LiquidChain is a Layer 3 blockchain project that wants to unify the liquidity of Bitcoin, Ethereum, and Solana into a single execu...

Best Crypto Wallets for February 2026 – Top Wallets Compared

39 mins

39 mins The best crypto wallets in February 2026 start with Best Wallet as our top pick for retail users who actively manage crypto on mobile, including DeFi, swaps, and presales.

MetaMask and Phantom also rank highly for users focused on EVM (Ethereum Virtual Machine) and Solana ecosystems, thanks to wide dApp connectivity and a simple setup.

To build this list, we analyzed wallets using a clear methodology that scores security models, supported blockchains, user experience, pricing, and feature depth. Below is our updated comparison for February 2026 and the full breakdown by use case.

Key Takeaways on Crypto Wallets

- Crypto wallets come in various formats: desktop, mobile, browser, and hardware.

- In 2025, hot wallets accounted for approximately 78% of crypto wallet usage, with software wallet downloads exceeding 520M globally, according to CoinLaw research.

- Cold wallets (Trezor) are best for maximum offline security, and hot wallets (Best Wallet, MetaMask) enable faster DeFi access and everyday transactions.

- When choosing, consider security, custody type, supported blockchains, and UX.

- For safety, never share your seed phrase or private key with anyone.

11 Best Crypto Wallets to Use in February 2026

Here’s a curated list of the best crypto wallets for investors in 2026:

- Best Wallet – The overall best crypto wallet app for iOS and Android users

- Walletium – Telegram-native multi-chain wallet without KYC

- MetaMask – The most popular browser wallet for Ethereum and EVM-based tokens

- Phantom – Highly rated hot wallet and mobile app specializing in Solana

- Trust Wallet – Globally popular app supporting over 100 blockchains

- Base App – A good option for first-timers seeking non-custodial storage

- Binance Wallet – Best option for users of the Binance CEX and BNB chain

- Trezor Safe 5 – Best hardware solution for long-term holders and large portfolios

- Electrum – The best open-source desktop wallet for safely storing Bitcoin

- Zengo – Flexible crypto wallet with multi-party computation for security

- Exodus – Great choice for storing cryptocurrencies on Windows or Mac

Best Crypto Wallets for Beginners

If you’re new to crypto, then we recommend you try one or more wallets from our top wallet picks.

1. Best Wallet (4.9⭐) – Our Top Wallet Pick for Storing Cryptocurrencies on a Mobile Device

Best Wallet is a non-custodial Web3 wallet for iOS and Android, with a launchpad for crypto presales. It supports multiple blockchains, including Bitcoin, and the app has cross-chain swaps and staking. Due to Multi-Party Computation (MPC), users can set up a wallet with just an email address without needing to manage seed phrases.

Best for: Web3 users, people who don’t want to do KYC, presale buyers

Our Experience: We found Best Wallet really easy to use, thanks to the built-in swaps and easy fiat onramping, which is provided by Onramper. We also liked that it clearly shows all your wallets, including one for airdrops, which makes tracking a lot easier. It’s very easy to use a dApp like Lido for DeFi.

The Best Wallet app features a simple interface with swaps. Source: Best Wallet

| Type | Non‑custodial mobile wallet |

| Chains | Multiple (supports 1,000+ cryptocurrencies) |

| Standout Use | Launchpad/presale access |

| CER Security Rating | – |

| CertiK Skynet Score | 70.02 (BBB) |

| Star Rating | 4.9/5 |

| Price | Free |

2. Walletium (4.7⭐) – Telegram-Based Crypto Wallet with Hybrid Key Management

Walletium is a multi-chain hybrid crypto wallet that operates within the Telegram environment. It is building an ecosystem that lets you hold, swap, and spend crypto without leaving your Telegram chat window. One of the main features is the wallet’s hybrid model, which allows you to choose between a custodial or a non-custodial configuration.

Best for: Telegram users, Web3 users

Our Experience: We found that the initial setup via the Telegram bot was quick, with no KYC required. While Walletium uses Telegram’s convenience, it also operates as an independent service and is available as both a Web App and a Progressive Web App (PWA).

Walletium features a flexible staking option for TEX tokens. Source: Walletium

| Type | Hybrid (custodial/ non-custodial) |

| Chains | BTC, ETH, BNB, TON, TRX, and SOL |

| Standout Use | Telegram integration, Mild Staking |

| CER Security Rating | – |

| CertiK Skynet Score | – |

| Star Rating | 4.7/5 |

| Price | Free |

3. MetaMask (4.5⭐) – Top-Rated Hot Wallet Extension with Over 100 Million Users Worldwide

MetaMask is a non-custodial wallet, available for mobile and web browsers. It supports EVM-compatible chains. Solana is supported, but can be difficult to use. MetaMask includes a built-in DEX, cross-chain swaps, NFT support, and a fiat on-ramp.

Best for: Beginners looking for a user-friendly interface and simple token swaps

Our Experience: Most of us have used or use MetaMask, so it feels familiar, even if newer wallets might look a little slicker. Mobile is the simplest of the three solutions they offer, and the phone app offers a place to get boosted points for their LINEA airdrop. We were impressed to see that they’ve added support for the Bitcoin blockchain; however, when we tried to swap $5 from Arbitrum to Bitcoin, the price impact was huge, implying low liquidity.

