Identifying the best crypto to mine in 2026 depends on your hardware, electricity costs, and risk tolerance.

Using Bitcoin is one of the best ways to transact around the world completely privately. You can send and receive BTC, trade other cryptocurrencies, and more – all completely anonymously.

However, to achieve anonymity, you first need to buy Bitcoin anonymously. That’s getting more difficult since many crypto exchanges now require Know Your Customer (KYC) checks and ID verification. But there are still several ways you can purchase Bitcoin without revealing your identity.

In this guide, we’ll explore how to buy Bitcoin anonymously using four easy approaches. Keep reading to learn how to get into crypto with no KYC.

How to Buy Bitcoin Without Verification in 2025

There are several ways to buy Bitcoin with no KYC, but the easiest and cheapest by far is to use Best Wallet. Here’s an overview of how the process works:

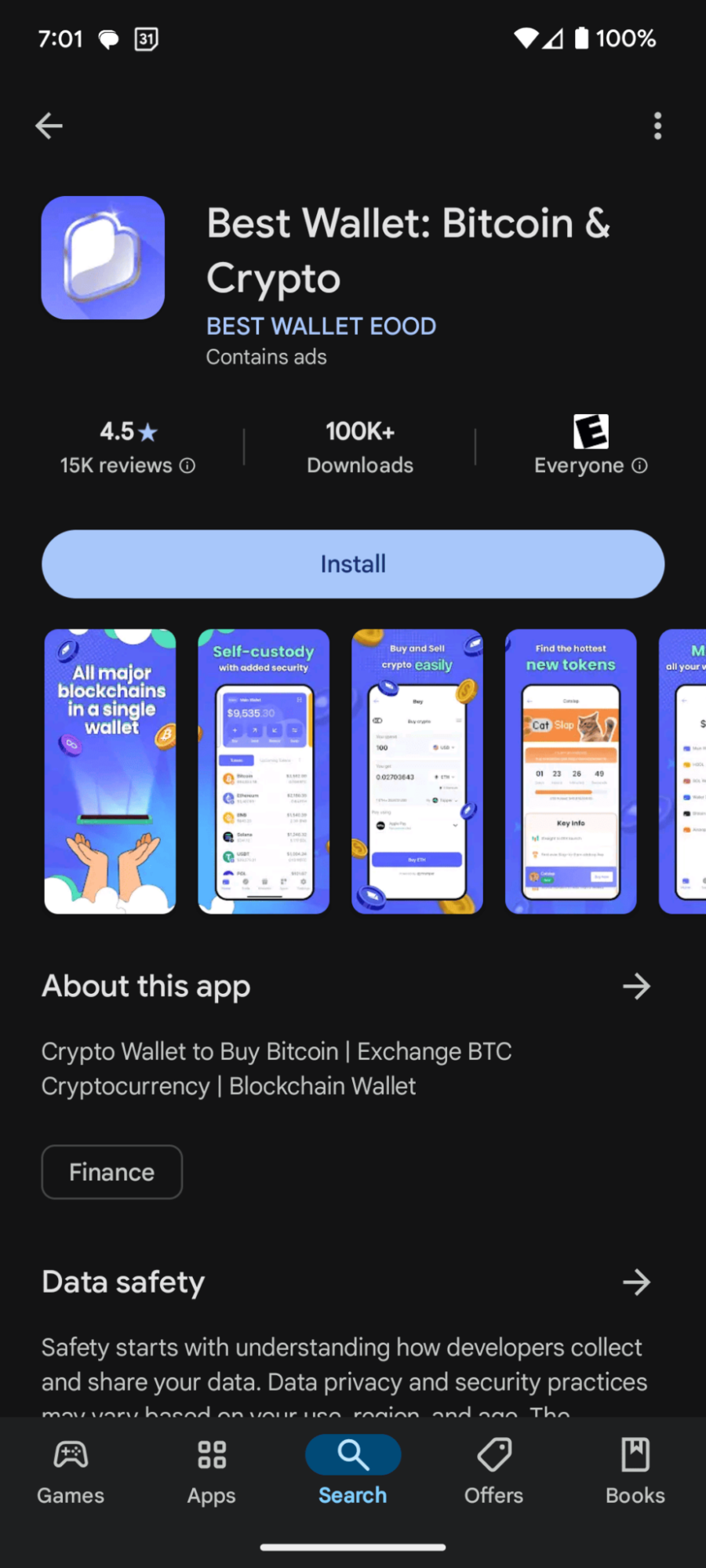

- Download Best Wallet: The Best Wallet app is available for free in Google Play and the Apple App Store.

- Create an Account: Sign up for Best Wallet with your email. There’s no ID verification required.

- Set up a Purchase: Click Trade, then Buy. Select Bitcoin as the token to purchase.

- Choose Your Payment Method: Select your payment method. Best Wallet accepts credit/debit cards, Google Pay, Apple Pay, PayPal, Venmo, and bank transfers.

