This Vortex FX (VFX) price prediction guide explores prices predicted through 2026, 2030, and 2036, looking at the potential heigh...

After analyzing dozens of cryptos under $1 through presale data, market trends, and early adoption signals, we found that Bitcoin Hyper (HYPER) might have the best chance of being the next crypto to hit $1 in 2026.

Its Layer 2 solution for Bitcoin addresses a $2.2 trillion market opportunity that no other project has tackled effectively. MAXI and RTX also show promise as solid runners-up with their own unique advantages.

Finding real winners in a crypto market that has over 17,000 active tokens today takes serious research. Our methodology takes into account everything from tokenomics and liquidity to developer activity and listing rumors for both existing coins and brand new presales.

In this guide, we’ll break down the most promising cryptos under $1, compare what makes each special, and explain the market conditions that could push them past $1.

Key Takeaways

- Sub-$1 tokens can explode upward but crash just as fast.

- Coins tied to current themes and narratives like AI, scaling, or PayFi tend to attract more attention.

- Presales give early buyers an edge when projects like Bitcoin Hyper, Maxi Doge, or Remittix gain traction before listings.

- Tokens with strong communities, like Pudgy Penguins, usually last longer than purely hype-driven launches.

- Liquidity depth, balanced token distribution, and transparent leadership can help distinguish credible projects from opportunistic cash grabs.

Editor’s Picks – Best Crypto Likely to Hit $1 in 2026

- First Bitcoin Layer 2 enabling fast, low-cost transactions

- Fixes Bitcoin’s speed and fee limitations with near real-time performance

- Enables a Bitcoin-native DeFi ecosystem

- Degen meme coin inspired by max-leverage trading

- A tribute to high-risk hustle — fueled by sweat and conviction

- Ethereum-born, culture-driven, aiming for multichain

- Quantum-resistant security infrastructure for wallets and enterprise use

- Uses deflationary tokenonomics, including burns, tied to quantum workload execution

- Staking and governance participation expand token utility

- Shared liquidity spanning Bitcoin, Ethereum, and Solana

- Improved trade execution through faster speeds and secure cross-chain capital movement

- Opens up greater cross-ecosystem connectivity for builders and developers

- Build your own virtual meme coin mining rig.

- 100% virtual and requires no additional computing power.

- Top miners get additional bonuses in Pepe, Fartcoin, and other meme coins.

- AI-Powered Virtual Influencers

- 20% APY Staking Rewards

- VIP perks: livestreams, BTS content, credits, and more.

- Connecting DeFi and TradFi in a singular exchange

- BFX holders earn USDT from platform trading activity

- Access to over 500 tradable assets, including commodities

- High-performance broker for pros and newcomers alike

- Rebates and buybacks come from VFX's own market activity

- 10% bonus on sign up and early staking access

Top Crypto That Could Reach $1

- Bitcoin Hyper (HYPER) – Bitcoin Layer-2 Solution Powered by Solana Virtual Machine

- MAXI Doge (MAXI) – Meme Coin Built on Leverage and Trading Culture

- Remittix (RTX) – Cross-Border Payments Platform For DeFi Apps

- PEPENODE (PEPENODE) – Gamified Mine-to-Earn Token

- BlockchainFX (BFX) – Unified Trading Platform Bridging Crypto and Traditional Markets

- Layer Brett (LBRETT) – Ethereum Layer-2 Packaged in Meme Branding

- Echelon Prime (PRIME) – Web3 Gaming Ecosystem Token That Powers Blockchain Games and Token-Gated Features

- MobileCoin (MOB) – Privacy Payments Integrated With the Signal App

- Pudgy Penguins (PENGU) – Crypto Token Tied to One of the Biggest NFT Collections

- Nexchain AI (NEX) – Layer-1 Blockchain With Built-In AI Infrastructure

Next Crypto to Hit $1 – Reviews and Analysis

With fundamentals out of the way, let’s move on to our detailed reviews and analysis of each best crypto under $1:

1. Bitcoin Hyper (HYPER) – Bitcoin Layer-2 Solution Powered by Solana Virtual Machine

Bitcoin Hyper is a Layer 2 scaling solution for Bitcoin that handles 65,000 transactions per second. Bitcoin’s base layer does 3 to 5 TPS, which is why nobody uses it for anything except basic transfers.

The platform runs on Solana Virtual Machine infrastructure but settles everything back to Bitcoin’s main chain for security. That setup means BTC holders can actually use their Bitcoin for DeFi, smart contracts, and dApps without giving up the security that makes Bitcoin valuable in the first place.

Bitcoin Hyper homepage. Source: Bitcoin Hyper

Bitcoin Hyper targets Bitcoin’s $1.9 trillion market where 95% of BTC sits idle without DeFi access by creating a fast lane for transactions that costs pennies instead of dollars. The presale has raised $30.21M with tokens currently priced at $0.013545.

| Category | Layer-2 / Infrastructure |

| Chain | Bitcoin Layer-2 (using SVM) |

| Launch Status | In Presale |

| Time Until Next Price Increase | Loading...

|

| Current Price | $0.013545 |

| Exchange Signal | No confirmed listings yet |

| Community Size | 4.5K+ Telegram / 14K+ X |

The real risk is execution. Building a Layer 2 that settles to Bitcoin while running Solana’s VM is complicated, and plenty of projects promise revolutionary tech in presale then deliver nothing at launch.

