LiquidChain is a Layer 3 blockchain project that wants to unify the liquidity of Bitcoin, Ethereum, and Solana into a single execu...

Ruvi AI (RUVI) combines generative AI (text, image, audio, and video) with Web3 mechanics, token-based incentives, and user-driven model training.

The buzz around the project is growing by the day, especially now that its RUVI token presale is live. Naturally, investors are wondering how RUVI’s price may trend post-listing and in the years to follow.

Seeing how RUVI is still in its presale phase, there is a wide range of possibilities. On one end, we have near-term gains baked into the project’s tokenomics. On the other hand, we have long-shot bull cases based on utility and adoption, and of course, the broad AI market cycle.

Below, we’ll explore both realistic and ambitious Ruvi AI price predictions and highlight the risks you should consider before investing in this token.

Key Takeaways: Ruvi AI Token Price Forecast

- The Ruvi AI presale is structured to push the token from $0.015 to $0.07 over successive phases, providing an almost 5x uplift if everything goes smoothly. This might sound great, but it could lead to post-launch dumping.

- Bullish voices suggest 100x+ upside, drawing comparisons to Solana- or Avalanche-style trajectories. More conservative models foresee a shorter-term ceiling in the $0.03 to $0.05 range, especially if listing or adoption is slower than hoped.

- The upside here hinges on several trigger factors, including strong user growth, high on-chain activity, broad exchange listings, and the continued success of Ruvi’s AI tools.

- Risks include delays in rollout, weak retention, liquidity constraints, or regulatory headwinds.

| Year | Bearish Scenario | Moderate Scenario | Bullish Scenario |

| 2026 | $0.02 – $0.05 | $0.07 – $0.15 | $0.25 – $0.40 |

| 2027 | $0.06 – $0.10 | $0.20 – $0.35 | $0.80 – $1.20 |

| 2030 | $0.10 – $0.20 | $0.40 – $0.70 | $1.50 – $2.50 |

Featured Alternative – Editor’s Choice

- First Bitcoin Layer 2 enabling fast, low-cost transactions

- Fixes Bitcoin’s speed and fee limitations with near real-time performance

- Enables a Bitcoin-native DeFi ecosystem

Ruvi AI Token Price Prediction for 2026-2030

Predicting the future of any token is extremely difficult, especially for new coins. Analyzing RUVI’s potential means looking at both what is already baked into its presale structure and what could realistically happen once the token starts trading freely.

Ruvi AI has a solid concept, but like any project, it is still unproven, and there are a handful of red flags to watch out for. The next few years will determine whether it becomes a strong ecosystem or just another short-lived hype story.

Let’s see how our analysts predict this token’s future.

2026: Presale to Public Trading

Ruvi’s presale has set a clear price ladder, starting around $0.015 and topping out near $0.07 in the final phase. This alone gives early buyers an upside, but what happens next depends on execution. Such a large difference between the starting price and the listing price could easily lead to token dumping after launch. To make it through its first weeks, Ruvi will likely have to drive enough demand and engagement to counteract this effect.