In addition to standard functions, MetaMask offers access to DeFi and NFT storage. Source: MetaMask

| Type | Non-custodial browser & mobile wallet |

| Chains | EVM chains (ETH, BNB, Polygon, Arbitrum, etc.) and now Solana and Bitcoin |

| Standout Use | DeFi, dApps, NFT access, token swaps |

| CER Security Rating | AA-AAA |

| CertiK Skynet Score | 89.81 (AA) |

| Star Rating | 4.5/5 |

| Price | Free |

4. Phantom (4.7⭐) – Free Mobile and Browser Wallet for the Solana Ecosystem

Phantom is a Web3 wallet that started on Solana and is now a multi-chain app and browser extension. There are built-in swaps via Solana DEXs like Jupiter.

The mobile app has a 4.8 rating on Google Play with 130K reviews and over 10M downloads (January 2026), making Phantom a strong choice.

Best for: People who primarily trade on Solana

Our Experience: We decided to test Phantom’s browser extension since we’d heard mixed things. What we found is that while it lacks advanced features, it works really well for managing wallet addresses (called accounts) in a simple way. Basic functions are all there, and while the icons at the bottom aren’t as intuitive as they could be, it’s still a simple and distraction-free experience.

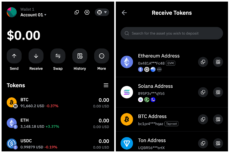

Phantom is primarily focused on Solana but also supports other blockchains. Source: Phantom

| Type | Non-custodial browser & mobile wallet |

| Chains | SOL, ETH, Polygon, Base, Bitcoin, Sui |

| Standout Use | Solana trading on mobile |

| CER Security Rating | – |

| CertiK Skynet Score | 85.76 (A) |

| Star Rating | 4.7/5 |

| Price | Free |

5. Trust Wallet (4.4⭐) – Highly Rated for Managing a Diversified Portfolio

Trust Wallet is a non-custodial mobile wallet that provides a decent multichain trading experience. It supports over 100 blockchains. There is a dApp browser, and WalletConnect enables quick access to DeFi apps like Pancakeswap and NFT marketplaces.

Best for: Users seeking a widely used wallet with good safety features

Trust Wallet has over 210 million installs and over $750M locked in staking.

Our Experience: Although Trust Wallet was first to have a multicoin wallet, and does it with a smoother interface than MetaMask, we noticed that it didn’t see all of our coins, unlike MetaMask. Nevertheless, we liked using it, and the earn feature makes it very easy to stake your coins. Staking them via Web3 protocols will earn you slightly more interest, but this is a low-hassle way to get a decent APR.

Trust Wallet offers Alpha Tokens on the app’s main screen. Source: Trust Wallet

| Type | Non-custodial mobile & browser wallet |

| Chains | 100+ |

| Standout Use | Multi-chain access, in-app swaps |

| CER Security Rating | AAA |

| CertiK Skynet Score | 91.96 (AA) |

| Star Rating | 4.4/5 |

| Price | Free |

6. Base App (4.3⭐) – User-Friendly Non-Custodial Crypto Wallet Tied to Coinbase

Base App (formerly Coinbase Wallet) is a non-custodial mobile wallet. After last year’s rebrand, it’s now a so-called “everything app”, combining standard wallet features, like swaps, with social chat and mini-apps.

Best for: Coinbase CEX users, BASE blockchain users

Our Experience: Although our team has previously tested the Coinbase wallet, when we tried to sign up for the new Base App, we were put on a waitlist. It’s hard to know if this is legitimate scarcity or a marketing tactic, but for now, we’ll have to wait and see.

Base App’s simple, user-friendly interface shows multiple currencies and QR codes for easy transfers. Source: Base

| Type | Non-custodial mobile & browser wallet |

| Chains | BTC, ETH, SOL, DOGE, and all EVM-compatible chains |

| Standout Use | Easy onboarding and on-ramping |

| CER Security Rating | AAA |

| CertiK Skynet Score | 84.84 (A) |

| Star Rating | 4.3/5 |

| Price | Free |

7. Binance Wallet (4.1⭐) – Best Wallet for Beginners in the Binance Ecosystem

Binance Wallet is a Web3 self-custody wallet integrated in the Binance app. It uses MPC to remove the need to remember seed phrases and allows users to export their wallet to a traditional private key type in case of emergency. It connects to multiple chains and dApps with a built-in DEX, cross-chain swaps, and the Binance Alpha launchpad.

Best for: Binance users who want a web3 option available on mobile, web, and through a browser extension

Our Experience: The Binance Wallet feels very similar to a DEX or CEX, which makes it feel a bit confusing in comparison to other Web3 wallets, especially as you can log in with your Binance account. But this may provide an enhanced experience for CEX users getting started with web3.

To switch to Binance Wallet, you just need to use the swap option at the top of the exchange app. Source: Binance Wallet

| Type | Exchange-linked Web3 wallet |

| Chains | 300+ blockchains and thousands of tokens |

| Standout Use | Integration with Binance exchange, staking, fiat on-ramps |

| CER Security Rating | – |

| CertiK Skynet Score | 91.59 (AA) |

| Star Rating | 4.1/5 |

| Price | Free |

Visit Binance Wallet’s Official Website

Best Crypto Wallets for Advanced Users

If you’ve been around for a while or want to do more with your crypto, or maximise safety, then try these.

