LiquidChain is a Layer 3 blockchain project that wants to unify the liquidity of Bitcoin, Ethereum, and Solana into a single execu...

Want to trade XRP futures with low margin requirements? Read our beginner’s guide on how to trade XRP futures in 2026.

We created a robust research methodology to rank the top XRP futures trading platforms. CoinFutures, our top pick, offers a safe trading experience with 1000x leverage, plus instant payments and a licensed framework.

XRP futures are derivative contracts that support low collateral requirements. They enable both long and short positions on the XRP price, but traders do not own the underlying coins.

While futures appeal to traders with a higher-risk mindset, knowing how to mitigate risk is essential. We discuss where and how to trade XRP futures, and which strategies reduce investor risk.

Key Takeaways

- The Chicago Mercantile Exchange (CME) launched XRP futures in May 2025, yet traditional exchanges have listed them for several years.

- On retail-friendly platforms like CoinFutures, Binance, and MEXC, traders buy and sell XRP futures with high leverage multipliers.

- As a derivative product, futures do not provide ownership. Traders only speculate on XRP price movements.

- The most risk-averse way to trade XRP futures is with modest leverage amounts and stop-loss orders.

- Consider key factors to choose the right futures trading platform, including liquidity depth, funding rates, commissions, and margin terms.

The Best XRP Futures Platforms Ranked

We’ve researched the crypto derivative market extensively to determine the best XRP futures trading platforms:

- CoinFutures: The Overall Best Place to Buy and Sell XRP Futures in 2026

- Binance: Quarterly and Bi-Quarterly Delivery Futures With XRP Settlement

- MEXC: Trade XRP Perpetuals Alongside 900+ Other Futures Markets

- KCEX: The Lowest-Fee Crypto Futures Exchange for XRP Traders

- Bybit: Top-Rated XRP Trading Platform With High-Level Analysis Tools

Best XRP Futures Trading Platforms Reviewed

The following reviews explore where to trade XRP futures safely and cost-effectively. Choose a platform based on your trading preferences.

1. CoinFutures: Trade XRP Futures fom $1 with 1000x Leverage

CoinFutures is our overall top place for XRP futures trading and caters to traders new to crypto derivatives. The platform offers instant accounts without KYC or minimum deposits, allowing traders to speculate on XRP from as little as $1 per futures position. Users increase their XRP exposure through leverage, and CoinFutures offers a maximum multiplier of 1000x.

While CoinFutures is the best crypto futures trading platform for high leverage, it offers several tools to reduce liquidation risk. Platform users may lower their multipliers, apply stop-loss orders, and automatically cash out at set profit targets.

Exploring XRP/USDT futures and 1000x leverage on CoinFutures. Source: CoinFutures

Traders also diversify to avoid overexposure to the XRP price. CoinFutures supports a wide selection of crypto offerings, from Bitcoin (BTC) and Cardano (ADA) to Litecoin (LTC) and Dogecoin (DOGE).

CoinPoker, the parent company of CoinFutures, has been operating since 2017 and utilizes Fireblocks, an institutional-grade infrastructure that safeguards client-owned cryptocurrencies. Cold storage cryptocurrency wallets with MPC technology store those digital assets, and customers verify holdings through proof of reserves.

CoinFutures’ approach to transparency is daily proof of reserves. Source: CoinFutures

As a licensed platform, CoinFutures accepts traditional money and cryptocurrencies. Choose from Visa, MasterCard, and e-wallets like Google Pay and Apple Pay for instant payments, or transfer funds from an external wallet. According to our research, CoinFutures approves withdrawals instantly, so traders receive their funds several minutes later.

Pros

- The overall best platform for XRP futures trading

- Leverage multipliers range from 1x to 1000x

- Enter long and short positions with instant execution

- Diversify into other futures markets like ETH and DOGE

- Liquidated trades retain the initial margin only

- Cash out automatically through stop-loss and take-profit orders

- No KYC

Cons

- Lacks high-level charting tools like indicators and trend lines

- Customer service doesn’t offer telephone support

2. Binance: Coin-M Delivery Futures That Margin and Settle in XRP

Binance lists perpetual and delivery futures, which both track the XRP price. Delivery futures are inverse (Coin-M) by default, since margin, profits, and losses settle in XRP coins. These contracts raise the trader’s risk-reward, and contract expirations include quarterly and bi-quarterly.

