LiquidChain is a Layer 3 blockchain project that wants to unify the liquidity of Bitcoin, Ethereum, and Solana into a single execu...

While the presale has raised over $4.74M so far, some commentators are skeptical about the project’s potential.

Snorter Bot (SNORT) is a trending presale project that gives token holders access to an advanced Telegram trading bot with lighting-fast trading, the ability to auto-snipe new coins, and honeypot scam detection. The project helps onboard retail clients who want exposure to digital assets but don’t have the time or skills to closely analyze the market and use the various tools necessary for success.

This guide examines the question in great depth: Is Snorter Bot a scam or a legitimate Web 3.0 project? Read on to learn everything about SNORT, including its use cases, presale campaign, tokenomics, and future exchange listings.

Is Snorter Bot Legit? Key Points

- Snorter Bot lets users trade Solana-based meme coins within the Telegram app.

- The bot monitors Solana liquidity pools in real-time, allowing users to instantly purchase trending meme coins with optimal slippage and tax settings.

- Users can customize automated trading strategies using limit orders and dynamic stop-losses, ensuring they minimize risk while maximizing potential gains. Users pay fees whenever the bot executes positions.

- The Snorter Bot team offers a transparent presale process. The event spans 60 stages, and buyers pay between $0.0935 and $0.1053, depending on when the investment is made. The presale claim will launch on October 27.

- The development roadmap has entered the advanced beta testing phase, with a select group of early adopters having access to the product, indicating real development milestones.

- SolidProof and Coinsult have completed full contract audits to ensure legitimacy. The audits found no vulnerabilities or risks in the smart contracts.

The Snorter Bot presale homepage. Source: Snorter Bot

How to Know if Snorter Bot is Legit? Core Factors to Explore

Investors should consider these variables when exploring the question: Is Snorter Bot a scam or a legitimate project?

Does the Project Have a Transparent Team?

Seasoned Web 3.0 analysts conduct due diligence on the team before investing in new projects because scams and rug pulls are unfortunately common in the crypto market. They often focus on the core founders and management team to assess credibility, experience, and prior success in their respective fields.

Snorter Bot’s whitepaper confirms that Meme Studio LAB Limited backs the project, a registered company in the British Virgin Islands. However, the project documents don’t provide a breakdown of Snorter Bot’s lead developers or CEO.

Are the Tokenomics Safe and Sustainable?

