as confirmation of the next directional move.

Short-Term DOGE Price Prediction

| Month | Minimum Price | Average Price | Maximum Price | Potential ROI |

| Jun 2025 | $ 0.175036 | $ 0.199531 | $ 0.234233 | 25.89% |

| Jul 2025 | $ 0.194655 | $ 0.210636 | $ 0.223476 | 20.11% |

| Aug 2025 | $ 0.199262 | $ 0.215724 | $ 0.226361 | 21.66% |

| Sep 2025 | $ 0.214332 | $ 0.232366 | $ 0.264772 | 42.30% |

| Oct 2025 | $ 0.197191 | $ 0.209494 | $ 0.228064 | 22.58% |

| Nov 2025 | $ 0.185605 | $ 0.196561 | $ 0.205589 | 10.50% |

| Dec 2025 | $ 0.188719 | $ 0.196075 | $ 0.208444 | 12.03% |

Mid-Term Dogecoin Price Prediction

| Month | Minimum Price | Average Price | Maximum Price | Potential ROI |

| Jan 2026 | $ 0.189324 | $ 0.195044 | $ 0.207138 | 11.28% |

| Feb 2026 | $ 0.189313 | $ 0.299896 | $ 0.429746 | 130.87% |

| Mar 2026 | $ 0.240308 | $ 0.285784 | $ 0.394104 | 111.73% |

| Apr 2026 | $ 0.246422 | $ 0.302819 | $ 0.330556 | 77.59% |

| May 2026 | $ 0.233569 | $ 0.264234 | $ 0.307363 | 65.13% |

| Jun 2026 | $ 0.219994 | $ 0.230615 | $ 0.243399 | 30.76% |

| Jul 2026 | $ 0.245062 | $ 0.26785 | $ 0.281156 | 51.05% |

| Aug 2026 | $ 0.259273 | $ 0.281255 | $ 0.298113 | 60.16% |

| Sep 2026 | $ 0.25458 | $ 0.267603 | $ 0.279395 | 50.10% |

| Oct 2026 | $ 0.20917 | $ 0.231043 | $ 0.247039 | 32.72% |

| Nov 2026 | $ 0.231892 | $ 0.246287 | $ 0.306593 | 64.71% |

| Dec 2026 | $ 0.261009 | $ 0.275588 | $ 0.299986 | 61.16% |

Long-Term Dogecoin Price Prediction (2025-2030 and Beyond)

| Month | Minimum Price | Average Price | Maximum Price | Potential ROI |

| Jan 2030 | $ 0.469819 | $ 0.471496 | $ 0.475761 | 155.60% |

| Feb 2030 | $ 0.470464 | $ 0.511458 | $ 0.54997 | 195.46% |

| Mar 2030 | $ 0.486819 | $ 0.498969 | $ 0.531959 | 185.79% |

| Apr 2030 | $ 0.492519 | $ 0.508925 | $ 0.516904 | 177.70% |

| May 2030 | $ 0.484572 | $ 0.493352 | $ 0.508811 | 173.35% |

| Jun 2030 | $ 0.480047 | $ 0.483738 | $ 0.48968 | 163.07% |

| Jul 2030 | $ 0.490731 | $ 0.496736 | $ 0.500664 | 168.97% |

| Aug 2030 | $ 0.493141 | $ 0.500148 | $ 0.506089 | 171.89% |

| Sep 2030 | $ 0.487386 | $ 0.495434 | $ 0.499849 | 168.54% |

| Oct 2030 | $ 0.476439 | $ 0.483518 | $ 0.487793 | 162.06% |

| Nov 2030 | $ 0.484013 | $ 0.49016 | $ 0.508916 | 173.41% |

| Dec 2030 | $ 0.490814 | $ 0.497672 | $ 0.503854 | 170.69% |

Key Factors Influencing Dogecoin’s Price

A unique mix of market dynamics, social sentiment, and broader developments in the crypto space shapes Dogecoin’s price. Unlike many other digital assets, DOGE is heavily influenced by community engagement and online narratives, making it particularly sensitive to social media activity.

