LiquidChain is a Layer 3 blockchain project that wants to unify the liquidity of Bitcoin, Ethereum, and Solana into a single execu...

Learn how to trade Solana futures in this beginner’s guide. We explain proven strategies, best practices, and top futures platforms.

Billions of dollars in Solana futures trade daily, with many platforms offering leverage of 50x or more and supporting both long and short positions. Successful SOL futures trades can yield substantial profits, but beginners should understand proven strategies and best practices before entering the market.

This guide explains how and where to trade SOL futures in 2026. Read on to learn about key concepts like margin requirements, liquidation risks, perpetual contracts, and risk management.

What Are Solana Futures?

Solana futures are derivative products that track the SOL spot price, providing market exposure without requiring direct ownership of coins. Futures offer several benefits over traditional spot markets, including small margin requirements and the ability to go long or short.

Regulated Solana futures are available on the CME exchange, yet they are aimed at institutional clients rather than retail traders. The minimum trade requirement is 25 SOL for micro contracts and 500 SOL for standard futures.

Retail traders are better suited for “perpetual” futures, which, unlike traditional futures, never expire. Perpetual futures, or “PERPS”, also have low minimum requirements, making them ideal for casual traders on a budget.

One example is Margex, which offers 50x leverage on Solana futures, which amplifies a $100 trade to $5,000. This high-leverage structure lets traders to enter large positions without incurring substantial risk.

How Does Solana Futures Trading Work?

Most retail clients lose money when trading perpetuals, so it’s wise to learn the fundamentals before starting. This section provides a detailed explanation of how Solana futures work.

Derivative Products

Popular exchanges like Margex, MEXC, and Binance offer Solana futures. They are derivative products, so you don’t own or control the SOL coins when trading them. Instead, traders use Solana futures to speculate on short-term price movements.

The SOL-Perp chart view when trading futures on Margex. Source: Margex

Perpetuals, which you’ll be trading as a retail client, never expire. While this perpetuity means you keep positions open indefinitely, futures exchanges charge funding fees. These fees are typically charged every eight hours, making them unsuitable for long-term storage.

Long or Short

One of the key benefits of trading SOL futures is that you can go long or short. Traders place buy orders (long) if they believe the Solana price will rise, and vice versa for sell orders (short).

To make money going short, the SOL needs to decline below the entry price.

Margin Requirements

Solana futures require an upfront margin, which, unlike spot trading, is a small percentage of the total trade value. For example, if the futures exchange has a minimum margin requirement of 2%, a trader who wants to enter a $10,000 position would only need $200 to enter the trade.

Note that the exchange liquidates the futures trade if its value declines to an amount equal to the margin balance. More on this later.

Fees and Funding Rates

Solana futures attract trading fees like any other investment product. Traders pay a commission when they enter and exit trades, and that commission is multiplied by the total position value. This structure means the commission is based on the leveraged amount, not the margin you pay.

Futures contracts also incur funding rates. Exchanges usually charge them every eight hours based solely on the amount borrowed (the leverage). However, exchanges only charge either longs or shorts each eight-hour cycle, depending on whether the PERPS price is above or below the SOL spot price. If traders are charged a funding fee, the amount is deducted from the margin balance.

Realized Profits

Profits can be significant when trading futures, as gains are multiplied by the total position size, which typically includes high leverage.

A long trader who risks $1,000 at 50x controls a $50,000 futures position, so if the SOL price rises by 10%, they make $5,000 (less fees).

How to Trade Solana Futures: Step-by-Step Guide

Learn how to trade Solana futures in the walkthrough below. Margex is used for this tutorial to explain each step, although the process is similar at most other retail-centric platforms.

Step 1: Open a Futures Trading Account

You need an account to trade futures at Margex.

Opening an account on Margex to begin a futures trade. Source: Margex

Visit the Margex website and click “Sign Up”. Then enter an email address and choose a password.

Note: While Margex is one of the best crypto exchanges for beginners, it’s also a no-KYC provider. This means Margex doesn’t ask for personal information or government-issued ID.

