Goldman Sachs (GS) Shares Jump 4% in Pre-Market as Q2 Result Shows Impressive Revenue

The Q2 report Goldman Sachs posted is arguably one of the best performances when compared with how its core competitors performed in the second quarter.

The Q2 report Goldman Sachs posted is arguably one of the best performances when compared with how its core competitors performed in the second quarter.

Analysts opine that expected earnings reports could impact investors’ reaction to the stock market after last week’s volatility.

Elliott Management is the biggest investor in Pinterest. The Vanguard Group has an 8.7% stake in the company.

The stock market turned up underwhelming numbers on Thursday as talks of a recessionary plunge continue to dominate the financial outlook.

The US stock market seemed to be under pressure, losing out on all major sectors as key inflation data draws near.

The Nasdaq, S&P 500, and Dow all closed lower as US equities fell to begin the week ahead of anticipated quarterly reports.

The decision Musk has taken to back out of the Twitter deal has caused the company’s shares to crash as a legal battle brews.

The US stock market futures will always be an indication of how healthy the economy is at the time.

Over the last week’s trading sessions, US stocks are showing a good uptick. Analysts think that the drop in the flow of negative news has helped the market to revive its lost grounds.

As GameStop surged in reaction to the stock split news, the company’s shares closed at $117.43.

While the US stock market is bracing for a recession, several market experts are expecting this to be a mild one.

While Tesla stock dipped 4% on Tuesday, JPMorgan believes that the automobile company could plunge further.

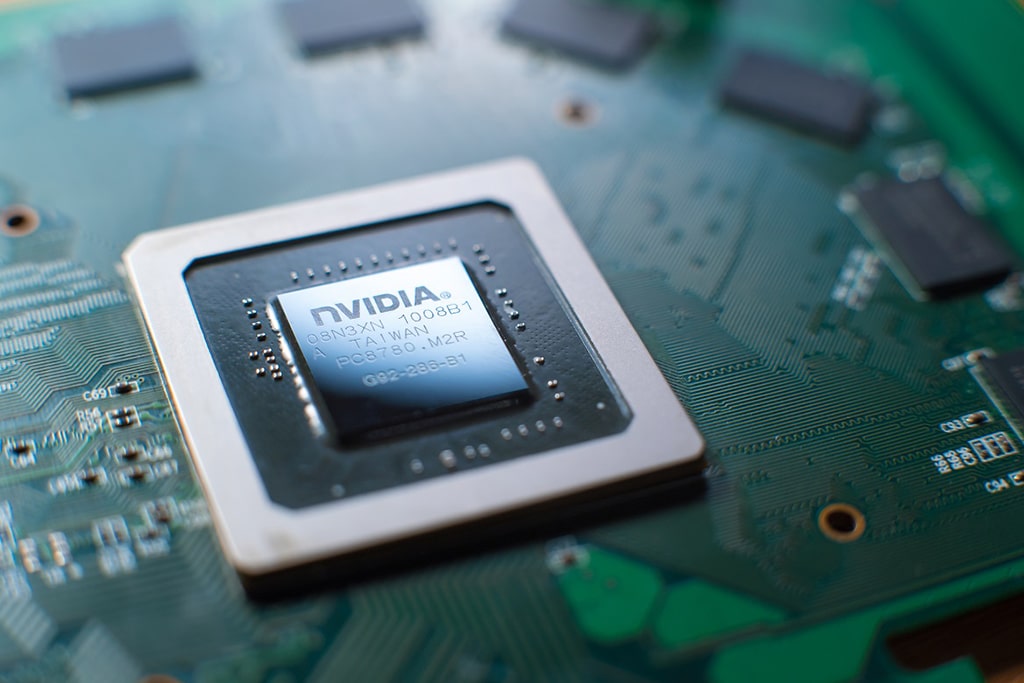

Nvidia expects to sell significantly fewer semiconductor chips after the crypto winter and inflation reduced global demand.

For MicroStrategy, Bitcoin is still the top digital currency, despite the downturn in market trends and volatility. And according to Binance CEO, there is common sense in such a position and Bitcoin-related decisions made by Michael Saylor.

The broader concerns of stakeholders in the airline industry can be attributed to the fears of recession.