1. Trezor Safe 5 (4.8⭐) – Multi-Currency Hardware Wallet with Institutional-Grade Security

Trezor Safe 5 is an open-source hardware wallet with a touchscreen. It stores private keys offline and requires on-device confirmation for each transaction for maximum security. There’s support for thousands of coins. The Safe 5 is around $169, while the Safe 3 is approximately $79, and the Model One is $49.

Best for: Users who want a high-end hardware wallet and maximum security, especially for long-term holders and those with large portfolios

Our Experience: Using Trezor feels good from a safety perspective, with randomised on-screen PIN buttons (and other safety features) so that even if someone is looking over your shoulder, it would be hard for them to guess. This makes it a great wallet for safety and long-term storage, but if you try to do a lot of transactions, such as in DeFi, the extra steps get tiring fast.

The Trezor Safe 5 comes with a 1.54-inch 240×240 px color touchscreen. Source: YouTube

| Type | Non-custodial hardware wallet |

| Chains | 8,000+ |

| Standout Use | Safety through offline storage |

| CER Security Rating | – |

| CertiK Skynet Score | – |

| Star Rating | 4.8/5 |

| Cost | $49–$169 |

| Size | 2.6 × 1.6 × 0.3 inches |

2. Electrum (4.2⭐) – An Original Bitcoin Wallet Aimed at Long-Term Holders

Electrum is an open-source, time-tested wallet, built exclusively for Bitcoin. True to cypherpunk ideals, it’s non-custodial, and keys are stored locally. There are no swaps or on-ramps as the focus is on secure BTC storage. Electrum supports hardware wallets or creating an offline wallet for ultimate security. It’s available on Windows, macOS, and Linux.

Best for: Bitcoin maxis who value advanced security features like multisig and view-only wallet modes

Our Experience: Using Electrum certainly feels like going back in time. The initial setup is easy and gives you various options from a standard wallet to 2FA and more. The basic interface is simple, but so simple that it can be daunting to those who don’t know what they are doing. There are advanced features such as ‘channel’ and ‘console’, which we weren’t sure what they were for, but you can just ignore them to do basic sending and receiving of Bitcoin.

The Electrum wallet screen has a retro design as a nod to its roots. Source: Electrum

| Type | Non-custodial desktop & mobile wallet |

| Chains | Bitcoin only |

| Standout Use | Lightweight, fast, privacy-focused BTC storage |

| CER Security Rating | DD |

| CertiK Skynet Score | 70.26 (BBB) |

| Star Rating | 4.2/5 |

| Price | Free |

3. Zengo (4.6⭐) – Enhanced Safety Ideal for Beginners Who Want to Actively Use Web3

Zengo is a non-custodial wallet that replaces seed phrases with MPC. This means you can recover your account using 3FA: 3D face biometrics, a cloud-stored recovery file, and an email magic link. The core wallet is free. Zengo Pro adds a firewall, risk alerts, theft protection systems, and an inheritance feature.

Best for: Users who want a hot wallet that has extra security layers

Our Experience: You have to sign up for both the desktop and the mobile app to unlock all the features of the wallet, which seemed unnecessary. However, the interface feels super easy to use and see, with quick but helpful explainers and a clear menu with big text. Some of the team were so impressed that since testing, they have added Zengo to their commonly used wallets.

In addition to sending, receiving, and swaps, Zengo provides access to Top Dapps. Source: Zengo

| Type | Non-custodial mobile wallet |

| Chains | BTC, and EVM-compatible blockchains |

| Standout Use | Keyless recovery |

| CER Security Rating | AAA |

| CertiK Skynet Score | 85.19 (A) |

| Star Rating | 4.6/5 |

| Price | Core Wallet is free. Pro Plan – $49.99 a year |

4. Exodus (4.5⭐) – Free and Secure Crypto Storage via User-Friendly Desktop Software

Exodus is a non-custodial wallet for Windows and macOS, and also mobile. Its features include ease of use and supporting 50 blockchains+, a broad range of cryptocurrencies, and custom tokens. The desktop app has a portfolio tracker and staking, where available. Users can on-ramp fiat through card, bank, PayPal, Apple Pay, or Google Pay.

Best for: Users who want wallet access on desktop, mobile, and browsers, and those who value a clean and intuitive UI

Our Experience: We found that Exodus does what it promises, easy access to the wallet and built-in swaps. The interface has flashy colors, but is pretty simple, making this a good choice for beginners who don’t want too many features, but rather prefer simplicity and some short tutorials.

The Exodus mobile app stands out with its modern design but offers only basic functionality. Source: Exodus

| Type | Non-custodial desktop and mobile wallet |

| Chains | 50+ (BTC, ETH, SOL, BNB, AVAX, etc.) |

| Standout Use | Ease of use, portfolio tracking |

| CER Security Rating | AAA |

| CertiK Skynet Score | 85.40 (A) |

| Star Rating | 4.5/5 |

| Price | Free |

Wallets That Didn’t Quite Make the Cut

While the following wallets didn’t make our Top 10, they each bring unique strengths for specific use cases, such as Tangem’s physical card for safety while trading, or Ledger’s Bluetooth and connectivity options.