2. MAXI Doge (MAXI) – Meme Coin Built on Leverage and Trading Culture

Maxi Doge takes the familiar dog-meme coin vibe and cranks it up to “gym-bro meets crypto-degenerate trader”. The project leans into a theme of high-risk, high-reward culture. Think heavy workouts, energy drinks, and chasing the next green candle.

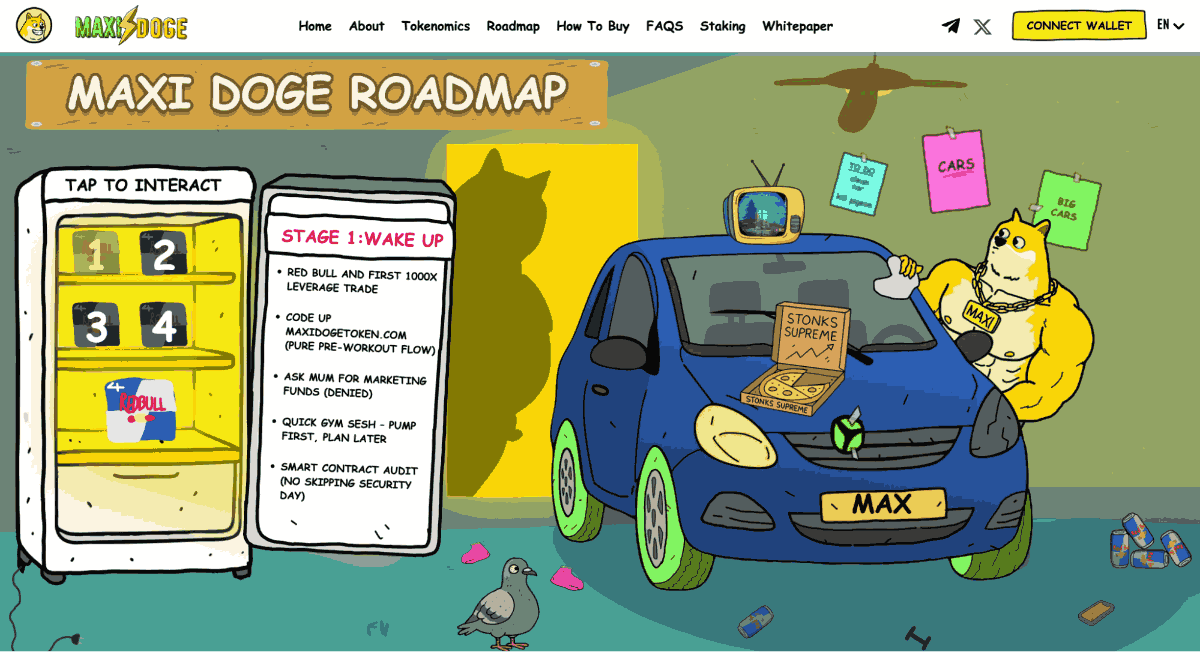

The Maxi Doge roadmap. Source: Maxi Doge Presale Website

Launched in 2025, the presale of MAXI has already drawn serious attention. The presale broke the $4 million mark already, which is a sign that there is real interest among traders. On top of this, the team behind the coin is trying to go beyond just memes. There are staking programs, trading competitions, and a roadmap that includes future integration with leveraged trading.

| Category | Meme / Lifestyle |

| Chain | Ethereum |

| Launch Status | In Presale |

| Time Until Next Price Increase | Loading...

|

| Presale Price | $0.000277 |

| Exchange Signal | No confirmed listings yet |

| Community Size | 4.2K on X, and over 2.1K on Telegram |

That said, meme coins are notorious for making big promises and delivering very little. Without tangible utility, $MAXI’s value depends almost entirely on presale momentum and community excitement.

3. Remittix (RTX) – Cross-Border Payments Platform for DeFi Apps

Remittix ties crypto utility directly to real-world payments. It supports crypto-to-bank transfers in more than 30 countries, and adds DeFi mechanics like staking and low-fee swaps, serving everyday users who want cheaper transfers as well as DeFi traders who are looking for staking yields.

Remittix presale homepage: Source: Remittix

We added it to our list because it has a working product vision, it sits at the crossroads of global payments and decentralized finance, and it trades under $1 despite strong presale traction. However, keep in mind that Remittix will likely face fierce competition from similar platforms.

| Category | PayFi / Crypto-to-Bank Utility |

| Chain | Ethereum (with cross-chain features) |

| Launch Status | In Presale |

| Presale Raised | Around $20M raised so far |

| Exchange Signal | BitMart listing triggered at $20M |

| Community Size | 19K followers on X |

The issue is that Ripple already dominates institutional cross-border payments, and Stellar owns the retail space. Remittix enters a crowded market late with less capital and brand recognition. Unless they find a specific niche the giants ignore, it’s going to be hard.