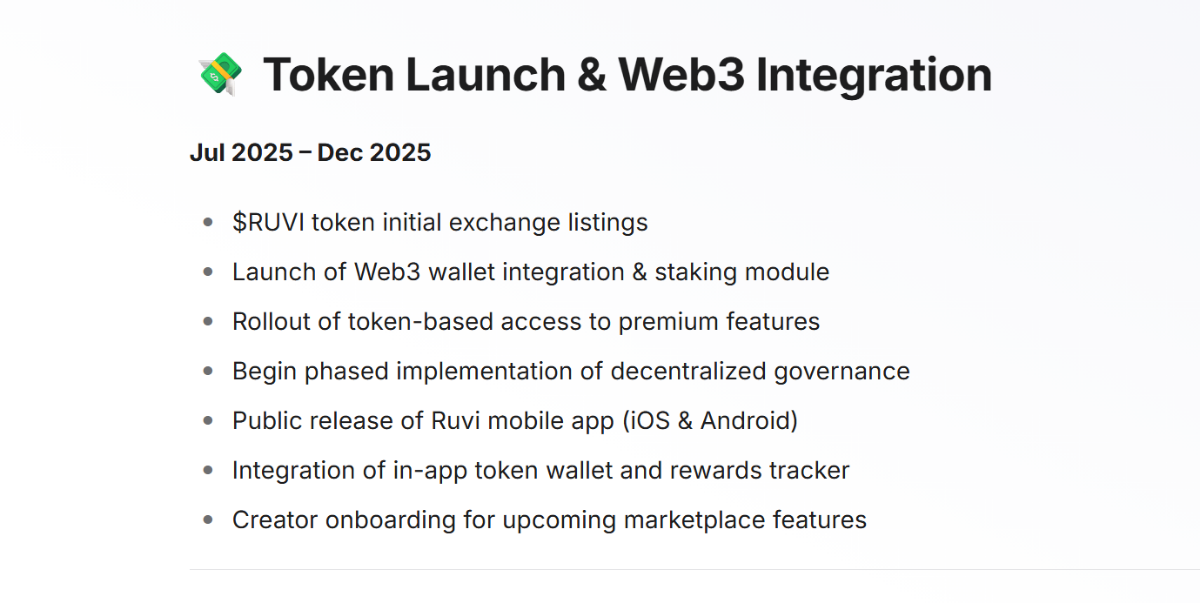

Ruvi AI token launch roadmap. Source: Ruvi AI

Bearish Scenario

In a bearish 2026, RUVI might trade between $0.02 and $0.05 if liquidity is weak or if exchange listings take longer than planned. Many tokens struggle after launch when early investors sell.

Moderate Scenario

In a moderate scenario, prices in the $0.07 to $0.15 range look fair. This assumes listings on mid-tier exchanges, a smooth rollout of staking, and active use of Ruvi’s web platform. The presale’s structure supports this outcome since it works on steady awareness and community growth.

Bullish Scenario

In a bullish case, RUVI could get to $0.25-$0.40. That would require strong hype, successful mobile app testing, and visible partnerships. If trading volumes mirror the enthusiasm we’ve seen during other AI token launches, there might be a sharp post-listing spike, but sustaining that price is another challenge altogether.

2027: Testing Real Utility

By 2027, Ruvi’s fate will depend less on hype and more on actual product usage. According to its roadmap, this period aligns with the full rollout of the Creator Marketplace, DAO governance, and developer APIs.

Ruvi AI roadmap detailing DAO transition. Source: Ruvi AI

Bearish Scenario

In the bearish range of $0.06 to $0.10, user engagement could fail if competing AI projects capture more attention. There is also the risk of delays in mobile updates or a lack of real marketplace traction, which would slow growth.

Moderate Scenario

A moderate outlook of $0.20 to $0.35 assumes Ruvi successfully transitions into a decentralized ecosystem. Its governance model should be live by this point, and users might be earning tokens through content creation, staking, and feedback contributions. This would make RUVI a functioning utility token rather than just a speculative asset. It’s important to note that even this moderate scenario requires decent adoption and healthy demand for the token.

Bullish Scenario

The bullish path targets $0.80 to $1.20. In this scenario, Ruvi establishes itself as a go-to decentralized AI platform with real-world integrations. This is hard to achieve, but it is possible if the app becomes mainstream among creators or if its SDK/API tools are adopted by third-party developers.

2030

By 2030, the early excitement will have long passed. What remains will be the core strength of the ecosystem. Now, if Ruvi manages to survive by this point and adapt, it could evolve into a fully decentralized AI economy. Alternatively, it could fade into irrelevance if it fails to scale.

Bearish Scenario

In a bearish scenario, the token could hover between $0.10 and $0.20, reflecting competition from newer, more advanced AI-Web3 projects. AI changes quickly, and if this project’s technology doesn’t keep pace, even the loyal base it now has might move on to something else, pushing its value down.

Moderate Scenario

A moderate range of $0.40-$0.70 assumes consistent upgrades of the network and steady user engagement, both through its DAO and creator marketplace.

Bullish Scenario

In a bullish scenario, Ruvi could trade between $1.50 and $2.50, turning into a big name in decentralized AI. This outcome would depend on full DAO control and strong developer participation.

