LiquidChain is a Layer 3 blockchain project that wants to unify the liquidity of Bitcoin, Ethereum, and Solana into a single execu...

Want to trade Tron futures long and short with leverage? Read our beginner’s guide on how to trade TRX futures safely in 2026.

As a top 10 crypto by market capitalization, Tron (TRX) remains a popular futures trading market. Traders go long and short on the TRX price without needing to cover the full contract value, which enables them to enter much larger positions.

After testing 20+ futures exchanges, we found that CoinFutures is the best option for crypto traders. The platform offers TRX leverage of up to 1000x with low fees, and isolated-style markets ensure traders limit their downside to the original stake.

This guide helps beginners understand Tron futures trading, including investing best practices and risk-averse strategies. We explain important futures concepts in simple terms, including initial and maintenance margin, derivative contract types, and liquidation.

Key Takeaways

- Tron futures offer exposure to TRX price movements, and unlike traditional investing, traders do not take ownership of the underlying coins.

- Crypto traders access futures through perpetual and delivery futures, with both products offering leverage and short-selling facilities.

- Research shows that the best Tron futures trading platforms support leverage of up to 1000x, yet traders must evaluate liquidation risks.

- Futures suit active traders with short-term strategies like scalping and day trading, since they incur much higher fees than spot trades.

- Experts recommend stop-loss orders to reduce risk, and avoiding cross margin products to limit the loss potential.

The Best Tron Futures Platforms Ranked

Here are the best Tron futures platforms for crypto traders, according to our research:

- CoinFutures: The Best Place to Trade TRX Long and Short With High Leverage

- MEXC: Professional-Grade Charting Tools With 200x Perpetual Futures Contracts

- CoinEx: A Great Option for Market Diversification With Over 260 Futures Pairs

- Binance: Buy and Sell Tron Futures Passively With Automated Trading Tools

- KCEX: Trade Hundreds of Futures Markets With Max Commissions of 0.1%

Best Tron Futures Trading Platforms Reviewed

To make an informed decision, we encourage readers to explore our platform reviews. We discuss the best TRX futures exchanges in great detail, including their pros, cons, and key features.

1. CoinFutures: Safe and User-Friendly TRX Futures Platform With 1000x Leverage

Our top pick for trading Tron futures in 2026 is CoinFutures, a safe, licensed, and beginner-friendly platform. Users access popular cryptocurrencies with small trade minimums, including TRX, Ethereum (ETH), Dogecoin (DOGE), Litecoin (LTC), and Bitcoin (BTC). While each market trades against USDT, stakes are entered in USD for added simplicity.

Research shows that CoinFutures offers the highest leverage in the market, since traders magnify their positions by up to 1000x. A trader who enters a $20,000 TRX trade posts an initial margin of just $20.

Our top pick CoinFuturesoffers 1000x leverage on TRX/USDT futures. Source: CoinFutures

The initial margin, called “Wager” on CoinFutures, represents the maximum downside. Alongside negative balance protection and stop-loss orders, these features ensure users avoid excessive losses. The platform also supports take-profit orders, so traders exit positions automatically when they hit the profit target.

We reviewed safety controls and confirmed that CoinFutures offers tier-one security through Fireblocks. The regulated institution provides custodian services through insured cold wallets with MPC security and transparent proof of reserves. Users avoid privacy risks, too, as CoinFutures is a no-KYC platform.

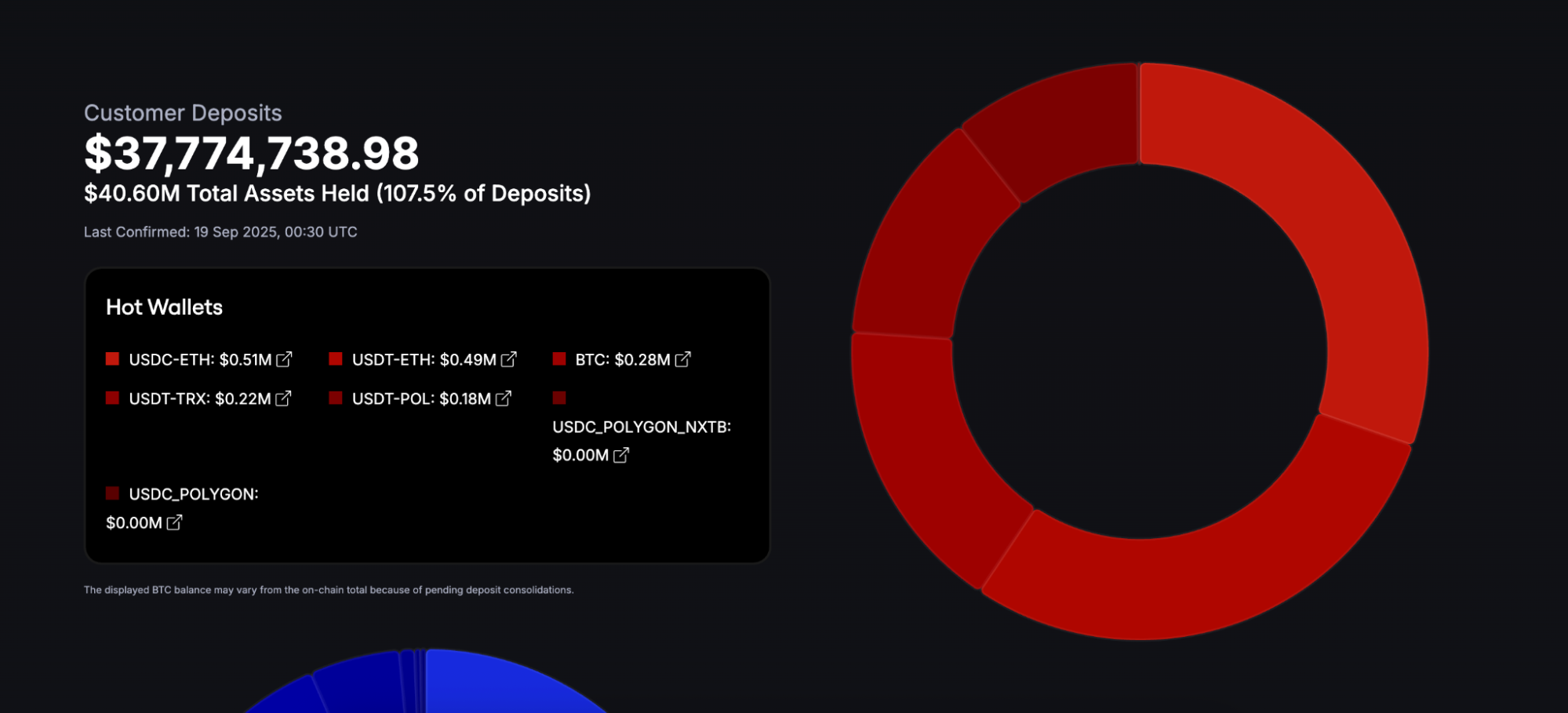

CoinFutures publishes daily proof of reserves for its hot and cold storage wallets. Source: CoinFutures

Traders fund their accounts with crypto and fiat money without minimum deposit requirements, and withdrawals are usually processed right away.

