LiquidChain is a Layer 3 blockchain project that wants to unify the liquidity of Bitcoin, Ethereum, and Solana into a single execu...

What Is Ethereum? Comprehensive Guide to ETH & Its Ecosystem

11 mins

11 mins What is Ethereum? Learn how the Ethereum blockchain works, what ETH is used for, and how it powers the leading decentralized applications.

Ethereum is a decentralized blockchain that facilitates transactions without the need for banks or intermediaries. It creates a peer-to-peer network that utilizes smart contracts to execute code, enabling the secure transfer of digital currency and assets.

More simply, Ethereum is like a vast, global computer that anyone can utilize. However, instead of being controlled by a single company or person, it’s run by many people worldwide and kept highly secure through Proof-of-Stake consensus mechanisms.

The native cryptocurrency, ETH, effectively powers the blockchain, as it is used to pay ‘gas’ fees for executing transactions across the entire ecosystem.

Key Takeaways

- Ethereum was founded in 2013 as a programmable blockchain that could execute code (via smart contracts) rather than simply record transactions.

- ETH powers the network, serving as gas for transactions, staking collateral, and as a reserve asset.

- DeFi, Layer 2s, and EVM compatibility have contributed to the ecosystem’s growth into the juggernaut it is today.

- The Ethereum market cap firmly establishes Ethereum as the second-largest cryptocurrency by market capitalization.

Who Created Ethereum?

In 2013, developer Vitalik Buterin proposed a blockchain that could execute code, rather than merely record transactions. Drawing on his experience writing about Bitcoin’s technical design, he introduced the idea in the Ethereum White Paper as a decentralized “world computer” that anyone could use to build or access blockchain apps.

A public crowdsale in 2014 raised over 31,000 BTC (approximately $18 million at the time), providing funding for early development. Anyone who has ever wondered what they would do with a time machine should note that the presale price of ETH was $0.31.

Ethereum then officially launched on July 30, 2015, with the first version, called “Frontier”. With a live, programmable blockchain in front of them, developers quickly began building a variety of dApps, ranging from decentralized finance to gaming and prediction markets.

How Ethereum Works?

At a technical level, Ethereum is more than a ledger of transactions. It’s a network of computers that can execute code, verify the results of executed code, and agree on how user account balances should be updated. Ethereum accomplishes all this without a central authority.

Ethereum Virtual Machine (EVM)

The Ethereum Virtual Machine (EVM) is the computational layer of the Ethereum network: a runtime environment that executes smart contract code and, by extension, dApps (groups of interoperable smart contracts).

Each validator node runs the EVM, ensuring that transactions and contract executions produce identical, verifiable results without the need for centralization.

When users interact with a dApp, the EVM executes each instruction, such as token transfers, balance updates, or calls to other smart contracts. The results are then recorded on the blockchain.

The EVM’s consistent structure has made it a standard in blockchain development, and its ubiquity ensures a strong developer community. Hundreds of public and private blockchain networks now support EVM compatibility.

Smart Contracts with Gas Fees

The basic role of smart contracts on the Ethereum blockchain is to function as conditional switches: “if this happens, then do that (otherwise, do something else)”. These programs can be simple or complex, and over time, more complex dApps have emerged that combine multiple smart contracts and which often use off-chain data as triggers.

The Ethereum network charges transaction fees (gas fees) based on the demand these contracts place on the network’s computing power. In short, more complex transactions cost more because they require more computing resources. However, this isn’t always a reflection of how complex the transaction is, but rather how complex its code is.

Network demand also plays a role in transaction costs. During periods of higher network demand, gas prices may spike. In one, now-famous, example, the CryptoKitties NFT game caused a congestion crisis on the Ethereum blockchain.

Gas fees are paid in Ether (ETH) and compensate validators for processing transactions and executing code. They also act as a safeguard against network spam or inefficient programming by making large or unnecessary computations expensive.

Proof-of-Stake Consensus

Ethereum relies on a system called Proof of Stake (PoS) to reach consensus on the state of its blockchain (wallet balances). Validators lock up ETH as collateral (known as staking). This process creates incentives for honest behavior through staking rewards paid in ETH, while penalizing those who engage in misconduct.