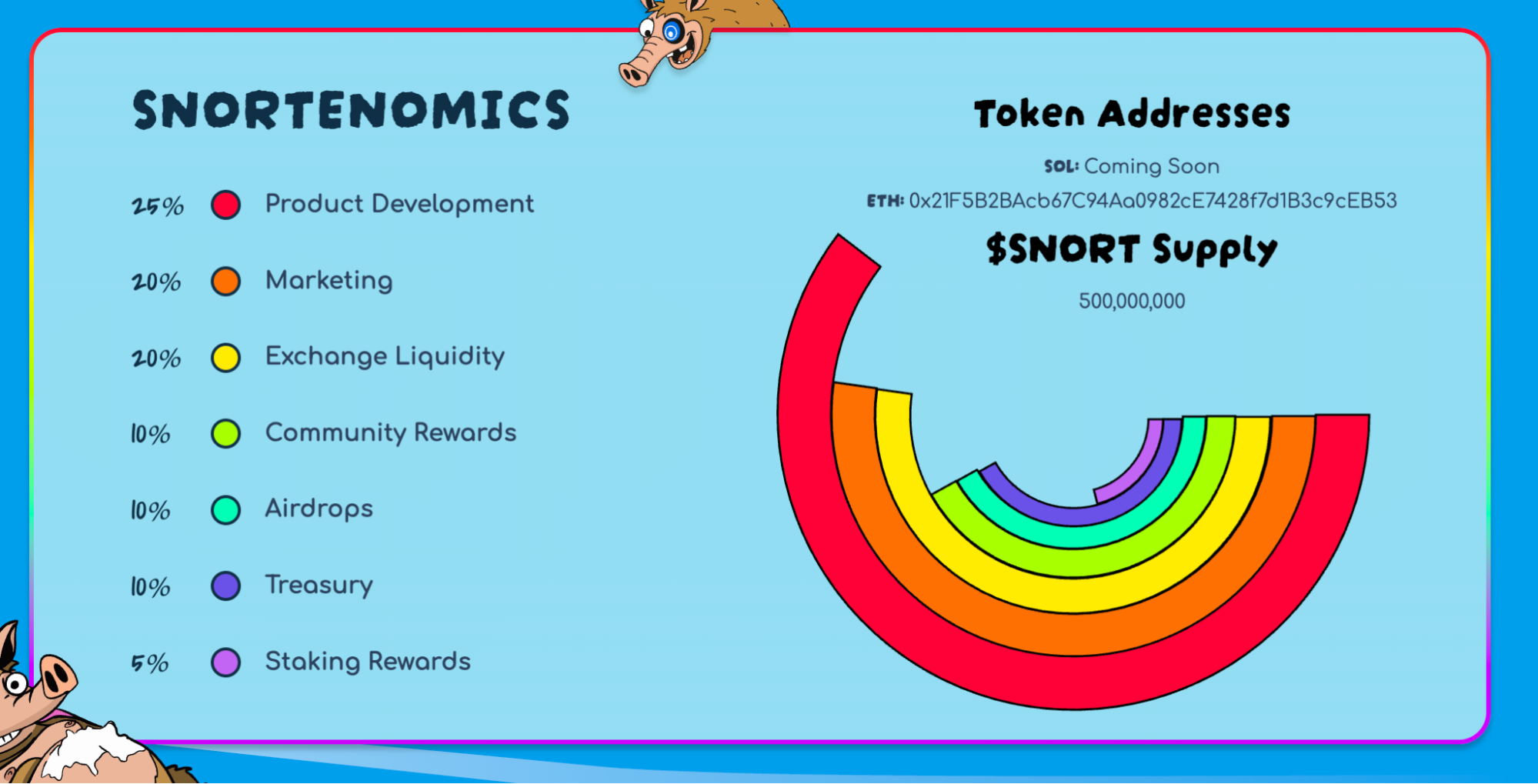

Legitimate crypto projects have sustainable tokenomics (which the project calls “Snortenomics”) — it forms the economic backbone of the native token, SNORT.

The team created a 500 million supply and, as confirmed by the contract audit, it cannot issue new tokens. This token structure is favorable for holders, as the finite supply ensures they cannot be diluted by new issuances. The tokenomics distributes SNORT tokens across various departments, including product development, marketing, and exchange liquidity.

Does Snorter Bot Offer Any Innovative Use Cases?

The crypto market is home to millions of tokens, and the vast majority offer no use cases or utility. Our research shows that Snorter Bot is a utility-driven project that provides token holders with real value. Everything is centered around its proprietary Telegram-based bot, which enables users to trade Solana Program Library (SPL) tokens without leaving the Telegram app.

While there are other Telegram bots on the market, Snorter Bot’s unique selling point is its private RPC infrastructure. This helps user avoid slippage, network congestion, and frontrunning risks.

The team developed a wide range of additional features to maximize value for its community, including copy trading, custom orders, portfolio management, and automated sniping.

Have Reputable Blockchain Security Firms Audited the Smart Contract?

Illegitimate projects usually launch cryptocurrencies without having their native smart contract audited, allowing them to commit blockchain scams like honeypots and rug pulls. This isn’t always the case and even audited projects can turn out to be scams, but audits from reputable auditors are a positive sign.

Snorter Bot made sure to reassure investors by securing audits from SolidProof and Coinsult, two of the most reputable blockchain security firms. These companies audited the SNORT contract and found no vulnerabilities.

Here are links to the Snorter Bot contract audit:

Will the Project Generate Long-Term Revenue?

Snorter Bot seems to have developed a sustainable, long-term revenue framework: the bot charges fees when it executes trades for users. While standard users pay 1.5% of the transaction value, SNORT holders get a reduced fee of 0.85%.

Our research shows that 0.85% is the lowest rate in the industry, especially when you factor in the bot’s slippage and tax optimizer. Holders must meet a minimum balance requirement to retain their discounted commission, creating stable market conditions for the SNORT price.

Is the Presale Structure Fair and Transparent?

The research team examined Snorter Bot’s presale framework to ensure fairness. The whitepaper confirms an initial price of $0.0935 per token, with small increases as the presale progresses. The final presale price is $0.1053, so early-stage investors secure a modest upside of just 12%.