1. Ledger Stax – Advanced Cold Wallet for Long-Term Crypto Security

Ledger Stax is Ledger’s premium hardware wallet. It has an e-Ink touchscreen, Bluetooth, and USB-C connectivity, and can be used with a mobile. The device costs around $399 (January 2026) and measures 3.35 × 2.13 × 0.24 inches.

The Ledger Stax wallet display is a lot smaller than a smartphone. Source: Ledger

- Why it fell short: Ledger’s proprietary nature means that users must place trust in the company. A recent security breach exposed users’ physical addresses.

- Stronger option: Trezor is the cold wallet of choice for many, as its open-source nature gives it more transparency.

2. Bybit Wallet – In-App Web3 Wallet and Chrome Extension for Bybit Users

Bybit Wallet is a self-custody Web3 wallet in the Bybit CEX app. It offers DEX routing and cross-chain swaps for low fees. It supports 30+ blockchains, has an app, and a Chrome extension.

Like most exchange-based wallets, Bybit Wallet offers only basic functionality. Source: Bybit

- Why it fell short: Although it’s a decentralized wallet, ties to the Bybit exchange (and the February $1.5B hack) make it less appealing than independent Web3 wallets.

- Stronger option: Best Wallet offers similar features, such as access to airdrops, and without KYC.

3. Margex Wallet – Exchange-Linked Self-Custody for Active Traders

Margex Wallet bridges centralized and decentralized trading, letting users move funds between spot, futures, and Web3 with one login. It supports MPC security, simple swaps, and in-wallet access to staking and yield tools.

Margex Wallet offers a classic exchange-style interface with staking and converter. Source: Margex Wallet

- Why it fell short: The wallet is tightly bound to the Margex platform, which limits its appeal for users seeking independent non-custodial storage.

- Stronger option: Zengo offers a more advanced self-custody setup.

4. Tangem – Card-Based Hardware Wallet with NFC Simplicity

Tangem stores private keys offline on a physical card. This keeps it off the internet and safer from hacks, while enabling the ability to quickly tap to approve transactions on a mobile device. The device costs around $55 (January 2026) and measures 3.37 × 2.13 × 0.04 inches.

The Tangem looks like a regular bank card, which can be convenient for storage. Source: YouTube

- Why it fell short: Limited ecosystem integrations reduce flexibility for advanced users.

- Stronger option: Trezor offers more advanced features than Tangem.

Top Crypto Wallets Compared

The best crypto wallets in 2026 are compared below:

| Crypto Wallet | Wallet Type | Device Type | Supported Chains | Price | Exchange Integration |

| Best Wallet | Hot | Mobile | Bitcoin, Ethereum, EVM chains, and Solana | Free | Yes – native DEX |

| MetaMask | Hot | Browser extension, mobile, web app | Ethereum and all EVM blockchains. Solana | Free | Yes – third-party support |

| Phantom | Hot | Browser extension, mobile, web app | Solana, Bitcoin, Ethereum, and several EVM blockchains | Free | Yes – third-party support |

| Trust Wallet | Hot | Browser extension, mobile | 100+ blockchains, including Bitcoin and Ethereum | Free | Yes – third-party support |

| Base App | Hot | Browser extension, mobile | Bitcoin, Ethereum, Solana, Dogecoin, and all EVM blockchains | Free | Yes – Coinbase CEX |

| Binance Wallet | Hot | Mobile, web, browser extension | 300+ blockchains and thousands of tokens | Free | Yes – Binance CEX |

| Trezor Safe 5 | Cold | Hardware | 20+, including Bitcoin, Solana, and Cardano | $169 | Yes – third-party support |

| Electrum | Hot | Desktop, mobile (Android only) | Bitcoin | Free | No |

| Zengo | Hot | Mobile, desktop | Bitcoin, Dogecoin, TRON, Ethereum, and several EVM blockchains | Free (paid plan offered) | Yes – third-party support |

| Exodus | Hot | Desktop, mobile, browser extension | 50+, including Bitcoin, BNB Chain, and XRP | Free | Yes – third-party support |

Best Crypto Wallet by Use Case

Whether you’re focused on DeFi, Bitcoin security, or trading meme coins, some wallets are better suited for specific goals. Here’s a quick guide to help you choose:

| Use Case | Wallet | Why |

| Mobile DeFi | Best Wallet | Easy to use, Presale access |

| EVM & dApps | MetaMask | Browser app is good |

| Solana trading | Phantom | SPL, swaps, NFTs |

| All-in-one mobile | Trust Wallet | 100+ chains, simple UI |

| CEX-integrated Web3 | Base App | Coinbase users, BASE users |

| CEX-to-Web3 bridge | Binance Wallet | MPC, dApp browser, on or off ramp |

Which Wallet Is Right for You?

The most universal choice among the best crypto wallets in 2026 is Best Wallet, thanks to secure non-custodial storage and access to swaps, NFTs, and dApps. Below, we break down which wallet to choose depending on different usage scenarios.

For Beginners

For newcomers to crypto, all-in-one options like Best Wallet and Trust Wallet are a good fit. If you need something even simpler, Binance Wallet is a solid choice, since all you need is the exchange app.

For Storing More Than $10,000

Users with larger capital should definitely look at hardware wallets. Trezor Safe 5 and Ledger Stax store keys offline on separate devices, which is much safer than any hot wallet.

For Bitcoin Maximalists

Electrum is built specifically for storing the first cryptocurrency and does not include extra features. However, it is a hot wallet, so Trezor Safe 5 and Ledger Stax are still safer options, though they do require a purchase.