For more flexibility, consider perpetual futures with linear terms (USDT-M). They have no expiration dates and the contracts margin and settle in USDT, making the collateral balance less prone to XRP volatility. Binance offers linear futures in USDC, albeit with less liquidity and volume. As one of the top crypto staking platforms, the exchange also allows investors to earn interest on their XRP in between trades.

Binance traders get access to XRP delivery futures across two contract durations. Source: Binance

Regarding fees, Binance uses the maker-taker system and offers discounts to traders who surpass monthly volume milestones. The entry-level commission for both Coin-M and USDT-M futures is 0.02% and 0.05%. The exchange reduces fees by 10% when traders hold BNB (BNB).

Maintenance margin rates start at 0.5% on XRP futures, and the maximum leverage is 100x. Position sizes above 40,000 USDT reduce leverage caps to 75x and increase margin maintenance to 0.6%.

Pros

- Lists Coin-M futures that settle in XRP coins

- Maximum leverage of 100x

- Traders limit risk with isolated margin

- Widespread liquidity and competitive fees

Cons

- The platform may be too advanced for complete beginners

- Registered users must upload an ID to unlock account access

3. MEXC: Access a Diverse Range of Futures Markets with Low Upfront Margins

MEXC remains the largest crypto futures trading platform for supported markets. Traders diversify their derivative portfolios from a single account, supported by over 900 perpetual futures pairs. Together with XRP, MEXC lists the top meme coins such as Pepe (PEPE), Brett (BRETT), and Shiba Inu (SHIB), as well as major altcoins like ETH and LTC.

Contract terms cover both linear and inverse positions on major markets, such as XRP, allowing users to add collateral with USDT or the underlying coin. The maximum XRP leverage is 300x, and the maintenance margin increases on large-scale positions.

MEXC lists over 900 perpetual futures, including XRP. Source: MEXC

While MEXC charges funding rates to longs or shorts every eight hours, it offers a countdown timer and estimated fee. This transparency helps traders assess potential liquidation risks in real-time. Commissions are competitive for market makers at 0.1%, yet takers pay a much higher 0.4%.

MEXC’s advanced charting tools cover indicators such as the MACD and Bollinger Bands, as well as Moving Averages across various timeframes. The exchange’s native app lets users trade XRP futures on the move. It optimizes analysis tools to ensure a smooth experience for mobile users.

Pros

- The best choice for diversification with 900+ futures markets

- XRP/USDT futures offer 300x leverage

- Transparent funding rates with real-time estimated fees

- Top-rated charting interface for desktops and mobiles

Cons

- Only allows EUR and BRL for direct bank deposits

- Does not accept U.S.-based traders

4. KCEX: Low-Cost Futures Trading Platform with Max Commissions of 0.1%

Our research shows that KCEX is the best place to trade XRP futures with low fees. The platform’s maker-taker model offers 0% and 0.1% commissions, respectively. Account holders pay these fees regardless of monthly trading volumes. This structure lets traders buy and sell futures contracts on a spread-only basis.

KCEX offers XRP futures with USDT and USDC settlement, and traders choose between cross or isolated markets. In addition to leverage of up to 75x, trade minimums of $2.82 ensure an affordable experience for casual traders.

KCEX users never pay more than 0.1% per side when trading XRP futures. Source: KCEX

The trading dashboard offers custom order types like trigger and post only, and market data includes liquidation maps, industry news developments, and market depth. It also offers custom charting tools and technical indicators like the 75-minute and 300-minute Moving Averages.

Because KCEX is a top no KYC exchange, you don’t need to give away all of your personal details just to deposit crypto. The main downside is that it doesn’t support fiat payments. Users get fee-free crypto withdrawals that typically process in minutes.

