LiquidChain is a Layer 3 blockchain project that wants to unify the liquidity of Bitcoin, Ethereum, and Solana into a single execu...

A rug pull is a common crypto scam where developers abandon a project and disappear with investors’ funds, leaving behind worthless tokens. If you’re new to crypto, it’s one of the first and most dangerous terms you’ll encounter.

Rug pulls usually work because the team behind a crypto project controls something users consider safe – smart contract backdoor keys, token liquidity, etc. Once enough buyers commit to the project, insiders can profit by dumping liquidity, selling a large portion of their holdings, or even completely restricting selling.

In this guide, we’ll explain the different types of rug pulls (hard, soft, honeypots) and the various schemes that typically accompany a “rug”, as it’s often called. While some rug pulls are instant, others can unfold slowly, draining user funds over time and without notice. We’ll also point out high-profile examples to help you connect the dots before you connect your wallet.

Key Takeaways:

- Most rug pulls happen in low-liquidity projects.

- Rugs aren’t always instant. While some use backdoors in the code to steal funds immediately, others are pump-and-dump schemes disguised as legitimate projects.

- Rug pulls usually rely on hype, influencers, or fake partnerships to attract capital.

- You can avoid rug pull scams by analyzing the “tokenomics” and using token contract scan tools to ensure the team can’t mint new tokens or pull the liquidity.

What Is a Rug Pull?

A rug pull is a scheme in which crypto developers abandon a project and run off with investors’ funds. “Developers” and “project” might be too flattering as terms in this context, but some scams can seem legitimate. Imagine you’re standing on a rug, and then someone yanks it out from under you. You’re left off-balance, probably on the ground. In the crypto world, “on the ground” translates to an empty or near-empty wallet.

This type of exit scam thrives on decentralized exchanges (DEXs) without KYC, particularly in the memecoin world. Decentralized exchanges allow anyone to list a new token. This open door allows anyone to launch legitimate projects, but also invites malicious developers to create tokens solely to steal money.

Rug pulls usually follow a familiar pattern. The developers hype the project to attract buyers. Once the pot (typically, a liquidity pool) is big enough, they drain it. The result is instant and looks like a cliff on the chart. The token’s price crashes, leaving investors holding worthless bags of crypto assets.

How Do Crypto Rug Pulls Work?

Every scam can bring unique twists. However, the general anatomy of a rug pull usually follows a predictable pattern. Let’s look at the most common structure: DEX rugs. Developers create a new cryptocurrency token and pair it with a valuable cryptocurrency in a liquidity pool on a DEX. For example, let’s say they pair a new meme coin token with Ethereum (ETH).

- The Setup: Scammers launch the token and create a buzz on social media. Maybe they pay influencers, use bots on Telegram, or promise some dubious future utility (“powers the meme-frog metaverse”) to drive hype.

- The Bait: As investors rush in, they swap valuable assets like ETH or SOL for the new token. This increases the amount of valuable crypto in the liquidity pool and pushes up the apparent value of the rug token. The rising price attracts more FOMO (fear of missing out). The chart goes parabolic.

- The Pull: Once the liquidity pool’s value becomes worth a substantial amount, the developers pull the rug. They might trigger a function in the token’s smart contract or use their control over the liquidity provider (LP) tokens to withdraw all the valuable cryptocurrency (ETH) from the pool. They don’t care about the scam tokens in the pool. It was all about getting the ETH, or whatever the scam token was paired with.

- The Aftermath: Without a liquidity pool, the token becomes untradeable. While the token still shows a value, you can’t sell it. It’s worthless. Game over.

Why Are Rug Pulls Dangerous?

Rug pulls exploit the very features that make decentralized finance (DeFi) attractive: anonymity and a lack of regulation. In the traditional financial world, if a CEO embezzles funds, somebody’s going to jail. In the crypto world, rug pull developers are harder to identify. There’s also no “undo” button in crypto, and new traders are often the victims.

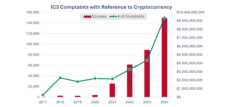

Cryptocurrency investment fraud (including rug pulls) accounted for $5.8 billion in reported losses in 2024, up by 47% year over year. That’s just in America, and most rug pulls are never reported. The losses become the cost of tuition, or perhaps a reason to leave crypto altogether.

Complaints With Reference to Cryptocurrency. Source: ic3.gov

When you trade on a decentralized exchange, you are interacting with a smart contract, not a company. If that contract is designed to steal your money, no one can freeze the transaction. The virtual anonymity of the blockchain means the developer who just rugged a project can hide behind pseudonymous wallet addresses and disposable social media handles.