For Exchange Users

Choose your exchange’s wallet. If you use Bybit, go with Bybit Wallet. If you prefer Binance, your funds will be stored in Binance Wallet. Just keep security in mind and do not use exchange wallets to store large amounts.

For Web3 Users

Best Wallet and Trust Wallet provide access to swaps, staking, NFTs, dApps, and many other features. If you are focused on Ethereum, you should also look at MetaMask. If you are a fan of the Solana ecosystem, Phantom is the right choice.

As you can see, choosing the best wallet depends on your goals and usage scenarios. Someone who plans to invest a large amount in Bitcoin and hold it for years does not need a multifunctional wallet; reliability and security matter most. At the same time, active crypto users cannot rely on hardware wallets alone.

How We Chose the Best Crypto Wallets – Our Methodology

To find the best crypto wallets for 2026, we followed a structured and data-backed review process. It uses both objective performance metrics and real experiences. Our methodology combines reviewing for technical analysis, user feedback, security audits, and hands-on testing to provide recommendations for various use cases.

1. Security and Custody Model (35%)

Security is the most important factor for a crypto wallet. We focused on wallets that provide strong protection for private keys through non-custodial architecture, MPC, or hardware isolation. We considered the trade-off to user experience. To quantify this, we referenced independent security benchmarks like the CER Security Rating and CertiK Skynet Score.

2. Chain and Token Support (15%)

We assessed wallets for their ability to support major Layer 1 and Layer 2 blockchains, including EVM chains like Ethereum, Polygon, BNB Chain, Base, but also Bitcoin, Solana, and support for custom coins. Extra points were awarded to wallets that can manage cross-chain portfolios.

3. User Experience and Accessibility (15%)

Ease of use is vital. We evaluated how easy (or not) it was to get started, the clarity of the interface, swap functionality, and mobile vs. desktop experience. Wallets like Exodus scored highly for the clean UI and beginner-readiness, while Best Wallet and Phantom excelled in mobile DeFi access.

4. DeFi and dApp Integration (15%)

We tested each wallet’s ability to interact with decentralized applications, DEXs, NFT marketplaces, and staking protocols. MetaMask, Trust Wallet, Phantom, and Best Wallet performed well here due to native integrations and reliable connections with platforms like Uniswap, Jupiter, and OpenSea.

5. Pricing and Fees (10%)

All wallets were reviewed for hidden costs, including fiat on-ramp fees and fee markups. We highlighted those that offer core features for free (like Electrum or Base App) and flagged wallets with high purchase or swap fees. We also considered the usefulness of paid features such as Zengo’s inheritance system for abandoned wallets or access to customer service.

6. Reputation and Longevity (10%)

We examined developer activity, open-source status, and community trust alongside external security indicators like CER and CertiK ratings, which provide ongoing transparency into project reliability. Long-standing wallets such as Electrum, MetaMask, and Trezor scored higher for proven stability and a clean security record.

Together, these criteria shaped our final list, ensuring a balance between security, usability, features, and performance.

What Is a Crypto Wallet?

A crypto wallet is a digital tool that allows you to securely store, send, and receive cryptocurrencies. Whether you’re holding Bitcoin, Dogecoin, or Solana, a wallet is essential for managing your cryptocurrencies and interacting with the blockchain.

Think of it like a bank account, but for crypto, not fiat. The key advantage, especially when using a non-custodial wallet, is that you retain full control of your funds. This means no centralized third party (like an exchange) can access your cryptocurrencies or block transactions.

Crypto wallets also unlock access to Web3: dApps, DeFi, token swaps, and NFTs.

Without a self-custodial wallet, you’ll need to rely on custodians such as exchanges like Binance. In those cases, they control the private keys, limiting your ability to move funds freely. By contrast, non-custodial wallets eliminate that counterparty risk, giving you full ownership and flexibility, but also responsibility.

How Do Crypto Wallets Work?

Crypto wallets generate and manage a pair of cryptographic keys: a public address used to send and receive funds, and a private key that authorizes transactions. When you send crypto, the wallet signs a transaction with your private key and broadcasts it to the blockchain for verification.

Below, we’ll explain how wallet addresses, private keys, and backup passphrases interact to secure and recover your cryptocurrencies.

Wallet Addresses

Wallet addresses are a bit like bank account numbers, allowing users to receive cryptocurrencies from another location. The address will be unique to your crypto wallet, generated when creating it.

Example of a wallet address offering a QR code to avoid copy and paste mistakes when transferring crypto. Source: Best Wallet

Wallet addresses are usually long and complex, containing upper/lowercase letters and numbers.

For example, here’s what an example Bitcoin wallet address looks like:

- 3PXBET2GrTwCamkeDzKCx8DeGDyrbuGKoc

Ethereum Virtual Machine addresses usually start with 0x and look like this:

- 0x95222290dd7278aa3ddd389cc1e1d165cc4bafe5

Now, wallet addresses can only be used to receive cryptocurrencies, so you can safely give them to others. However, wallet addresses are trackable on the blockchain, meaning anyone can check your balance and trading history.

Private Keys

Private keys are a secret string of numbers and letters that are unique to the wallet. Keeping private keys secure is vital, as whoever holds them has full control of the wallet. Back up your private key!