Pros

- Low-fee futures platform with maximum commissions of 0.1%

- Supports XRP futures with USDT and USDC settlement

- Trading data includes news and liquidation maps

- Crypto withdrawals process fee-free

Cons

- The exchange does not hold any licenses

- Users cannot deposit funds with traditional payment methods

5. Bybit: Next-Gen Charting Tools and Analysis Features for Futures Trading Pros

Experienced traders use Bybit for its world-class trading platform. It comes packed with tools and features that help XRP traders make informed decisions. From time cycles and sine lines to Elliott triple combo waves and cypher patterns, platform users access hundreds of indicators and drawing tools. Traders may customize their charting area, including real-time comparisons between selected markets.

Bybit offers futures via perpetual contracts, with XRP/USDT being the most actively traded. Some users trade the XRP/USDC market, yet liquidity is weaker. Another option is inverse contracts that settle in XRP. The exchange supports hundreds of other futures markets, including the best altcoins like Solana (SOL), Sui (SUI), and Bitcoin Cash (BCH).

Experienced futures traders trust Bybit’s powerful charting tools and features. Source: Bybit

Non-EU traders open Bybit accounts without providing personal information, and deposit methods include debit/credit cards and peer-to-peer transfers. It also supports bank transfers via SWIFT, although deposits take up to five working days to arrive.

Pros

- Perform high-level technical research with hundreds of analysis tools

- Non-EU users trade anonymously with high withdrawal limits

- Leveraged positions receive competitive funding rates

- The futures exchange supports hundreds of crypto pairs

Cons

- Bank transfers take up to five working days

- Maximum leverage of 75x on XRP perpetuals

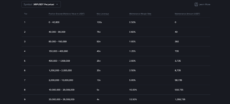

Comparing the Top XRP Futures Exchanges

Compare XRP futures trading platforms by contract types, leverage, commissions, and other important factors:

| Supported XRP Futures | Settlement Options | Margin Options | Max XRP Leverage | Mobile App? | Max Futures Trading Fees | KYC? | |

| CoinFutures | Simulated | USDT | Isolated | 1000x | Yes | Variable or commission-based | No |

| MEXC | Perpetual | USDT, USDC, XRP | Isolated and cross | 300x | Yes | 0.04% | No |

| Binance | Perpetual and delivery | USDT, USDC, XRP | Isolated and cross | 100x | Yes | 0.05% | Yes |

| KCEX | Perpetual | USDT, USDC | Isolated and cross | 75x | Yes | 0.1% | No |

| Bybit | Perpetual | USDT, USDC, XRP | Isolated and cross | 75x | Yes | 0.055% | No (non-EU users) |

What Are XRP Futures?

Futures are derivative contracts that track the price movements of XRP. Exchanges typically support perpetual futures, as they provide XRP exposure without contract expiration dates. Perpetual contracts support both long and short trading, which is ideal for short-term strategies such as day trading and scalping.

Traders enter predictions through buy (long) and sell (short) orders, and once contracts settle, they incur a profit or loss depending on the XRP price.

The main advantage of trading XRP futures is that traders deposit an initial margin, which reflects a small fraction of the overall market exposure. Our research shows that leverage limits range from 75x to 1000x, so traders increase their capital by up to 1000 times. This helps traders open significant position sizes without making a large upfront deposit.

As a first-time futures trader, understanding the risks associated with liquidation is crucial. Liquidation occurs if the futures position declines below the maintenance margin, which happens if the XRP price moves unfavorably. This outcome results in instant trade closure, and traders forfeit their margin.

How Does XRP Futures Trading Work?

XRP futures traders aim to predict price movements. The process begins by setting up a buy or sell order. These entry orders depend on whether traders expect XRP to increase or decrease in value.

Position sizes differ from traditional XRP investing. Traders enter an initial margin and, when trading with isolated margin, this amount reflects the maximum loss potential. Exchanges require users to select a leverage multiplier, which amplifies the initial margin.

For example, if the trader posts a $10 margin and applies 75x leverage, the trade value increases to $750. If the trader predicts the XRP price direction correctly, their total leveraged position determines the profit total. A 10% price increase on a $750 position delivers $75 gains, yet without leverage, those returns are just $1.

The CME exchange offers regulated XRP futures markets for accredited investors. Source: CME Group

The leverage applied also dictates the risk potential, since futures platforms require a minimum maintenance margin. That margin requirement moves closer to the entry price as the leverage multiplier increases. Once the trade equity falls below that amount, the exchange closes the position. As such, traders exit the market and lose their original margin.