They can vanish instantly, often routing the stolen funds through a mixer to obscure the trail. For the victim, often a newer trader exploring DeFi for the first time, the loss is unrecoverable.

Types of Crypto Rug Pull Scams

Scammers use various methods to steal money in the crypto world. Sometimes it’s code exploits or liquidity pulls, and sometimes it’s more elaborate. In some cases, it’s just a time-tested ruse that looks legit.

Hard (Fast) Rug Pulls

Hard rug pulls are the digital equivalent of a bank robbery; they happen fast. In this category, the malicious intent is often programmed into the token’s smart contract. The developers have no intention of letting the project succeed. Instead, the smart contract code is designed to steal funds.

These scams are often impossible to recover from because the theft is a valid blockchain transaction. The victim signs the transaction to buy the token using their crypto wallet, but the developer secretly holds the keys to trigger the token’s hidden functions later. For instance, the contract may hold malicious functions, such as adjustable transaction taxes or address blacklisting. Honeypots and Liquidity Pulls are the most common tactics used in hard rugs, although liquidity pulls center on removing the liquidity pool itself.

Soft (Slow) Rug Pulls

Soft rug pulls are more like a long con. There’s usually no malicious code in the smart contract. Instead, the developers use social engineering and market manipulation to steal funds.

SafeMoon price slowly dropping to ~$0. Source: CoinGecko

In a soft rug, the project might look legitimate, including elaborate white papers and ambitious roadmaps, but the developers have no intention of building a real product. They hype the token to drive the price up, then slowly sell off their own massive supply of tokens over weeks or months. Because the price drops gradually, the community often stays in denial, many still “buying the dip”, while the team quietly exits with the money. Pump-and-dump schemes are a common example of a soft rug. While slower, the result is the same.

Liquidity Pulls

This is the most common form of crypto rug. When a token is listed on a DEX, the developer must provide liquidity. For example, maybe it’s a meme-frog token paired with ETH. In a liquidity pull scam, the developer does not “lock” these LP tokens. This means they retain the ability to withdraw the liquidity at any time. When the pool fills up with investor money, the developer simply withdraws their stake in the pool, taking all the ETH and leaving the pool empty. Token holders have no way to sell.

Pump and Dump Schemes

Pump-and-dump scams are often more elaborate and typically involve a group of external manipulators. The developer may not be involved at all. The group coordinates to buy a low-cap token, pumps the token on social media, and then they dump their holdings in a wave of coordinated selling. The price crash leaves late FOMO investors with significant losses. Beware, some scammers treat this as a rinse-and-repeat scam, blaming someone else for selling.

Honeypot Scams

A honeypot scam is a specific type of hard rug where the smart contract allows investors to buy the token but prevents them from selling or transferring it. The chart looks incredible, with only green candles going up. Investors rush in, thinking they have found a gem, without knowing why the chart has gone parabolic. However, the developer has whitelisted only their own wallets for selling and transfers. Some occasional “sells” from these insider wallets keep the game going longer because it looks like natural profit-taking. Eventually, the developer takes the rest of their profit by pulling the liquidity.

Exit Scams

The term “exit scam” is more of an umbrella term, but it usually refers to centralized platforms or investment protocols rather than a single token. In this scenario, a platform operates legitimately (or appears to) for a period of time, collecting user deposits and building trust. Suddenly, the website goes dark, social media accounts are deleted, and the operators vanish with the users’ custody funds. Unlike a token rug, where you still hold the (worthless) coins, in an exit scam, you typically lose access to your account entirely.

In 2021, the Thodex Turkish exchange suddenly halted trading, claiming a “temporary closure” for maintenance. The CEO fled the country with $2 billion in user funds. He was eventually caught and sentenced to over 11,000 years in prison, but most users never saw a dime.

DeFi & Yield Farming Scams

These scams prey on investors looking for high interest rates. Developers create a platform that promises huge returns (APY) if you deposit your crypto. But there’s often a trap hidden in the code.

- The Hard Rug: The code might have a backdoor that allows the developer to withdraw all the user funds from the pool to their own wallet instantly.

- The Soft Rug: Alternatively, they might just mint (print) millions of new reward tokens for themselves and sell them into the market. The impossibly high yields end up costing money as the token value drifts toward zero.

Terra Luna Classic (LUNC) death candle. Source: CoinGecko

Ponzi Schemes

A project claims it can virtually print money using some whiz-bang tech they invented. What’s really happening in a crypto Ponzi is that earlier investors are being paid with the funds from new investors. It’s robbing Peter to pay Paul, but with whitepapers, Peter probably never gets paid.

Crypto scammers didn’t invent the idea; they polished the presentation. These schemes inevitably collapse when new recruitment slows down, and the perpetrators disappear with the remaining money.