4. PEPENODE (PEPENODE) – Gamified Mine-to-Earn Token

PEPENODE is a browser-based crypto mining simulator. The project raised over $2.61M since its July 2025 launch.

PEPENODE homepage. Source: PEPENODE

The virtual mining game lets PEPENODE holders deploy nodes, upgrade facilities, and compete for leaderboard positions, with plans to add NFT upgrades and distribute similar coins like PEPE to top performers.

| Category | Mine-to-earn |

| Chain | Ethereum |

| Launch Status | In Presale |

| Presale Price | $0.0012161 |

| Time Until Next Price Increase | Loading...

|

| Exchange Signal | No confirmed listings yet |

| Community Size | 3.5K on X, and over 2.8K on Telegram |

Editor’s Take: The 70% burn on upgrades matters more than the game itself. PEPENODE forces deflation every time someone upgrades a node. Getting to $1 depends on whether the team keeps players engaged long enough to burn serious supply. The mining simulator is already live, which puts them ahead of projects that promise features later.

If they add the planned integrations with PEPE and other meme coins for mining rewards, people have reasons to keep playing and burning tokens. The game doesn’t need to be amazing forever, just interesting enough to drive consistent upgrade activity.

5. BlockchainFX (BFX) – Unified Trading Platform Bridging Crypto and Traditional Markets

BlockchainFX is aiming to become a unified trading platform where you can trade over 500 assets (cryptocurrencies, forex, stocks, ETFs, futures, options, and even bonds).

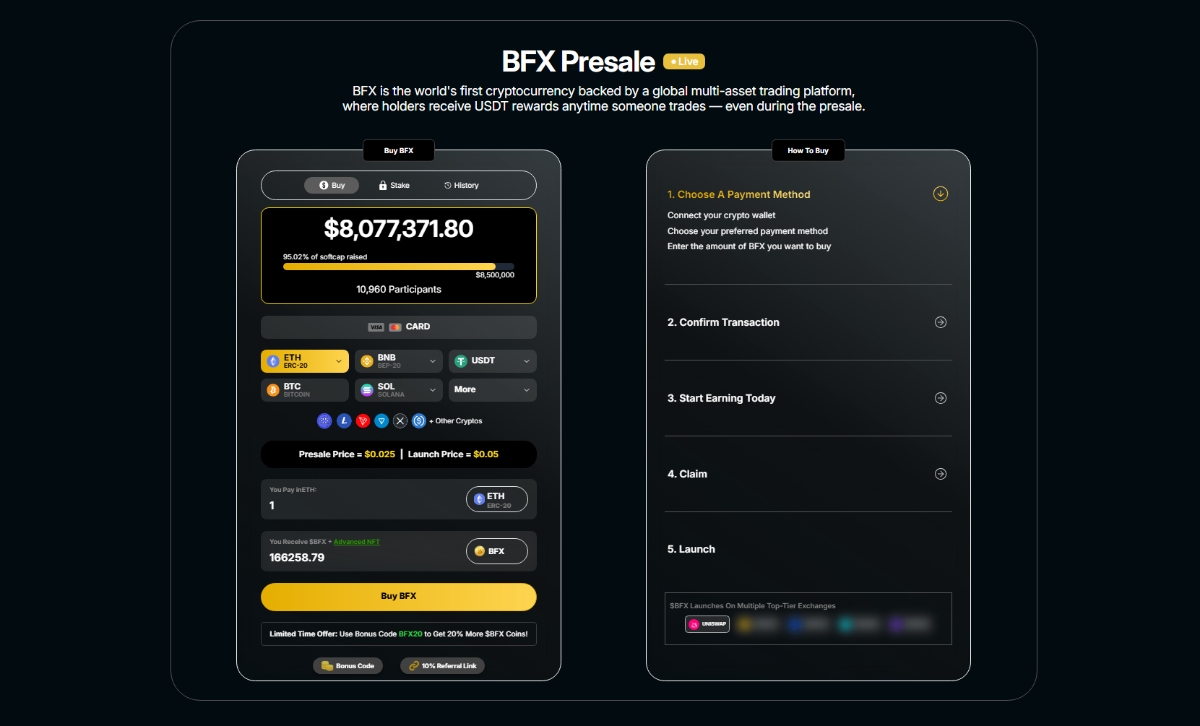

BFX presale homepage. Source: BlockchainFX

The presale has already pulled in over $10 million from nearly 17,000 participants, which is an excellent sign for a new coin. On top of this, BFX token holders can earn daily rewards in both BFX and USDT, capturing up to 70% of the platform’s trading fees. This revenue-sharing structure is refreshing and more generous than most exchanges.

| Category | Trading Platform |

| Chain | Multi-Asset |

| Launch Status | In Presale |

| Presale Price | $0.029 |

| Staking Rewards | Up to 70% of trading fees |

| Presale Raised | $10.88M+ |

If they do manage to launch with strong liquidity and active users, BFX might just become the next crypto to hit $1 or more.