Validators are randomly selected to propose a block of transactions, while other validators verify that the transactions in the proposed block comply with the protocol’s rules (including no double-spending, no altering the transaction history).

When a block is approved, it becomes part of the blockchain, and the validator who proposed it earns ETH as a reward. If a validator attempts to cheat or remains offline for an extended period, a portion of their stake can be forfeited (slashed).

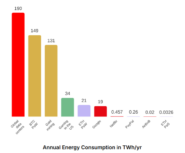

Ethereum moved from Proof of Work to Proof of Stake in September 2022 in an extremely ambitious update called The Merge, which reduced the network’s energy consumption by more than 99%. The upgrade also paved the way for future improvements, including sharding and support for Layer 2 scaling networks.

The annual energy consumption of Ethereum. Source: Ethereum.org

What Is ETH Used For?

ETH is Ethereum’s native cryptocurrency that powers every action that takes place on the blockchain, from simple operations such as transferring tokens between wallets to creating liquidity pool positions or minting NFTs.

ETH also secures the Ethereum network through its Proof-of-Stake consensus, where validators lock 32 ETH as collateral to participate in block validation and earn staking rewards.

In addition to securing the chain, ETH serves as a de facto reserve asset. A wide range of tokens are paired with and priced in ETH across decentralized exchanges. As a consequence, ETH is a common base asset in trading pairs, and rising demand for other tokens often translates into additional demand for ETH. Hence why ETH has reached such a high value over the years, trading at $2,054.26 as of February 14, 2026.

Demand for block space, participation in DeFi, and staking activity all increase demand for ETH. However, ETH’s value ultimately depends on network demand relative to other chains.

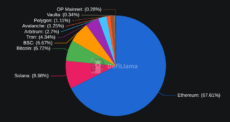

While Ethereum continues to lead in TVL with nearly 70% share, competing networks have carved out niches for specific use cases. A decline in network usage could impact ETH’s value, as well as the value of assets denominated in it.

Ethereum is the dominant chain across DeFi. Source: DefiLlama

Ethereum Pros & Cons

Ethereum’s position as the leading smart contract platform comes from a mix of security, decentralization, and a mature developer ecosystem. These strengths shape how apps are built on the network, making Ethereum an anchor for Layer 2 chains and sidechains. At the same time, there are drawbacks to the ecosystem:

Pros

- Deepest liquidity and highest Total Value Locked (TVL) in the market.

- Largest smart-contract developer community in crypto.

- Massive economic security from ~36M ETH staked (~$124B backing), malking attacks unlikely.

- EVM compatibility encourages new projects to build on Ethereum.

- Preferred chain for institutions exploring tokenization and digital settlement.

Cons

- High gas fees during periods of network activity – even basic wallet transfers can be costly for small users.

- Layer 2 fees also spike during heavy market volatility.

- Solo staking is expensive (32 ETH minimum), creating a high entry barrier.

- Ethereum also remains vulnerable to Maximal Extractable Value (MEV), where block builders or automated bots reorder or insert transactions for their own profit.

What Is the Future of Ethereum?

Ethereum’s long-term roadmap focuses on improving scalability, efficiency, and decentralization. Rather than a single upgrade, “Ethereum 2.0” refers to a series of upgrades that reshape how the network handles computation and data.

The term originally centered on the shift from Proof-of-Work to Proof-of-Stake, marking a clear before-and-after moment for the protocol. However, the moniker has since been retired to avoid confusion. There is no “new Ethereum”. Instead, the project reflects a renewed commitment to improving Ethereum’s usability, performance, and security over time.

The Merge and the Shift to Proof of Stake

The Merge took place in September 2022, replacing Ethereum’s Proof-of-Work system with Proof-of-Stake. This transition reduced the network’s energy use by more than 99 percent and introduced staking as the method for securing the chain. PoS also cut ETH issuance dramatically. Prior to The Merge, ETH was notably inflationary. After conversion to PoS, ETH’s supply has proven remarkably stable, and even deflationary at times.