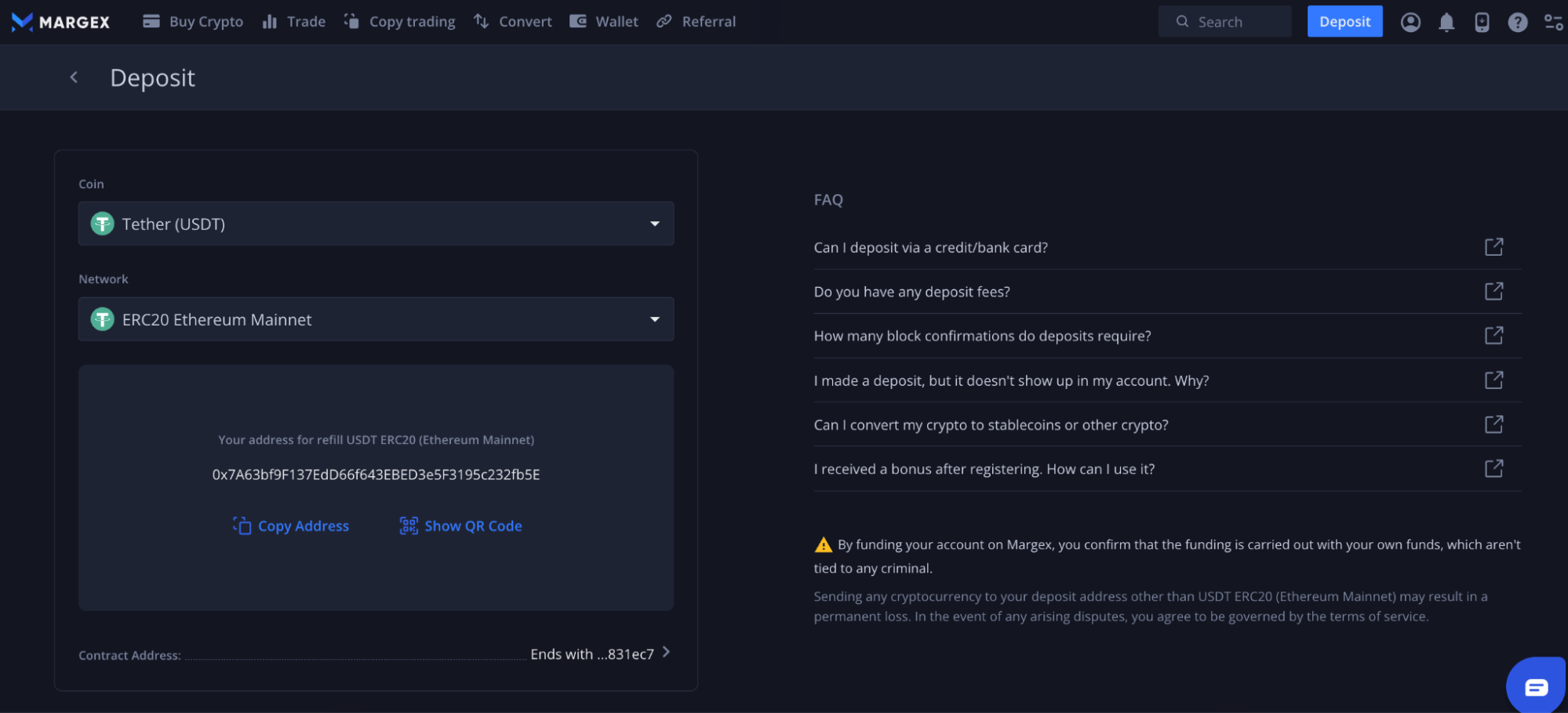

Step 2: Add Funds to the Futures Account

The next step is to deposit funds into the Margex account. The exchange accepts cryptocurrencies and fiat money.

If you hold a supported digital asset like Bitcoin, Ethereum, or Solana, click the “Wallet” button and copy the deposit address. This is the blockchain address to use when making a wallet transfer.