6. Layer Brett (LBRETT) – Ethereum Layer-2 Packaged in Meme Branding

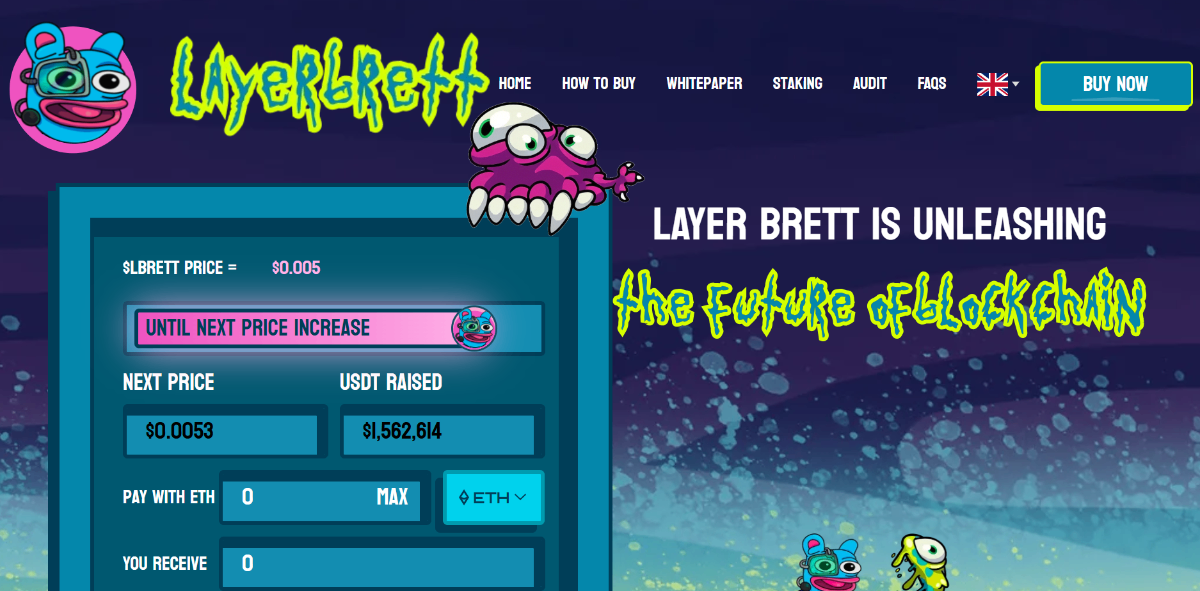

Layer Brett launched its presale in August 2025 and pulled in close to $4 million so far. The project builds an Ethereum Layer 2 specifically for meme tokens, with staking rewards, NFTs, and transactions that cost almost nothing. The platform claims it can handle 10,000 transactions per second, which would put it on par with other successful Layer 2 solutions.

Layer Brett homepage. Source: Layer Brett

Right now staking rewards sit around 600% APY and the presale price is $0.0061. The team stays anonymous, which is pretty normal for meme projects but definitely adds some risk to the mix.

| Category | Meme/Ethereum L2 |

| Chain | Ethereum Layer-2 |

| Launch Status | In Presale |

| Presale Price | ~$0.0044 |

| Exchange Signal | No listings confirmed |

| Community Size | Growing presence across X & Telegram |

The gamble is whether an anonymous team can build and maintain serious infrastructure. Most can’t.

7. Echelon Prime (PRIME) – Web3 Gaming Ecosystem Token That Powers Blockchain Games and Token-Gated Features

Echelon Prime isn’t your typical “new cycle” token. This is one of the few gaming ecosystem coins that grew out an actual, real product called Parallel, a sci-fi trading card game that’s been praised for its quality and on-chain integrations.

Parallel Prime League homepage. Source: Parallel

PRIME, the native token of the project, sits at the center of the whole Echelon ecosystem. It acts as the currency players use to unlock in-game items, participate in token-gated drops, and interact with “PRIME sinks” (places where players spend PRIME to get exclusive cards or perks).

PRIME already has live usage at this point. Players spend it, stake it, and earn it across Echelon-connected apps.

| Category | Gaming/ Web3 Ecosystem |

| Chain | Ethereum |

| Launch Status | Live token with an active gaming ecosystem |

| Exchange Signal | Listed on Coinbase, Kraken, and other exchanges |

| Community Size | Active Parallel TCG + Echelon communities on X and Discord and game channels |

Editor’s take: Echelon Prime is in a different category from most of the $1 hopefuls. It’s not a micro-cap meme coin trying to moon off hype. It’s a gaming ecosystem token with actual usage inside apps. If Parallel keeps gaining players and the ecosystem expands, PRIME benefits directly because players actually need it. This is a big advantage over tokens that rely only on speculation.

8. MobileCoin (MOB) – Privacy Payments Integrated with the Signal App

MobileCoin focuses on fast, private payments built directly into messaging apps. The project integrates with Signal to give millions of users access to crypto transfers inside an app they already trust for private communication.

MobCoin homepage. Source: MobileCoin

Its design puts speed and simplicity first, with transactions settling in seconds and protected by strong cryptography.

