LiquidChain is a Layer 3 blockchain project that wants to unify the liquidity of Bitcoin, Ethereum, and Solana into a single execu...

How and Where to Buy XRP Safely – Beginner’s Guide (2026)

11 mins

11 mins If you’re wondering how and where to buy XRP, the process comes down to just a few simple steps.

You can purchase XRP on centralized exchanges (CEXs) such as Binance or MEXC, through decentralized exchanges (DEXs), on peer-to-peer (P2P) platforms, or inside supported non-custodial wallets like Trust Wallet or Trezor. In this guide, we walk through each option and explain how to make your first XRP purchase safely and efficiently.

XRP is the cryptocurrency sitting at the heart of a global payment network that allows financial institutions to conduct cross-currency transactions on a decentralized ledger.

How to Buy XRP in 5 Easy Steps

Let’s start with a quick step-by-step of how to buy XRP as a first-time crypto investor:

- Choose your preferred method for buying XRP: CEX, DEX, P2P, or directly within a wallet.

- Set up an exchange or wallet account, enable all security options, and complete KYC if required.

- Evaluate the amount of capital to risk on XRP, and consider dollar-cost averaging to mitigate short-term volatility.

- Search for XRP, select a fiat or swap currency, and choose your preferred payment method to complete your purchase.

- Keep your XRP in a non-custodial wallet, such as Ledger or Trezor, to ensure long-term safety.

Where to Buy XRP: Comparing the Best Options

When you know which route you want to take for buying XRP, you need to choose the right platform for you. We have rounded up some of the most trusted options below:

| Platform | Type | Min Purchase | Fees |

| Binance | CEX, P2P | $15 | 0.1% |

| MEXC | CEX, P2P | $10 | 0% (maker) / 0.05% (taker) |

| Margex | CEX | $5 | 0.019% (maker) / 0.06% (taker) |

| Trezor | Hardware wallet | Varies by fiat on-ramp | Variable provider fees |

| CoinEx | CEX, P2P | $10 | 0.16% (maker) / 0.2% (taker) |

| Bybit | CEX, P2P | $10 | 0.1% |

| OKX | CEX, P2P | $1 | 0.08% (maker) / 0.1% (taker) |

| PancakeSwap | DEX | No minimum | 0.01%–1% |

| Uniswap | DEX | No minimum | Dynamic fees |

| MetaMask | Software wallet | $2 | Variable provider fee |

How to Buy XRP, All Options Explained Simply

Investors purchase XRP through various methods. We found that centralized exchanges (CEXs) remain the best option for beginners, although some traders prefer decentralized exchanges (DEXs), P2P platforms, or non-custodial wallets.

Here we will guide you through each process:

Buying on a Centralized Exchange

CEXs are specialized exchanges that connect crypto buyers and sellers. They operate similar models to stockbrokers, as traders open accounts, upload their ID, and invest in their preferred assets.

Here are the steps needed to start buying on a CEX:

- Open an account with a Tier 1 exchange such as Binance or MEXC, and complete the KYC process with a government-issued ID.

- Enable two-factor authentication (Authenticator App or Passkeys) and biometrics (e.g., fingerprint login)

- Add a payment method: options usually include bank transfers, debit/credit cards, Apple Pay, and Google Pay.

- Search for “XRP” on the exchange, and complete the purchase using the Buy Crypto interface options.

- Withdraw the newly purchased XRP to a non-custodial wallet (e.g., Trezor or Ledger) for self-custodial storage.

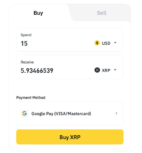

The easiest way to buy XRP on Binance is through instant payment methods, such as debit/credit cards and Google/Apple Pay. Source: Binance

While Tier 1 exchanges typically have excellent security mechanisms, storing XRP in a custodial wallet carries risk. If your exchange incurs regulatory, solvency, or cybersecurity issues, you may lose access to the XRP tokens.

Review the best crypto wallets to choose a non-custodial provider, and then request a withdrawal. Input the wallet address, and once Binance approves the transfer, you will receive the XRP tokens within seconds.

Buying on a Decentralized Exchange

Blockchain ecosystems like Ethereum and BNB Chain offer “wrapped” versions of XRP. These are available on popular DEXs like PancakeSwap, and each token is backed by real XRP, just on a different network standard.

Despite the added complexity, buying XRP on DEX platforms offers several perks. Investors eliminate centralized exchange risks by trading directly on-chain. Traders swap cryptocurrencies for XRP via liquidity pools, and since DEXs use wallet-to-wallet transfers, users avoid KYC processes.

- Get a crypto wallet that supports the BNB Chain network.

- Deposit BNB into the wallet.