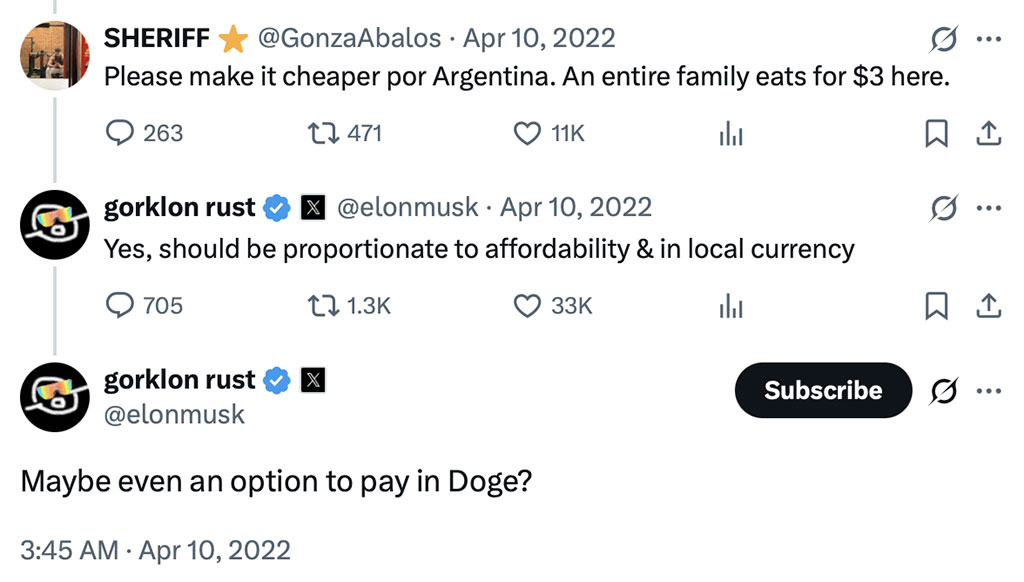

One of the most significant factors is influencer support, particularly from prominent figures like Elon Musk. Tweets or public comments from high-profile personalities have historically triggered rapid price surges or declines, often independent of fundamental metrics. This makes Dogecoin highly reactive to external sentiment rather than purely technical or macroeconomic signals.

Elon Musk tweeted about Dogecoin. Source: X

Market trends and Bitcoin’s performance also play a significant role. As a high-beta asset, Dogecoin tends to follow the broader direction of the crypto market, rising sharply during bull cycles and correcting aggressively during downturns. When investor risk appetite grows, DOGE often becomes a favored speculative bet due to its low unit price and meme appeal.

Another key driver is liquidity and exchange listing activity. Wider availability on platforms like Coinbase and Robinhood has increased accessibility, fueling retail interest and volume spikes. In contrast, delistings or regulatory uncertainty can lead to abrupt drops in market confidence.

Elon Musk tweeted about Dogecoin. Source: X

Finally, network activity and development updates occasionally influence investor perception. Although Dogecoin’s codebase evolves slowly compared to other top assets, announcements about upgrades or integration into payment systems (e.g., for tipping or merchant acceptance) can enhance its utility narrative and drive price momentum.

Combined, these factors make Dogecoin’s price highly volatile but uniquely responsive to cultural and social triggers, distinguishing it from more technically anchored cryptocurrencies.

Risks and Opportunities for Dogecoin Investors

Investing in Dogecoin entails a distinct set of risks and opportunities that reflect its unconventional nature within the crypto market. On the risk side, one of the most significant concerns is high volatility. Dogecoin’s price can swing sharply in response to social media trends, celebrity mentions, or changes in overall market sentiment, often without any underlying fundamental shift.

Moreover, Dogecoin remains a largely speculative asset. Unlike cryptocurrencies with clearly defined use cases or technological roadmaps, DOGE lacks a strong development narrative or institutional backing. This makes it vulnerable to loss of investor interest, especially in bear markets when hype-driven assets tend to underperform. The limited technical upgrades and relatively slow pace of innovation further contribute to concerns about its long-term sustainability.

At the same time, Dogecoin offers unique upside potential. Its strong and active community has historically demonstrated an ability to mobilize around the token, driving awareness and market rallies. From Reddit campaigns to viral memes, this grassroots enthusiasm gives DOGE a level of resilience rarely seen in other meme-based assets.

Additionally, Dogecoin has benefited from increased mainstream visibility and accessibility on major platforms, such as Robinhood and Coinbase. These factors make it an entry point for many retail investors exploring crypto for the first time. In moments of market euphoria, DOGE has shown the ability to generate rapid, meme-driven price spikes, offering high-risk, high-reward opportunities for short-term traders.

For investors, Dogecoin represents a gamble on culture as much as on crypto fundamentals – a volatile asset with limited intrinsic value but powerful social momentum.

Conclusion: Should You Buy, Hold, or Sell Dogecoin?

Dogecoin remains one of the most unconventional yet persistent assets in the crypto market. In the short term, its price tends to react sharply to news cycles, social media momentum, and broader crypto volatility, making it attractive to high-risk traders seeking quick gains. However, this same reactivity can lead to sudden reversals, highlighting the importance of active risk management.