While most privacy coins struggle with usability, MobileCoin hides complexity under the hood and delivers a product fit for mainstream adoption. However, there’s a lot of regulatory pressure on privacy coins, and that might hinder its growth potential in the upcoming period.

| Category | Privacy / Payments |

| Chain | Custom chain (MobileCoin) |

| Launch Status | Live since 2021 |

| Price | ~$0.18 |

| Exchange Signal | Listed on Binance, Kraken |

| Community Size | 22K followers on X |

But regulatory pressure killed Monero on major exchanges, and MOB faces the same risk. Governments hate privacy coins. If exchanges keep delisting them, your token becomes harder to buy and sell, regardless of how good the tech is. It works if regulators back off, but that’s a big if.

9. Pudgy Penguins (PENGU) – Crypto Token Tied to One of the Biggest NFT Collections

Pudgy Penguins already has visibility through toys, licensing deals, and community-driven initiatives, which gives it more recognition than most crypto projects.

Pudgy Penguins homepage. Source: Pudgy Penguins

The PENGU token extends that brand into the crypto market and gives trading opportunities and community incentives for holders. While its appeal still rests on meme culture, the connection to an existing NFT brand adds a layer of credibility and reach that new tokens usually don’t have.

| Category | NFT Brand Extension |

| Chain | Ethereum |

| Launch Status | Live since 2024 |

| Price | $0.03148 |

| Exchange Signal | Listed on multiple CEX/DEX |

| Community Size | Large NFT + token following |

Editor’s Take: The Pudgy Penguins brand already exists outside crypto with toys in Walmart and actual consumer products. That’s rare for meme coins. Most launch with nothing but a mascot and hope. PENGU has built-in recognition from one of the top NFT collections, which gives it staying power that other memes lack.

The problem is that NFT hype vanished years ago. Tying a token to NFTs might be anchoring to a sinking ship instead of an advantage.

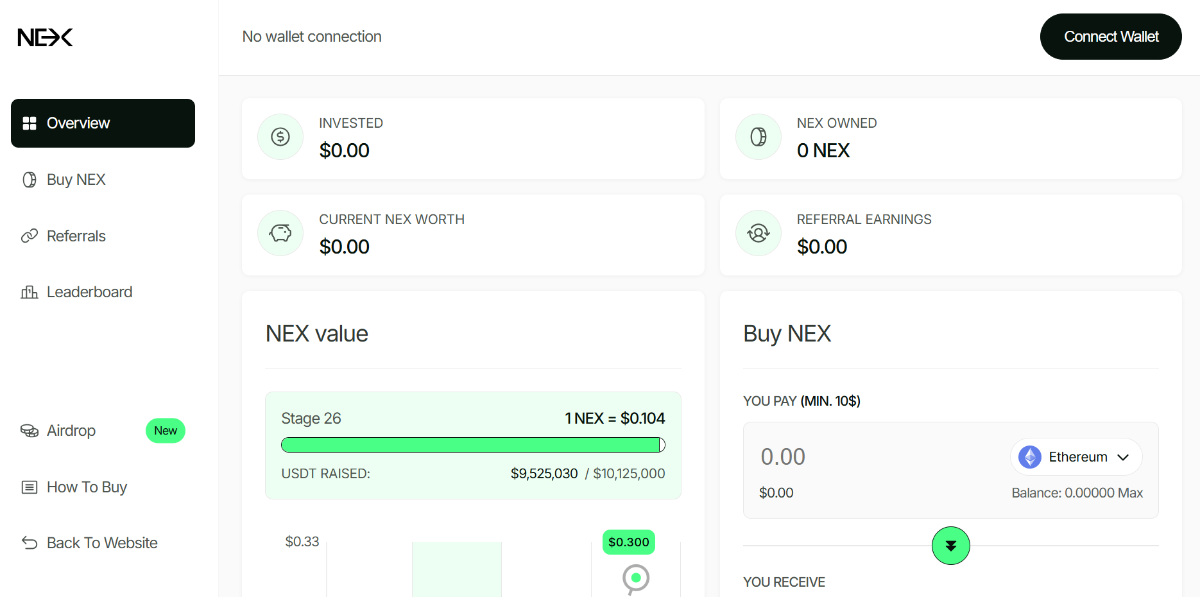

10. Nexchain AI (NEX) – Layer-1 Blockchain with Built-In AI Infrastructure

Nexchain AI runs a Layer-1 network that integrates artificial intelligence directly into its development stack. Developers can already test contracts on their public network and access AI tools for automation, optimization, and model execution.

NexChain home page. Source: NexChain

The project raised more than $10 million in its presale, which shows that there’s clear market demand for this type of AI project. Unlike chains that plug into third-party APIs, Nexchain embeds AI functions directly on-chain, which creates a tighter ecosystem and stronger developer control.

| Category | Layer-1 / AI Infrastructure |

| Chain | Nexchain (AI-optimized blockchain) |

| Launch Status | Active presale |

| Price | $0.108 per NEX token |

| Exchange Signal | Not yet listed on exchanges |

| Community Size | Growing through presale & testnet campaigns |

However, AI hype fades fast. Remember when every project added “metaverse” to their name in 2021? Most died when the trend cooled.

