Using Bitcoin is one of the best ways to transact around the world completely privately. You can send and receive BTC, trade other...

11 New Upcoming Binance Listings to Watch in September 2025

38 mins

38 mins Bitcoin Hyper (HYPER) is our top pick for a new Binance listing. While there are no guarantees of its success, HYPER brings smart contracts and dApps to Bitcoin.

BTCFi as a whole has a total value locked (TVL) of $7.38B and has received $175M in VC funding, according to a report by Maestro.

Results from applying our detailed research methodology suggest that Maxi Doge (MAXI) and Mantle (MNT) could also list soon on Binance, due to the continued popularity of meme coins and growing overall DeFi TVL.

Most cryptocurrencies see a price surge after a Binance listing, although profit is never certain. This guide outlines projects our analysis indicates as having the best chance of listing on Binance soon, and the reasons behind our picks.

Predicted New Binance Listings in September 2025

- First Bitcoin Layer 2 enabling fast, low-cost transactions

- Fixes Bitcoin’s speed and fee limitations with near real-time performance

- Enables a Bitcoin-native DeFi ecosystem

- Degen meme coin inspired by max-leverage trading

- A tribute to high-risk hustle — fueled by sweat and conviction

- Ethereum-born, culture-driven, aiming for multichain

- Build your own virtual meme coin mining rig.

- 100% virtual and requires no additional computing power.

- Top miners get additional bonuses in Pepe, Fartcoin, and other meme coins.

- Dual-chain design with Ethereum and Solana integration

- Exclusive Alpha Chat community and trading utilities

- NFT ecosystem, gamified quests, and loyalty rewards

- Fastest meme coin sniper on Solana and EVM

- Multichain Telegram bot with lowest fees and instant execution

- Snipe new tokens before bots and whales

- Exclusive in-app access to vetted crypto presales

- Staking rewards with an annual percentage yield (APY) of up to 152%

- Upcoming Best Card enables crypto spending at millions of merchants with cashback

- AI-Powered Virtual Influencers

- 20% APY Staking Rewards

- VIP perks: livestreams, BTS content, credits, and more.

11 New Binance Listings to Watch in 2025

The following cryptocurrencies could be the next new Binance listings:

- Bitcoin Hyper (HYPER) – Bitcoin’s first SVM layer 2 for fast, low-cost transactions

- Maxi Doge (MAXI) – Whimsical meme that makes fun of other dog coins

- Mantle (MNT) – Scalable Ethereum layer 2 with governance token

- PEPENODE (PEPENODE) – Mine-to-earn Ethereum meme coin with high APYs

- Snorter Token (SNORT) – Telegram-native trading bot with advanced scam protection

- Best Wallet Token (BEST) – Utility token for a leading web3 wallet ecosystem

- Hyperliquid (HYPE) – High-performance layer 1 with on‑chain perpetual DEX

- Wall Street Pepe (WEPE) – Meme token with alpha chat & multichain ambitions

- SUBBD (SUBBD) – Web3-powered content subscription platform for creators and fans

- SpacePay (SPY) – Real-world payments through crypto and NFC technology

- Trusta AI (TA) – On-chain identity & reputation token built for web3 & AI

Exploring the Top Upcoming Binance Listings

Learn more about our predicted Binance new coin listings. Each crypto project will be fully explained, allowing you to assess whether a Binance listing could be imminent.

1. Bitcoin Hyper (HYPER) – Bitcoin’s Layer 2 Meme Coin Designed for DeFi and Speed

Bitcoin Hyper is a Layer 2 ecosystem for Bitcoin, built on the Solana Virtual Machine (SVM). While Bitcoin has the largest market cap, it’s also among the slowest blockchains. Hyper aims to change this by enabling fast, low-cost transactions with high-speed, high-volume activity, making payments, meme coins, and dApps practical on the BTC network.

Bitcoin Hyper Official Website. Source: Bitcoin Hyper

Bitcoin was initially designed without smart contract abilities, but the release of the SegWit update laid the building blocks for smart contracts, ordinals, and BTC Layer 2s.

There are various types of BTC Layer 2s, some of which are simply for payments. Many of which run on the Lightning Network. Developers have expressed concern about the speed and safety of the Lightning network, making BTC Hyper’s SVM-based rollup settlement layer a potentially appealing solution.

Key Points on Bitcoin Hyper:

- Why We Picked It: Bitcoin Layer 2s may become the key to unlocking BTC’s next phase by enabling faster apps and payments

- Risks & Considerations: The technical documentation for the SVM Layer 2 has not yet been released

- Total Token Supply: 21 billion HYPER

- Distribution Model: The presale is allocated 20% of the supply, with the rest for development, treasury, marketing, and exchange listings

- Utility and Use Cases: The HYPER token pays for transaction fees, voting rights, and can be staked for 73% APY

- Binance Listing Probability: Very likely

| Project | Bitcoin Hyper |

| Best For | Degens, builders, and BTC holders looking to do more with their Bitcoin |

| Community Stats | X followers: 14.5K and growing |

| Live Price | $0.012925 |

| Chain | Ethereum |

| Market Cap | $16.24M raised in presale |

| Exchanges | Major exchange listings are anticipated, but still to be confirmed. |

| Launch | TBA (Q4 2025) |

2. Maxi Doge (MAXI) – Dog Themed Meme Coin Using Humor and Leverage

Maxi Doge is a community-based meme coin with a mascot that traces its lineage to ‘cousin Doge’. The deeper concept behind Maxi Doge is the idea of uniting traders through humor and memes, as well as competitions, alpha groups, and a leverage trading partnership.