- Buy Bitcoin Anonymously: Tap Buy BTC to complete your purchase.

Now that you know the basics, let’s walk through how to buy Bitcoin with no KYC in Best Wallet in more detail.

Step 1: Download Best Wallet

The first thing you need to do is download the free Best Wallet app. It’s available in Google Play for Android devices and in the Apple App Store for iOS devices.

Download page for the Best Wallet mobile app in Google Play. Source: Google

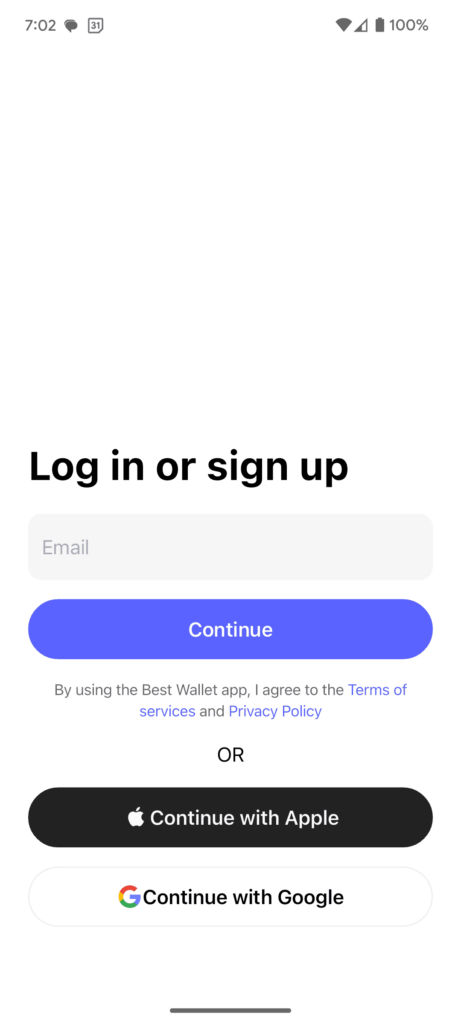

Step 2: Create an Account

Open the Best Wallet app and enter your email address to create an account. Best Wallet doesn’t require any personal information or ID verification, so it’s completely anonymous.

Sign up page for Best Wallet mobile app. Source: Best Wallet

You’ll be asked to set a password for your account and a four-digit PIN code to unlock your wallet. In addition, you have the option to add a fingerprint or face ID to further secure your wallet. You can also add a phone number to enable two-factor authentication.