Pros

- The overall top place to trade Tron futures in 2026

- Access 1000x leverage with a $1 minimum trade size

- The user-friendly trading dashboard suits beginners

- Enter and exit positions without relying on platform liquidity

- Fast payments without KYC verification

- Fireblocks partnership ensures tier-one security and transparency

Cons

- Doesn’t support inverse contracts with TRX settlement

- Telephone support isn’t available

2. MEXC: Trade TRX Perps With 200x Leverage and Advanced Charting Features

Tier-one exchange MEXC boasts significant trading volumes and competitive fees. Its diverse futures trading platform offers hundreds of markets, from TRX, BTC, and ETH to the popular meme coins like DOGE, Bonk (BONK), and OFFICIAL TRUMP (TRUMP).

The platform lists TRX futures with Tether (USDT) and USDC (USDC) pairs, and traders may choose between cross and isolated margin. As a high-leverage exchange, MEXC users enter positions with a minimum initial margin of just 0.5%. This margin ratio raises the trader’s stake by up to 200x.

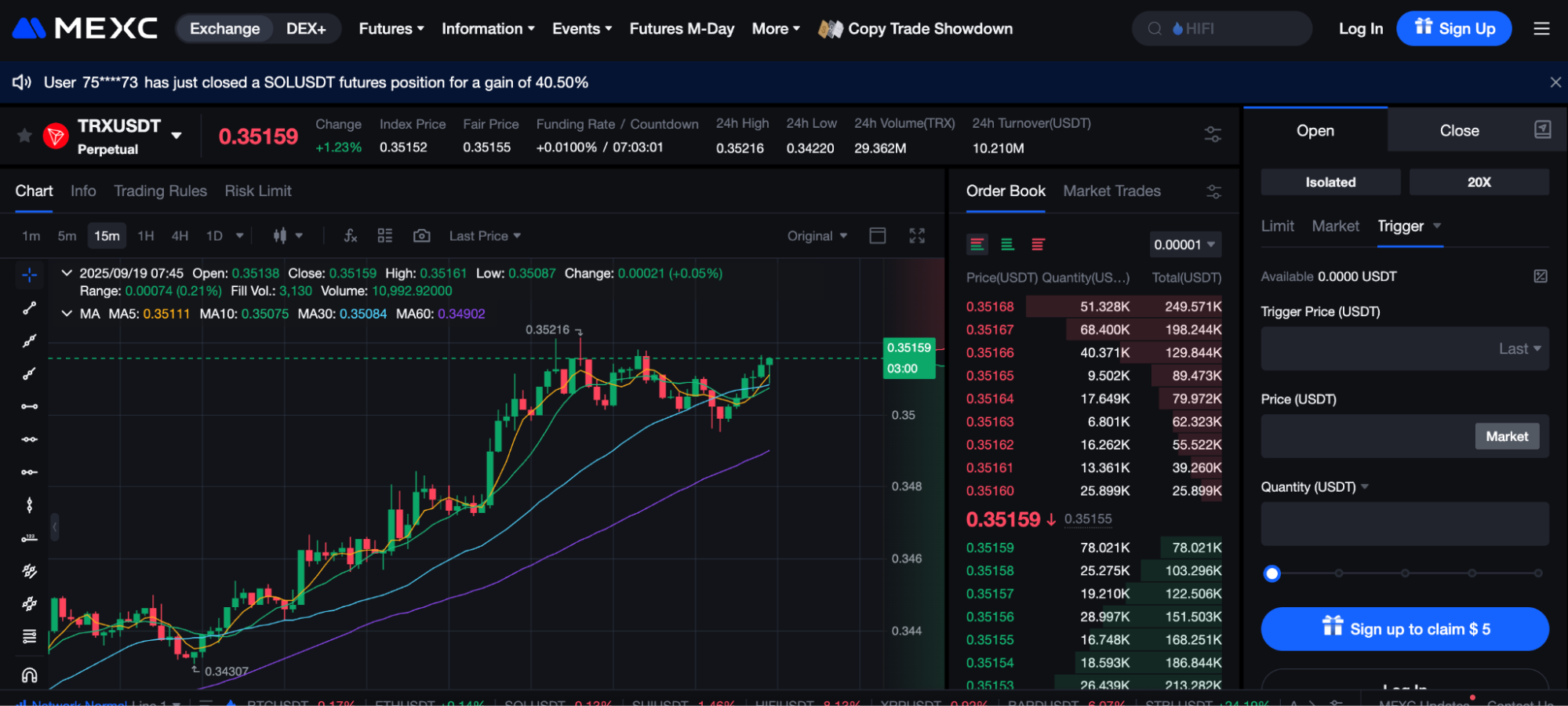

TRX/USDT futures on MEXC support huge leverage limits of 200x. Source: MEXC

We found that MEXC is one of the best crypto futures trading platforms for charting tools. Its professional-grade trading screen offers liquidation maps, indicators, drawing tools, custom order types, and market depth. Its TradingView integration provides additional functionality, including real-time signals.

Advanced futures traders may deploy algorithmic bots via an API connection. This feature allows traders to automate their TRX trades 24/7 through rule-based strategies. Alternatively, MEXC offers pre-built bots without additional charge.

Pros

- Powerful charting dashboard that supports algorithmic bots

- TRX perpetuals offer leverage of up to 200x

- Contract settlement options include USDT and USDC

- Also supports Ethereum futures and 900+ other altcoin pairs

Cons

- Best suited for experienced traders with technical analysis skills

- Some deposit methods incur high transaction fees

3. CoinEx: One KYC-Free Account Unlocks Access to Over 260 Futures Markets

We found that CoinEx appeals to futures traders who seek exposure to a wide range of markets. It offers over 260 derivative pairs with stablecoin settlement, and each includes leverage with stablecoin settlement. In addition to TRX, account holders trade major altcoins like ETH, BNB (BNB), and Solana (SOL), plus new cryptocurrencies with small market capitalizations.

All futures markets trade via perpetual contracts, and the maximum TRX leverage is 50x. The initial and maintenance margins are 2% and 1%, respectively, up to the first 2 million TRX traded.