This is where custodianship comes into the equation:

- Non-custodial wallets like MetaMask ensure that only the user can access the private keys. This is like storing crypto in a safe, with only the owner knowing its combination.

- Custodian wallets are more aligned with traditional bank accounts. The custodian holds the private keys and will help you to recover your account if necessary.

- Private keys are highly sought-after by crypto hackers. A successful breach will mean the hacker can access the wallet and withdraw the funds. There will be no accountability, as wallet hacks are anonymous.

Backup Seedphrase/Wallet Words

You should also understand the role of seed phrases or wallet words when choosing the best crypto wallet. Most providers offer a 12-word passphrase, aka seed phrase, which, just like private keys, is unique to the wallet.

Backup passphrases enable users to recover the wallet balance if access is no longer possible.

- For example, suppose you’re using a desktop wallet, but the laptop storing it is stolen.

- You could download the same software wallet and import the backup passphrase.

- The original wallet balance will now be available on the new device.

Just like private keys, keeping the backup passphrase secure is vital. Misplacing it will mean your wallet funds can be stolen.

Why Do You Need a Crypto Wallet?

You need a crypto wallet because it’s the only way to truly own, store, and control your cryptocurrencies. A wallet enables transfers without intermediaries and connects you to decentralized finance and Web3.

Centralized exchanges let you trade without one, but relying on them means surrendering control and missing out on opportunities, from using dApps, receiving staking rewards, (most staking rewards on CEXs are lower than rewards from staking directly on-chain).

You’ll also need a crypto wallet to participate in upcoming crypto ICOs, join crypto airdrops, and get new crypto coins, since most token launches require direct on-chain interaction for contribution and claim steps.

Portfolio Tracking and Management

Crypto wallets help to track and manage your portfolio, especially when holding cryptocurrencies from multiple blockchains and protocols.

The best crypto wallets support dozens of blockchains, so that all investments can be managed from one place. You can normally view real-time portfolio data, displayed in your preferred currency. However, only certain wallets can see DeFi activities, so you may find a portfolio checker like Zerion or Debank useful.

Some crypto wallets come with built-in trading tools, too. However, be aware of swap fees before, as there is often a markup. If you’re comfortable using a DEX, you can usually get better prices from aggregators like DeFiLlama swap for EVM chains or Jupiter for Solana.

Types of Crypto Wallets

While all wallets serve the same basic purpose, they can offer vastly different features, security measures, and token offerings. They are typically split into four main categories: custodial wallets, non-custodial wallets, hot wallets, and cold wallets.

Here’s a quick breakdown of the main types of crypto wallets that you need to know about.

| Wallet Type | Internet Connection | Key Ownership | Best For | Example |

| Hot Wallet | Always connected | You (non-custodial) or third party | Active use, DeFi, quick access | MetaMask/Phantom |

| Cold Wallet | Offline | You (non-custodial) | Long-term storage, high security | Trezor/Tangem |

| Custodial Wallet | Online | Third party (e.g., exchange) | Beginners, convenience | CEX like Kraken or Binance |

| Non-Custodial Wallet | Online or offline | You | Full control, DeFi, self-custody | Most decentralized wallets |

Here’s more info to help explore the various wallet types: hot vs cold, and custodial vs non-custodial, to help you make the correct choice for your needs.

Hot vs Cold Wallet

Hot and cold wallets offer unique advantages and trade-offs that suit different needs.

Hot Wallets – Best for Active Crypto Investors

Hot wallets are always connected to the internet, so transacting is ideally easy. Options include mobile apps, browser extensions, and desktop software. This means immediate access to your crypto.

For example, the best crypto wallets are often made for iOS and Android smartphones. This means you can send and receive crypto from any place. Hot wallets also grant access to DeFi and dApps.

However, there is a downside when it comes to security. Because of their connection to the internet, they are vulnerable to hacking attempts. Risks include viruses, malware, keyloggers, phishing, social engineering, and smart contract hacks, leading to wallets being drained.

Cold Wallets – Best for Storing Large Amounts

Cold wallets are designed with security first. The private keys are stored within a physical device, which is never connected to the internet. By extension, this eliminates online hacking attempts.

When people want to use their cold wallet, transactions are usually confirmed via a USB-C cable or Bluetooth. The user physically enters a PIN on the device before any transactions are authorized.

SafePal cold wallet in action, entering a recovery word on the device for offline key storage and transaction signing. Source: SafePal

This means the wallet funds are safe even if the hardware device is stolen. Recovery is possible remotely by entering the backup passphrase from another wallet (hot or cold). However, while cold wallets provide institutional-grade security, they’re cumbersome for active traders to manage as each transaction needs to be signed with a long process.

When cold wallets are unhelpful:

- For example, suppose you’re on a long daily commute and read about a new meme coin.

- You want to buy that meme coin, but can’t do so until you get home. This is because the transaction can only be verified on the hardware device itself.

- The meme coin markets move quickly, so the opportunity could have been lost by the time wallet access is available.

Now compare the experience when using a mobile crypto app. As long as you have your phone, it takes seconds to make a trade.

Custodial vs Non-Custodial Wallet

Choosing between a custodial and non-custodial wallet is an even more important choice. This determines who holds and controls the private keys, and therefore who truly holds the crypto.