Famous Crypto Rug Pulls

Crypto’s relatively short timeline is marked by some truly impressive scams that serve as cautionary tales. While some were obvious traps in hindsight, others fooled even experienced veterans. The good news is that we can learn from them. Let’s look at some of the more famous examples of rug pulls in the crypto world.

- Squid Game Token: Riding the wave of Squid Game mania due to the popular Netflix show, the Squid Game token (no official relation to the show) rocketed to $2,800 per token in a matter of days. In classic Honeypot fashion, buyers couldn’t sell. The devs eventually dumped, crashing the price to near zero instantly and stealing millions.

- BitConnect: In perhaps the most infamous Ponzi scheme in crypto history, BitConnect promised 1% daily returns through its volatility trading bot. Investors had to trade Bitcoin (BTC) for the BCC token to join. Behind the scenes, there was no bot. BitConnect was paying early investors with proceeds from new investors. When the project collapsed in 2018, billions in BTC value vanished into the blockchain ether as BCC’s price plummeted.

- HAWK (Hawk Tuah Meme Coin): In a recent example of the celebrity meta, viral personality Haliey Welch launched HAWK with the help of several crypto veterans. On-chain analysts noted snipers (insider wallets) buying up a massive supply moments after launch. While the team denied it was a rug, the chart plummeted as insider wallets dumped on retail. Several copycat meme coins added insult to injury as many of those also rugged in various ways.

- Libra (“Javier Milei” Coin): A meme coin claiming association with Argentine President Javier Milei. After gaining traction, the promotional accounts deleted their presence, and the token value plummeted. Libra serves as a reminder that political (or celebrity) affiliation in crypto is often faked to lure victims.

- SafeMoon: While SafeMoon had a massive community, claims that the token’s liquidity was locked came under scrutiny. Investigators uncovered that the “locked” liquidity was accessible to the developers, and millions of dollars were allegedly siphoned from the liquidity pool over time. This one was a massive, slow-motion soft rug pull.

Are Rug Pull Scams Illegal?

Many of the rug pull examples we’ve discussed are likely illegal in several jurisdictions, but proving it is difficult for several reasons, including crypto’s global reach. As a result, most rug pull victims never see justice.

However, hard rug pulls like stealing crypto through hidden smart contract functions or lying to investors about locked liquidity constitute fraud. The U.S. Department of Justice (DOJ) has successfully prosecuted high-profile cases like the Frosties NFT rug pull and the SafeMoon executive team. In a more recent example, Do Kwon was sentenced to 15 years in prison in 2025 for his role in the collapse of the Terra Luna project. Fraud charges have seen the most successful prosecutions.

On the other hand, soft rug pulls exist in a troublesome legal gray area. If a developer launches a token with no written promises and sells their own supply legally, it is often difficult to prove criminal intent versus profit-taking or claims of simply losing interest in the project and recouping an investment.

How Can Traders Identify and Avoid Rug Pulls?

The safest approach is to view new projects with a healthy skepticism. Your own due diligence is your best defense against rug pulls. Here is a checklist to run before you buy any new token.

1. DYOR (Do Your Own Research)

Never buy a new cryptocurrency solely based on a social media recommendation. Dig into the whitepaper and the community discord or Telegram group.

2. Check the Team’s Backstory

Are the developers doxxed (publicly known) or anonymous? What’s their reputation? Anonymity doesn’t make a project a rug, but it may increase the risk, particularly for meme coins. Consider how easy it would be for the developers to simply disappear.

3. Examine the Project’s Social Media

Look for organic engagement. If a project has 50,000 followers but only two likes per post, those followers are bots. Dig deeper to see who is following the project and who is responding to posts.

4. Analyze the Tokenomics

Use a block explorer like Etherscan or Solscan to view the “Holders” tab. If the top 10 wallets hold more than 20% of the supply, one person selling can tank the price. For meme coins, the risk threshold is often lower. Someone dumping 1% can start a death spiral.

5. Audit Smart Contracts

Free automated scanners like Token Sniffer or Honeypot.is can help identify possible rug pulls by looking at key metrics (Token Sniffer) or malicious contract functions (Honeypot.is). Notably, these tools can generate false alarms, but they provide a starting point.

6. Watch Out for Red Flags

Check for warning signs before investing.

- Liquidity is not locked: If the liquidity isn’t locked via a reputable third-party locker, the dev can pull it at any second. Notably, projects can also “burn” the liquidity by sending the pool to an unrecoverable address on the blockchain. This is even better than locked liquidity because it never expires.