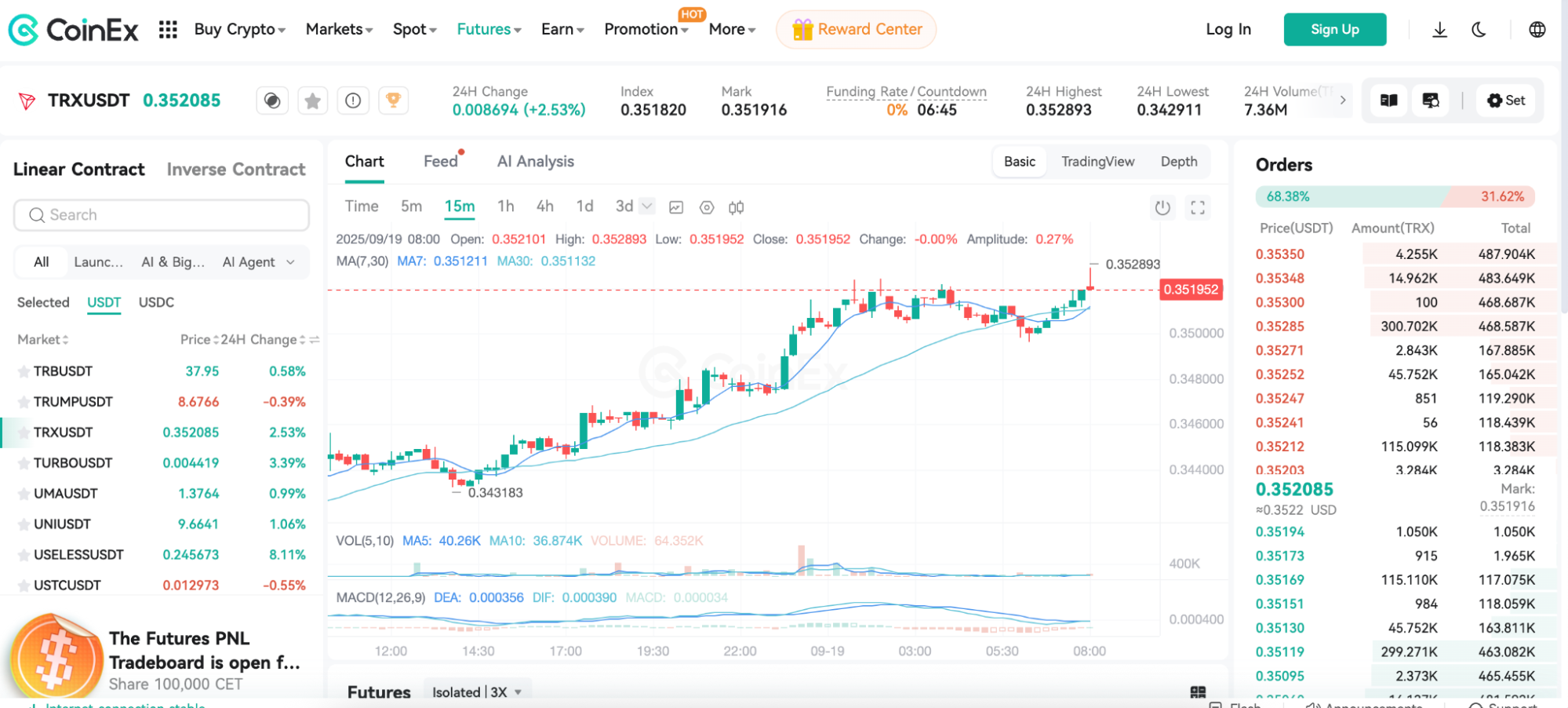

CoinEx offers over 260 futures markets with competitive fees. Source: CoinEx

Although CoinEx charges funding rates three times daily, the platform sometimes offers 0% fee depending on market conditions and promotions. Standard futures commissions are 0.05% and 0.03% for limit and market orders. Traders receive lower fees as they increase their VIP status, which is based on 30-day trading volumes.

The no-KYC crypto exchange offers popular decentralized finance (DeFi) products. In between trades, users may deposit TRX into flexible savings accounts and earn 3.11% APYs.

Pros

- Trade TRX and over 260 other futures markets

- Competitive funding rates from 0% per cycle

- One of the most user-friendly exchanges in the market

- Earn competitive APYs on idle TRX balances

Cons

- At 50x, leverage limits are below the industry average

- The peer-to-peer payment feature has limited activity

4. Binance: Gain Exposure to TRX Futures Passively via Copy Trading and Automated Bots

Binance is a top choice for traders who prefer passive investing experiences. The exchange offers automated trading bots that buy and sell TRX futures based on predetermined strategies. Users select TRX as their preferred market, and Binance responds with a wide selection of rules-based systems.

Some bots trade TRX futures through the grid trading strategy, and others identify arbitrage opportunities. Each bot provider states a minimum investment requirement, which starts at about $12. Users do not require prior experience; they simply enter their investment size, and once activated, the futures bot begins trading.

Binance users trade TRX futures passively through bots and copy trading tools. Source: Binance

Binance is also one of the best crypto exchanges for copy trading. Verified traders specialize in perpetual contracts, and since they trade various markets, users avoid being overexposed to the TRX price.

As the crypto market’s largest spot and derivative exchange, traders may also speculate on Tron futures without automated tools. Market makers and takers pay futures commissions of 0.05% and 0.02%, respectively, and TRX contracts settle in USDT or USDC.

Pros

- Buy and sell TRX futures autonomously via automated bots

- Bot minimums start at approximately $12

- Copy experienced derivative traders for a passive experience

- Manually trade perpetual futures in a deep liquidity environment

Cons

- Cumbersome KYC requirements even for crypto-only accounts

- The exchange restricts derivative trading in some countries

5. KCEX: The Cheapest Crypto Exchange to Trade Tron Futures

If low trading fees are the key priority, KCEX remains the cheapest exchange in the market. The platform offers maker and taker commissions of 0% and 0.1%, and those fees remain available regardless of VIP status. KCEX also waives deposit and withdrawal fees, yet it supports crypto transfers only.

On KCEX, traders buy and sell TRX futures with perpetual contracts, which settle in USDT. Traders apply leverage of up to 75x on the position’s first $580,000. The leverage multiplier reduces rapidly to 37x after this threshold.