Maxi Doge is buying the top. Source: Maxi Doge

Binance frequently lists small-cap memecoins that achieve significant social attention, such as PEOPLE (Constitution DAO). Although there are many memes on the market, if Maxi Doge can attract enough followers, it could be a strong contender for a Binance listing.

Key Points on Maxi Doge:

- Why We Picked It: Doge-themed meme coins continue to outperform the market, with Doge likely to get its own ETF

- Risks & Considerations: Animal meme coins have high competition, but the humor angle makes it one to keep an eye on

- Total Token Supply: 150.24 billion MAXI

- Distribution Model: 40% of the total supply for the presale. The remaining includes 25% for marketing and partnerships

- Utility and Use Cases: The token offers staking rewards of 155%, and the roadmap mentions community-based trading events

- Binance Listing Probability: If the community rallies behind MAXI, then the possibility is medium-high

| Project | Maxi Doge |

| Best For | Meme coin traders, DOGE fans, and those seeking high-risk and potentially high-reward plays |

| Community Stats | Over 7.5k followers on X and Telegram |

| Live Price | $0.0002575 |

| Chain | Ethereum |

| Market Cap | $2.23M currently, hard cap target of $37.5M by the end of presale |

| Exchanges | TBA |

| Launch | When the hard cap is reached |

3. Mantle (MNT) – Scalable Ethereum Layer 2 with Governance Token

Mantle Network is a DeFi ecosystem and a high-performance, modular Ethereum Layer 2, backed by BitDAO. The modular aspect is designed for advanced DeFi strategies, allowing developers to build dApps that benefit from the liquidity of Ethereum while using the speed of Mantle.

Mantle Network’s homepage. Source: Mantle

Ondo Finance ONDO $1.03 24h volatility: 0.8% Market cap: $3.26 B Vol. 24h: $164.53 M is one of their most popular dApps. Mantle offers grants for new projects, suggesting that the ecosystem will continue to grow.

Mantle aligns closely with Binance’s current listing strategy. They frequently list Layer 2 tokens that bring both utility and ecosystem momentum.

Key Points on Mantle:

- Why We Picked It: Robust Ethereum Layer 2 with governance and utility in a growing ecosystem

- Risks & Considerations: Established, but Layer 2 competition is a consideration

- Total Token Supply: 6.2 billion MNT

- Distribution Model: Approximately 51% in public circulation. The remaining 49% is held in the Mantle Treasury for ecosystem growth, grants, and incentives

- Utility and Use Cases: MNT is used for gas fees, governance, staking rewards currently at 71% via Coinbase

- Binance Listing Probability: Watch closely; fits Layer 2, governance, and ecosystem utility criteria

| Project | Mantle |

| Best For | Developers, DeFi users, yield-seekers |

| Community Stats | 882k followers on X |

| Live Price | [NC] |

| Chain | Ethereum Layer 2 |

| Market Cap | Approx $3.6B |

| Exchanges | Multiple |

| Launch | 2024 |

4. PEPENODE (PEPENODE) – Mine-to-Earn Ethereum Meme Coin

PEPENODE is a mine-to-earn ecosystem built on Ethereum that rewards users based on real-time ETH block activity. The project combines utility with the virality of a meme coin. Users ‘mine’ PEPENODE and other coins like PEPE through a gamified smart contract-driven mechanism that scales with participation.

PEPENODE Official Website. Source: PEPENODE

The live dashboard tracks staked supply, APY, and block-by-block reward emissions. At the time of writing, over 270M tokens have been staked.

The broader plan is to expand into decentralized infrastructure, providing bandwidth, RPC endpoints, and compute resources for dApps.

Key Points on PEPENODE:

- Why We Picked It: The project delivers 1339% staking during presale. With no vesting or lockups, PEPENODE may be a good contender for Binance

- Risks & Considerations: The game is not yet released, the project’s longevity depends on how the mining rewards are managed

- Total Token Supply: 210 billion PEPENODE

- Distribution Model: Treasury, protocol development, marketing, listings, and community rewards.

- Utility and Use Cases: Virtual mine-to-earn system and staking rewards. 70% of tokens spent on upgrades will be burned, creating a deflationary mechanism

- Binance Listing Probability: Watch closely, depends on mining participation and narrative growth

| Project | PEPENODE |

| Best For | Ethereum-native users, high-risk miners, meme coin holders who want live yield |

| Community Stats | Early-stage, active dashboard metrics available; Web3Payments checkout live |

| Live Price | $0.0010617 |

| Chain | Ethereum |

| Market Cap | $1.18M raised in presale |

| Exchanges | Not yet announced |

| Launch | TBA (mining phase begins at TGE) |

5. Snorter Token (SNORT) – Solana Trading Bot and Meme Coin

Snorter aims to transform Telegram into a terminal for Solana meme coin trading. This enables users to swap, snipe, copy trade, and monitor portfolios within the app. SNORT token holders can stake for 120% APY rewards.

Snorter Token Official Website. Source: Snorter Bot

Snorter positions itself as better than existing bots, due to sub-second execution speeds and MEV protection. The project claims to offer the lowest fees at just 0.85% for token holders and reports detecting rug pulls and honeypots with 85% accuracy.

Snorter Token could be an upcoming Binance listing, given its position in the expanding crypto trading bot market.