Featured Alternative – Editor’s Choice

- Degen meme coin inspired by max-leverage trading

- A tribute to high-risk hustle — fueled by sweat and conviction

- Ethereum-born, culture-driven, aiming for multichain

What Is Ruvi AI?

Ruvi AI is a decentralized AI superapp built on Web3 technology. It combines different AI capabilities: text, image, audio, and video generation, all in one platform. With plans to be community-powered, users won’t just consume the platform’s AI-generated content.They will actively help train Ruvi’s models and earn RUVI tokens for their contributions.

This project aims to solve the lack of transparency and user ownership within the AI industry. Instead of using a closed model where companies keep all the profits, Ruvi purports to turn its users into stakeholders who can benefit from the ecosystem they help build.

Ruvi is currently live in public beta, with a fully functional web version and mobile apps for Android and iOS scheduled for release soon.

Ruvi AI homepage. Source: Ruvi AI

The Role of the RUVI Token

Ruvi functions as a multi-model AI platform, which means that it integrates several AI tools under one roof. Users can generate articles, social posts, designs, soundtracks, or videos without needing multiple subscriptions to different services.

The RUVI token is the backbone of the Ruvi ecosystem. It’s a utility and governance token used for payments, access, staking, and community voting.

- Access and payments: Users can use RUVI to unlock premium tools, buy advanced templates, or pay for high-resource tasks such as video generation or long-term writing.

- Rewards and incentives: Tokens are distributed to users who provide feedback, complete AI trending tasks, or participate in community challenges.

- Staking: Holders can stake RUVI to earn passive rewards, gain loyalty perks, or increase their voting weight in governance.

- Governance: The platform gradually moves toward decentralization, allowing RUVI holders to propose and vote on major decisions.

Tokenomics and Presale

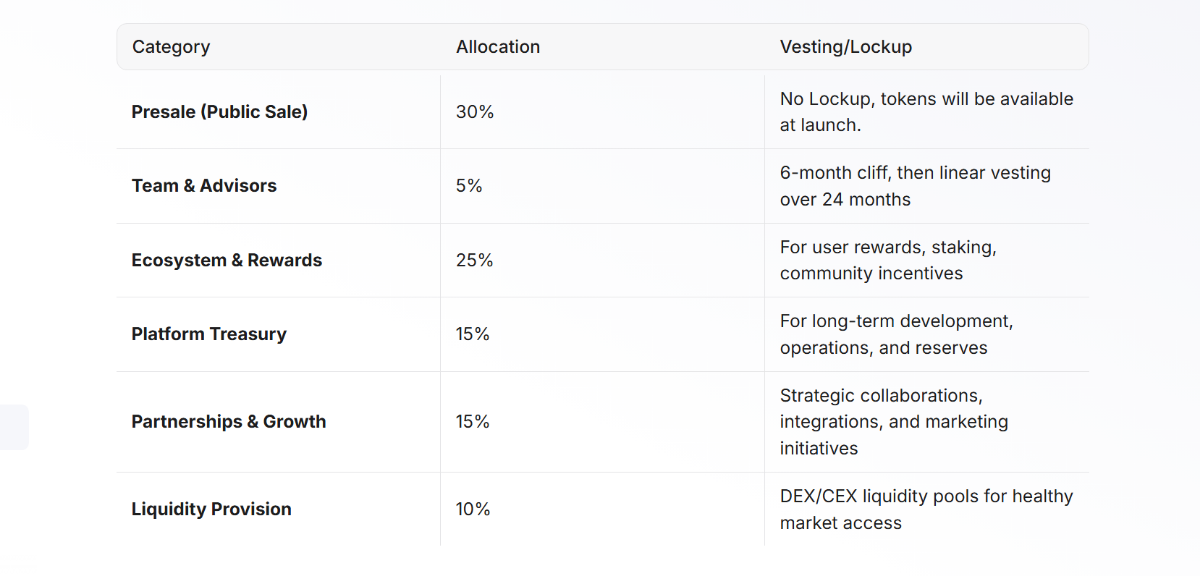

Ruvi’s tokenomics were built with a focus on sustainability rather than hype. The total supply is capped at 5 billion RUVI tokens, divided among key categories that support liquidity, development, and user incentives.