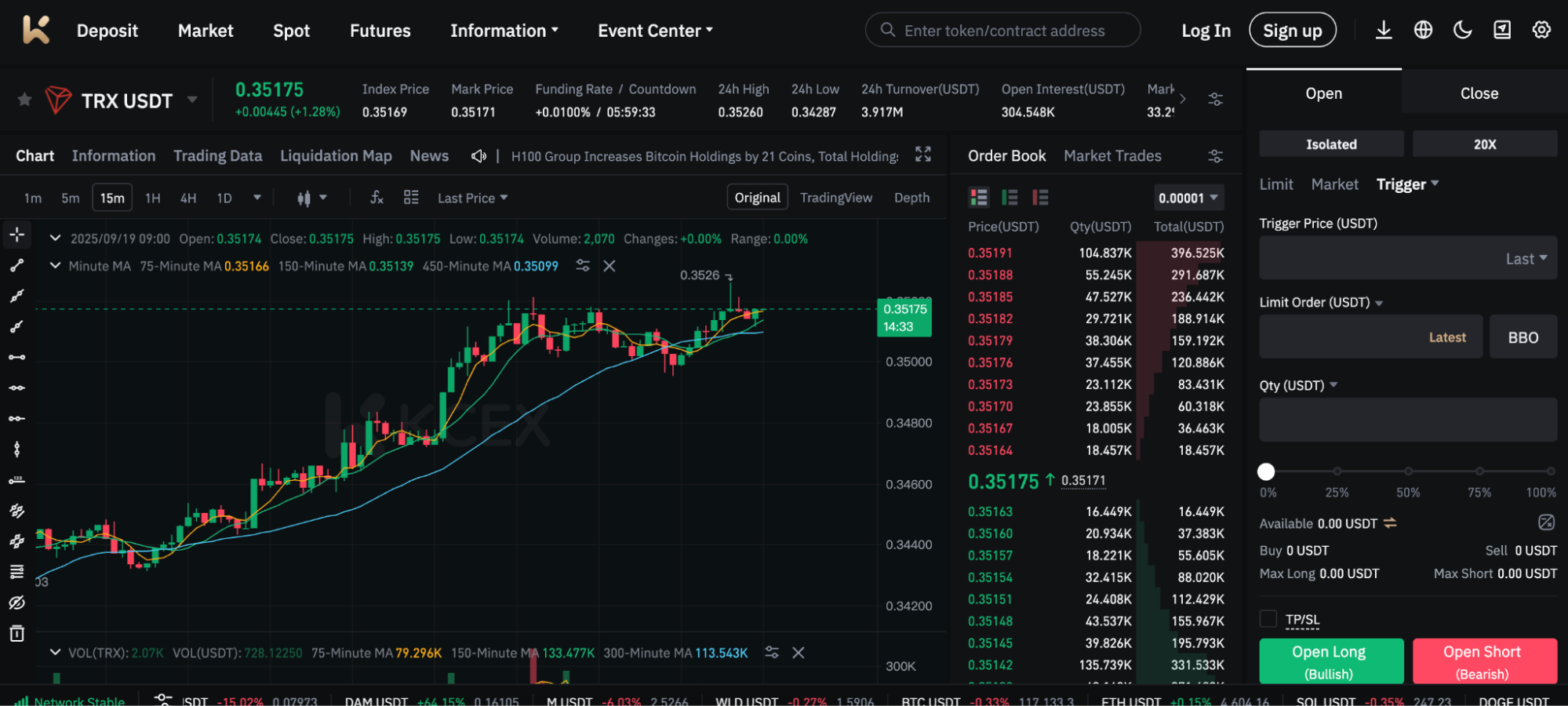

On KCEX, makers and takers pay commissions of 0% and 0.1%. Source: KCEX

Our research confirms that KCEX offers a huge selection of alternative futures markets, including all major altcoins. Since it also supports micro-cap tokens with extreme volatility, traders may discover the next 1000x crypto gem.

Another top feature is the exchange’s daily trading competitions. It allocates 20,000 USDT to the daily prize pool, and it determines winners based on the highest profit margins. Futures competitions are free to enter, although traders must use real account funds.

Pros

- The cheapest TRX futures platform in 2026

- Traders pay 0% or 0.1% on limit and market orders

- No deposit or withdrawal fees

- Comprehensive charting tools with desktop and mobile accessibility

Cons

- Mid-tier trading volumes lead to wider spreads

- The exchange supports crypto payments only

Comparing the Top Tron Futures Exchanges

Still unsure which platform to choose? Here are the top Tron futures platforms ranked by core metrics:

| Supported TRX Futures | Settlement Options | Margin Options | Max TRX Leverage | Mobile App? | Max Futures Trading Fees | KYC? | |

| CoinFutures | Simulated | USDT | Isolated | 1000x | Yes | Variable or commission-based | No |

| MEXC | Perpetual | USDT, USDC | Isolated and cross | 200x | Yes | 0.04% | No |

| CoinEx | Perpetual | USDT, USDC | Isolated and cross | 50x | Yes | 0.05% | No |

| Binance | Perpetual and delivery | USDT, USDC, TRX | Isolated and cross | 75x | Yes | 0.05% | Yes |

| KCEX | Perpetual | USDT, USDC | Isolated and cross | 75x | Yes | 0.1% | No |

What Are Tron Futures?

Tron futures are financial derivatives that permit speculative trading on the TRX price. Traders swap contracts rather than real TRX coins like on conventional spot exchanges.

Research shows that most platforms specialize in perpetual futures, so unlike traditional delivery contracts, traders avoid expiration dates. Perpetuals allow traders to go long or short, making them suitable for both bullish and bearish markets. Those who expect the TRX price to rise or fall simply enter the market with buy or sell orders.

Tron futures continue to experience surging trading volumes due to their high-risk, high-return nature. Derivative traders post an initial margin to unlock exposure to TRX price movements, and this margin represents a small portion of the position size.

One example is MEXC, which has an initial margin requirement of 0.5%. Taking full advantage of that minimum allows leverage of 200x, which magnifies profits by a factor of 200 times. CoinFutures reduces the initial margin to just 0.1%, increasing leverage to 1000x.

How Does Tron Futures Trading Work?

Futures traders set up buy or sell orders based on their market prediction and risk profile. They trade the TRX price long or short, and enter an initial margin as their stake. Traders select a leverage multiplier, which boosts the initial margin and the overall position size. This dynamic unlocks significant market exposure, even for traders with minimal funds.

Suppose the trader goes long on TRX with a $100 initial margin. Since they trade with 40x leverage, that $100 magnifies to $4,000 in trading capital. If the TRX price increases by 10%, the position generates a trading profit of $400. Based on the initial margin of $100, the trader secures a 300% gain, despite TRX rising by 10% only.