Custodial Wallets – Allow a Third-Party to Control Your Private Keys

With custodial wallets, you’re entrusting your cryptocurrencies with a centralized third party. The majority of custodial wallets are offered by exchanges, with popular providers including Gemini, Binance, and Kraken.

Here’s an overview of how custodial wallets work:

- Suppose you buy Bitcoin with a credit card on Kraken.

- That Bitcoin is then added to your Kraken wallet. You can view the Bitcoin balance at any time by logging into the Kraken account.

- However, only Kraken has control of the wallet’s private keys.

- So, if you want to transact, you need to place a request and wait for Kraken to approve it.

- Only then will the Bitcoins be released.

The issue is here control. Unlike non-custodial wallets, you can’t freely make transfers, let alone connect with DeFi ecosystems. While Kraken is a legitimate exchange with enhanced security, the same thing was said about FTX before it went bankrupt.

Crypto exchanges can also be hacked, which could impact any stored cryptocurrencies.

Non-Custodial Wallets – Truly Build Crypto Wealth Through Private Key Ownership

The only way to truly own your cryptocurrencies is with a non-custodial wallet. Once you download the preferred wallet, the private keys will be encrypted and stored on your mobile, hardware, or desktop device. Nobody else, including the provider, can access the private keys.

You can send and receive cryptocurrencies at any time; permission from third-party custodians isn’t needed. Moreover, you won’t get a KYC request with threats of account closure. Any stored cryptocurrencies are yours to store, transfer, or trade.

However, there is a drawback to consider. While having full control is a major perk, you’re also solely responsible for security. Mistakes will be costly, such as connecting the wallet to a malicious platform. Stolen funds will be unrecoverable, so following wallet best practices is a must.

How to Pick a Crypto Wallet

You should pick a crypto wallet based on how you plan to use your cryptocurrencies (long-term storage, active trading, or DeFi participation), while prioritizing security, supported blockchains, and usability. Below, you’ll know what that means in practice and what to compare before making your choice.

Wallet Type and Custodianship

- Those storing large amounts of Bitcoin should get a hardware device like the Trezor Safe 5.

- Those looking to actively trade Solana meme coins will prefer a hot wallet app like Phantom.

Available Blockchains and Supported Cryptocurrencies

The best crypto wallets support a wide range of cryptocurrencies and blockchains. This makes it easy to actively store and trade tokens across different ecosystems.

List of blockchains and cryptocurrencies in the Best Wallet app. Source: Best Wallet

However, not all wallets are compatible with such a broad selection of blockchains. Some, such as Electrum, only support Bitcoin.

Security

After choosing a recommended wallet, consider additional safeguards like two or three-factor authentication, facial ID, multisig permissions, and address whitelisting. Specific security controls can vary depending on the crypto wallet type.

Pricing

You won’t need to pay fees to install a wallet unless you’re purchasing a hardware device, or you want to add on features with a subscription like the one offered by Zengo.

No fees are required when receiving or storing cryptocurrencies, regardless of the wallet type.

How to Get a Crypto Wallet

After choosing the best crypto wallet, the next step is getting everything set up.

Here’s an overview of the required steps when using a hot wallet:

- Step 1: Download the Wallet. First, download the chosen wallet to your device, whether that’s a desktop or mobile.

- Step 2: Secure the Wallet. You’ll likely be asked to choose a PIN/password or biometrics. Writing down the backup passphrase is also crucial.

Follow these steps when using a cold wallet:

- Step 1: Purchase a Hardware Wallet. Purchase a hardware wallet directly from the manufacturer. This ensures you’re buying a legitimate wallet that hasn’t been tampered with.

- Step 2: Download the Wallet’s Software. Ensure you’re downloading the software directly from the manufacturer’s website.

- Step 3: Secure the Wallet. Now complete the security steps, such as choosing a PIN and writing down the backup passphrase.

If you’re just getting started, see our explainer on how to buy crypto.

How to Check a Crypto Wallet is Safe

Safety should always be the priority when choosing the best wallet for crypto.

Here’s what to check when selecting a provider:

- Public Reviews: Researching public reviews is one of the most effective safety strategies. The best crypto wallets have positive reviews across multiple platforms. Reviews should have validity, meaning they’re based on thousands of independent ratings.

- Open-Source: The safest crypto wallets are often open-source. This means the wallet’s code is publicly viewable, allowing the developer community to scrutinize it. Open-source wallets also benefit from fast patches when vulnerabilities are discovered.

- Always go directly to the wallet provider: Whether you’re buying a hardware device or downloading a free browser-based wallet, always go directly to the source. Never obtain a wallet from a third party – it could be fake. This means any cryptocurrencies deposited could be immediately compromised.

- Audits: Some wallets have been audited by reputable security firms, adding an extra layer of credibility.

- Time in the Market: Another safety check is to assess when the wallet was launched. Established wallets are often preferred, considering they have a longer track record. You should also avoid wallets that have previously been hacked.

Wallet Best Practices to Avoid Costly Mistakes

No crypto wallet is 100% immune to hacks or mistakes. Following wallet best practices is a must.

Here’s what you need to know:

- Use Separate Devices or Logins: If possible, it’s always best to use a separate device or login account specifically for storing and managing cryptocurrencies. You’ll reduce the risks of downloading viruses or clicking on malicious links.

- Use Two-Factor Authentication: A code will be sent to the primary device when verifying transactions (e.g., an SMS). This means both devices would need to be compromised for a hacking attempt to succeed.