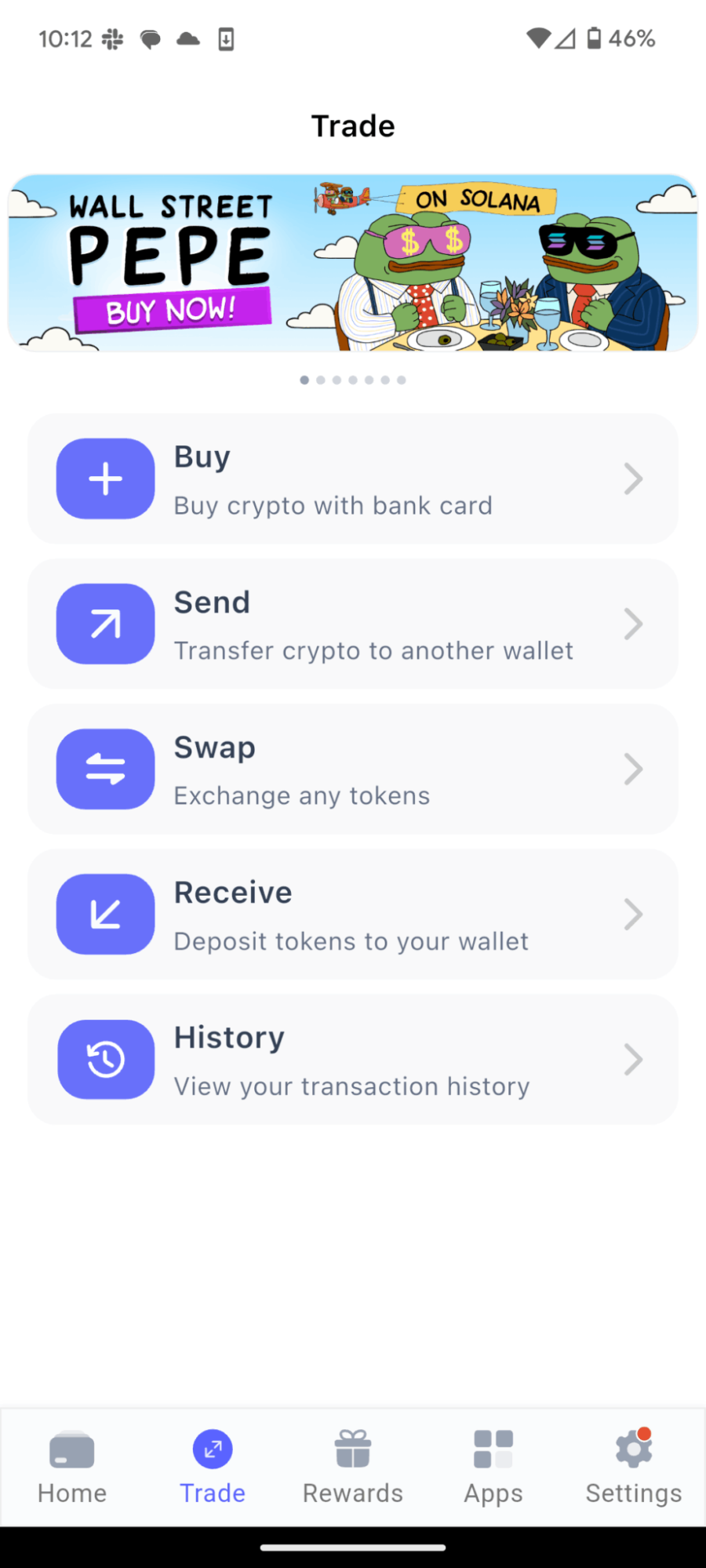

Step 3: Set Up a Purchase

From the Best Wallet dashboard, tap Trade, then Buy to initiate a crypto purchase. Select Bitcoin as the token you wish to purchase.

Trade panel in Best Wallet mobile app. Source: Best Wallet

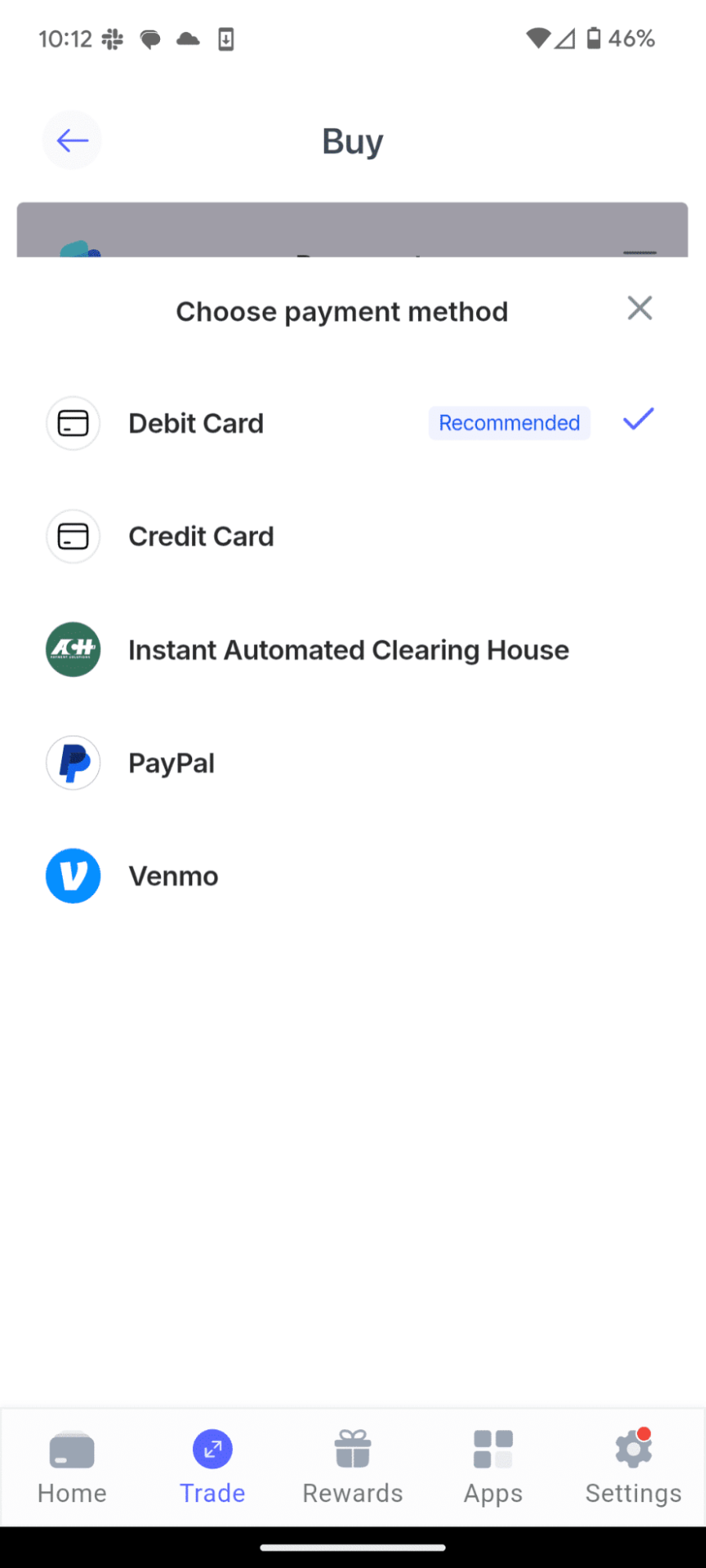

Step 4: Choose Your Payment Method

Tap on the payment box to select your payment method. Best Wallet supports credit and debit cards, Google Pay, Apple Pay, PayPal, Venmo, and bank transfers.