Key Points on Snorter:

- Why We Picked It: Snorter offers fast execution with low fees on Solana. With over $3.95M raised in SNORT appears to be demonstrating market validation

- Risks & Considerations: Still in presale with no trading history, but targeting the massive trading bot market with proven early validation

- Total Token Supply: 500 million SNORT

- Distribution Model: 60% of the tokens are for the public sale. The remainder is for development, marketing, airdrops, and exchange liquidity

- Utility and Use Cases: Reduced trading fees for the Snorter Bot, staking rewards, and access to airdrops and other community rewards

- Binance Listing Probability: Very likely

| Project | Snorter Token |

| Best For | Active meme coin traders, Solana ecosystem participants, and copy trading enthusiasts. |

| Community Stats | Telegram and X followers are rapidly growing |

| Live Price | $0.1045 |

| Chain | Solana (multichain expansion planned) |

| Market Cap | $3.95M raised in presale |

| Exchanges | Major DEX/CEX listings planned post-presale |

| Launch | Q2 2025 |

6. Best Wallet Token (BEST) – Utility Token for Leading Web3 Wallet Ecosystem

Best Wallet is a non-custodial cryptocurrency wallet that provides access to early-stage presales and multi-chain token swaps. The wallet launched in August 2024, followed by a presale for its new token, BEST, in November 2024. It can be staked for APY rates currently at 84%.

Best Wallet Official Website. Source: Best Wallet

Best Wallet uses Fireblocks to provide secure multi-party computation (MPC) cryptography. The focus on ecosystem growth and security makes this project a potentially strong and disruptive competitor within the crypto wallet sector, which MetaMask, Phantom, Ledger, and Trezor currently dominate.

Key Points on Best Wallet:

- Why We Picked It: If Best Wallet’s momentum continues (the team reports over 500k users on board), the Best Wallet Token could be a good candidate for Binance

- Risks & Considerations: Faces competition from other wallets; the app is not available in the UK

- Total Token Supply: 10 billion BEST

- Distribution Model: The token is allocated to product development, marketing, airdrops, staking, and exchange liquidity

- Utility and Use Cases: BEST offers reduced transaction fees, exclusive access to new presales, airdrops, and staking rewards

- Binance Listing Probability: Watch Closely

| Project | Best Wallet |

| Best For | Long-term holders and believers in fundamental Web3 values, such as decentralization and privacy. |

| Community Stats | X followers 70k, Telegram holders 47k |

| Live Price | $0.025645 |

| Chain | Ethereum |

| Market Cap | $15.89M raised through presale so far |

| Exchanges | Still in presale, with major exchange listings (including Binance) possible. Best Wallet also has its own DEX, connecting to over 200 decentralized platforms. |

| Launch | Q2 2025 |

7. Hyperliquid (HYPE) – High-Performance L1 with On‑Chain Perpetual DEX

Hyperliquid is both a Layer 1 blockchain and a DEX supporting on-chain perpetual futures with <1s latency and native order-book architecture. With a $14B market cap, trading volume of around $700M/day, and partnerships like Phantom integration, it’s gaining a lot of attention.

Hyperliquid Official Website. Source: Hyperliquid

Hyperliquid’s technical foundation is strong, and its on-chain perpetual DEX design is performance-focused. Ideal for trading professionals and DeFi users, emphasizing speed and low cost. Because HYPE is already live on multiple CEXs, it’s in a good position to join Binance, especially as Layer 1 infrastructure tokens are now high on Binance’s radar.

Key Points on Hyperliquid:

- Why We Picked It: Combining an ultra-fast Layer 1 with on-chain DEX perpetuals and strong volume

- Risks & Considerations: Mature but rising; technical complexity risk

- Total Token Supply: 1 billion HYPE

- Distribution Model: Tokens allocated for future emissions, early users, core contributors, and the Hyper Foundation

- Utility and Use Cases: HYPE is used for staking at approx 2.5% on Coinbase, protocol fees, governance, and security within the Hyperliquid ecosystem

- Binance Listing Probability: High; strong infrastructure & volume signals

| Project | Hyperliquid |

| Best For | Pro traders and DeFi users needing performance and scalability |

| Community Stats | 298k Twitter followers |

| Live Price | HYPE $53.59 24h volatility: 1.2% Market cap: $14.51 B Vol. 24h: $545.18 M |

| Chain | Hyperliquid Layer 1 |

| Market Cap | Approx $14B |

| Exchanges | Multiple CEXs (Kucoin, BitGet) |

| Launch | Nov 2024 |

8. Wall Street Pepe (WEPE) – Meme Token with Alpha Chat & Multichain Ambitions

Wall Street Pepe is a meme-powered crypto project that blends viral internet culture with trading tools and community-driven features. It positions itself as a utility meme coin for retail traders, offering benefits like Alpha Chat for trading insights, a staking system, and a collaborative “WEPE Army” for collective decision-making.

Wall Street Pepe Website. Source: Wall Street Pepe

The project gained early attention through a major presale, but it remains a high-risk token and long-term value will depend on how well it delivers on its roadmap and trading-focused ecosystem.

Key Points on Wall Street Pepe:

- Why We Picked It: With viral social traction and a live market cap of approximately $11M, it’s a good candidate for Binance consideration

- Risks & Considerations: Hype-driven; dependent on delivery and continued momentum

- Total Token Supply: 200 billion WEPE

- Distribution Model: The distribution allocates tokens to a treasury, marketing, and trading rewards

- Utility and Use Cases: Grants rewards, incentives, and membership to a trading group. NFTs to grant governance rights and perks

- Binance Listing Probability: Moderate-High. Strong social traction, multi-chain push to Solana

| Project | Wall Street Pepe |

| Best For | Meme traders and retail degens seeking social trading & multichain entry. |

| Community Stats | 66k+ X followers |

| Live Price | $0.00005339 |

| Chain | Ethereum |

| Market Cap | raised in presale |

| Exchanges | MEXC, XT.COM, KCEX, OKX, Kyberswap, Uniswap |

| Launch | Coin launched Feb 2025 |

9. SUBBD (SUBBD) – Web3-Powered Content Subscription Platform for Creators and Fans

SUBBD is an AI-powered platform built for the creator economy. It helps users create, manage, and monetize content across formats, making it easier for digital creators to grow and streamline their work.