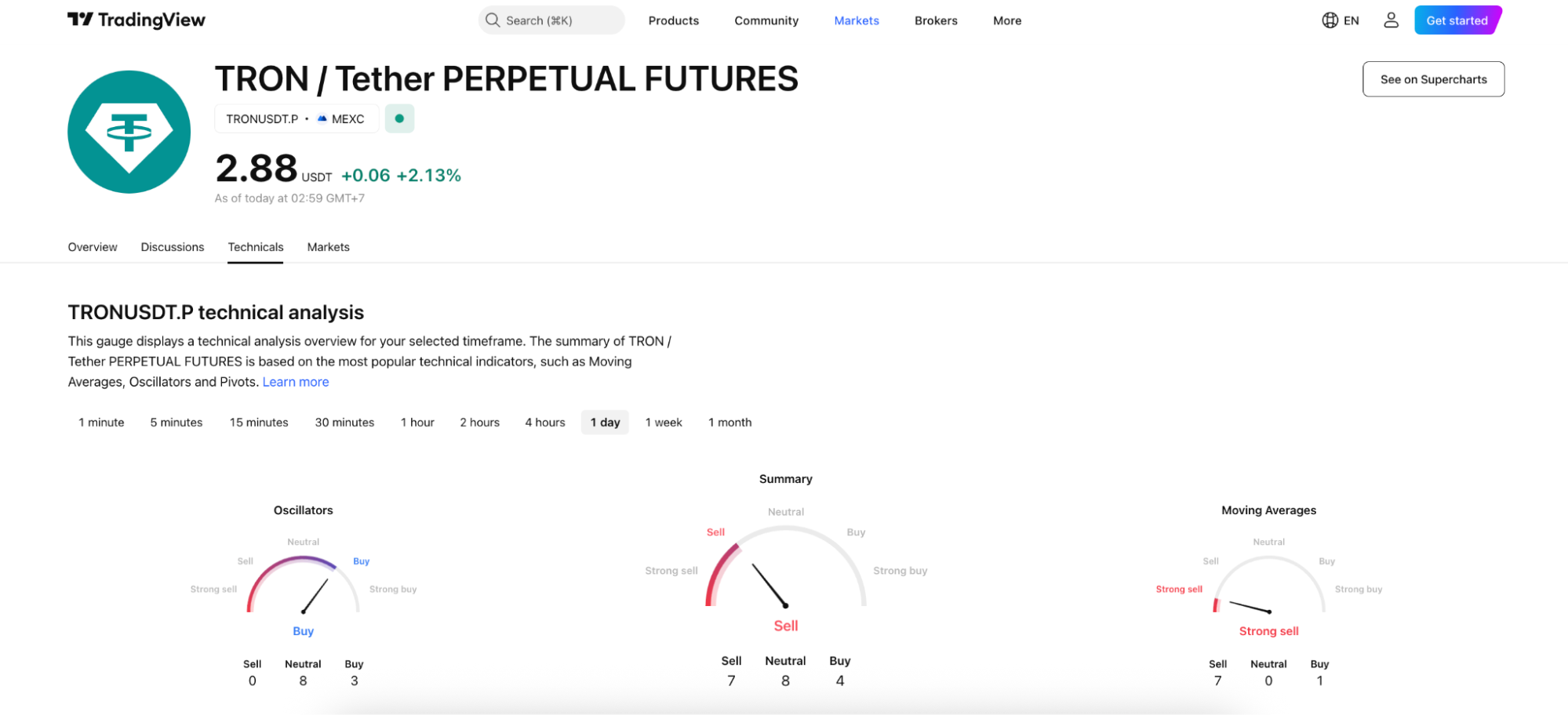

Traders go long and short on Tron futures to capitalize on fluctuating sentiment. Source: TradingView

As with any derivative product, Tron futures carry liquidation risks. Exchanges display the liquidation price when traders set up their orders, and if TRX hits that price, they close the position automatically.

The risk exposure varies considerably by the amount of leverage applied. Low leverage multipliers give traders a much wider barrier against liquidation, as they consume less margin. Using high leverage amounts, however, means positions could be closed quickly.

Another important point is settlement. Because most TRX futures pairs trade against USDT, traders post margin in the stablecoin. They also receive profits in USDT. Our research shows that Binance supports TRX settlement via inverse contracts, although these suit experienced traders with higher risk profiles.

How to Trade Tron Futures

This section walks beginners through the TRX futures trading journey. By using CoinFutures, beginners enjoy a user-friendly futures dashboard with a $1 minimum position size, plus a maximum leverage multiplier of 1000x.

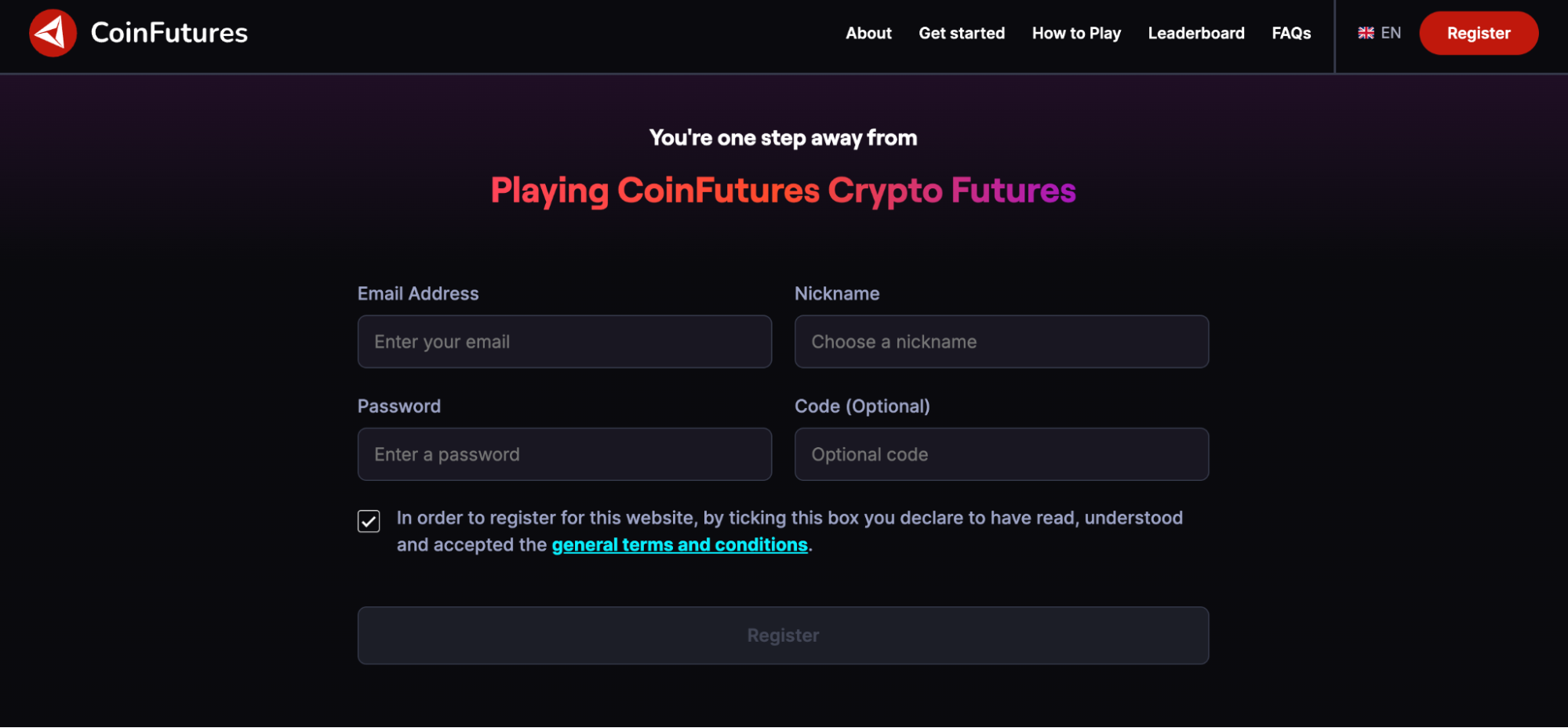

Step 1: Register a Futures Account

The account opening process takes less than a minute to complete. Just visit the CoinFutures website and input an email address.

The no-KYC account opening process at CoinFutures lets traders register anonymously. Source: CoinFutures

Choose a nickname and password, and click the exchange’s email verification link to confirm the account.