- Visit the PancakeSwap website and connect your wallet to the DEX.

- Click “Trade” and input XRP as the receiving currency.

- Input the trade size and swap BNB for XRP.

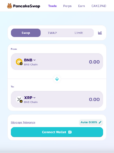

PancakeSwap lets users trade BNB for wrapped XRP tokens. Source: PancakeSwap

Once you complete the trade on PancakeSwap, a smart contract automatically deposits wrapped XRP into the connected wallet.

Buying in a Wallet

Investors primarily use crypto wallets to send, receive, and store XRP. We found that the best decentralized crypto wallets also have built-in gateways that enable fiat services, allowing users to buy and sell XRP tokens.

- Download a reputable non-custodial wallet that supports XRP purchases. Some popular examples are Trezor Safe, MetaMask, Exodus, and Atomic Wallet.

- Complete the initial setup and store your keys/recovery phrase offline. Remember, only you have access to your wallet with these keys. Don’t lose them, and don’t let anyone else access them.

- Head to the wallet’s built-in “Buy” or “Purchase Crypto” gateway.

- Choose XRP as the asset, enter the purchase amount, and select a supported payment method such as debit/credit card or PayPal.

- Complete the payment, and the purchased XRP is delivered into your wallet once the gateway provider processes the transaction (usually within a few minutes).

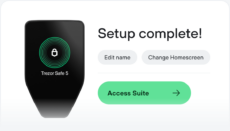

Wallets such as the Trezor Safe 5 support XRP natively and offer an easy way to send, receive, and buy XRP. Source: Trezor Wallet

While fees are higher than those of CEXs, users can combine non-custodial storage with instant trading features.

Buying via P2P

P2P platforms allow users to buy XRP from local sellers. Providers like OKX and Binance ensure safety through escrow wallets, which sellers must fund before buyers complete payment.

- Open an account with a popular P2P exchange like Binance and complete the KYC process.

- Click “P2P” under “Trade”, and search for USDT sellers that accept your preferred payment method and currency.

- Once the seller deposits USDT into Binance’s escrow wallet, complete the transfer.

- Go to the Binance spot exchange, search for “XRP”, and select the “XRP/USDT” trading pairs.

- Select a market or limit order, input the purchase amount, and confirm to swap USDT for XRP.

- Once you buy XRP from a P2P exchange, withdraw tokens to a private wallet for safe storage.

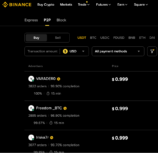

Buy USDT on a P2P platform like Binance before buying XRP. Source: Binance

The benefits of P2P trading include same-currency payments, access to domestic methods like bank transfers, and fast settlement times.

However, even the best P2P crypto exchanges lack direct support for XRP. Most traders buy Tether (USDT) and then swap it for XRP on the platform’s spot exchange.

Additional Methods

Here are some other ways to gain exposure to XRP in 2026:

- XRP ATMs: Thousands of crypto ATMs support XRP purchases. Find the nearest provider on CoinATMRadar, then insert cash notes into the kiosk. The ATM transfers your XRP tokens to a private wallet within minutes. Note that fees average 10-20%, which is significantly higher than anyone else.

- XRP ETFs: The Securities and Exchange Commission’s (SEC) decision on XRP spot ETFs is imminent. Approval enables retail clients and financial institutions to indirectly buy and sell XRP on regulated exchanges like the NASDAQ.

- XRP Derivatives: Another way to speculate on the XRP price is through derivative products. As the best crypto futures trading platforms offer margin facilities, users enter trades with high leverage. XRP derivatives provide no asset ownership, and ongoing fees hinder long-term strategies.

What Is XRP?

Founded by Ripple Labs in 2012, XRP is both a decentralized payment network and a cryptocurrency. The network enables banks and other financial institutions to conduct cross-border transfers with superior performance metrics.

Since XRP transactions settle in single-digit seconds at a small fraction of a cent, it provides a real alternative to SWIFT, which dominates the interbank sector. SWIFT handles several trillion dollars daily in global payments, despite cross-currency transactions often taking days to settle with high fees.

To streamline international transfers, XRP tokens act as a liquidity bridge. This framework helps institutions in emerging nations make cross-currency swaps without relying on correspondent banks.

XRP’s extensive banking partnerships highlight its long-term potential. Partnering institutions include Standard Chartered, PNC Bank, American Express, Bank of America, and J.P. Morgan.

Although Ripple Labs created XRP for the institutional space, anyone can use the network. Investors may purchase XRP from an online exchange, hold tokens in a private wallet, and transfer funds to other ecosystem users.

Why Should I Buy XRP?

