This Vortex FX (VFX) price prediction guide explores prices predicted through 2026, 2030, and 2036, looking at the potential heigh...

This detailed guide aims to provide a clear answer to one key question: Is Maxi Doge legitimate or just a scam? Read on to see what we discovered.

Maxi Doge (MAXI) is a new Dogecoin-inspired meme coin featuring a muscular “gym bro” version of Doge that’s obsessed with high-leverage trading. Its playful meme vibe aside, Maxi Doge has raised $4.43M from enthusiastic supporters since its presale launch, leaving many to wonder if it’s a worthwhile investment opportunity.

This article will examine whether Maxi Doge is legitimate or just another scam by taking a close look at its tokenomics, use cases, security audits, presale setup, and other key details.

- Degen meme coin inspired by max-leverage trading

- A tribute to high-risk hustle — fueled by sweat and conviction

- Ethereum-born, culture-driven, aiming for multichain

Is Maxi Doge Legit? Overview

- Maxi Doge. which features a dog-themed mascot and a degen trading lifestyle theme, brands itself as a culture or vibe meme coin, rather than a utility crypto.

- The MAXI token presale launched in late July 2025 with an initial price of $0.00025. The presale follows an incremental price strategy, where the token price increases in each subsequent round.

- About 40% of the total token supply is allocated to the public presale. Our research confirms that there was no private sale or insider pre-allocation that could potentially lead to whale dumping after exchange listings.

- Maxi Doge’s smart contract code has undergone audits by Coinsult and SolidProof, which have found no vulnerabilities or malicious functions. The contract cannot mint new tokens, blacklist users, or impose arbitrary fees, which are common tactics used by scammers.

- The project offers a staking program for MAXI holders, with an annual yield of up to 72% for presale buyers. This means token holders can lock in MAXI to earn passive rewards even before the presale ends.

- Maxi Doge token has limited utility, with a clear four-phase roadmap on its official website. Looking at the initial traction and organic community interest, the meme coin shows all signs of being genuine.

Is Maxi Doge Legit? Main Factors to Explore

It’s extremely important to carefully evaluate the following points before deciding whether Maxi Doge is trustworthy or a scam.

Maxi Doge homepage. Source: Maxi Doge

Does Maxi Doge Have a Transparent Team?

Maxi Doge’s team is largely anonymous, as there are no individual founders named on the website or whitepaper. While an anonymous team might raise red flags in traditional finance, it’s actually quite common in meme coin projects. The creators of some of the best cryptocurrencies, including Bitcoin, remain anonymous or pseudonymous.

What’s important is that despite not knowing their identities, we can observe the team’s actions. So far, they’ve launched a functional presale platform, published a detailed whitepaper, and completed third-party audits.

Are the Project Tokenomics Sustainable?

Our independent analysis of Maxi Doge’s tokenomics suggests that it’s designed with community and longevity in mind. There are no private sales or seed rounds that offer early investors tokens at an ultra-low rate. This is important because many scam projects quietly sell 20–30% of their tokens in private rounds, which they can then dump on public investors at the time of listing.

From a sustainability standpoint, the fixed supply (with no inflation) and the absence of mint functions in the contract mean Maxi Doge can’t dilute holders or create new tokens out of thin air.

Does Maxi Doge Offer Innovative Use Cases?

Maxi Doge has been transparent about its tech and utility in all its official documents. It explicitly states that it’s a classic meme coin that does not pretend to solve a Web3 problem or offer a DeFi protocol.

Despite downplaying its utility, a closer look at the project reveals that it does offer a few community engagement features, such as staking and user contests. These features could easily keep the project relevant over the long term beyond an initial wave of hype, at least more so than a meme coin with absolutely no holder perks.

Have Reputable Blockchain Security Firms Audited the Smart Contract?

Coinsult and SolidProof, which are two of the most reputable audit firms in the industry, have given the green light to Maxi Doge’s smart contract code. In their public reports, they’ve highlighted no critical vulnerabilities or scam features.

The audits confirm that there are adequate provisions in place to prevent devs from minting new tokens, blacklisting wallets, or setting high fees on transactions. The presence of audits doesn’t guarantee a project’s success or honesty, but it’s one of the strongest green flags one can ask for in a new token.

Can the Project Provide Long-Term Revenue?

Many investors consider a project legit if it shows a clear path to generating income over time, not just because it avoids being a rug pull. Being a meme coin, Maxi Doge doesn’t generate revenue from a product or service per se, but it does offer a staking portal for its community.

Maxi Doge Staking. Source: Maxi Doge

Investors who buy Maxi Doge tokens and lock them in the staking contract can earn daily rewards from the dedicated staking pool. Currently, you can earn a passive yield of up to 72% annually, without even waiting for the MAXI token to list on exchanges.

Is the Presale Structure Transparent?

The Maxi Doge token presale is structured into 50 rounds, each selling a fixed tranche of tokens (around 1.2 billion tokens per round) at a set price that increases slightly with each stage. The starting price was $0.00025 in Phase 1 and will rise to $0.0002745 by Phase 50, which is a roughly 10% total increase.