Payment methods for buying Bitcoin with Best Wallet. Source: Best Wallet

Step 5: Buy Bitcoin Anonymously

Review your purchase and tap Buy BTC. You will be taken to one of Best Wallet’s third-party partners to enter your payment details and complete your purchase. Once done, your Bitcoin will be available in your Best Wallet account instantly.

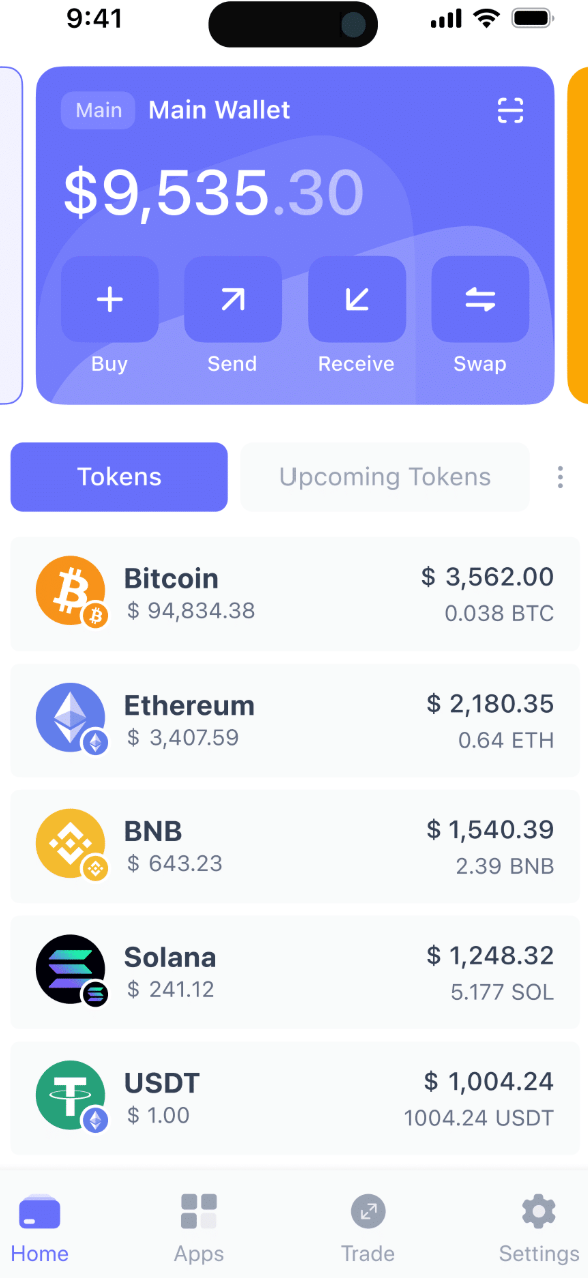

Best Wallet dashboard showing Bitcoin balance. Source: Best Wallet

Best Ways to Buy Bitcoin Anonymously

As we have mentioned previously, there are several different ways to buy Bitcoin without KYC checks. We’ll take a closer look at each method and cover the pros and cons of each.

1) Best Wallet – Overall Best Way to Buy Bitcoin Anonymously

The simplest and cheapest way to buy Bitcoin without ID verification is to use Best Wallet. This free self-custody wallet lets you buy BTC with a variety of convenient payment methods, including credit and debit cards and even PayPal. You only need an email address to sign up, and the purchase process is really seamless.

Best Wallet puts no limits on how much Bitcoin you can buy without KYC, which is a big advantage compared to other methods of buying crypto anonymously. In addition, it works with Onramper to help you find the best exchange rate and the lowest fees for every purchase. So, you get the most BTC for your money every time.

Best Wallet homepage. Source: Best Wallet

Another benefit to using Best Wallet to buy Bitcoin is that you already have a powerful and secure self-custody wallet to store your tokens. With Best Wallet, you can manage your BTC and tokens from 60+ other blockchains in one place, invest in new crypto tokens through a built-in launchpad, stake your coins, and so much more. Best Wallet is one of the most secure crypto wallets on the market and has never been hacked.

Whether you’re new to buying Bitcoin or an experienced crypto user looking to maintain your privacy, Best Wallet is the best way to buy Bitcoin without verification. Download the app for free today to get started.