Deposit funds into your Margex account. Source: Margex

To use fiat money, click “Buy Crypto”, select the preferred currency, and choose “USDT” as the receiving asset. USDT is the best cryptocurrency to buy when trading futures, as it’s easier to track profits and losses. The exchange accepts over 150 payment methods, including debit/credit cards, Neteller, and bank transfers.

Step 3: Go to the SOL Futures Platform

With a funded account, you can now go to the Solana futures page.

Viewing Solana futures on Margex. Source: Margex

Click “Trade’ and type in “SOL”. Tap the market that appears.

Step 4: Create a SOL Futures Order

You need to complete a futures order form, which is located to the left of the Solana price chart.

Completing a futures order form. Source: Margex

The initial step is to choose between a limit or a market order:

- Limit Order: Lets traders choose the entry price. The exchange executes the order only when the target price aligns with the market price.

- Market Order: The best option for beginners, market orders execute instantly based on the next best available price.

Choose the leverage ratio from 5x to 50x by moving the slider, and confirm.

Enter the order size in USDT. This is the total amount, including leverage. For example, a 10,000 USDT trade at 50x leverage requires an upfront margin of 200 USDT.

The final step is to click the “Buy” or “Sell” button, depending on whether you’re long or short.

Risk Management

One of the best ways to manage the risk around your trading is to set up a stop-loss. This will tell the platform to close your position if the price drops past a certain point. You choose the threshold, maybe 5% or 10% below your entry, and the system will work based on that.

Take-profit orders work the same way, just in the other direction. You pick a price where you’d be happy to exit, and if the market gets there, the platform will sell automatically. Your profits are locked in, and you don’t have to be online at that moment.

Both tools take a few seconds to set up when you place your order. They won’t guarantee a winning trade, but they give you some control over how much you stand to lose and when you walk away with a profit.

Best Platforms to Trade SOL Futures

Many online platforms allow traders to speculate on Solana futures. This section explains the different platform types, who they’re suitable for, and what to consider when choosing a provider.

Centralized Exchanges

The vast majority of retail clients use centralized exchanges to access SOL futures. These platforms operate like regular brokerages. Users open an account, deposit funds, and place trades in their preferred market.

Exchanges like Margex and MEXC ensure smooth trading conditions, and traders place market or limit orders to execute positions. The traditional order book system relies on liquidity, so futures traders should ensure the platform attracts substantial volumes.

Centralized exchanges typically offer advanced analysis tools, too, such as technical indicators (e.g., RSI and MACD) and drawing lines.

The drawback of centralized futures platforms is that they have a single point of failure. Hacks and internal malpractice can lead to a loss of funds.

Decentralized Exchanges

You can also trade Solana futures on decentralized exchanges. They’re a popular alternative to centralized exchanges due to their non-custodial framework. You retain control of your cryptocurrencies at all times, reducing counterparty risks like account closures.

Hyperliquid is one of the largest decentralized exchanges for futures trading, and it offers 20x leverage on SOL markets. No account is required, as traders simply connect a self-custody wallet and fund orders from their balance.

While decentralized exchanges are often known for their weak liquidity, over $1 billion in Solana futures was traded on Hyperliquid in the past 24 hours.

SOL Futures ETFs

For people who want exposure to Solana futures without touching crypto at all, there are now ETFs that handle it for you. Volatility Shares launched two of them in March 2025. SOLZ gives you standard exposure to SOL price movements, while SOLT amplifies it with 2x leverage.

These funds don’t hold actual Solana. They’re built on CME futures contracts, so prices can drift slightly from the spot market. But for investors who want a regulated product they can buy through a traditional brokerage, this is about as simple as it gets. No wallets, no private keys, no learning curve.

A few months later, REX-Osprey launched the first U.S. Solana ETF that includes staking. The fund pays out a 7.3% yield on top of the price exposure, which is something you couldn’t get from a traditional ETF until now.