From a medium- to long-term perspective, Dogecoin’s appeal lies less in its technical fundamentals and more in its cultural relevance. Its dedicated community, meme status, and wide accessibility have helped sustain market interest even during downturns. For those with a high tolerance for volatility and a belief in the power of decentralized, community-driven assets, holding a modest allocation of DOGE may offer asymmetric upside, especially in speculative bull markets.

Conversely, investors with a conservative profile or long-term value-driven strategies may find Dogecoin’s lack of a development roadmap and utility limiting. Without consistent innovation or institutional adoption, DOGE remains a sentiment-driven asset that may struggle to deliver sustainable returns outside of hype cycles.

Ultimately, whether to buy, hold, or sell Dogecoin depends on your investment goals, time horizon, and risk appetite. It is not a traditional store of value, but as a social and speculative phenomenon, it continues to defy expectations. For many, Dogecoin isn’t just a cryptocurrency – it’s a bet on the crowd.

Disclaimer: This article is for informational purposes only and does not provide financial, trading, or investment advice. Cryptocurrency prices can fluctuate wildly, so always do your own research (DYOR), assess risks, and consult a professional before making financial decisions. The author and team are not responsible for any losses from using this information.

FAQ

What is the current price of Dogecoin?

Dogecoin is trading at approximately DOGE $0.15 24h volatility: 1.5% Market cap: $24.95 B Vol. 24h: $2.20 B , with moderate daily fluctuations.

What is the short-term outlook for Dogecoin’s price?

In the short term, Dogecoin appears to be in a consolidation phase, with potential for a breakout if social sentiment or trading volume spikes.

What are the mid-term price predictions for Dogecoin?

Mid-term forecasts suggest Dogecoin could range between $0.20 and $0.35, depending on market momentum and community engagement.

How high can Dogecoin rise by 2030?

Some optimistic projections place Dogecoin between $0.75 and $1.50 by 2030, assuming continued adoption and meme-driven market cycles.

What are the risks of investing in Dogecoin?

Key risks include extreme volatility, speculative price action, and the potential for declining public interest during bear markets.

How do social media trends affect Dogecoin’s price?

Dogecoin’s price is susceptible to social media activity – tweets from influencers or viral memes can trigger sharp price moves.

Is Dogecoin still considered a good investment?

Dogecoin may be a viable high-risk, short-term opportunity, but it’s less suited for long-term, fundamentals-driven investors.

How does Dogecoin compare to other meme coins like Shiba Inu?

Dogecoin has a larger market cap, longer track record, and broader name recognition than Shiba Inu, although both rely heavily on community sentiment.

What technical indicators are important when analyzing Dogecoin?

Traders often use moving averages, RSI, and MACD to track momentum, trend reversals, and overbought/oversold conditions in DOGE.

What is the average price forecast for Dogecoin over the next few years?

Average forecasts suggest Dogecoin may hover between $0.25 and $0.60 through 2026–2027, depending on market trends and sentiment.

Can Dogecoin reach a new all-time high in the future?

While it is possible, reaching a new all-time high (above $0.73) would likely require a strong bull market and renewed social media-driven hype.

How volatile is Dogecoin compared to other cryptocurrencies?

Dogecoin is more volatile than most large-cap coins like Bitcoin or Ethereum, largely due to its meme status and speculative trading patterns.

Coinspeaker in Numbers

Monthly Users

Articles & Guides

Research Hours

Authors

BMIC (BMIC) is a presale project that wants to create quantum-resistant security for crypto wallets and digital assets. The team s...

Wondering how to buy crypto but not sure where to start? Our beginner's guide explains how and where to invest in digital assets l...

Tony Frank

Crypto Editor, 50 postsTony Frank is an accomplished cryptocurrency analyst, author, and educator whose work bridges the gap between complex blockchain technology and accessible, actionable insights for global audiences. Over the past decade, he has emerged as a respected voice in the rapidly evolving world of digital assets, combining technical expertise with a talent for storytelling to help readers navigate everything from Bitcoin’s monetary philosophy to the intricacies of decentralized finance (DeFi). Tony earned his Bachelor’s degree in Economics and Finance from the University of Melbourne, where he developed a deep interest in monetary systems and market structures. He later pursued a Master’s degree in Blockchain and Digital Currency from the University of Nicosia, one of the first academic institutions to offer accredited programs in cryptocurrency studies. Before focusing full-time on blockchain, Tony worked as a financial analyst for a multinational investment firm, covering emerging technologies and alternative asset classes. His early exposure to macroeconomic policy, global market behavior, and fintech innovation laid the foundation for his later work in crypto research and writing. Tony’s expertise spans multiple sectors of the blockchain industry, including cryptocurrency fundamentals, altcoin market cycles, DeFi and web3 trends and regulatory landscapes. Tony combines on-chain data analysis with macroeconomic research, providing readers with both the technical “how” and the market “why” of cryptocurrency movements.