Pros

- Seamless mobile experience for buying Bitcoin

- Supports Bitcoin and thousands of other tokens

- Highly secure self-custody crypto wallet

- Crypto management tools and built-in launchpad

- No limits on how much BTC you can buy

Cons

- Slightly higher fees than other anonymous methods for buying Bitcoin

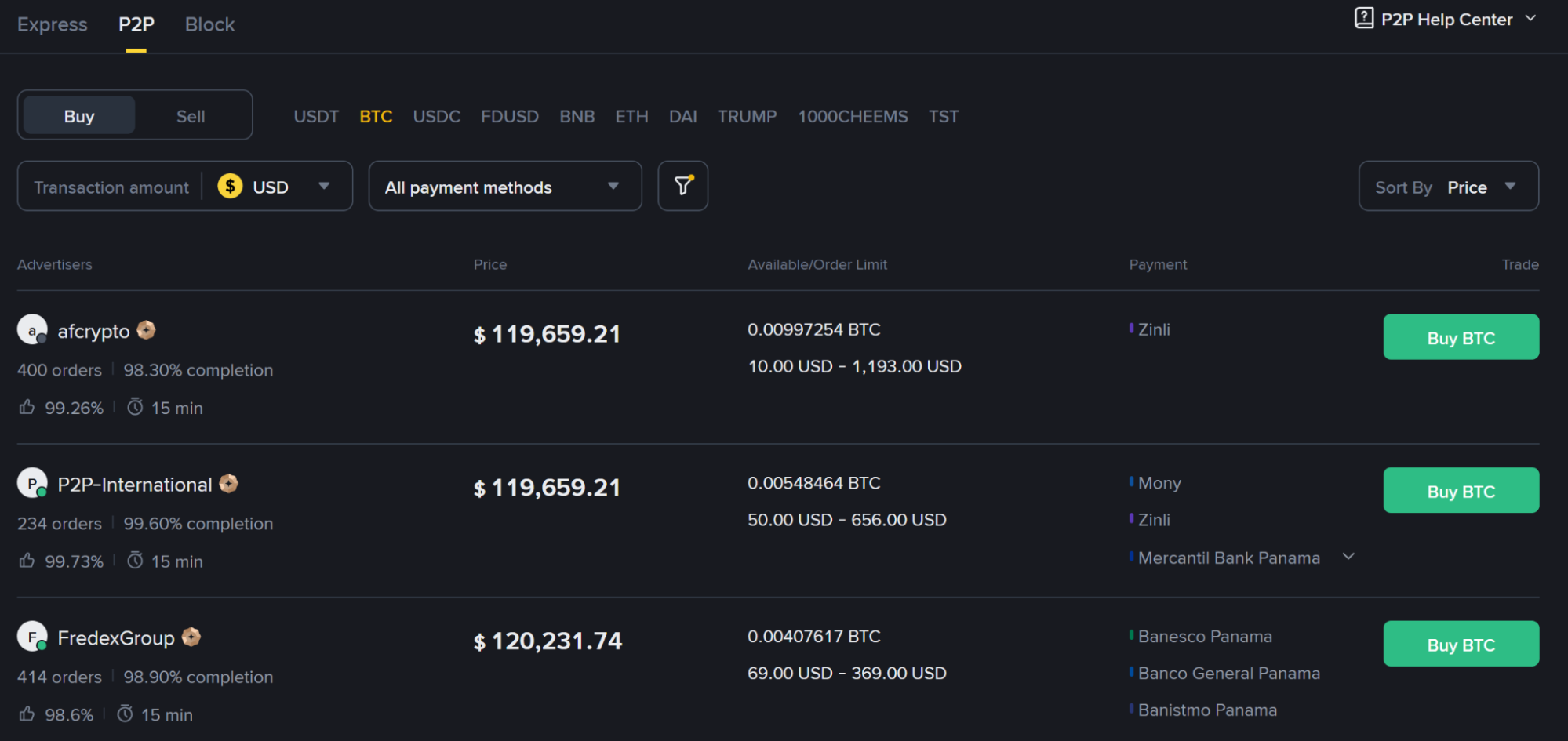

2) Peer-to-Peer Marketplaces – Best for Avoiding KYC

Peer-to-peer crypto marketplaces enable you to buy Bitcoin directly from another individual who already holds it. They’re a good alternative to using a crypto on-ramp like Best Wallet if you’re willing to go through a bit of extra hassle to pay the lowest possible transaction fee.

In a peer-to-peer marketplace, individuals typically list the amount of Bitcoin they’re selling and the payment methods they’ll accept. You can filter all the listings according to the payment methods you want to use and the amount of Bitcoin you want to buy. You may have to wait or try a different marketplace if there’s currently no seller offering a listing that meets your criteria.

Binance P2P Marketplace for Bitcoin. Source: Binance

If you’re buying a large amount of Bitcoin, you may be able to lock in a better-than-market exchange rate or pay reduced fees compared to buying through an onramp or exchange. Most P2P marketplaces are completely free to use, although beware that some do charge a small fee for helping to connect buyers and sellers.

Also, be sure to check whether the marketplace you’re using has protections in place to ensure you get your Bitcoin. Many marketplaces are run by major crypto exchanges, which use escrow accounts for transactions to maintain trust between buyers and sellers.