This pricing structure is unlike many presale events, which offer unsustainable upsides of several hundred percent to encourage early participation. Those early investors often sell their tokens at the exchange launch to lock in their gains, creating significant selling pressure from the get-go.

Another positive factor is that the Snorter Bot team opted against a private sale for institutional investors and strategic partners. This should ensure that presale buyers get a fair price, no matter their budget or investing experience.

Who Runs Snorter Bot? A Closer Look at the Project Founders

The Snorter Bot whitepaper was issued by Meme Studio LAB Limited at the following registered address: Intershore Chambers, Road Town, Tortola, British Virgin Islands. While we were unable to find any information about the company (e.g., a list of shareholders), as per the British Virgin Islands’ data protection laws, the business registration number provided is legitimate and valid.

The whitepaper mentions just one company employee, namely the managing director, Aleksandar Radev Kostov. We couldn’t find any public information about Kostov, including social media profiles. This lack of transparency increases the risk spectrum, as there is no direct accountability if the project fails.

The key safeguard for SNORT investors is the audited smart contract. With both SolidProof and Coinsult confirming that the contract is free from vulnerabilities, investors avoid rug pulls and other crypto scams.

Additionally, some of the best cryptocurrencies to buy were created anonymously, including the world’s largest digital asset, Bitcoin. Shiba Inu, SPX6900, and dogwifhat are other notable examples of successful projects without a clear and transparent team.

Is Snorter Bot’s Telegram Bot Legit?

Snorter Bot’s underlying technology is both legitimate and innovative. Users access Solana decentralized exchanges (DEX) directly in the Telegram app, ensuring privacy and anonymity. The project’s native RPC infrastructure can be a powerful tool for investors, executing trades at lightning-fast speeds before regular DEX traders can act.

The private infrastructure helps users avoid mainstream DEXs like Raydium and Jupiter, which often provide a subpar experience during meme coin rallies, including failed transactions, loading issues, and extortionate fees.

Snorter Bot’s features. Source: Snorter Bot

Snorter Bot also provides additional, proprietary use cases for a wide range of trading goals and strategies, such as its copy trading tool. Users choose their preferred meme coin trader, set an investment amount, and the bot automatically copies their positions in real-time.

The bot also facilitates “snipe trades” on new cryptocurrencies, buying tokens within milliseconds of liquidity appearing. This benefit lets investors purchase digital assets at tiny market capitalizations that are often under $50,000, delivering an attractive risk-reward ratio. Built-in safeguards include frontrunning and MEV protections, custom routing, and auto-calculated slippage and tax settings.

Investors should, however, remember that Snorter Bot is a new project that remains in development, with many features and tools yet to be launched in the public domain. These risks are reflected in the presale valuation, with analysts expecting a small market capitalization at the token generation event (TGE).

Analyzing the Snorter Bot Tokenomics

Studying a project’s tokenomics can help seasoned traders decide whether the token supply and distribution are fair, sustainable, and aligned with long-term utility.

The SolidProof and CoinSult audits confirm a maximum and finite supply of 500 million SNORT tokens. Investors prefer cryptocurrencies with a capped supply, as it prevents dilution and creates scarcity over time, which are key factors that can encourage organic growth and rising token demand.

Of the 500 million supply, 25% is allocated for product development. This gives the team sufficient capital to develop, test, and refine the Telegram bot and ensure it’s free from potential bugs and vulnerabilities. 20% of the supply is reserved for marketing, with the team aiming to onboard platform users and build a community of loyal token holders. The remaining tokens are used for exchange liquidity, staking, community rewards, airdrops, and the treasury.

The Snorter Tokenomics (“Snortenomics”). Source: Snorter Bot

No tokens are explicitly allocated to the team, presenting both pros and cons. While the token supply is exclusively reserved for the project’s long-term success, some may question the team’s motivation if they’re not financially incentivized.

After evaluating the initial presale distribution, no tokens were sold to private buyers (e.g., crypto whales). Only those joining the public presale can invest, which is open to anyone with a wallet and some tokens.

Snorter Bot Marketing Strategy: Price-Driven or Utility-Focused?