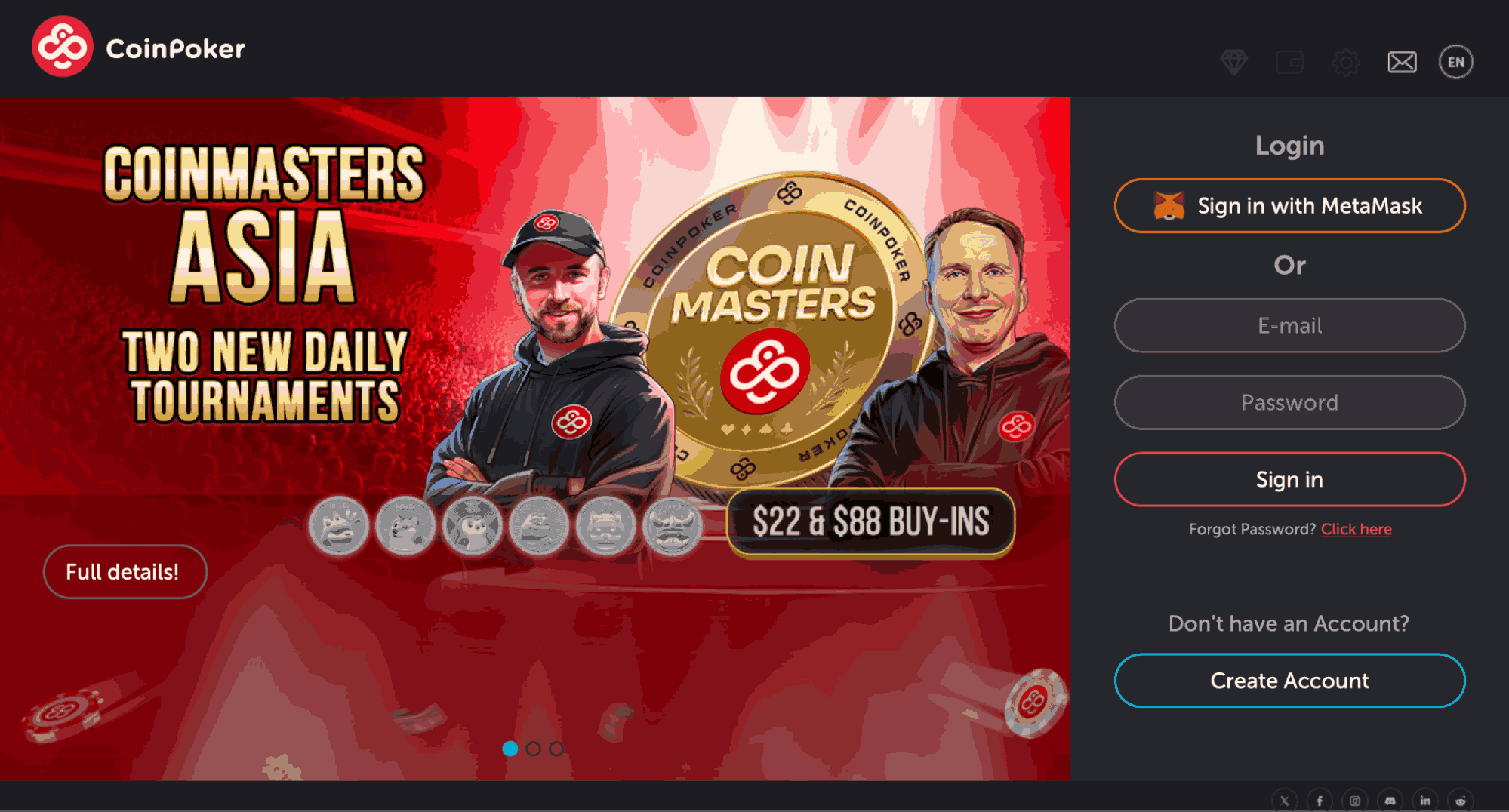

Step 2: Download the Futures Trading Software

Download the CoinPoker (CoinFutures’ parent company) software to access your futures trading account. The software is available on multiple operating systems across desktop and mobile devices.

CoinFutures operates on the CoinPoker software for desktops and mobiles. Source: CoinFutures

Open the CoinPoker interface and sign in with your CoinFutures account details.

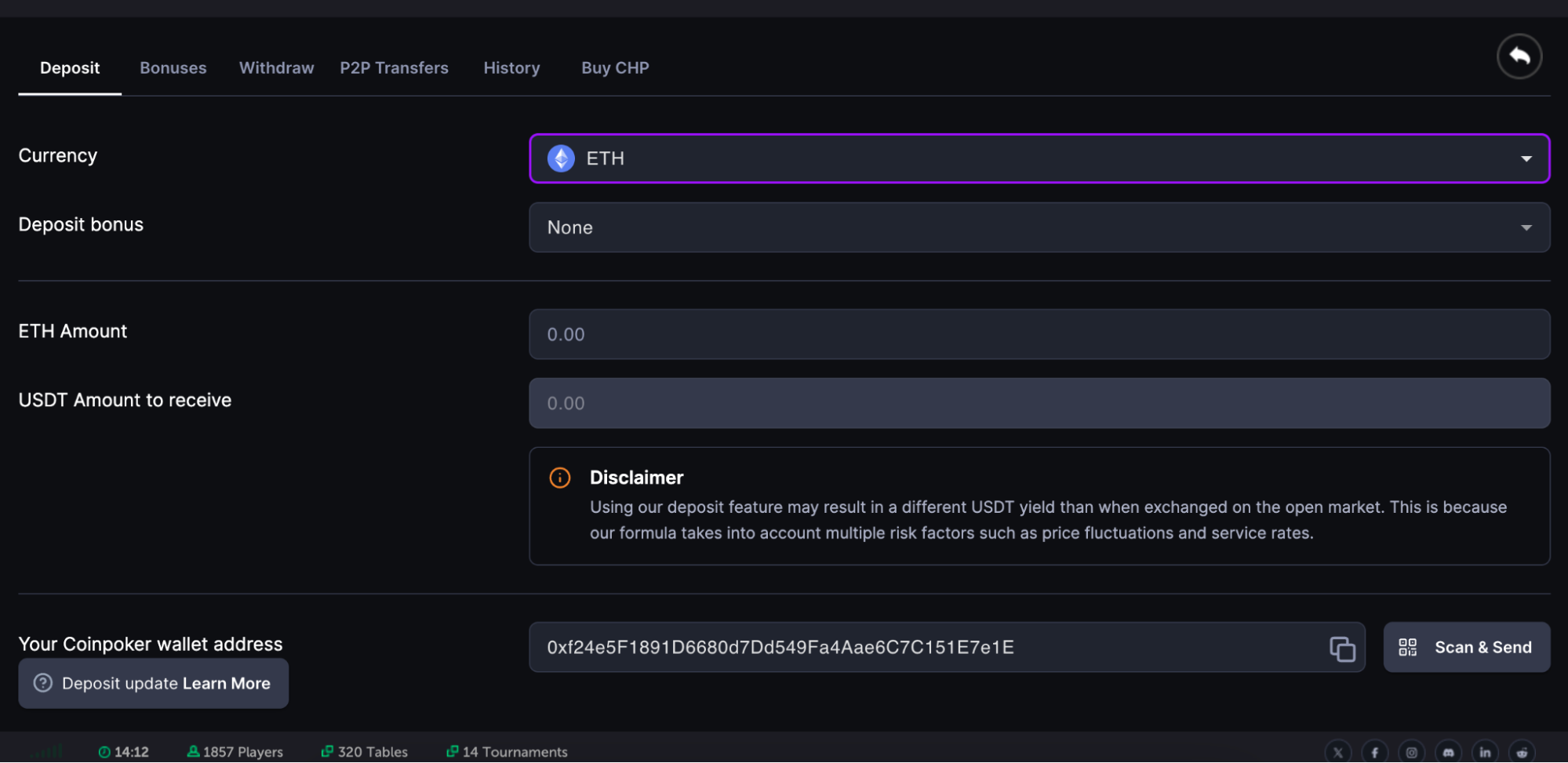

Step 3: Make a Deposit

On the cashier page, select a crypto wallet transfer or a fiat payment.