Pros

- Lower fees than crypto onramps or exchanges

- Support a wide range of currencies and payment methods

- Can buy small or large amounts of Bitcoin

- Escrow accounts protect buyers and sellers

Cons

- You can’t specify the amount of Bitcoin to buy

- Exchange rates vary among sellers and payment methods

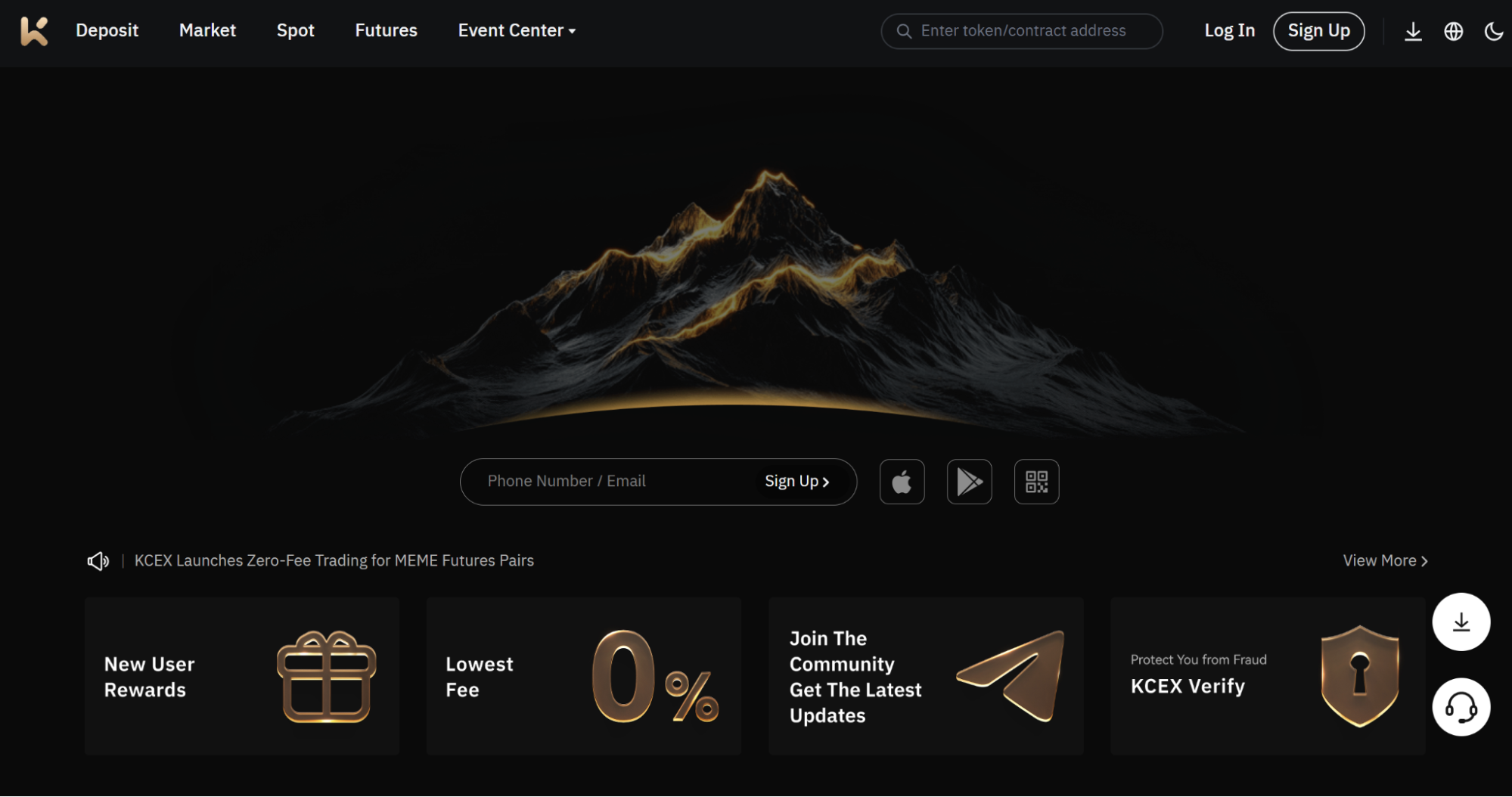

3) No KYC Exchanges – Best for Buying Small Quantities

No KYC exchanges are centralized crypto exchanges that let you buy small amounts of Bitcoin with fiat without requiring ID verification. Examples include KCEX, Bitunix, and MEXC.

At these exchanges, you can purchase a limited amount of BTC and other cryptos without KYC checks. The amount you can buy varies, but it’s usually limited to $1,000 of Bitcoin or less per day. Importantly, your crypto withdrawals from these exchanges are also limited without KYC, although the limits are generally much higher. For example, KCEX lets you withdraw up to 30 BTC per day without verification.