What Does “Next Crypto to Hit $1” Really Mean?

When people ask what’s the next crypto to hit $1, they usually picture a coin exploding in value.

But the $1 milestone is only meaningful if you look at market capitalization and token supply. A token trading at $0.005 with a massive circulating supply might need hundreds of billions in market cap to ever touch $1, which makes it mathematically unrealistic.

To evaluate whether a coin can reach $1, you need to multiply its supply by that price and ask: Is this market cap feasible compared to other projects?

Dogecoin and Shiba Inu, for example, have shown that hype can push a token pretty far, but both still struggle with huge supplies that limit upside.

Here’s a quick feasibility table that shows why not every sub-$1 crypto can make the leap:

| Price Now | Market Cap at $1 | Feasibility* | Precedent |

| $0.001 | $1B | Rare | DOGE, SHIB |

| $0.05 | $20B | Difficult | ADA, SOL |

| $0.25 | $5B | Moderate | XRP |

| $0.70 | $700M | Likely | Smaller caps with narrative tailwinds |

*Feasibility = relative odds based on supply, precedent, and exchange traction.

Examples of Coins That Already Hit $1

These cryptocurrencies started well below $1 and proved that massive price leaps happen when fundamentals align with market demand.

| Token | Start Price | Date Hit $1 | Time Elapsed | Key Driver |

| MATIC | $0.003 | May 2021 | ~2 years | L2 adoption surge |

| AXS | $0.12 | July 2021 | ~8 months | Play-to-earn boom |

| SAND | $0.05 | Nov 2021 | ~18 months | Metaverse hype |

| FTM | $0.02 | Oct 2021 | ~2.5 years | DeFi expansion |

| AVAX | $0.50 | Nov 2020 | ~3 months | ETH alternative |

Every successful $1 breakthrough combined a compelling utility narrative, major CEX listings like Binance or Coinbase, and viral community growth that created sustained buying pressure.

That’s why the coins featured as our top picks were chosen not just because they’re cheap, but because they align with the right catalysts.

Coins that Are Unlikely to Hit $1

Here are some well-known cryptocurrencies that trade under $1 but won’t realistically ever reach that milestone:

1. VeChain (VET)

VeChain launched in 2016 as a blockchain built for businesses that need to track supply chains and prove their products are legit. The platform runs on two tokens where VET handles staking and governance while VTHO pays for transactions. Right now, the network has 101 verified nodes running everything, and they’re planning to switch to a different staking system by the end of this year.

Why it can’t hit $1:

VeChain has 86 billion tokens in circulation, so hitting $1 needs an $86 billion market cap, which is 34 times bigger than what it has now and larger than almost every crypto except Bitcoin and Ethereum.This project targets boring enterprise clients who want supply chain tracking, not retail traders looking for moonshots, so the hype just isn’t there to push it anywhere near $1.

2. Pepe (PEPE)

Pepe launched in April 2023 as a meme coin inspired by the internet’s most famous frog character that’s been around since 2005. The token went live during the 2023 meme coin craze and quickly built a massive community of holders who treated it like the next Dogecoin.

Why it can’t hit $1:

PEPE has a circulating supply of 420 trillion tokens, which means reaching $1 would require a $420 trillion market cap that’s roughly 135 times larger than the entire global cryptocurrency market combined. The token exists purely as a meme with no burns, no utility, and no mechanism to reduce supply, so the math literally makes $1 impossible without destroying 99.9999% of all tokens first.

3. Shiba Inu (SHIB)

Shiba Inu launched in August 2020 as a self-proclaimed “Dogecoin killer” and quickly became one of the biggest meme coins in crypto history. The project started when anonymous creator Ryoshi sent half the supply to Vitalik Buterin, who then burned 40% and donated the rest to charity in what became a billion-dollar moment.

Why it can’t hit $1:

SHIB has 589 trillion tokens in circulation, so reaching $1 would need a $589 trillion market cap that’s bigger than the entire global economy and roughly 189 times Bitcoin’s current valuation. Even with regular token burns happening through Shibarium transactions, the supply is so massive that burning enough tokens to make $1 realistic would take thousands of years at current burn rates.

Why 2026 Could Trigger the Next Crypto to Hit $1

Let’s look at some of the reasons why 2026 might be one of the best years for the projects under the $1 valuation:

Alt-Season Rotation

Capital often rotates out of Bitcoin into altcoins during the bullish window. When that happens, smaller tokens under $1 typically have the most upside. Institutional flows into crypto via new products can increase this rotation.

Bigger Presale Rounds & VC Liquidity

A well-funded presale can change the playbook. Projects that raise tens of millions can hire teams, ship faster, market harder, and more. This makes the path to $1 more realistic for a handful of entrants, but it also raises execution risk if the money is wasted.

Meme-Coin Revival + Narrative Rotation

Viral meme coins remain powerful today, especially when they are paired with a fresh narrative. Tokens that match the trending narrative and have low token float tend to move faster, but volatility and risk remain high in 2026.