By late October, spot Solana ETFs finally went live after the SEC gave its stamp of approval. Two are already trading, and there are more in the pipeline. The SEC also introduced a new listing framework in September that makes it easier for altcoin ETFs to get through the approval process, so the options are likely to keep expanding.

Solana CME Futures

If you’re an institutional trader or just prefer a more traditional venue, Solana futures also trade on CME, the world’s largest derivative exchange. The exchange launched them in March 2025, and it’s the same infrastructure used for commodities and other major derivatives.

Institutional traders on CME – a smaller, more boutique experience. Source: CME

What’s surprised a lot of people is how quickly institutions have jumped in. Solana futures hit $1 billion in open interest in just five months, faster than Ethereum managed at eight months and way ahead of Bitcoin, which took three years to reach the same level.

Since launch, more than 540,000 contracts have traded, worth over $22 billion in total. August 2025 set records, with daily volume that averaged around $437 million. That’s a far cry from the early days when a typical session might see $9 million.

There are two contract sizes available. The standard one is 500 SOL, which comes out to roughly $82,000 at current prices. If that’s too steep, there’s also a micro contract at 25 SOL, though even that requires a decent chunk of capital.

CME added options on Solana futures in October 2025, which gives traders more ways to hedge or express a directional view. The venue is still smaller than crypto-native exchanges, but the gap has narrowed fast. For institutions that want regulated exposure without ever touching a crypto wallet, this is now a real option.

Types of Solana Futures Trading

This section provides a closer look at the various types of futures contracts that support SOL.

Perpetual Futures

The easiest way to trade Solana futures is via perpetual contracts. They’re available on over 100 crypto exchanges – many offer a no-KYC experience and high leverage limits. Perpetual futures never expire, but funding rates make them unsuitable for long-term strategies.

Delivery Futures

Unlike perpetuals, delivery futures have an expiration date. When that date arrives, the contract settles based on wherever the market price lands. There’s no rolling over, no funding rates eating into your position overnight. You open the trade, hold it until expiry, and settle up.

This makes them a better fit if you’re planning to hold a position for weeks or months rather than hours. The lack of funding fees means you’re not bleeding money just to stay in the trade.

Binance is one of the more popular futures platforms for Solana delivery contracts. They offer both quarterly and bi-quarterly expirations, with solid liquidity and fees that stay competitive. If you already use Binance for spot or perpetuals, adding delivery futures to the mix is straightforward.

Contract Settlement

When a Solana futures trade closes, it has to settle in something. Most contracts use stablecoins like USDT or USDC, which means your profits and losses show up in dollar terms. This is the simpler option, because you know exactly what your position is worth in an instant.

Inverse contracts, on the other hand, settle in SOL. If your trade goes well, you end up with more SOL. But if things go the wrong way, you’re losing SOL while the price of SOL might also be falling, so the risk can compound.

You also post margin in SOL with inverse contracts, so even your collateral fluctuates with the market. Most beginners stick with stablecoin-settled futures until they’re comfortable with how everything works.

Benefits of Solana Futures Trading

Traders access several benefits from speculating on Solana futures, including high leverage, low margin requirements, and the ability to short-sell.

Let’s unravel the key benefits of SOL futures in more detail.

High Leverage and Low Margin Requirements

Retail clients are drawn to the high leverage limits provided by Solana futures. By extension, traders can open positions worth significantly more than their account balance allows, unlike conventional spot trading.

We mentioned that Margex offers 50x leverage, so traders get $5,000 in market exposure for every $200 they deposit. Other exchanges offer even higher leverage, with MEXC users having access to up to 300x.

Easy Access

The best Solana futures trading platforms are highly accessible. Many accept traders from around the world, with no KYC requirements or country restrictions.

Minimum deposits are often low, and combined with high leverage, those on a budget can access substantial capital.

Short-Selling

Futures let traders capitalize on falling Solana prices. Traders place sell orders and, if the SOL price declines, they make a profit. When you buy SOL from a regular spot exchange, you only profit if the price increases.

Ideal for Hedging

Traders often use futures to protect their positions from market uncertainty, rather than sell the existing position, which can trigger realized capital gains if the sale is profitable. Instead, they open a short futures position, which offsets gains or losses from the existing trade.