This incremental structure is quite common for presales and is considered fair, offering early buyers a small discount without the risk of a massive post-launch dump. There’s also a real-time countdown and funding bar on the site that shows exactly how long the current round has left and how much money the presale has raised.

This gives buyers instant, transparent insight into the Maxi Doge presale’s progress. For example, MAXI tokens are currently selling out for $0.000277 each, but this price will increase shortly.

The Team Behind Maxi Doge

Per the Maxi Doge whitepaper, the MAXI token is issued by Maxi Doge Labs Ltd., a company based in Costa Rica, but the developers themselves remain anonymous.

As we mentioned earlier, this type of setup appears frequently, even in many of the top picks in our best meme coins guide. From what we can infer, the team seems to comprise seasoned crypto experts and developers who are well-versed in both Web3 tech and internet culture.

The completion of audits and a detailed website with interactive elements, timers, and a staking interface suggests they have competent developers. Viral meme posting on the Maxi Doge X account and efforts to create genuine community engagement also hint at the involvement of experienced marketing professionals.

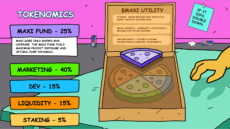

Maxi Doge Tokenomics

The total supply of MAXI Tokens is fixed at 150,240,000,000, with no provisions to mint more tokens in the future. Of these, Maxi Doge is offering 40% of the tokens (just over 60 billion MAXI) to its presale buyers. The project aims to raise approximately $15.76 million through the 50 presale rounds and use those funds for the project’s development, marketing, liquidity, and other purposes.

Out of the remaining token supply, Maxi Doge has reserved 25% of the tokens for Maxi Fund. This fund will finance future partnerships, collaborations, and community competitions or rewards.

Maxi Doge Tokenomics. Source: Maxi Doge

The team has set aside 15% of the Maxi token supply for devs to fund the platform’s future development. This could be used to introduce new platform features and user contests, effectively acting as the project’s operational fund in token form.

Maxi Doge also reserves 15% of the supply just for providing adequate liquidity. These tokens will be paired with ETH or other base pairs to provide initial liquidity on Uniswap (and potentially even on centralized exchanges).

Finally, the remaining 5% of the tokens are exclusively reserved for staking rewards. These tokens will be distributed to users who stake their MAXI tokens and enter circulation as a result of staking interest over time.

Is the Maxi Doge Marketing Strategy Hype-Driven or Utility-Focused?

Maxi Doge doesn’t shy away from the fact that it’s primarily based on a meme and lifestyle theme, rather than being a utility token.

Interestingly, the meme coin perceives its brand identity as a form of utility itself. Since the team’s goal is to make Maxi Doge as viral and culturally relevant as possible, this approach could attract a loyal community and drive its value over the long term.

Dogecoin famously had no use cases or a utility premise, yet its community and branding propelled it to a market cap of more than $30 billion. By positioning MAXI as the next big dog coin with a twist, they’ve already caught the attention of investors looking for the next 1000x crypto coin.

Maxi Doge Presale Legality and Ethical Considerations

Navigating the legality of any crypto presale can be tricky, as regulations vary by region. PwC’s 2025 Global Crypto Regulation Report points out that a pro-crypto stance by the US Securities and Exchange Commission (SEC) could set the stage for more transparency in the coming years.

In the current regulatory context, Maxi Doge makes several disclaimers and offers a number of noteworthy protections. For example, the Maxi Doge whitepaper includes a disclaimer that purchasing MAXI is not an offer of a security or any regulated financial instrument. This means Maxi Doge is conducting its token sale under the typical crypto assumption that it falls outside the purview of the securities law.

Looking ahead, Maxi Doge’s regulatory path could become clearer if the US SEC follows through on the sweeping “Project Crypto” agenda unveiled by Chair Paul Atkins.

To comply with international laws, Maxi Doge offers retail buyers a brief cooling-off period following the purchase of the token. After purchasing MAXI, you’ll have 14 calendar days to change your mind and request a refund. To do that, simply send an email to [email protected] within two weeks of purchase. Keep in mind that any blockchain network fees you paid aren’t refundable, and the refund window will shut the moment MAXI lists on exchanges.

Since the MAXI token is issued by a corporate entity in the Republic of Costa Rica, it falls outside the direct jurisdiction of the US and UK. Due to the gray area in these jurisdictions, many Web3 founders are now opting to incorporate their projects in crypto-friendly countries. As a result, opting for this route is quite common and doesn’t mean Maxi Doge is a scam.

Maxi Doge Roadmap Breakdown

Maxi Doge’s roadmap is split into four phases that correspond to a single intense day in the life of its mascot, from “Wake Up” to “Evening”. But behind the jokes, this Ethereum meme coin has outlined concrete development and branding goals for the project.

- Stage 1: “Wake Up” – This is essentially the meme coin’s launch phase, which has already been completed. This phase includes foundational goals like launching the official presale website and completing the security audits for the MAXI token.