Looser US Exchange Appetite & ETF Tailwinds

The arrival of spot crypto ETPs and growing institutional access has already increased liquidity in the market. Spot Bitcoin ETFs were approved earlier, with spot Ethereum products following in 2025. This change matters because it deepens liquidity and gives a chance to investors who previously couldn’t touch small caps.

Institutional and Bank Access is Expanding

Big traditional players are loosening restrictions around crypto. For instance, Bank of America announced that wealth advisors will be able to recommend crypto ETPs to clients starting in early 2026. This means that more traditional capital could flow into digital assets.

In a related move, U.S. regulators now say banks can act as intermediaries in crypto transactions. This could make it easier for mainstream money to enter the market.

Early Signals That a Crypto Might Hit $1

Spotting the next crypto to hit $1 often comes down to watching the right early signals across on-chain data, social activity, and market traction.

Here are the cues that you should keep track of:

- Whale accumulation: When whale wallets begin accumulating tokens during low-volume periods, it often means institutional investors see future value.

- GitHub Commits Surge: A steady rise in developer activity is a good sign that the real features are being built behind the scenes.

- CEX Wallet Integration: Exchanges often integrate wallets quietly weeks before announcing a listing. Seeing this early is one of the clearest hints that a token may get wider exposure.

- DEX Liquidity Climbs: More liquidity on decentralized exchanges shows real money is flowing in, which reduces the slippage and gives the token stronger trading support.

Is it Legal to Invest in Low-Cost Crypto Projects?

Yes, buying cryptocurrencies that cost less than $1 per token is legal in most countries, though regulations vary widely by location. The United States allows crypto investments, but the SEC classifies some tokens as securities with stricter compliance requirements. The European Union permits crypto trading under MiCA regulations, while countries like China have banned crypto transactions entirely.

Legality depends more on how projects operate than on their token price. Scam projects that defraud investors violate laws everywhere.

Always verify that exchanges and projects comply with your local regulations. Check if platforms require KYC verification and hold proper licenses in your jurisdiction. Remember that tax obligations apply to all crypto gains regardless of purchase price, so keep records and report transactions according to local tax laws.

The Risks of Investing in Sub-$1 Crypto Projects

Just because a token trades under a dollar doesn’t mean it’s safe. In fact, low-priced coins often carry higher risks. Here are the biggest risks to watch out for:

Volatility

Daily price swings of 20% or more are common in low-cap tokens. Because these projects often trade in smaller pools with less volume, even a few big buys or sells can move the chart dramatically.

Investors who aren’t ready for this kind of turbulence can end up panic-selling or missing their exit.

Low Liquidity

Thin order books make entering and exiting positions costly. A single market order can cause heavy slippage, and sometimes it’s impossible to sell without crushing the price. For anyone putting in meaningful capital, liquidity is just as important as price.

Rug Pulls & Scams

Unaudited smart contracts, anonymous developer teams, and rushed presale structures open the door for bad actors.

Many sub-$1 tokens vanish overnight and leave buyers with worthless assets.

Exchange Delistings

Smaller caps often get listed on mid-tier exchanges, but if volumes dry up or compliance concerns arise, they can lose support quickly.

De-listing leaves investors stranded, unable to trade their tokens outside obscure decentralized pairs with near-zero liquidity.

How to Reduce Risk

- Diversify across sectors: Don’t go all-in on one theme like meme coins or AI. Spread exposure so one sector’s collapse doesn’t wipe out your portfolio. Check out our guide on how to buy meme coins safely.

- Vet tokenomics and contracts: Study inflation schedules, unlock timelines, and whether the project passed audits to spot red flags early.

- Prioritize doxxed teams: Tokens backed by visible, verifiable developers carry less risk than those run by anonymous figures.

- Watch community sentiment: Check Telegram, Discord, and Twitter. Healthy projects grow communities steadily, while scams rely on hype and spammy engagement.

How We Picked These $1 Crypto Contenders – Our Methodology

We looked at hundreds of crypto projects under $1 to find the ones with a real shot at hitting that milestone this year. Let’s talk about how we did it:

Presale Performance and Funding: 20%

Early funding shows if people actually believe in a project. We checked how much money the projects raised, who was buying (whales or retail investors), and whether the early participants were set up fairly or not.

The best projects had steady and organic growth. They raised at least $1 million without having to rely on celebrity hype. And, they gave most of their tokens to the public while locking insider holdings to prevent big dumps.

Technical Feasibility and Market Fit: 20%

A good project has to actually work and solve a real problem. We looked at whether the technology was live or just on paper, if the team had a good track record, and if smart contracts were audited.

Timing matters a lot, too. Projects tied ot trending sectors like AI, meme coins, or Layer 2 solutions scored higher if their value was easy to understand.

Exchange Listings and Liquidity: 20%

For a token to grow, it needs trading volume. We focused on projects that are planning major exchange listings, with active DEX trading, enough holders, and tokenomics that support healthy trading.

Projects that allocated funds to liquidity pools and locked them for a year or more ranked higher, especially if market makers were involved.