A common tactic used by presale projects is to offer a significant upside for those investing in early rounds. This strategy leverages short-term speculation with promises of high returns, as those who secure the lowest presale price often sell when the tokens are listed on exchanges.

Snorter Bot’s marketing materials almost exclusively focus on the underlying utility, including the bot’s use cases, features, and holder-specific perks. Speculative traders are unlikely to find the presale appealing, since the maximum upside available to stage-one inventors is just 12%.

The general perception of Snorter Bot in the public domain is limited, with the presale campaign only launching in May 2025. While the project’s X account has about 15,000 followers, this figure is likely to increase as the presale progresses.

Investors will have a clearer picture of the team’s strategy after the fundraising event, with 20% of the token supply allocated to marketing.

Is the Snorter Bot Presale Legal and Ethical? Regulatory Considerations

The Snorter Bot whitepaper suggests that the team, while largely choosing to remain anonymous, takes regulatory compliance seriously. It provides the whitepaper issuer, including the company name, address, registration number, and managing director.

The document also confirms that UK residents are restricted from joining the presale event, and that those based in the European Union (EU) have 14 days to request a refund. The EU stipulation, which must be submitted before the TGE, ensures that Snorter Bot complies with the Markets in Crypto-Assets Regulation (MiCA).

It’s unclear how the presale team will determine where investors are located, as participants invest anonymously on a wallet-to-wallet basis.

Project materials, including the whitepaper and website, present sufficient risk warnings, including price volatility and speculation. Despite being a legal presale project, local rules and regulations may differ on specific features, such as copy trading or wider bans on Telegram usage. Ensure you research laws in your home country before proceeding.

Snorter Bot Roadmap: Tracking Core Development Objectives

It’s far too early to assess Snorter Bot’s roadmap progress as the presale event launched recently.

The roadmap’s first stage covers generic processes, such as smart contract development and audit, website optimization, and whitepaper release. In the second and current stage, Snorter Bot completes its presale event and TGE, as well as community beta testing.

The most important development milestones happen in the third and fourth roadmap stages: this includes launching the Telegram bot on multiple EVM chains, ecosystem growth, trading algorithms, and decentralized finance (DeFi) partnerships.

The best practice is to follow the project on X for development announcements, compare the projected timeline dates with actual progress, and evaluate whether the team is reliable and competent.

Snorter Bot vs Other Presale Projects: Key Comparison

Here’s how Snorter Bot compares with other top crypto presales that are currently raising funds:

| Presale | Ticker | Current Presale Price | Raised (To Date) | Ecosystem Utility |

| Snorter Bot | SNORT | $0.1079 | $4.74M | A Telegram trading bot that executes orders via a private Solana RPC infrastructure. Features include limit orders, snipping, copy trading, and anti-fraud measures. |

| Bitcoin Hyper | HYPER | $0.01367600 | $31.58M | A decentralized side-chain for the original Bitcoin blockchain, allowing BTC holders to access DeFi products and reduce transaction times to single-second speeds. |

| Maxi Doge | MAXI | $0.00028050 | $4.63M | A hyper-leveraged, DeFi meme presale token designed for degen traders chasing massive gains via staking. |

| Best Wallet Token | BEST | $0.025905 | $16.85M | Utility token that backs a popular self-custody wallet, offering holders reduced fees, higher staking rewards, and priority access to new Launchpad events. |

These presale projects offer innovative use cases, although each has varying risks and upside potential. They cover several high-growth narratives, including Layer 2 technologies and self-custodial storage.

How Does Snorter Bot Compare?

Snorter Bot’s target market is active traders who want to capitalize on Solana meme coin trends, with support for EVM-compatible networks planned in future roadmap phases.

Beginners can copy their preferred traders, as the bot automatically executes positions based on their buy and sell activities. More experienced traders use the bot’s sniping feature, which enables them to purchase new cryptocurrencies within milliseconds of their launch on DEXs.

While other Telegram-based bots are in the Web 3.0 market, Snorter Bot is the only stakeholder to have a private RPC infrastructure. This unique feature means platform users get the fastest execution speeds and the lowest fees, even during bull cycles.

Where and How to Buy Snorter Bot Tokens Safely?