Proto-Danksharding and Full Danksharding

In 2024, Ethereum introduced Proto-Danksharding (EIP-4844). This upgrade introduced a new data format called “blobspace”, providing rollups with a more cost-effective way to publish their transaction data. The change significantly reduced L2 transaction costs.

Full Danksharding will further expand the blobspace, increasing the network’s data capacity and enabling significantly higher throughput across Layer 2 chains. This upgrade serves as the backbone of Ethereum’s long-term scaling strategy.

Verkle Trees and Lighter Nodes

Another roadmap milestone centers on Verkle trees, a data structure that reduces the amount of information that nodes must store to verify the chain. The upgrade reduces hardware requirements and enables more users to run Ethereum nodes. They also support Ethereum’s longer-term goals, such as enabling lightweight or “stateless” clients.

Ethereum’s Layer 2-Centric Future

As scaling advances, Ethereum’s ecosystem is expected to rely increasingly on Layer 2 networks for day-to-day activity. However, institutional users may continue to gravitate toward the Ethereum mainnet for specific use cases. dApps and wallet apps will likely continue the trend of abstracting on-chain and cross-chain activity. Ultimately, Ethereum will become a larger ecosystem that finds the most efficient way to process transactions without requiring users to understand the mechanics that make that efficiency possible.

Learn More

Disclaimer: This article is for informational purposes only and does not provide financial, trading, or investment advice. Cryptocurrency prices can fluctuate wildly, so always do your own research (DYOR), assess risks, and consult a professional before making financial decisions. The author and team are not responsible for any losses from using this information.

FAQ

How is Ethereum different from Bitcoin?

Do I need to buy a full ETH to use Ethereum?

How do I store ETH safely?

Can Ethereum be used for real-world payments?

Is Ethereum environmentally friendly?

References:

- Ethereum Whitepaper (ethereum.org)

- Layer-2 scaling for Ethereum (ethereum.org)

- The Inside Story of the CryptoKitties Congestion Crisis (consensys.io)

- EIP-1559: Fee market change for ETH 1.0 chain (eips.ethereum.org)

- Ethereum Energy Consumption (ethereum.org)

- Chains | DeFiLlama (defillama.com)

- Ethereum Supply Growth Since The Merge | Ultrasound Money (ultrasound.money)

- Ondo Finance (ondo.finance)

- Ethereum Infrastructure: Wall Street Says … | Yahoo Finance (finance.yahoo.com)

- JPMorgan Brings Dollar Deposit Token | Yahoo Finance (finance.yahoo.com)

- Verkle Trees | Ethereum Roadmap (ethereum.org)

Coinspeaker in Numbers

Monthly Users

Articles & Guides

Research Hours

Authors

The team behind IPO Genie has not yet announced an end date for the presale.

AI cryptocurrencies combine blockchain with artificial intelligence to power decentralized machine learning networks, GPU computin...

Fact-Checked by:

Fact-Checked by:

Otar Topuria

Crypto Editor, 39 postsI’m a crypto writer and analyst at Coinspeaker with over three years of experience covering fintech and the rapidly evolving cryptocurrency landscape. My work focuses on market movements, investment trends, and the narratives driving them, helping readers what is happening in the markets and why. In addition to Coinspeaker, my insights and analyses have been featured in other leading crypto and fintech publications, where I’ve built a reputation as a thoughtful and reliable voice in the industry.

My mission is to demystify the crypto markets and help readers navigate the noise, highlighting the stories and trends that truly matter. Before specializing in crypto, I worked in the IT sector, writing technical content on software development, digital innovation, and emerging technologies. That made me something of an expert in breaking down complex systems and explaining them in a clear, accessible way, skills I now find very useful when it comes to unpacking the intricate world of blockchain and digital assets.

I hold a Master’s degree in Comparative Literature, which sharpened my ability to analyze patterns, draw connections across disciplines, and communicate nuanced ideas. I’m particularly passionate about early-stage project discovery and crypto trading, areas where innovation meets opportunity. I enjoy exploring how new protocols, tokens, and DeFi projects aim to disrupt traditional systems, while also evaluating their potential risks and rewards. By combining market analysis with forward-looking research, I strive to provide readers with content that is both informative and actionable.