Community Quality: 20%

Strong communities drive success in the crypto industry. That being said, we looked for real engagement, not just big numbers. Healthy communities grow steadily and generate organic content. They foster discussions beyond just price hype.

At this stage, we dropped all projects with fake or inactive communities.

Risk and Sustainability: 10%

All low-cost tokens are risky, but some risks are manageable. We accepted new technologies, anonymous teams with proven track records, and competition from bigger players.

Dealbreakers here included no working product after six months or so, as well as teams controlling too much supply. Unaudited or shady smart contracts and tokens pushed only through paid hype also left our list at this point.

Data and Verification: 10%

To avoid hype or lies, we used multiple sources: on-chain data from Etherscan/BSCScan, trading data from DEXTools/DexScreener, development activity on GitHub, and audits from CertiK or Hacken.

In short, we filtered out the hype and focused on projects that are actually building something meaningful, giving them a real chance to reach $1.

Should You Bet on Crypto Under $1? Pros and Cons

Cheap tokens look tempting. After all, who wouldn’t want to grab thousands of coins for a few dollars? But whether the next crypto to hit $1 is truly a bargain depends on understanding the trade-offs.

- Massive upside potential: A token moving from $0.10 to $1 delivers 10x returns, while Bitcoin needs to hit $1 million for the same multiplier.

- Lower capital requirements: You can build meaningful positions with $500-1000, unlike blue-chip cryptos, where that barely buys a fraction of one token.

- Portfolio diversification: Small allocations across multiple sub-$1 projects spread risk and still expose you to high-profit potential projects.

- Community access: Smaller projects often have direct team communication and real influence on project direction through governance.

- Higher failure rate: About 95% of tokens under $1 never reach that milestone, with many going to zero instead.

- Liquidity problems: Low trading volume makes it hard to exit positions without massive slippage, especially during panic selling.

- Manipulation risk: Whale wallets can pump and dump prices easily when market caps stay under $100 million.

- Limited exchange access: Most sub-$1 tokens only trade on DEXs or sketchy exchanges with withdrawal issues and security concerns.

- Research difficulty: Finding reliable information requires extensive on-chain analysis since professional coverage rarely exists.

At the end of the day, coins under $1 can deliver big profits, but only if you size your bets wisely and do your research first.

Will Another Token Hit $1 in 2026? Final Verdict

Finding the next crypto to explode isn’t easy, but Bitcoin Hyper and Maxi Doge look like the best bets for hitting $1. You can buy these tokens now before they hit exchanges, and since there are no private VC deals, early buyers get a real head start.

Just remember, chasing massive crypto profits can be risky. The $1 price target keeps attracting investors with stories of tremendous gains, and those stories happen every bull cycle. Those 1000x returns come from tiny, volatile tokens that could easily crash to zero. For every MATIC or AXS that crossed $1, hundreds of projects promised the same and delivered nothing.

For 2026, the smart approach is to spread your bets across several promising projects and focus on tokens with clear use cases and/or community traction. With the institutional flows expanding and Layer 2 adoption growing, the year ahead could see some real breakout moments. Still, caution is key when investing in crypto. Smart investors spread their bets across different tokens and only put in what they can afford to lose.

FAQ

What is the next crypto to hit $1?

What are the best cryptos under $1 to buy?

Can a crypto under 1 cent reach $1?

Is it smart to invest in sub-$1 altcoins?

Which meme coins could hit $1 in 2026?

References

- How Many Cryptocurrencies Exist? – Tangem

- Crypto Market Cap Charts – TradingView

- Token Supply Explained – Binance Academy

- Tokenomics Deep Dive – Binance Research

- US bank regulator says banks can act as crypto intermediaries – Reuters

- Bank of America expands crypto access for wealth management clients – Reuters

Coinspeaker in Numbers

Monthly Users

Articles & Guides

Research Hours

Authors

BMIC (BMIC) is a presale project that wants to create quantum-resistant security for crypto wallets and digital assets. The team s...

Wondering how to buy crypto but not sure where to start? Our beginner's guide explains how and where to invest in digital assets l...

Fact-Checked by:

Fact-Checked by:

29 mins

29 mins

Filip Stojanovic

, 39 postsI’m a crypto content strategist and writer who helps Web3 projects tell their story, build trust, and grow engaged communities in an increasingly competitive space. I’ve worked with presale tokens, exchanges, blockchain startups, and crypto marketing agencies, shaping content strategies that not only explain complex concepts but also inspire confidence, attract investors, and drive adoption.

My experience spans a wide variety of formats, from whitepapers, token launch campaigns, and pitch decks to thought leadership articles, technical documentation, and in-depth guides. Before diving into Web3, I built my expertise in B2B SaaS writing. This structured, analytical approach now underpins my work in crypto, allowing me to bring clarity and credibility to projects in a space often criticized for hype and jargon.

I’m especially interested in how blockchain innovation translates into real-world utility. My recent work explores the evolving role of DeFi protocols, NFT ecosystems, and next-generation infrastructure in reshaping industries and creating new opportunities for both businesses and individuals.