KCEX No-KYC crypto exchange homepage. Source: KCEX

No KYC exchanges are very easy to use, and you get the safety that comes with using a centralized exchange. Many support credit and debit cards along with a variety of fiat currencies, like USD, GBP, and EUR. Once you buy Bitcoin, you have access to all of the exchange’s trading and portfolio management tools.

However, these exchanges tend to charge high fees for purchasing crypto – 4% or more is not uncommon. So, no KYC exchanges are best if you’re only buying a small amount of Bitcoin and are willing to pay a premium for convenience.

Pros

- User-friendly and very trustworthy

- Access to trading and portfolio tools

- Support credit and debit card payments

- Moderately high withdrawal limits

Cons

- Above-average fees for Bitcoin purchases

- Purchasing limits can be very restrictive

4) Bitcoin ATMs – Best for Immediate In-Person Access

Bitcoin ATMs provide a convenient way to purchase Bitcoin in person. They’re ubiquitous around the world and can be found in convenience stores, grocery stores, retail businesses, and more. Anyone can use a Bitcoin ATM, and they accept cash, making them even more anonymous than digital platforms that require a bank card linked to your name.

However, many Bitcoin ATMs have limits on how much BTC you can buy without ID verification. It’s usually less than $500 worth, and ATMs that don’t require KYC may not be fully licensed and registered – meaning they come with extra risk that your purchase won’t go through as expected.

Bitcoin ATM illustration. Source: atm.bitcoin.com

Additionally, it’s essential to note that even when using cash, many Bitcoin ATMs are equipped with cameras. Your Bitcoin can also be tracked on-chain.

The biggest drawback to using a Bitcoin ATM is that they have very high fees. Typically, you can pay around 10-12% of your total purchase in fees. That’s very expensive, so this method of purchasing Bitcoin anonymously is really only suitable if you want to use physical cash.

Pros

- Accept cash payments

- Widely available in convenient locations

- Daily limits can be circumvented by visiting multiple ATMs

Cons

- Very high fees for buying Bitcoin

- Some no-KYC Bitcoin ATMs are unregistered

Best Ways to Buy Bitcoin Without ID Compared

Wondering which of these approaches to buying Bitcoin with no KYC is right for you? Here’s an overview of how they stack up.

| Payment Methods Accepted | Purchase Limits | Transaction Fees | Accessibility | |

| Best Wallet | Credit/debit cards, PayPal, Venmo, bank transfers | None | 2-4% | iOS and Android apps |

| Peer-to-peer Marketplaces | Bank transfers, PayPal, Skrill, other e-wallets | None | 1-2% | Web, iOS, Android |

| No KYC Exchanges | Credit/debit cards, bank transfers | Approx. $500-$1,000 per day | 4-5% | Web, iOS, Android |

| Bitcoin ATMs | Credit/debit cards, cash | Approx. $500 per day | 10-12% | In-person only |

Why Buy Bitcoin With No Verification?

There are a few important reasons why you might consider buying Bitcoin through a no-KYC method.

Enhanced Privacy

The top reason why many Bitcoin and other cryptocurrency owners choose to buy without ID verification is to maintain their privacy. Bitcoin was originally designed to function like digital cash, keeping the identity of its owner anonymous. While tokens can be tracked on-chain using digital forensics, buying Bitcoin anonymously makes it a lot more difficult for anyone to find out who you are.

That’s a big deal for anyone who cares about their privacy. When you buy Bitcoin anonymously, you don’t have to worry about a crypto exchange leaking your personal information in a data breach. You also don’t have to worry about potential attackers putting a target on your back because you have a wallet filled with Bitcoin. And of course, it enables you to transact with others around the world without revealing who you are.

Faster Onboarding

Another benefit of buying Bitcoin without KYC checks is that it’s faster. KYC checks add a lot of time to the purchase process. You have to enter information and upload documents, and then your exchange has to review all of that information and approve your account.

Without KYC, you can simply create an account and buy Bitcoin. The entire process takes only a minute or two.

That’s especially good if you need Bitcoin for a purchase right now. It’s also important if you find a hot crypto trading opportunity and need to move quickly, so you don’t miss out.

Greater Accessibility

Buying Bitcoin without ID verification is especially important if you live in a country where cryptocurrencies are banned or owning them could get you in trouble. Without KYC checks, it’s possible to buy Bitcoin while flying under the radar of your country’s financial regulators.

That’s very important for maintaining some financial freedom in restrictive countries. Bitcoin can also enable you to transfer value outside of the country and access a much wider range of financial services.

Is Bitcoin Ever Truly Anonymous?

It’s important to keep in mind that buying Bitcoin without KYC doesn’t mean you’re invisible. Your purchase will still show up on the Bitcoin blockchain along with every other Bitcoin transaction. And there are digital forensic techniques that can be used to trace your Bitcoin on the blockchain and potentially identify you.

It’s also important to keep in mind that no purchase method is truly anonymous. Your purchase can be traced to your device’s IP address, for example. Or if you use a credit or debit card to buy Bitcoin, your card provider knows who you are and what you bought. Even if you use cash at a Bitcoin ATM, there’s a good chance your purchase is being caught on camera.