- Impossible Yields: If a yield seems too good to be true, it probably won’t last, or you might pay for your yield in supply inflation and declining token prices.

- Fair Launch Claims: Be wary of “fair launches” where the price pumps instantly. This often means insiders sniped the supply at launch.

What Can You Do If You’re Caught in a Rug Pull?

If you find yourself holding a token that has just been rugged, the options are limited, but immediate action is required.

- Revoke Permissions: If the scam involved a malicious contract approval, use a tool like revoke.cash to disconnect your wallet from the contract to prevent further draining of other assets.

- Sell What You Can: If there’s any liquidity left (and it’s not a honeypot), try to salvage whatever you can by selling it using a DEX.

- Report It: File a report with the FBI’s Internet Crime Complaint Center (IC3) or cybercrime authorities in your jurisdiction.

- Alert the Community: Post on social media and flag the address on block explorers to prevent others from falling for it.

- Accept the Loss: Unfortunately, retrieving funds from a crypto rug pull is rarely possible. For most, it’s an expensive lesson in risk management.

The Future: Can AI Help Investors Avoid Rug Pull Scams?

AI is starting to level the playing field for retail traders. We now have tools that can scan smart contracts in seconds, flagging hidden code that a human eye would likely miss. Beyond just reading code, machine learning tools can watch the blockchain in real-time to spot wash trading (where developers fake volume to lure you in) or identify wallets linked to the team.

That said, AI isn’t a magic wand. It can give you better data. However, it can generate false alerts and still can’t replace your gut check. The rules of survival haven’t changed: manage your risk, don’t bet the rent money, and if you’re going to play with high-risk tokens, keep your position sizes small. If a project feels off, it probably is, no matter what the tools and token checkers say. There are plenty of other projects out there. Pick a different one.

Investment risk warning: Rug pulls can happen fast, and when they do, there’s usually no undo button. Liquidity vanishes, prices crash, and the funds are gone. Treat every potential investment like a worst-case scenario until everything checks out: smart contracts, team credibility, tokenomics, liquidity.

FAQ

What does “rug pull” mean in crypto?

Can I get my money back if I get rug-pulled?

What happens to developers and teams who create rug pull tokens?

What is a honeypot crypto scam?

What is liquidity locking?

Was the TRUMP meme coin a rug pull?

How can I protect myself against rug pull scams?

Are rug pulls illegal?

References:

- 2024 Internet Crime Report (ic3.gov)

- CEO of Turkish cryptocurrency exchange Thodex missing as police launch investigation (cnbc.com)

- Two Defendants Charged In Non-Fungible Token (“NFT”) Fraud And Money Laundering Scheme (justice.gov)

- Chief Executive Officer of Digital Asset Company Found Guilty in Multi-Million Dollar Crypto-Fraud Scheme (justice.gov)

- Crypto-Enabled Fraudster Sentenced For Orchestrating $40 Billion Fraud (justice.gov)

- Token Sniffer (tokensniffer.com)

- Honeypot Detector for BSC & Ethereum (honeypot.is)

- Revoke Token Approvals (revoke.cash)

Coinspeaker in Numbers

Monthly Users

Articles & Guides

Research Hours

Authors

The team behind IPO Genie has not yet announced an end date for the presale.

AI cryptocurrencies combine blockchain with artificial intelligence to power decentralized machine learning networks, GPU computin...

Fact-Checked by:

Fact-Checked by:

18 mins

18 mins

Otar Topuria

Crypto Editor, 39 postsI’m a crypto writer and analyst at Coinspeaker with over three years of experience covering fintech and the rapidly evolving cryptocurrency landscape. My work focuses on market movements, investment trends, and the narratives driving them, helping readers what is happening in the markets and why. In addition to Coinspeaker, my insights and analyses have been featured in other leading crypto and fintech publications, where I’ve built a reputation as a thoughtful and reliable voice in the industry.

My mission is to demystify the crypto markets and help readers navigate the noise, highlighting the stories and trends that truly matter. Before specializing in crypto, I worked in the IT sector, writing technical content on software development, digital innovation, and emerging technologies. That made me something of an expert in breaking down complex systems and explaining them in a clear, accessible way, skills I now find very useful when it comes to unpacking the intricate world of blockchain and digital assets.

I hold a Master’s degree in Comparative Literature, which sharpened my ability to analyze patterns, draw connections across disciplines, and communicate nuanced ideas. I’m particularly passionate about early-stage project discovery and crypto trading, areas where innovation meets opportunity. I enjoy exploring how new protocols, tokens, and DeFi projects aim to disrupt traditional systems, while also evaluating their potential risks and rewards. By combining market analysis with forward-looking research, I strive to provide readers with content that is both informative and actionable.