The team behind the project attracted over 2,000 influencers with a combined audience of 250,000 fans before the SUBBD presale launched.

SUBBD Official Website. Source: SUBBD

For fans, SUBBD provides a range of perks from VIP content access to discounts and XP bonuses. For creators, a suite of tools (such as auto-scheduling, AI-powered chat services, and content editing) streamlines workflows, reduces the risk of burnout, and may inspire greater creativity.

Key Points on SUBBD:

- Why We Picked It: Highly disruptive and innovative project, crosses over multiple Web3 verticals (AI and SocialFi)

- Risks & Considerations: Unproven project and token, that competes with established social platforms

- Total Token Supply: 1 billion SUBBD

- Distribution Model: 20% of the supply for the presale, the rest for product development, marketing, liquidity, and creator rewards

- Utility and Use Cases: Subscriptions, access to AI tools, exclusive content and perks, and 20% APY staking rewards

- Binance Listing Probability: Watch Closely

| Project | SUBBD |

| Best For | High-risk investors |

| Community Stats | X followers: 76K |

| Live Price | $0.05645 |

| Chain | Ethereum |

| Market Cap | $1.15M raised during the ongoing presale |

| Exchanges | Still in presale, major DEX and CEX launches to come. |

| Launch | Q2 2025 |

10. SpacePay (SPY) – NFC Crypto Payments for Real-World Retail Adoption

SpacePay aims to offer crypto adoption at the point of sale. The team is building a bridge between traditional retail transactions and digital currencies through a tap-to-pay crypto system. The idea is to provide merchants with an alternative to Visa and Mastercard by offering lower fees and instant settlement via blockchain technology.

SpacePay Official Website. Source: SpacePay

The project aims to onboard over 1,000 merchants globally by the end of 2025, with early pilot programs already running in the UK and parts of Europe. Currently in its presale phase, SpacePay offers investors early access to its terminals and payment solutions before the public rollout.

Key Points on SpacePay:

- Why We Picked It: Crypto needs easy-to-use real-world payment solutions, and SpacePay is offering that

- Risks & Considerations: Still in presale with long-term integration goals for merchants. The concept is ambitious and technically complex

- Total Token Supply: 34 billion SPY

- Distribution Model: 20% for the public sale, the rest for user rewards, partnerships, and marketing.

- Utility and Use Cases: SPY will power ecosystem transactions. Holders can vote, stake, and receive a portion of platform revenue

- Binance Listing Probability: Moderate

| Project | SpacePay |

| Best For | Crypto payment utility believers, NFC tech adopters, presale-stage investors |

| Community Stats | X followers: 42K |

| Live Price | $0.003181 |

| Chain | Ethereum (ERC-20) |

| Market Cap | $1.2M raised in presale |

| Exchanges | Listings expected post-2025 |

| Launch | Q4 2025 |

11. Trusta AI (TA) – On-Chain Identity & Reputation Token Built for Web3 & AI

Trusta AI’s token powers a decentralized identity and reputation protocol designed for both human users and AI agents. By providing attestations, trust scoring, and permissionless identity layers across multiple chains (handling 2.5M attestations and 200K MAUs), Trusta AI addresses a critical infrastructure need in growing Web3 ecosystems.

Trusta AI website. Source: Trusta AI

The token launched via an IDO/Presale, revealing strong institutional and community interest. It’s live on Binance Alpha and MEXC. While its listing signals are promising, a smart-contract exploit on BNB Chain caused a 35% price drop shortly after launch, raising security concerns. However, the price has since recovered following a buy-back from the team and continued commercial interest.

Key Points on Trusta AI:

- Why We Picked It: First-mover identity layer token for AI/Web3; live Binance Alpha listing

- Risks & Considerations: High liquidity, but a past exploit underlines smart-contract risk

- Total Token Supply: 1 billion TA

- Distribution Model: 66% of the token supply allocated to the community, ecosystem, and foundation. The rest is for early backers and core contributors.

- Utility and Use Cases: Staking, payments for identity services, and governance. It will also be used for gas fees

- Binance Listing Probability: Moderate. Early Alpha access is promising, but security & vulnerability may delay a full listing

| Project | Trusta AI |

| Best For | Infrastructure investors, AI investors, and Web3/AI developers |

| Community Stats | 3M wallet connections, 2.5M attestations, 200K MAUs |

| Live Price | [NC] |

| Chain | BNB Chain, Arbitrum, EVM-compatible chains |

| Market Cap | Approx $25M circulating |

| Exchanges | Binance Alpha, Gate.io, PancakeSwap V3, MEXC |

| Launch | June 2025 |

Our Methodology for Predicting Binance Listings

Although predicting Binance listings can be challenging, we examined several important criteria during our research and analysis that help determine which coins will list on Binance, including the following:

Narrative and strategic fit – 20%

We selected projects that align with trending narratives (from BTC and ETH Spot ETFs, AI, memecoins, Layer 2s, Web3, and DeFi), and matched them to specific types of investors.

Use cases – 15%

As the world’s leading crypto exchange by trading volume, Binance will likely prioritize cryptos with clear utility and ecosystems that address and solve real-world problems.

Reputation and track record – 15%

To be included in our list, each project needed to have a strong and reliable reputation in the Web3 space. Other factors like community strength, roadmap delivery, and transparent communication were also considered.