Regarding contract durations, XRP perpetual futures remain open until the holder sells their position or it reaches the liquidation price. Delivery futures, which are less common than perpetuals, offer specific contract settlement dates like quarterly or bi-quarterly. If the trader still holds those contracts on the expiration date, they settle at the respective XRP price.

If you want to get started trading XRP futures but are worried about the risks, you can use one of the top crypto copy trading apps to test out your strategies without any risking real money first.

What Are CME XRP Futures?

The CME is the largest derivatives exchange in the U.S., and it launched XRP futures markets in Q2 2025. Contracts settle in US dollars weekly and monthly, yet since it primarily serves accredited and institutional clients, CME requires substantial margin.

Initial XRP margin requirements range from $67,000 to $73,000, depending on the contract, which makes them unsuitable for casual XRP traders.

Instead, retail clients typically use regular XRP futures trading platforms like CoinFutures and Binance. These providers have small upfront requirements and high leverage multipliers, so users gain significant XRP exposure with affordable amounts.

How to Trade XRP Futures

Read our beginner’s guide to trade XRP futures on the CoinFutures platform. We explain how to enter a futures position from just $1 with a maximum leverage of 1000x. Learn how to deposit and trade safely in under 10 minutes.

Step 1: Register a Futures Account

The first step is to visit the CoinFutures website, click “Register”, and complete the simple sign-up form.

Open a CoinFutures account without providing personal information or ID documents. Source: CoinFutures

Unlike many trading platforms, CoinFutures doesn’t require personal information or ID verification documents. Instead, new clients simply join with an email address.

The account opens instantly once you verify the provided email.

Step 2: Download the Futures Trading Software

CoinFutures users trade futures on the CoinPoker software. For context, CoinPoker created the CoinFutures brand alongside its poker, casino, sportsbook, and cryptocurrency products. CoinPoker launched in 2017 and has maintained an excellent reputation across 50,000+ active players.

CoinPoker’s user-friendly software runs seamlessly on desktop and mobile devices. Source: CoinFutures

The CoinPoker software is available on desktop and mobile devices. Download and install the software, and log in with your email address and password.

Step 3: Make a Deposit

CoinFutures supports deposits via digital assets and traditional money.

Most users prefer crypto transfers, as they remain anonymous and avoid transaction charges. CoinFutures supplies a unique deposit address for each supported coin and network. Accepted assets include many of the best cryptocurrencies to invest in, like BTC, BNB, ETH, and USDT.

CoinFutures provides users with unique deposit wallet addresses for their preferred coin or token. Source: CoinFutures

Click the preferred deposit asset to get the wallet address, and complete the transfer.

Users who favor fiat payments click the “Deposit With Card/Bank” button. CoinFutures offers a 1:1 exchange rate between USD and USDT, and deposit types include debit/credit cards and e-wallets.

Choose your region to finish setting up your account. Source: CoinFutures

Enter your mobile number to receive a verification code, and input the payment details when prompted. Once the gateway processes the payment, it adds USDT to your CoinFutures balance immediately.

Step 4: Go to Crypto Futures and Select XRP

Click “Crypto Futures” and “BTC/USDT” to explore available markets.

Exploring Futures markets on CoinFutures. Start with BTC/USDT and then find XRP/USDT. Source: CoinFutures

Choose “XRP/USDT” to go to the XRP futures dashboard.

Step 5: Choose the Trade Parameters

CoinFutures requires the trade parameters, including the market direction. Select “Up” or “Down” to speculate on XRP prices rising or falling, respectively.

The “Wager” is the initial margin to post to the XRP futures trade. Remember that you forfeit the margin if adverse price movements liquidate the position. Consider risking small amounts (the minimum is $1) to avoid excessive losses.

The XRP/USDT Futures chart on CoinFutures. Source: CoinFutures

Set the leverage multiplier, which amplifies the wager amount. Our example shows a $10 wager with 15x leverage, so the position size rises to $150.

Important: Evaluate the Entry and Liquidation Prices

After you select a long or short position and input the wager and leverage multiplier, CoinFutures displays the “Bust Price”.