Here are the core reasons why people buy XRP:

Investment Returns

Most stakeholders purchase XRP as an investment asset. Anyone can buy and sell XRP tokens on crypto exchanges, and market forces determine prices like other cryptocurrencies. XRP’s current price is XRP $1.42 24h volatility: 2.0% Market cap: $86.34 B Vol. 24h: $2.36 B .

Due to the network’s use cases, banking partnerships, and sector value, some investors may believe that XRP will deliver significant returns over time.

| Current price | $1.41 |

| 24h change | -2.29% |

| Market cap | $141.26B |

| Circulating supply | 99.99B |

| Total supply | 99.99B |

| All-time high | $3.84 |

Visit our live XRP dashboard to see today’s price, market cap, volume, and other data.

Since the token’s exchange inception in 2013, XRP has increased by more than 41,000%. However, remember that past performance is not a guarantee of future results.

Settlement Sector Potential

XRP aims to achieve 14% of SWIFT’s cross-border volume by 2030. As SWIFT handles approximately $7 trillion daily, XRP’s target would require almost $1 trillion in 24-hour transactions.

While these objectives are ambitious, XRP’s payment system supersedes SWIFT in most departments. SWIFT often requires several business days to process currency swaps from emerging nations, and its reliance on correspondent banks leads to high fees and excessive red tape.

XRP offers transaction settlement in 4-5 seconds with fees of just 0.00001 XRP (about $0.0000384 based on all-time high prices).

Liquidity Bridge

Financial institutions purchase XRP as a liquidity bridge for exotic foreign exchange transactions. This is because global markets offer limited liquidity for currencies such as TRY, IDR, and THB, resulting in substantial bid-ask spreads and payment delays.

By holding XRP, banks bridge any two fiat currencies for seamless transaction settlement.

Conclusion

There are many paths to buy XRP in 2026. Beginners are likely to find it easiest to use centralized exchanges or crypto wallets. But more experienced crypto users may venture into other methods.

Our research suggests that Binance is the overall best place to buy XRP in 2026. The established Tier 1 exchange offers competitive fees, excellent security, and lets verified users instantly purchase XRP with debit/credit cards from just $10.

The platform also supports P2P trading, which provides access to over 100 fiat currencies and more than 800 local payment methods.

Once you complete the trade, remember to withdraw XRP tokens to a private wallet with non-custodial storage. That gives you true asset ownership, avoiding counterparty risks that come with centralized exchanges.

FAQ

How do I buy XRP?

When is the best time to buy XRP?

How much XRP should I buy as a beginner?

What is the best platform to buy XRP?

Should I buy XRP?

What are the risks of buying XRP?

Is XRP taxed?

References

- XRP Ledger Documentation (XRP)

- Ripple’s Case Bodes Well for Other Crypto Companies Battling SEC (Bloomberg)

- XRP vs Bitcoin: The differences between two crypto giants (MoonPay)

- The 2025 McKinsey Global Payments Report: Competing systems, contested outcomes (McKinsey Insights)

- Unlocking $120 billion value in cross-border payments: How banks can leverage central bank digital currencies for corporates (J.P. Morgan)

Coinspeaker in Numbers

Monthly Users

Articles & Guides

Research Hours

Authors

The team behind IPO Genie has not yet announced an end date for the presale.

AI cryptocurrencies combine blockchain with artificial intelligence to power decentralized machine learning networks, GPU computin...

Fact-Checked by:

Fact-Checked by:

Otar Topuria

Crypto Editor, 39 postsI’m a crypto writer and analyst at Coinspeaker with over three years of experience covering fintech and the rapidly evolving cryptocurrency landscape. My work focuses on market movements, investment trends, and the narratives driving them, helping readers what is happening in the markets and why. In addition to Coinspeaker, my insights and analyses have been featured in other leading crypto and fintech publications, where I’ve built a reputation as a thoughtful and reliable voice in the industry.

My mission is to demystify the crypto markets and help readers navigate the noise, highlighting the stories and trends that truly matter. Before specializing in crypto, I worked in the IT sector, writing technical content on software development, digital innovation, and emerging technologies. That made me something of an expert in breaking down complex systems and explaining them in a clear, accessible way, skills I now find very useful when it comes to unpacking the intricate world of blockchain and digital assets.

I hold a Master’s degree in Comparative Literature, which sharpened my ability to analyze patterns, draw connections across disciplines, and communicate nuanced ideas. I’m particularly passionate about early-stage project discovery and crypto trading, areas where innovation meets opportunity. I enjoy exploring how new protocols, tokens, and DeFi projects aim to disrupt traditional systems, while also evaluating their potential risks and rewards. By combining market analysis with forward-looking research, I strive to provide readers with content that is both informative and actionable.