Key metrics – 10%

We looked at on-chain and off-chain metrics, including a project’s number of token holders, social media followers, and audience engagement.

Potential risk – 10%

As Binance generally avoids projects with a high likelihood of failure, we factored in each coin’s regulatory standing, smart contract audits, and whether or not it had previously experienced controversial events.

Associated blockchains – 10%

Although projects built on Binance’s BNB Chain might have an edge, integration with other leading ecosystems (such as Ethereum and Solana) can also improve a coin’s chances of getting listed on Binance.

Market cap (or presale fundraising total) – 10%

A Binance listing forecast can help support and grow a token’s market cap, and prevent its value from dropping too far. Therefore, we chose coins with strong support floors and positive investor sentiment, and hand-picked some crypto presales that have been extremely popular in 2025.

Previous listings – 10%

Projects on mid-level and top-tier crypto exchanges will likely be listed on Binance. Such listings indicate a clear demand for a given token, potentially making it a lucrative business opportunity for Binance.

Price (or presale) performance – 5%

Our Binance coin predictions often focused on historic price performance and the amounts raised during token presales (where relevant).

Market Snapshot

Recent crypto market dynamics point to a shift in sentiment, with Bitcoin’s dominance declining as capital begins to rotate toward altcoins. This trend is supported by data from Mitrade, which recently reported that Bitcoin’s dominance has fallen below a critical level for the first time this cycle, showing a possible rotation of investor attention into altcoins. This movement suggests that altcoin season is beginning.

However, BTC Spot inflows are also heating up again with over $2.3B in the first week of September, as the Fed looks increasingly dovish, making BTC a powerful driver of investor narratives.

Presale momentum is heating up: top ICOs like Snorter, Bitcoin Hyper, and Best Wallet have collectively raised over $10 million in the past month, attracting thousands of holders each within days. This signals strong retail engagement, particularly in meme-meets-utility models (e.g., Telegram bots, Layer 2 Bitcoin bridges, and narrative-driven coins).

Investor behavior shows a clear pattern: rapid FOMO-driven entry into presale rounds, followed by waiting for exchange listing catalysts. Binance listings remain one of the most powerful triggers; each listing tends to produce a noticeable price pump and volume spike. Projects like Snorter (raising $175k in 24 hours of presale) exemplify how execution plus hype can translate into short-term gains.

Current market focus remains diverse but strategic:

- Meme-utility hybrids (bots, bridges, BTCFi)

- Multi-chain interoperability (Ethereum, Solana, BNB)

- Real-world and DeFi utility (payment rails, AI tools, Layer 2 scaling)

Combined, these trends are shaping a stronger funnel for new listings. Binance is deliberately increasing transparency and due diligence for new listings, prioritizing real usage, security, and community engagement.

Why this matters to you: This is a crucial window for early-stage participation. Presales that are backed by real progress – presale caps met, development targets achieved, user growth, and sustained community – are prime candidates for listing and subsequent performance. Our guide tracks these kinds of metrics so you get first-mover insight on what could be Binance’s next significant addition.

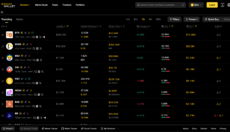

Most Recent New Binance Listings

Listed below are the most recent Binance coin listings:

| Project Listed | Ticker | Approval Date | Niche |

| Reservoir | DAM | August 18, 2025 | Cross-chain Stablecoin Protocol |

| Arena-Z | A2Z | July 30, 2025 | GameFi |

| Treehouse | TREE | July 27, 2025 | Rewards Token |

| Aspecta | ASP | July 24, 2025 | AI-powered developer tool |

| Alliance Games | COA | July 23, 2025 | Web3 gaming infrastructure |

| Yala | YALA | July 22, 2025 | DeFi/ RWA/BTCFi |

| Yooldo Games | ESPORTS | July 19, 2025 | Web3 gaming |

| CROSS Token | CROSS | July 4, 2025 | Layer‑1/Web3 Infrastructure |

Binance’s Criteria for New Coin Listings

Binance’s official listing requirements page was published in 2021 – no updates have been made. Projects should assume that the existing guidelines are valid.

Let’s start with a quick overview of the main points:

- No Set Requirements: Binance initially states that there are no set requirements, meaning it judges each application on a case-by-case basis.

- Minimum Viable Product: Binance states that projects should only apply if they have at least a minimum viable product. This means pre-development projects are unlikely to be considered.

- Proven Team: Binance notes that projects with proven teams are preferred. However, Binance lists multiple projects with anonymous teams, including Shiba Inu (SHIB) and Pepe (PEPE).

- Real Adoption: Another requirement is that the project is focused on real user adoption. This could cover increased holder numbers, trading volume, or daily active users.

- Community Updates: Binance also prioritizes projects that frequently engage with its community, such as weekly AMAs or Telegram updates.

- Large User Base: Binance requires listing applicants to have a substantial user base, although no specific minimum number is specified.

- BNB Incorporation: As the exchange’s native coin, new Binance listings should incorporate BNB into their ecosystems.

- Conduct: Binance also expects professional and responsive conduct from projects. It states that applicants should avoid “shilling” to get a listing.

One key takeaway is that many cryptocurrencies have been listed on Binance without meeting the above requirements, indicating that these requirements are open to interpretation.

How to Get Your Coin Listed on Binance. Source: Binance

Nonetheless, let’s take a closer look at each listing stipulation.

Minimum Viable Product

Binance mentions a minimum viable product (MVP), which means the project’s core product or service should be more than just a technical whitepaper.