Ruvi AI tokenomics table. Source: Ruvi AI

The Ruvi AI presale is structured in seven progressive phases, designed to reward the earliest participants. Prices begin at $0.010 per RUVI in Phase 1 and increase gradually to $0.070 in Phase 7, representing an almost seven-fold increase for early buyers.

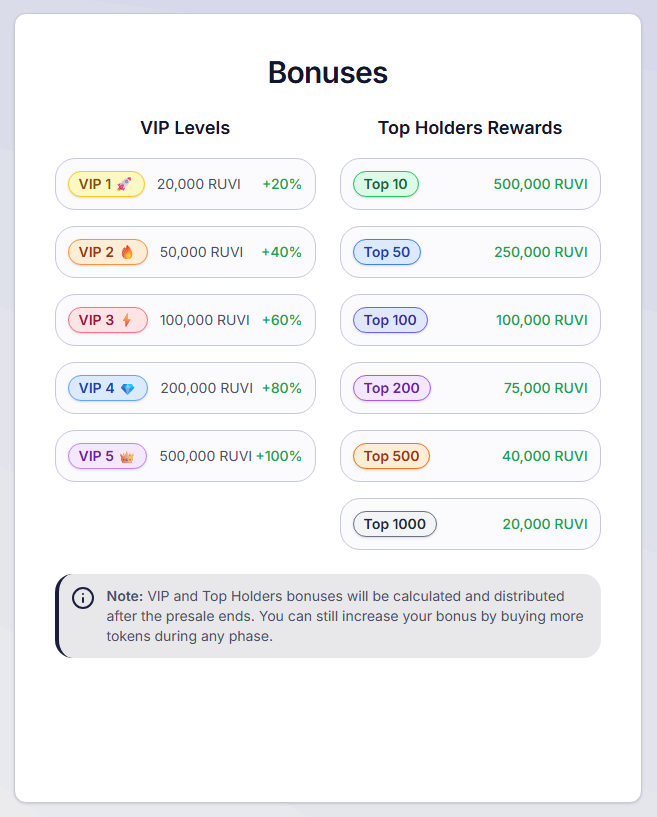

Each phase unlocks a specific allocation of tokens, with the presale representing 30% of the total supply. What makes this even more interesting is the VIP and leaderboard bonus system:

Ruvi AI bonus and VIP rewards. Source Ruvi AI

Reasons Why RUVI is attracting investors

Real Use Case

Ruvi AI is built around a working beta product. Its web app is already live and allows users to generate text, images, audio, and video.

Token Utility and Incentives

If all goes according to plan, RUVI will power the entire platform from unlocking AI tools and templates to staking and governance. This could give the token consistent, built-in demand, especially if more creators and professionals start using the app. This utility, combined with Ruvi’s user-reward system that allows participants to earn tokens to help train the AI, could build a strong foundation for token demand and engagement.

Decentralized and Community-Driven Vision

Ruvi’s gradual move toward decentralization makes it appealing to long-term investors. Over time, RUVI holders will have a say in how the platform evolves. This DAO-style governance adds a sense of ownership that many centralized AI companies lack.

Transparent Presale and Tokenomics

The seven-phase presale structure offers clear pricing, no hidden lockups, and tiered rewards for early supporters. The token allocation, especially the 25% for rewards and ecosystem, is designed to keep users involved long after launch.

Risks Linked to Investing in Ruvi AI

New project volatility

Like all presale tokens, RUVI carries a lot of early-stage risk. Prices can fluctuate significantly after launch, and early buyers may sell to make a quick profit. Since there are no lockups and early-stage prices are so heavily discounted, there is likely to be significant volatility during the first few weeks of public trading.

Execution risk

Ruvi’s roadmap is ambitious to say the least. It details mobile apps, DAO governance, a creator marketplace, and cross-chain expansion planned by 2026. Each milestone adds complexity to the project. If even one of these elements gets delayed, or if the user base doesn’t grow as expected, it could limit confidence and demand.