Snorter Bot recently launched its presale event, so investors can buy SNORT tokens directly from the project website, and we have previously written a full guide on how to buy SNORT. The event follows a traditional presale structure, allowing participants to connect a self-custody wallet and swap an accepted payment token.

Presale buyers can use ETH, USDT, USDC, SOL, or BNB without needing to complete KYC or minimum investing requirements. Participants claim their tokens after the presale, and they’re sent to the same wallet used to invest.

How to buy Snorter Token, using SOL, ETH, USDT, USDC, or a credit card. Source: Snorter Bot

The team plans to list SNORT tokens on an exchange(s) after the token claim, but it doesn’t mention specific platforms. Analysts suggest that the TGE will happen on a DEX like most new launches, although centralized exchanges (CEX) may also be an option if the presale is successful. The tokenomics reserve 20% of the SNORT supply for exchange liquidity, which is a higher allocation compared to most DEX listings, to help ensure stable trading conditions after launch.

Broader market conditions also play a role in the SNORT price trajectory. The tokens may see an initial rally if the wider crypto space is bullish, as investors possess a higher risk appetite during bull runs. Negative sentiment can harm SNORT’s price potential, so presale investors should adjust their strategy accordingly.

The Verdict: Is Snorter Bot a Scam?

The Snorter Bot presale presents both market opportunities and investment risks.

While the project provides a BVI company address and valid registration number, we were unable to find any information about the firm’s managing director, Aleksandar Radev Kostov. The whitepaper doesn’t mention any other team members, and this lack of transparency might represent a red flag, as utility-driven projects typically have a full breakdown of their core leaders.

Notable safeguards include two independent smart contract audits and compliance with legislation like MiCA, which enables EU investors to request a refund within 14 days of participating in the presale.

The vast majority of project materials focus on the core product rather than price speculation and potential profit. While discounts are available to those joining the presale early, 12% is the maximum upside offered to ensure stable conditions at the TGE.

Overall, Snorter Bot’s private RPC infrastructure may prove a game-changer in the automated bot niche. Platform users avoid the network congestion found with public DEXs like Raydium and Jupiter.

Presale participants must monitor the feature-rich roadmap to ensure the team meets its development targets, especially regarding the beta testing phase. Always conduct independent research before proceeding and avoid risking amounts you’re uncomfortable losing.

Presale ends in:

FAQs

Who runs Snorter Bot?

Is the Snorter Bot presale legal?

When does the Snorter Bot presale end?

References

- Snorter Bot Whitepaper (Snorter Bot)

- Solana Program Library Documentation (Solana)

- British Virgin Islands Data Protection Act 2021 (Government of the Virgin Islands)

- Regulation (EU) 2023/1114 Of The European Parliament And Of The Council (Official Journal of the European Union)

Coinspeaker in Numbers

Monthly Users

Articles & Guides

Research Hours

Authors

The team behind IPO Genie has not yet announced an end date for the presale.

AI cryptocurrencies combine blockchain with artificial intelligence to power decentralized machine learning networks, GPU computin...

15 mins

15 mins

Tony Frank

Crypto Editor, 33 postsTony Frank is an accomplished cryptocurrency analyst, author, and educator whose work bridges the gap between complex blockchain technology and accessible, actionable insights for global audiences. Over the past decade, he has emerged as a respected voice in the rapidly evolving world of digital assets, combining technical expertise with a talent for storytelling to help readers navigate everything from Bitcoin’s monetary philosophy to the intricacies of decentralized finance (DeFi). Tony earned his Bachelor’s degree in Economics and Finance from the University of Melbourne, where he developed a deep interest in monetary systems and market structures. He later pursued a Master’s degree in Blockchain and Digital Currency from the University of Nicosia, one of the first academic institutions to offer accredited programs in cryptocurrency studies. Before focusing full-time on blockchain, Tony worked as a financial analyst for a multinational investment firm, covering emerging technologies and alternative asset classes. His early exposure to macroeconomic policy, global market behavior, and fintech innovation laid the foundation for his later work in crypto research and writing. Tony’s expertise spans multiple sectors of the blockchain industry, including cryptocurrency fundamentals, altcoin market cycles, DeFi and web3 trends and regulatory landscapes. Tony combines on-chain data analysis with macroeconomic research, providing readers with both the technical “how” and the market “why” of cryptocurrency movements.