For example, a new decentralized exchange (DEX) with basic swapping features would likely be accepted. However, applicants with no evidence of any development progress are certain to be rejected. This ensures that only legitimate cryptocurrencies are added to the Binance exchange.

In this regard, it’s a good idea to focus on projects with strong utility, ensuring credible evidence of the respective concept. These projects have the best chance of being one of the next Binance new coins.

Proven Team

This Binance listing requirement is peculiar. Binance states that applicants should have a proven team, likely with experience in blockchain or key fields related to the project. For example, a decentralized hedge fund should be backed by experienced financial professionals, preferably at the C-Suite level.

This ensures that the right people manage projects and indicates that the founders must complete Know Your Customer (KYC) processes. Otherwise, Binance cannot verify any of the claims made.

However, it’s important to remember that several new coin listings have been given to projects with anonymous teams. This includes Shiba Inu, whose creator, “Ryoshi,” remains unknown to this day. This confirms that Binance will consider applications, even if the founders opt for anonymity, although this may be subject to more scrutiny.

Real Adoption

Coin listings should “focus on adoption”. This requirement is ambiguous because adoption could relate to various performance metrics. For example, adopting meme coins could mean consistent increases in token holders.

This could be why popular meme coins like dogwifhat and Bonk were listed, considering their large communities.

Alternatively, the adoption of utility-driven projects likely means actual users. For example, a play-to-earn game or metaverse should have a sufficient number of daily or monthly active users, often measured by the number of connected wallets or smart contract transactions. However, like most Binance listing requirements, no specific figures are provided.

Community Updates

Binance prioritizes project founders with a community-centric mindset. It states that token holders and Binance itself should receive regular updates before and after any approved listings.

Communication could include social media updates, AMAs, ecosystem statistics (e.g., user or holder growth), or recordings from the core developer. Binance mentions weekly or monthly updates, which is a reasonable expectation for most projects.

Large User Base

This listing requirement follows the “real adoption” specification. However, Binance doesn’t mention what it considers “large”, so it’s another requirement that can be interpreted.

Nonetheless, it likely refers to tens of thousands of unique holders and perhaps at least 100,000 real followers per social network. Binance likely wants to see thousands of adopters for technical projects with real products.

BNB Incorporation

According to the requirements page, Binance’s new crypto listings are favored when incorporating BNB into their ecosystems. BNB is Binance’s native coin, so BNB adoption directly benefits the exchange.

This isn’t a minimum requirement, as most cryptocurrencies on Binance listings have no affiliation with BNB. Nonetheless, BNB “incorporation” can relate to several different things. This could mean that the project has been bridged to the BNB Chain. FLOKI is a good example here. It’s an Ethereum-based meme coin that operates in the BNB ecosystem.

Binance also mentions that incorporation includes BNB acceptance when running fundraising campaigns (e.g., presales and launchpad events). Many token launches, including Solaxy, accept BNB as a payment method.

Conduct

Professional conduct is also required when applying for coin listings. Binance expects ethical behavior and explicitly states that pressure tactics should be avoided.

It claims that any projects “spreading FUD or negative comments” about Binance will be blacklisted. This is why aggressive shilling can be counterproductive.

The Binance Listing Process for New Coins

We’ve covered the requirements for coin listings. Now, let’s move on to the listing process itself.

Submitting an Application Form

Founders must complete a Binance listing application form. The form is different depending on the required platform. First, projects can apply for a direct listing, meaning spot trading pairs are added. This option is for projects with a working product or an established community.

The second application form is for the Binance Launchpad. This is for new projects seeking funding, similar to presales but directly on Binance. Binance users typically make investments with BNB. Launchpad projects are added to Binance’s spot exchange after the funding process is over.

Waiting Process

Binance will assess listing applications on a case-by-case basis. It provides no timeframe for when projects will receive a decision. Binance typically requests further information from projects that pass the initial review stage.

Founders are expected to respond promptly. However, projects should avoid following up with Binance for an update, as this can harm the application’s chances of approval.

One-Way NDA

Binance requires all applicants to sign a one-way non-disclosure agreement (NDA). This prevents projects from discussing any of the materials discussed with Binance.

Doing so is almost certain to end the listing process.

Internal Binance Listings

New Binance listings are often made internally, meaning projects don’t formally submit an application form. These listings are often cryptocurrencies with standout performance metrics or unique characteristics.

For example, OFFICIAL TRUMP TRUMP $8.52 24h volatility: 0.4% Market cap: $1.71 B Vol. 24h: $203.78 M , the meme coin backed by Donald Trump, was listed on Binance almost immediately after its launch. This was a unique event considering its association with the 47th US president.

Announcement of the TRUMP listing on Binance. Source: Binance X

Similarly, Binance often lists cryptocurrencies that blow up, including multiple meme coins with significant volumes. Binance generates revenue from trading commissions and wants to list the most in-demand projects.

How Does Binance Announce New Listings?

As per the NDA signed by applicants, coin listings can only be announced by the exchange. Announcements are made on the Binance listing and X pages. The X page is ideal for receiving real-time notifications, ensuring you stay aware.

The website announcement offers more comprehensive information about the listing. For example, Binance lists the time and date when tokens will go live, typically within 24 hours of the announcement. The available pairs are also provided, often covering USDT and USDC.

Important: Projects’ claims about new Binance listings are certain to be fake. Being listed on Binance is one of the biggest achievements possible for cryptocurrencies. Announcing the news before Binance would breach the NDA, meaning the listing approval would be revoked.

What Is Binance Alpha?

Binance Alpha is a feature of the Binance wallet app, where users can get early access to web3 projects and their tokens. These tokens are not yet featured on Binance’s main CEX, but Binance notes that while it’s not guaranteed, some tokens on Binance Alpha will go live on Binance.