Graphic showing the Bitcoin logo. Source: Gemini

So ultimately, Bitcoin isn’t fully anonymous, but rather pseudonymous. But it can be quite private if you buy it without KYC checks, especially if you compare BTC to other forms of digital payment like e-wallets and credit cards. That’s enough for most privacy-minded people.

If you want to take privacy a step further, there are several privacy tokens you can use that are more difficult to trace than Bitcoin.

Potential Drawbacks of Buying Bitcoin Without KYC

While buying Bitcoin without KYC can be a good option for some people, it’s not for everyone. Here are a few of the drawbacks to buying Bitcoin anonymously.

Higher Transaction Fees

One of the biggest downsides to buying Bitcoin without KYC is that it typically costs more than buying BTC through a centralized exchange or onramp that requires ID verification. For example, you can buy Bitcoin at no cost through some centralized exchanges, but you’ll almost always pay at least a 1% fee when using the anonymous methods we covered above.

If you’re buying a small amount of Bitcoin, this might not be a big deal. But if you plan to buy a lot of Bitcoin, those increased transaction fees can really eat into your holdings.

Greater Purchasing Risk

Another drawback to consider is that many platforms that enable you to buy Bitcoin without KYC aren’t licensed or regulated. No KYC exchanges, for example, frequently operate outside the bounds of regulators like the US’s Financial Crimes Enforcement Network (FinCEN). Peer-to-peer marketplaces have plenty of legitimate Bitcoin sellers, but they can also attract scammers and money launderers.

This exposes you to some risk that your Bitcoin purchase won’t go as planned. You could send money and get no Bitcoin in return, or you could receive Bitcoin from an illegal money laundering operation, only to have it confiscated by authorities later.

This risk is relatively small, but it’s important to be aware of. When using unregistered platforms, you have little legal recourse if you don’t get the Bitcoin you paid for.

Purchase and Withdrawal Limits

No KYC exchanges and Bitcoin ATMs have strict limits on how much Bitcoin you can buy without KYC. That can be very inconvenient if you want to buy a larger quantity of BTC, since you’ll either need to wait a day to make another purchase or visit another exchange or ATM.

In addition, many no KYC exchanges put limits on how much Bitcoin you can withdraw in a single day. These limits are high enough that they won’t get in the way for most small Bitcoin holders, but they can present a significant obstacle for larger Bitcoin holders.

Conclusion – Buy Bitcoin Without KYC With Best Wallet

Buying Bitcoin without the KYC checks eliminates hassle and enables you to maintain your privacy on-chain. While there are several ways to buy Bitcoin anonymously, Best Wallet stands out for its seamless mobile experience, low transaction fees, and support for a variety of popular payment methods.

With Best Wallet, you can sign up and buy Bitcoin in minutes and enjoy the peace of mind that comes with keeping your BTC in the most secure self-custody wallet available. Download Best Wallet today for iOS or Android to get started.

FAQs

Can Bitcoin be tracked?

What is the best way to buy Bitcoin anonymously?

Can I pay with Bitcoin anonymously?

Which Bitcoin wallets don’t require ID verification?

References

Coinspeaker in Numbers

Monthly Users

Articles & Guides

Research Hours

Authors

Based on our research, the best short-term cryptocurrencies have deep liquidity, high volatility, and sustained positive market se...

VerifiedX (VFX) has officially launched, offering a Bitcoin-inspired decentralized network with unique on-chain features. Learn wh...

Fact-Checked By:

Fact-Checked By:

16 mins

16 mins

Otar Topuria

Crypto Editor, 37 postsI’m a crypto writer and analyst at Coinspeaker with over three years of experience covering fintech and the rapidly evolving cryptocurrency landscape. My work focuses on market movements, investment trends, and the narratives driving them, helping readers what is happening in the markets and why. In addition to Coinspeaker, my insights and analyses have been featured in other leading crypto and fintech publications, where I’ve built a reputation as a thoughtful and reliable voice in the industry.

My mission is to demystify the crypto markets and help readers navigate the noise, highlighting the stories and trends that truly matter. Before specializing in crypto, I worked in the IT sector, writing technical content on software development, digital innovation, and emerging technologies. That made me something of an expert in breaking down complex systems and explaining them in a clear, accessible way, skills I now find very useful when it comes to unpacking the intricate world of blockchain and digital assets.

I hold a Master’s degree in Comparative Literature, which sharpened my ability to analyze patterns, draw connections across disciplines, and communicate nuanced ideas. I’m particularly passionate about early-stage project discovery and crypto trading, areas where innovation meets opportunity. I enjoy exploring how new protocols, tokens, and DeFi projects aim to disrupt traditional systems, while also evaluating their potential risks and rewards. By combining market analysis with forward-looking research, I strive to provide readers with content that is both informative and actionable.