- Stage 2: “Lunch & Gym” – This ongoing phase corresponds to the presale going live, allowing the public to buy Maxi Doge, and starting an initial marketing push. The project is already building and attracting a community on its social channels like X, Discord, and Telegram. The phase also jokingly mentions how it’ll learn from any early mistakes and adjust strategy. Up to this point, the progress of the second stage is on track.

- Stage 3: “PM Discord Ops” – It focuses on community engagement, partnerships, and feature rollouts during the presale (overlapping with the Stage 2 timeline). Using tokens from the Maxi Fund, it will increase market exposure, engage the community through staking rewards, and ultimately prepare the project for the final phase.

- Stage 4: “Evening” – This phase includes getting listed on exchanges and starting the creation of a longer-term ecosystem (trading games and other community contests). It’s where Maxi Doge could transition from its presale phase to an established meme coin.

How Does Maxi Doge Compare to Other Presales?

It may be helpful to compare Maxi Doge to some of the best crypto presales on the market to put its features in context.

| Presale | Ticker | Current Presale Price | Amount Raised | Use Case |

| Maxi Doge | MAXI | $0.000277 | $4.43M | Meme coin with a 1000x leverage trading lifestyle. Offers limited traditional utility in the form of community contests and staking rewards. |

| Bitcoin Hyper | HYPER | $0.013545 | $30.21M | First-ever Bitcoin Layer-2 solution using Solana’s tech. It aims to enable faster transactions and unlock smart contracts on the Bitcoin blockchain. |

| PEPENODE | PEPENODE | $0.0012161 | $2.61M | Gamified meme coin that simulates crypto mining without any hardware. Holders build virtual server rooms, upgrade nodes, and earn token rewards through active gameplay. |

How to Buy Maxi Doge Tokens Safely

To purchase Maxi tokens during its presale, it’s essential to visit only the official channels and follow best practices to stay safe. Investors can buy Maxi Doge (MAXI) tokens exclusively from the official Maxi Doge presale website or through the Best Wallet app.

You’ll need an Ethereum-compatible wallet to buy Maxi Doge. We recommend Best Wallet for ease of use, but you can also choose from other options on the presale site. Once connected, you can swap either ETH, USDT, USDC, or BNB for MAXI at its current price of $0.000277.

Maxi Doge presale widget. Source: Maxi Doge

Maxi Doge also offers an option to “Buy and Stake” in one go. This means right after you buy Maxi Doge tokens, you can lock them into the staking contract to start earning APY. It’s worth remembering that you won’t immediately get tradable tokens in your wallet after the purchase. Instead, you’ll be able to claim your MAXI tokens during the Token Generation Event (TGE).

You can join Maxi Doge’s Telegram group to get the latest updates on the TGE and other important matters.

Final Verdict: Is Maxi Doge Legit?

After carefully analyzing the MAXI token’s security audits, organic community engagement, and its whitepaper, our research suggests that Maxi Doge token is a legit meme coin. The team behind Maxi Doge has delivered on promises thus far, including the launch of its presale, conducting audits, developing a staking portal, and creating an active social media presence.

Importantly, the meme coin hasn’t made any outlandish false claims of guaranteed returns or sophisticated tech utility. Adding to the list of factors that make Maxi Doge legit, the project has transparent tokenomics with zero hidden allocations and also offers a 14-day refund option to presale buyers.

If you want to buy Maxi Doge, visit the official Maxi Doge website, but since it’s still early days for the meme coin, remember to always do your own research before purchasing high-risk digital assets.

Time until next price increase:

Maxi Doge Legit or Scam FAQ

What is Maxi Doge (MAXI), and what does it claim to offer?

Who is behind Maxi Doge?

What’s in Maxi Doge’s whitepaper?

Has Maxi Doge been audited?

Are there any signs of a potential rug pull with Maxi Doge?

Is Maxi Doge a scam?

References

Coinspeaker in Numbers

Monthly Users

Articles & Guides

Research Hours

Authors

BMIC (BMIC) is a presale project that wants to create quantum-resistant security for crypto wallets and digital assets. The team s...

Wondering how to buy crypto but not sure where to start? Our beginner's guide explains how and where to invest in digital assets l...

Fact-Checked by:

Fact-Checked by:

14 mins

14 mins

Filip Stojanovic

, 39 postsI’m a crypto content strategist and writer who helps Web3 projects tell their story, build trust, and grow engaged communities in an increasingly competitive space. I’ve worked with presale tokens, exchanges, blockchain startups, and crypto marketing agencies, shaping content strategies that not only explain complex concepts but also inspire confidence, attract investors, and drive adoption.

My experience spans a wide variety of formats, from whitepapers, token launch campaigns, and pitch decks to thought leadership articles, technical documentation, and in-depth guides. Before diving into Web3, I built my expertise in B2B SaaS writing. This structured, analytical approach now underpins my work in crypto, allowing me to bring clarity and credibility to projects in a space often criticized for hype and jargon.

I’m especially interested in how blockchain innovation translates into real-world utility. My recent work explores the evolving role of DeFi protocols, NFT ecosystems, and next-generation infrastructure in reshaping industries and creating new opportunities for both businesses and individuals.