- Using the Right Blockchain: Another common mistake is sending cryptocurrencies to the wrong chain. For example, sending Ethereum to a Solana address. There is no way to recover the funds when incorrect blockchains are used, so always double-check.

- Be careful when approving transactions: A big part of wallet security is being careful about what links you click and which websites you connect to. For safety, regularly revoke smart contract access that you no longer need.

Crypto Wallet Market Trends & Analysis (February 2026)

In February 2026, there have been some important developments in crypto wallet technology, affecting user security and product functionalities. Our curated insights explain what these updates mean for you.

MetaMask Adds TRON Network Support

MetaMask has integrated support for the TRON blockchain in its mobile app and browser extension. Users can now manage TRC-20 tokens and stake TRX via the mobile app, with staking providing Bandwidth and Energy to cover network fees. A TRON address is automatically created within the multichain account after updating the app.

Takeaway: MetaMask’s TRON integration signals deeper multichain wallet competition and growing focus on high-volume stablecoin networks.

Rumble Launches Non-Custodial Wallet With Tether Support

Rumble has launched a built-in non-custodial wallet supporting Bitcoin, USDT, and Tether Gold, allowing viewers to tip creators directly without intermediaries. The wallet uses MoonPay for fiat on- and off-ramps and is the first product built with Tether’s Wallet Development Kit.

Takeaway: Creator platforms are using self-custody wallets to enable direct, global payments.

Trust Wallet Faces Surge of False Claims After Hack

Trust Wallet identified 2,596 compromised addresses after a December browser extension hack, but received nearly 5,000 compensation claims, suggesting widespread duplicates or fraud attempts. The $7 million incident has slowed reimbursements as the team prioritizes accurate verification.

Takeaway: Wallet hacks expose not only security risks but also the complexity of post-incident reimbursements.

Investment Risk Warning

Crypto offers real innovation, but the risks are structural. Prices are highly volatile, 50% drawdowns can happen even in major cryptocurrencies, and there is no FDIC-style insurance. If a wallet is hacked, a device fails, or you lose a seed phrase, funds are typically gone for good. Regulation also remains changeable worldwide, so new rules or enforcement can change or restrict crypto access, force delistings, or change how wallets and tokens operate.

Conclusion

Choosing the right wallet is an important step when investing in the crypto markets. Non-custodial wallets are always recommended, ensuring you own and control the purchased crypto.

We found that Best Wallet is a solid choice in 2026, especially if you prefer managing cryptocurrencies on a user-friendly app. Security features include biometrics and MPC. Best Wallet also offers staking rewards and instant token swaps, and early access to presale tokens.

FAQ

What is the best crypto wallet?

How do I create a crypto wallet?

Are crypto wallets anonymous?

Is my money safe in a crypto wallet?

How do I pick a crypto wallet?

Do I need a wallet to buy crypto?

What is a cold wallet in crypto?

Are cold wallets better than hot wallets?

Which crypto wallet has the lowest fees?

Should I pick a non-custodial crypto wallet?

How many crypto wallets should I have?

References

- Cryptocurrency Wallet Adoption Statistics 2025: E‑Commerce, Payments & Regional Growth (CoinLaw)

- A Timeline of Cryptocurrency Exchange FTX’s Historic Collapse (ABC News)

- The Biggest Crypto Exchange Hacks: How to Make Sure You Protect Your Crypto Against Hacks (Kaspersky)

- Hot vs. Cold vs. Warm Wallets: Which Crypto Wallet is Right for me? (Fireblocks)

- What Are Crypto Wallets and How Do They Work? (Bloomberg)

- Wallet Security: Best Practices For Keeping Your Crypto Safe (Hacken)

Coinspeaker in Numbers

Monthly Users

Articles & Guides

Research Hours

Authors

The team behind IPO Genie has not yet announced an end date for the presale.

AI cryptocurrencies combine blockchain with artificial intelligence to power decentralized machine learning networks, GPU computin...

Fact-Checked By:

Fact-Checked By:

Otar Topuria

Crypto Editor, 39 postsI’m a crypto writer and analyst at Coinspeaker with over three years of experience covering fintech and the rapidly evolving cryptocurrency landscape. My work focuses on market movements, investment trends, and the narratives driving them, helping readers what is happening in the markets and why. In addition to Coinspeaker, my insights and analyses have been featured in other leading crypto and fintech publications, where I’ve built a reputation as a thoughtful and reliable voice in the industry.

My mission is to demystify the crypto markets and help readers navigate the noise, highlighting the stories and trends that truly matter. Before specializing in crypto, I worked in the IT sector, writing technical content on software development, digital innovation, and emerging technologies. That made me something of an expert in breaking down complex systems and explaining them in a clear, accessible way, skills I now find very useful when it comes to unpacking the intricate world of blockchain and digital assets.

I hold a Master’s degree in Comparative Literature, which sharpened my ability to analyze patterns, draw connections across disciplines, and communicate nuanced ideas. I’m particularly passionate about early-stage project discovery and crypto trading, areas where innovation meets opportunity. I enjoy exploring how new protocols, tokens, and DeFi projects aim to disrupt traditional systems, while also evaluating their potential risks and rewards. By combining market analysis with forward-looking research, I strive to provide readers with content that is both informative and actionable.