If XRP reaches that bust price, CoinFutures liquidates the trade. In this instance, you lose the wager amount and immediately exit the trade.

The key takeaway is that the price shifts as users change the leverage multiplier. Trading with small leverage amounts helps users mitigate risk.

Step 6: Set Exit Parameters and Place an XRP Futures Trade

Select “Auto” mode to set the exit orders.

We recommend choosing a stop-loss level that aligns with your risk tolerance. You may enter the stop-loss point in XRP/USDT prices or US dollars. Both options ensure you exit the futures trade automatically should the stop-loss trigger.

Placing a bet on CoinFutures on the XRP/USDT pair. Source: CoinFutures

Experts also suggest placing take-profit orders to secure XRP price gains without needing to monitor chart activity.

Our example shows a $3 stop-loss and a $100 take-profit point.

Once you place the XRP futures order, it closes when either the stop-loss or take-profit triggers.

XRP Futures vs Options

Futures and options both offer exposure to the XRP price without traditional ownership. They enable small upfront minimums and long and short trading via derivative contracts.

Futures traders post margin to enter positions, and select a leverage multiplier to determine the total exposure. The trade duration depends on the futures type. Delivery futures have set expiration dates, while perpetuals remain open until liquidated or closed.

Options require a premium instead of initial margin. Similar to margin, the premium reflects a portion of the trade value, yet the specific amount depends on the options’ strike price. Premium prices rise as the strike price becomes more probable, and vice versa.

While XRP futures incur liquidation risks, options traders may hold their contracts until the expiration date regardless of price volatility. If the XRP price closes outside of the strike price level, contract holders forfeit their premium.

Read our guide on the best XRP options trading platforms to learn more about this derivative type.

Key Things to Know About XRP Futures Trading

Mastering the specifics of XRP futures will help you become a more successful trader. Learn more about different contract and margin types, and the correlation between leverage multipliers and liquidation risk.

Futures Contract Types

Crypto traders access various XRP futures markets and contract types.

Beginners favor simulated and perpetual futures with linear settlement. These cash-settled contracts require USDT as margin. Trading gains and losses settle in USDT, too.

A more advanced contract type is inverse futures, which are margined and settled in XRP. This setup creates a higher risk-reward profile, as collateral values fluctuate more rapidly with XRP price volatility. This increased volatility directly affects the maintenance margin.

Note that on some trading platforms, “USDT-M” futures reflect linear contracts, and Coin-M describes inverse contracts.

Leverage and Margin

Leverage and margin inversely adjust as individual traders increase their risk exposure. If a trader posts a $50 margin with 50x leverage, they gain $2,500 in XRP exposure. This trade parameter is a 2% initial margin.

In general, exchanges liquidate futures trades when the position value drops below the margin. Therefore, by lowering the leverage multiplier, traders increase the margin threshold and reduce the liquidation risk.

XRP futures on Binance offer various leverage limits and margin requirements based on the position size. Source: Binance

The same XRP trade but with 2x leverage increases the initial margin to 50%, so the trader has a much wider safety net against liquidation.

Isolated and Cross Margin

The best crypto exchanges offer isolated and cross margin on XRP futures.

Experts explain that isolated margin is essential for inexperienced derivative traders. This margin type limits the potential downside to the initial margin. As traders avoid losing more than they post in margin, they protect their capital from excessive drawdown.

Traders with a strong grasp of risk management often switch to cross margin mode. They use the exchange margin account for multiple futures trades, which significantly increases capital efficiency. However, as the same margin funds back more than one futures position, a single liquidation could wipe out the entire account.

Funding Cycles

XRP futures, when traded as simulated or perpetual contracts, typically incur funding rates every eight hours (and often more frequently on some exchanges).

The funding system helps rebalance futures prices against the XRP spot price. Whichever side of the market contributes to the imbalance pays fees to the other side.

For example, when XRP short orders exceed longs, those short-sellers pay funding fees to longs (and vice versa). This dynamic means you could pay or receive fees, and those capital adjustments reflect in the maintenance margin balance.

Depending on market conditions, paying too many funding cycles could reduce the maintenance margin to critical levels. Without adding additional margin, liquidation becomes more likely. This is why swing traders prefer XRP delivery futures. They remain open until the expiration date without ever incurring funding fees.