Competitive AI Market

The AI sector is already crowded. From giants like OpenAI and Google to Web3 players like Fetch.ai and SingularityNET, the competition for attention is big. For Ruvi to stand out, it will need constant innovation, good marketing, and a product experience strong enough to keep users returning.

Team Anonymity

Currently, Ruvi’s team remains undisclosed, citing privacy and decentralization goals. This is not uncommon for Web3 startups, but it does raise questions about accountability.

How Ruvi AI Compares to Trending Presales

One of our criteria for predicting tokens’ future prices is comparing the project to others at its level. That being said, let’s compare Ruvi AI to other trending presales.

Maxi Doge

Maxi Doge follows a more classic meme-coin path, fueled by community hype and fast presale growth. It is seeing strong investor interest, but like most meme coins, it relies heavily on social momentum rather than a working product.

Ruvi AI, on the other hand, already has a beta platform and clear token use cases. The project’s extremely ambitious roadmap gives it a massive amount of growth potential in the long term, likely exceeding Maxi Doge’s, but it also faces significantly more execution risk.

How to Buy Ruvi AI

Buying RUVI is straightforward since the token is still in its presale phase. All you need to do is:

- Visit the official Ruvi AI presale page

- Choose your purchase token (ETH, USDT, or BNB)

- Connect your crypto wallet and complete the transaction

After payment, your RUVI tokens will appear in your presale dashboard. They will be claimable once the presale concludes.

Conclusion: Who Should Invest in Ruvi AI?

Ruvi AI offers something that is still rare in crypto – a functioning product paired with a token economy that rewards real user participation. This project could appeal to long-term believers in decentralized AI, as well as early adopters who like being a part of a community-driven tech platform with staking potential. It might also be a powerful tool for creators and professionals looking to integrate AI utility into their workflow while earning rewards for participation.

However, investors looking for instant profits or high-volatility meme runs might find Ruvi’s pace slower and more utility-driven. The token’s real value will depend on how quickly and successfully Ruvi delivers its roadmap and grows its user base. Don’t underestimate the risks involved in this project. It is still a new coin with much to prove.

FAQ

Is Ruvi AI available right now?

How can I buy RUVI tokens?

What will RUVI be used for?

When will Ruvi AI list on exchanges?

Is Ruvi AI a safe investment?

References

Coinspeaker in Numbers

Monthly Users

Articles & Guides

Research Hours

Authors

The team behind IPO Genie has not yet announced an end date for the presale.

AI cryptocurrencies combine blockchain with artificial intelligence to power decentralized machine learning networks, GPU computin...

12 mins

12 mins

Nadica Metuleva

, 47 postsI’m a seasoned writer with over a decade of professional experience, specializing in crypto, technology, business, and iGaming. Over the years, I’ve built a reputation as a trusted contributor to well-known outlets such as InsideBitcoins, CEOTodayMagazine, and Promo, while also collaborating with leading content and marketing agencies including Skale and Boosta. My portfolio spans a wide range of content types, exchange reviews, how-to guides, long-form comparisons, trend analyses, and thought leadership pieces, crafted to both inform and engage readers across different levels of expertise.

In the crypto space, I’ve developed a deep understanding of blockchain technology, digital assets, and the fast-moving decentralized finance (DeFi) ecosystem. I’ve written extensively on topics such as cryptocurrency exchanges, wallets, tokenomics, NFTs, and global regulatory developments. As a crypto investor myself, I bring a valuable firsthand perspective that allows me to balance technical accuracy with practical insights that resonate with traders, investors, and newcomers alike. Whether I’m breaking down blockchain mechanics or analyzing the latest market shifts, my work combines rigorous research, industry knowledge, and a keen sense of storytelling.

My educational background plays a key role in shaping my writing approach. I hold a Bachelor’s degree in Translation and a Master’s degree in English Literature and Teaching, disciplines that sharpened my ability to research complex subjects, distill technical information into accessible language, and adapt my tone to diverse audiences. This strong academic foundation underpins my clear, insightful, and authoritative style.

Passionate about making complex topics accessible, my mission is to cut through the jargon and deliver content that empowers readers to make informed decisions.

You can learn more about me and explore my portfolio on LinkedIn.