This hedging strategy is ideal during volatile market conditions or in anticipation of a major regulatory decision.

Risks to Consider When Trading SOL Futures

Futures are significantly riskier than standard Solana investments. Here are the key risks to consider before getting involved.

Liquidation

Solana futures attract liquidation risks, a direct consequence of trading with leverage. Liquidation happens when the Solana futures position declines by more than the initial margin. For instance, 100x amounts to a 1% margin requirement, so the trade is liquidated when it declines by 1%.

When an exchange liquidates the trade, it automatically closes the position, and the trader loses their margin. While billions of dollars worth of perpetuals are liquidated every month, the best practice is to keep leverage levels low and always to set stop-loss orders.

No Direct Ownership

When you trade Solana futures, you don’t actually own any SOL. You’re just betting on where the price goes next, which, for short-term traders, might be fine. But if you want to hold Solana for the long run and be part of the ecosystem, futures aren’t the right tool.

Solana futures mean not owning the asset outright, but speculating on its future price. Source: Solana

There’s also an opportunity cost. Without an actual SOL in your wallet, you can’t stake it, lend it, or use it in DeFi. Those options are only available to people who hold the real thing.

High Trading Fees

Fees on futures trades can add up faster than you’d expect. The commission isn’t based on what you put in. It’s based on the full position size after leverage.

Take Binance as an example. They charge market takers 0.05% per trade, which might not sound like a lot. But if you open a $500 position at 100x leverage, you’re really trading $50,000. That 0.05% turns into a $25 fee just to get in. You’ll pay another fee when you close.

On top of that, perpetual contracts charge funding rates every eight hours. Hold a position for a few days, and those small percentages start to add up. It’s worth doing the math before you trade, especially at higher leverage.

Conclusion

There’s a reason most traders lose money on futures. The leverage cuts both ways, fees stack up faster than you’d expect, and one bad trade can do real damage if you’re not careful.

However, we can’t say that futures aren’t worth learning. They do offer the flexibility that spot markets just can’t match. If you’re a type of trader who’s willing to put in the time to learn it properly, futures can be a powerful tool in your arsenal.

Use stop-losses, set take-profits, and don’t trade with more leverage than you can handle. Margex is a solid starting point if you’re new to this. Low minimums, clean interface, and enough tools to learn without getting overwhelmed. Start small, figure out how the mechanics work, and go from there.

FAQ

What is the difference between Solana spot and futures trading?

What are the funding rates for Solana futures?

What is the minimum amount needed to start trading Solana futures?

When did CME launch Solana futures?

References

- Why Perpetual Futures Matter (SC Johnson College of Business)

- Solana (SOL) Futures (CME Group)

- Hyperliquid Grows Into a Major Player in Crypto Derivatives (Bloomberg)

Coinspeaker in Numbers

Monthly Users

Articles & Guides

Research Hours

Authors

The team behind IPO Genie has not yet announced an end date for the presale.

AI cryptocurrencies combine blockchain with artificial intelligence to power decentralized machine learning networks, GPU computin...

Fact-Checked by:

Fact-Checked by:

17 mins

17 mins

Ibrahim Ajibade

, 373 postsI’m a research analyst with experience supporting Web3 startups and financial organizations through data-driven insights and strategic analysis. My goal is to help organizations make smarter decisions by bridging the gap between traditional finance and blockchain innovation.

With a background in Economics, I bring a solid understanding of market dynamics, financial systems, and the broader economic forces shaping the crypto industry. I’m currently pursuing a Master’s degree in Blockchain and Distributed Ledger Technologies at the University of Malta, where I’m expanding my expertise in decentralized systems, smart contracts, and real-world blockchain applications.

I’m especially interested in project evaluation, tokenomics, and ecosystem growth strategies, as these are areas where innovation can drive lasting impact. By combining my academic foundation with hands-on experience, I aim to provide meaningful insights that add value to both the financial and blockchain sectors.