Crypto deposits require users to select their coin or token, and if applicable, the network. Options include BTC and top altcoins like USDT, USDC, ETH, and BNB. The system displays the user’s account wallet address and a QR code. Open your non-custodial wallet and check the transaction before proceeding.

CoinFutures offers hassle-free payments via crypto, e-wallets, and debit/credit cards. Source: CoinFutures

CoinFutures processes fiat deposits in USD, and payment methods include Google/Apple Pay and debit/credit cards.

Step 4: Go to Crypto Futures and Select TRX

With the account funded, exit the cashier and select “Crypto Futures”.

Besides TRX, CoinFutures markets also include BTC, ETH, LTC, and DOGE. Source: CoinFutures

The drop-down list reveals available markets; select “TRX/USDT” to trade Tron.

Step 5: Choose the Trade Parameters

Choose a candlestick timeframe or tick chart to analyze TRX price movements and identify trends. Assess whether you believe the price action will increase or decrease, and select an “Up” or “Down” order accordingly.

Enter the position stake in the “Wager” box from $1 upward. CoinFutures uses the isolated margin system, so your risk exposure is limited to the stake.

CoinFutures’ easy-to-use dashboard makes it simple to trade Tron futures. Source: CoinFutures

The leverage tool amplifies the stake by your selected multiplier. The platform offers TRX/USDT leverage from 1x to 1000x, although we recommend using small amounts to mitigate liquidation risk.

Important: Evaluate the Entry and Liquidation Prices

Review the liquidation price (“Bust Price”) carefully to avoid reckless trading. It reflects the TRX/USDT price level that forces liquidation, and CoinFutures calculates that price based on the leverage multiplier and whether you trade long or short.

The key takeaway is that the liquidation price moves closer to the entry price when using excessive leverage. This dynamic means a volatile price swing could lead to liquidation right away.

Spend some time adjusting the leverage size to evaluate its impact on the liquidation risk.

Step 6: Set Exit Parameters and Place a TRX Futures Trade

CoinFutures offers risk management tools with instant execution.

In the following screenshot, the trader sets the stop-loss and take-profit targets at $15 and $40, respectively. This risk-averse trade means the trader seeks to make $40 in profit, yet they exit the position automatically if its value drops by $15.

Stop-loss and take-profit orders ensure sensible futures trading practices. Source: CoinFutures

To set your own risk management orders, click the “Auto” button and enter your parameters in USD. Alternatively, state the orders in TRX/USDT prices, should you identify key support and resistance levels.

Once you select “Place Auto Bet”, CoinFutures immediately executes the Tron futures trade.

Tron Futures vs. Options

Traders have several different ways to speculate on TRX prices through derivative instruments. Futures and options remain the popular methods, yet they differ in trade execution and risk.

Perpetual and delivery futures require an initial margin, and the minimum in percentage terms varies by exchange. Traders may apply leverage to amplify their futures position size and place buy or sell orders to trade long or short. Delivery futures have expiration dates (usually every three months), but perpetuals do not.

Similar to futures, options offer increased exposure to TRX prices without ownership, yet traders purchase calls or puts instead of buy and sell orders. Options usually provide multiple expiration dates, and each one typically lists 10-20 different strike prices.

Traders choose a strike price based on the prediction and risk profile. That strike price determines the premium cost, which traders pay for the right to buy or sell TRX on expiration. When contracts expire, traders earn a profit if TRX is higher or lower than the predicted strike price. Otherwise, traders forfeit the premium without additional financial exposure.

Tron futures, unlike options, carry liquidation risks. Traders can lose their initial margin at any time, as liquidation triggers when the position equity no longer covers the maintenance margin.

Key Things to Know About Tron Futures Trading

Learn more about TRX futures trading, including the varying contract types and settlement terms.

Contract Types

Futures exchanges allow traders to choose between two different contract types: linear and inverse.

Linear futures remain the lowest-risk contracts, since traders post margin in a stablecoin like USDT. Once traders close the futures position, profits and losses are adjusted in the same stablecoin.

Those who seek higher risk-reward outcomes select inverse contracts, where traders add margin in TRX rather than USDT. The underlying collateral fluctuates with increased volatility, which raises the liquidation probability. The benefit is that profitable futures trades provide greater returns, as inverse contracts settle in TRX.

Leverage and Margin

Traders provide an “initial” margin and a leverage multiplier when they set up futures positions. The leverage applied determines the minimum “maintenance” margin to avoid liquidation. Understanding the relationship between margin and leverage is essential, as it directly impacts the liquidation risks.