What Are the Benefits of Trading XRP Futures

Here are the key reasons why crypto traders speculate on XRP futures:

- Leverage Boosts Trading Profits: Successfully predicting XRP price movements with leverage can produce unprecedented gains. Some platforms offer leverage of up to 1000x, so futures profits amplify by 1000 times. The leverage system particularly appeals to traders without access to large upfront sums, since they control huge amounts of XRP with minimal deposits.

- Trade XRP in Both Directions: Crypto traders capitalize on XRP’s volatility through futures contracts. Depending on their analysis, traders may go long or short through buy and sell positions. They also speculate during “sideways” markets, where XRP trades between tight pricing zones.

- Expand Market Exposure: As traders post a fraction of the position value, futures help them increase their market exposure. Rather than consume the entire account balance on one trade, margin enables them to open multiple positions across varying crypto markets. This is unlike spot exchanges, which require users to cover the full purchase amount upfront.

- Avoid Wallet Storage: XRP futures are derivative contracts, so the underlying coins determine their value. Traders do not own or control those coins, which allows them to avoid storage responsibilities. This creates a more user-friendly experience, as traders focus on analysis and order placement rather than wallet security.

- Hedge Against Uncertain Markets: Investors who buy and hold XRP in the long term may trade futures to mitigate market uncertainty. Whether it’s XRP’s legal battles with the SEC or potential ETF approval, short-selling futures contracts offset near-term volatility risks.

Pros & Cons of XRP Futures Trading

Here are the pros and cons of XRP futures:

Pros

- Gain exposure to XRP price volatility without owning coins

- Enter large position sizes with a small upfront margin

- Leverage increases trading profits by significant amounts

- Futures support long and short trading

- Hedging strategies use futures to mitigate short-term uncertainty

- Traders choose between XRP and stablecoin settlement

Cons

- Beginners may find that futures contracts are complex to trade

- Cross margin contracts expose the entire margin account

- Liquidation leads to trade closure and margin forfeit

- Futures offer trading opportunities for short-term players rather than long-term investors

- Most exchanges charge funding fees every eight hours

Futures provide many benefits to XRP traders, from trading both market directions to low margin requirements and amplified profits. Beginners suit linear-style contracts with isolated margin, since these XRP futures reduce risk exposure without impacting profit potential.

According to our evaluation, CoinFutures is the best place to trade simulated XRP futures in 2026. CoinFutures offers anonymous accounts, instant payments, and a $1 minimum trade requirement. XRP futures attract 1000x leverage, which remains the highest in the industry.

References

- Derivatives exchange CME set to launch XRP futures in crypto push (Reuters)

- XRP futures contract specifications and margin (Chicago Mercantile Exchange)

- Understanding margin accounts (U.S. Securities and Exchange Commission)

FAQ

What are XRP futures?

What are the benefits of trading XRP futures?

Are XRP futures more risky?

What’s the minimum amount you need to trade XRP futures?

How do I trade XRP futures?

What is the best XRP futures trading platform?

Coinspeaker in Numbers

Monthly Users

Articles & Guides

Research Hours

Authors

The team behind IPO Genie has not yet announced an end date for the presale.

AI cryptocurrencies combine blockchain with artificial intelligence to power decentralized machine learning networks, GPU computin...

Fact-Checked by:

Fact-Checked by:

22 mins

22 mins

Ibrahim Ajibade

, 373 postsI’m a research analyst with experience supporting Web3 startups and financial organizations through data-driven insights and strategic analysis. My goal is to help organizations make smarter decisions by bridging the gap between traditional finance and blockchain innovation.

With a background in Economics, I bring a solid understanding of market dynamics, financial systems, and the broader economic forces shaping the crypto industry. I’m currently pursuing a Master’s degree in Blockchain and Distributed Ledger Technologies at the University of Malta, where I’m expanding my expertise in decentralized systems, smart contracts, and real-world blockchain applications.

I’m especially interested in project evaluation, tokenomics, and ecosystem growth strategies, as these are areas where innovation can drive lasting impact. By combining my academic foundation with hands-on experience, I aim to provide meaningful insights that add value to both the financial and blockchain sectors.