Alpha tokens may or may not get listings on the Binance exchange. Source: Binance

Binance Alpha allows users to view the tokens Binance is considering for a wider listing. And in return, it serves as a testpad to help Binance in considering a full listing.

Like for full CEX listings, Binance likes to see good community traction, a real and often innovative use case, and projects that are aligned with the latest trends in crypto. It then aims to spread awareness and education around these projects, to help them succeed.

Tokens in the Binance Alpha section feature slippage protection and extra MEV security, in order to reduce liquidity or other issues.

You can explore the Binance web3 wallet, along with Binance Alpha, a launchpad, wallet trackers and more, and this can be a good way to spot potential future Binance listings.

The Binance web3 Wallet. Source: Binance Wallet

How to Use Binance Alpha

To start, you’ll need to download the Binance Web3 Wallet. Ensure it’s properly backed up and that your Binance app is updated to at least version 2.93.0; otherwise, the Alpha section will not appear.

New Launches. When a new token is coming to Binance Alpha, Binance shares the details across its official social channels. Inside the Markets tab, you’ll see the Alpha section, complete with a countdown clock and chain information. You’ll also want to have enough of the chain’s native token ready in your wallet so you can join when it goes live, since Binance Alpha supports BNB and other chains.

Each Alpha showcase runs for 24 hours. During that time, projects are highlighted in batches, with full details available in-app. If you want to get involved, the Quick Buy button lets you pick up tokens directly during the window.

Once the 24 hours end, the tokens remain in the Alpha section, where you can continue to follow the projects and trade if you like.

How to Find Upcoming Binance Listings

The official website and X page are the primary sources for discovering Binance’s upcoming listings. Even so, seasoned investors often look for clues about potential approvals, giving them a first-mover advantage.

Read on for best practices when finding coin listings.

Join a Binance Listings Alert Service

First, joining a listing alert service is crucial. You’ll receive a near-instant notification whenever Binance announces a new listing through its official channels. In contrast, relying solely on X notifications will likely mean missing that initial advantage.

Cryptocurrency Listing Alerting. Source: Cryptocurrency Alerting

This is because Binance listing announcements are made from the main X page, which posts multiple times daily. Only a small fraction of those posts are related to listing announcements, meaning you’d need to check each one manually.

Cryptocurrency Alerting is a good option for beginners, as its free plan supports up to three active alerts. You can add Binance and two other tier-one exchanges, such as Coinbase and Kraken. Cryptocurrency Alerting offers multiple alert types, including email, SMS, and phone calls.

Follow Binance Launchpad Announcements

New crypto projects use Binance Launchpad without any existing exchange listings. Projects raise capital from Launchpad users through an initial exchange offering (IEO) process. After the fundraising event, Launchpad projects are listed on the Binance exchange.

Only a small number of projects are accepted by Binance Launchpad. The exchange conducts significant due diligence, ensuring the Launchpad is only used by quality projects. Moreover, considering that all Binance Launchpad cryptocurrencies get a Binance listing, events are always oversubscribed.

Considering the available discounted token price, the best-case scenario is investing during the Launchpad. However, those who miss out can purchase the respective tokens once they go live on the Binance exchange.

Keep Tabs on Trending Cryptocurrencies on the BNB Chain

Binance clearly states in its listing requirements that incorporating BNB is highly preferable. This means the listing team views cryptocurrencies operating on the BNB Chain favorably, giving them an edge over other ecosystem projects. The best practice is to analyze BNB Chain trends for potential gems.

BNB Chain on DappBay. Source: DappBay

For example, look for BNB Chain tokens with increased holder counts, trading volumes, and adoption rates. DappBay is a good option – it specializes in trending dApps on the BNB Chain, including transaction growth, users, and price performance.

Track Whale Wallet Movements for BEP20 Tokens

Another strategy for finding new Binance listings early is to follow whale wallet movements. Crypto whales invest institutional-grade amounts, meaning they often shape narratives and influence price movements. Whales are also well-connected and often aware of big exchange listings before the broader markets.

Nansen and Arkham are popular platforms for tracking whale wallets, as is Whale Alert on X. Notifications are sent whenever the tracked wallet transacts, including buy and sell orders on DEXs. When tracking transactions, it’s best to focus on BEP20 tokens, which operate on the BNB Chain.

Follow CZ on X for Potential Clues

Changpeng Zhao (CZ) is Binance’s founder and former CEO. Although CZ is prohibited from managing Binance (per a settlement agreement with the US Department of Justice), he’s likely still highly influential in key decisions. Therefore, following CZ on social media is a solid strategy for predicting new Binance listings.

CZ is highly active on X, with almost 10 million followers. Most posts are crypto-related and often focus on the BNB Chain ecosystem. Any potential clues, such as specific narratives (e.g., AI agents or meme coins), could be pivotal when forecasting upcoming listings.

Assess New Listings From Other Tier-One Exchanges

Having analyzed the best new coins on Binance, we found that many new listing announcements were “reactionary”. Unlike any other business, Binance isn’t the only exchange with a tier-one status, so it has competitors.

As such, we found that Binance often lists trending meme coins and cryptocurrencies recently added to other major exchanges.

For example, suppose a new meme coin with tens of millions of dollars in daily trading volume is added to Coinbase and Crypto.com. These competitors have millions of active traders, meaning the respective meme coin is likely to generate big numbers. This means Binance is missing out on commission revenues. In this scenario, Binance could add the meme coin to its spot exchange, ensuring it maximizes the potential commissions available.