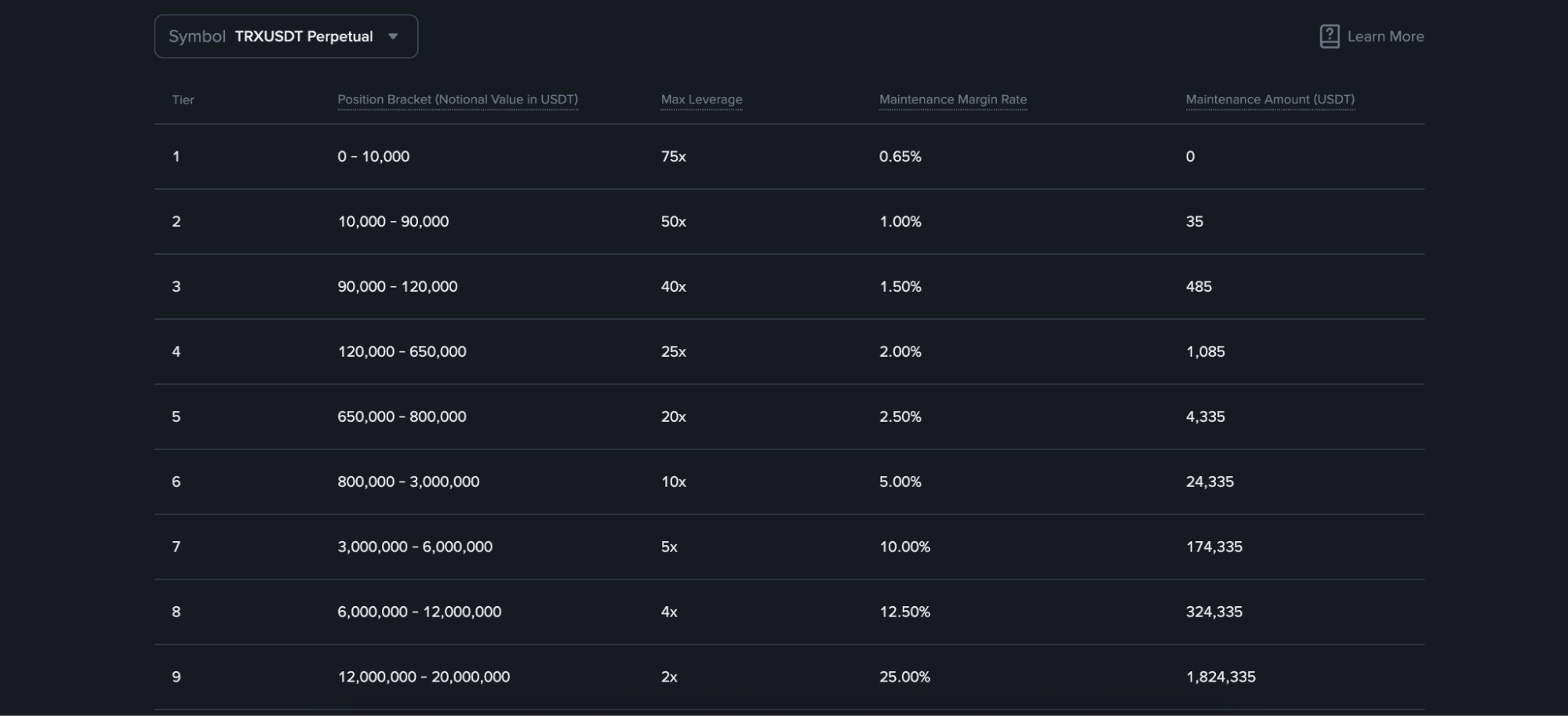

Binance reduces the maximum TRX leverage as traders increase their position exposure. Source: Binance

For example, applying 5x leverage converts to a maximum maintenance margin of 20%. If the futures position declines in value by 20%, the exchange closes the trade, and the contract holder loses their initial margin.

Increasing the TRX leverage to 50x reduces the maintenance margin to approximately 2%. As such, traders face much higher risk, since a 2% position decline leads to immediate liquidation.

Isolated and Cross Margin

TRX traders manage risk and reward by selecting an appropriate margin type.

Here’s the difference between isolated and cross margin:

- Isolated Margin: The initial margin is the maximum loss potential on the TRX futures trade. If the trader becomes liquidated, they forfeit the posted margin for that specific position only.

- Cross Margin: Traders may allocate their margin balance to more than one futures position, which provides them with increased market exposure. Adverse price movements could liquidate the entire account, as a single liquidation impacts all outstanding positions.

Commissions and Funding Cycles

Our research shows that average futures trading commissions are 0.02% and 0.05% for makers and takers, respectively. Exchanges charge commissions on the total position value, which magnifies fees on high-leverage orders. The futures trade needs to cover those fees just to break even, and traders incur them to both enter and exit the TRX market.

Funding cycles are additional futures trading fees to know about. They apply to simulated and perpetual contracts, and traders typically incur them every eight hours. The funding mechanism applies only to long or short traders per cycle, and it helps realign spot and futures prices.

If you are charged in any given cycle, exchanges deduct those fees from your margin balance. The key risk, particularly when trading Tron futures with high leverage multipliers, is that a single funding charge could liquidate the position.

What are the Benefits of Trading Tron Futures?

We found that traders buy and sell TRX futures contracts for several core reasons, including:

-

- Low Margin Requirements: Buying TRX coins on a traditional exchange provides real asset ownership, yet investors must cover the full investment amount upfront. Futures platforms differ in their upfront requirements, since traders post an initial margin rather than the full TRX amount. This concept makes futures trading more affordable, as it unlocks significant market exposure on a budget.

- Massive Leverage Multipliers: TRX is one of the largest cryptocurrencies by market capitalization, which means most futures platforms offer high leverage multipliers. As trading TRX futures on CoinFutures provides 1000x leverage, traders amplify their profit margins by up to 100,000%.

- Speculate on Rising and Falling TRX Prices: The ability to enter positions with buy or sell orders is another benefit exclusive to derivative products. Traders go long to capitalize on TRX price increases, and short if they expect prices to fall. This perk gives active traders the opportunity to profit from bullish and bearish markets. In contrast, buying TRX coins on a spot exchange unlocks investment returns during rising trends only.

- Isolated Margin Caps the Potential Losses: While some derivative contracts and strategies incur unlimited risk exposure, isolated margin caps the investment risk to the trader’s initial margin. Contract holders relinquish that margin on a liquidated position, yet exchanges cannot use additional account funds to cover losses. This margin structure is ideal to capitalize on high-risk, high-reward TRX predictions.

- Hedge Against Uncertain Tron Sentiment: Whether it’s a shift in Tron sentiment specifically or broader market uncertainty, futures contracts allow traders to hedge against short-term risk. A futures sell order offsets declining TRX prices, and vice versa if prices increase. Experts explain that trading against existing holdings is more efficient than cashing out, since asset disposals could trigger tax obligations.

Pros

-

- Trade TRX price movements in both directions

- Enter substantial position sizes with a small upfront margin

- Leverage boosts profitable trades by the selected multiplier

- TRX futures traders limit their loss potential through isolated margin

- Sell futures contracts to hedge against short-term uncertainty

Cons

-

- Traders lose their initial margin when they face liquidation

- Too many liquidations create financial and emotional risk

- Futures positions incur funding cycles every eight hours

- Holding derivative contracts provides no TRX ownership

- Crypto-centric derivatives remain banned in some countries

Choosing a safe futures trading platform like CoinFutures is also essential. CoinFutures is a licensed platform with initial margin requirements of 0.1% on TRX markets. As users buy and sell simulated futures from just $1, CoinFutures appeals to all investment budgets.

FAQs

What are Tron futures?

What are the benefits of trading Tron futures?

Are Tron futures more risky?

What’s the minimum amount you need to trade Tron futures?

How do I trade Tron futures?

What is the best Tron futures trading platform?

References

-

- Understanding Financial Derivatives: Forwards, Futures, and Options (Harvard Business School)

- The Risks of Financial Derivatives (International Monetary Fund)

- Similarities and Differences Between Initial and Maintenance Margin (SoFi)

Coinspeaker in Numbers

Monthly Users

Articles & Guides

Research Hours

Authors

The team behind IPO Genie has not yet announced an end date for the presale.

AI cryptocurrencies combine blockchain with artificial intelligence to power decentralized machine learning networks, GPU computin...

22 mins

22 mins

Ibrahim Ajibade

, 373 postsI’m a research analyst with experience supporting Web3 startups and financial organizations through data-driven insights and strategic analysis. My goal is to help organizations make smarter decisions by bridging the gap between traditional finance and blockchain innovation.

With a background in Economics, I bring a solid understanding of market dynamics, financial systems, and the broader economic forces shaping the crypto industry. I’m currently pursuing a Master’s degree in Blockchain and Distributed Ledger Technologies at the University of Malta, where I’m expanding my expertise in decentralized systems, smart contracts, and real-world blockchain applications.

I’m especially interested in project evaluation, tokenomics, and ecosystem growth strategies, as these are areas where innovation can drive lasting impact. By combining my academic foundation with hands-on experience, I aim to provide meaningful insights that add value to both the financial and blockchain sectors.