This strategy also works well with alert services like Cryptocurrency Alerting. For instance, suppose you get an alert about a new OKX listing. You can then track the listed crypto project to see if any other tier-one exchanges follow suit. If they do, a new Binance listing could be imminent.

Follow the Binance Alpha Wallet New Coin Listings

Although not a guarantee, many projects that are listed in web3 wallet feature Binance Alpha, are considered and sometimes approved for a full listing on the Binance CEX. Coins in Binance Alpha have usually already gained a fair amount of community support, such as Trusta AI, and often show promise of true innovation.

Another way to quickly check Binance Alpha coins is via Coingecko.

Why Do Crypto Traders Buy Upcoming Binance Coins?

Seasoned investors track upcoming listings and immediately enter the market when the announcement is made.

Binance Official Website. Source: Binance

The newly approved token will often “pump”, with the hype of a Binance listing attracting waves of speculative investors. This means an initial pricing rally is almost always the case.

The reasons for this include:

- Biggest Exchange: Binance is the world’s biggest crypto exchange across measurable metrics. It boasts over 275 million registered users, including millions of daily active traders.

- Significant Trading Volumes: Like any exchange, Binance’s trading volumes are influenced by broader market conditions. Nonetheless, Binance attracts substantially more volume than any other platform. For example, recent 24-hour volumes on Binance and Coinbase were almost $18 billion and $2.7 billion, respectively.

- Exclusive Club: Binance currently lists about 400 cryptocurrencies. This is a micro-fraction of the wider market, home to millions of tokens. Those listed on Binance are part of an exclusive club that attracts new investors.

- Easy Market Access: Binance accepts instant deposits with fiat money in many countries, allowing seamless market access with credit cards and e-wallets. This makes Binance highly accessible to first-time investors.

That said, it’s important to remember that new Binance listings aren’t guaranteed long-term success. We found that most approved tokens saw an immediate price pump, often lasting several days, and penny crypto projects sometimes benefit the most from listing on Binance. However, prices can reverse quickly once the hype dies down.

Buying cryptocurrencies on the back of a Binance listing often only works in the short term. Projects with strong fundamentals, alongside other exchange listings, have the best chance of producing long-term growth.

How Often Does Binance Add New Cryptocurrencies?

Binance’s new listings occur sporadically. Some weeks, there will be no new listings; in others, there can be multiple.

July 2025, for instance, saw eight cryptocurrencies added to the Binance exchange. Six were added in the previous month.

Ultimately, there are no set criteria that Binance needs to meet. If a specific token is trending and generating significant trading volume, it could be added to Binance at any time.

Conclusion

With over 275 million users, Binance is the world’s most sought-after exchange for crypto projects. Depending on market conditions, a Binance listing can result in an immediate pricing rally, often lasting for days or weeks. It also legitimizes the project’s vision.

However, predicting new Binance listings is speculative, as the exchange must make announcements directly. Even so, a potential incoming listing could be in sight for Bitcoin Hyper, a Layer 2 network for Bitcoin currently in presale. Bitcoin Hyper has raised over $16.24M so far.

FAQ

How do you find upcoming coin listings before they go live?

Where can I buy coins before they are listed on Binance?

Can a delisted coin be listed again on Binance?

References

- Binance Research on Key Trends in Crypto (Binance)

- Whale Alert (X)

- ARKHAM Intelligence (ARKHAM)

- Solana Onchain Data and Wallet Tracker (Nansen)

- The Ultimate Guide to Staying Listed on Binance (Binance)

- Crypto & Blockchain Venture Capital Q4 2024 (Galaxy)

- Market Reaction to Exchange Listings of Cryptocurrencies (ResearchGate)

- TLDR: 2025 crypto predications round-up (Piper Alderman)

- Web3 Developer Report 2024 (Electric Capital)

- Binance Effect Study (CoinDesk)

- DappBay (BNB Chain)

- Cryptocurrency Alerting (Cryptocurrency Alerting)

- BitcoinFi: A 2025 Market Report (Maestro)

Coinspeaker in Numbers

Monthly Users

Articles & Guides

Research Hours

Authors

Data-backed research, expert-driven insights, and industry trends led us to coins primed for growth, backed by strong fundamentals...

Our extensive research reveals the best platforms for crypto day trading. Learn where and how to day trade digital assets like Bit...

Fact-Checked By:

Fact-Checked By:

Otar Topuria

Crypto Editor, 19 postsI’m a crypto writer and analyst at Coinspeaker with over three years of experience covering fintech and the rapidly evolving cryptocurrency landscape. My work focuses on market movements, investment trends, and the narratives driving them, helping readers what is happening in the markets and why. In addition to Coinspeaker, my insights and analyses have been featured in other leading crypto and fintech publications, where I’ve built a reputation as a thoughtful and reliable voice in the industry.

My mission is to demystify the crypto markets and help readers navigate the noise, highlighting the stories and trends that truly matter. Before specializing in crypto, I worked in the IT sector, writing technical content on software development, digital innovation, and emerging technologies. That made me something of an expert in breaking down complex systems and explaining them in a clear, accessible way, skills I now find very useful when it comes to unpacking the intricate world of blockchain and digital assets.

I hold a Master’s degree in Comparative Literature, which sharpened my ability to analyze patterns, draw connections across disciplines, and communicate nuanced ideas. I’m particularly passionate about early-stage project discovery and crypto trading, areas where innovation meets opportunity. I enjoy exploring how new protocols, tokens, and DeFi projects aim to disrupt traditional systems, while also evaluating their potential risks and rewards. By combining market analysis with forward-looking research, I strive to provide readers with content that is both informative and actionable.