Crypto Experts Comment on Current Market Status at 2022 WEF

Many notable names in the crypto space present at the WEF spoke of the unsustainability of the existing cryptocurrencies.

Many notable names in the crypto space present at the WEF spoke of the unsustainability of the existing cryptocurrencies.

There are no statements from Binance as it is against the company’s policy to comment publicly on such matters.

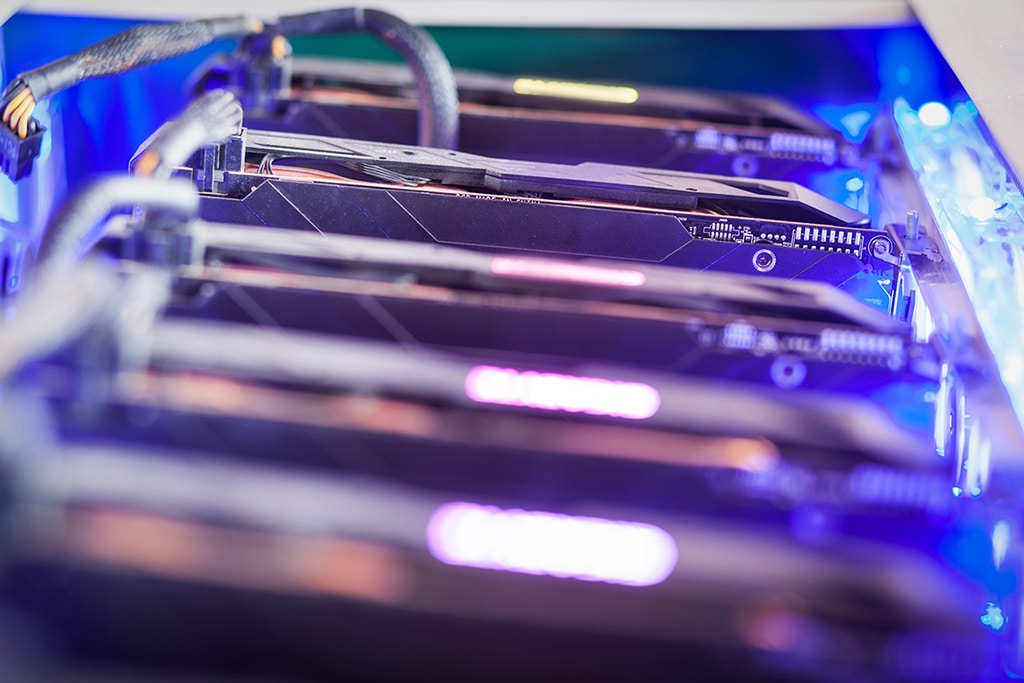

New York lawmakers have passed a moratorium that seeks to bar Bitcoin mining operations for two years in order to ease environmental concerns.

With several tech experts joining hands against crypto, Vitalik Buterin said that it pains to see that the crypto industry has turned so adversarial in the last decade.

The Bitstamp Earn product will offer returns only on staking ETH and ALGO. Note that it won’t be involved with any kind of lending process.

The Stablecoin bill passed by Japanese lawmakers is bound to take effect 12 months from now, and irrespective of these delays, the bill will still make the Asian giant the first to pioneer this area of the growing blockchain ecosystem.

In February, Dubai announced its first crypto regulation, making it illegal for anyone to deal with crypto assets without VARA approval.

Balancer worked along with decentralized investment platform Conjunction X to deploy a decentralized exchange (DEX) that will compete within the Optimism ecosystem.

Canonical kept its fund size small following the officials’ decision to concentrate on pre-seed and seed investments.

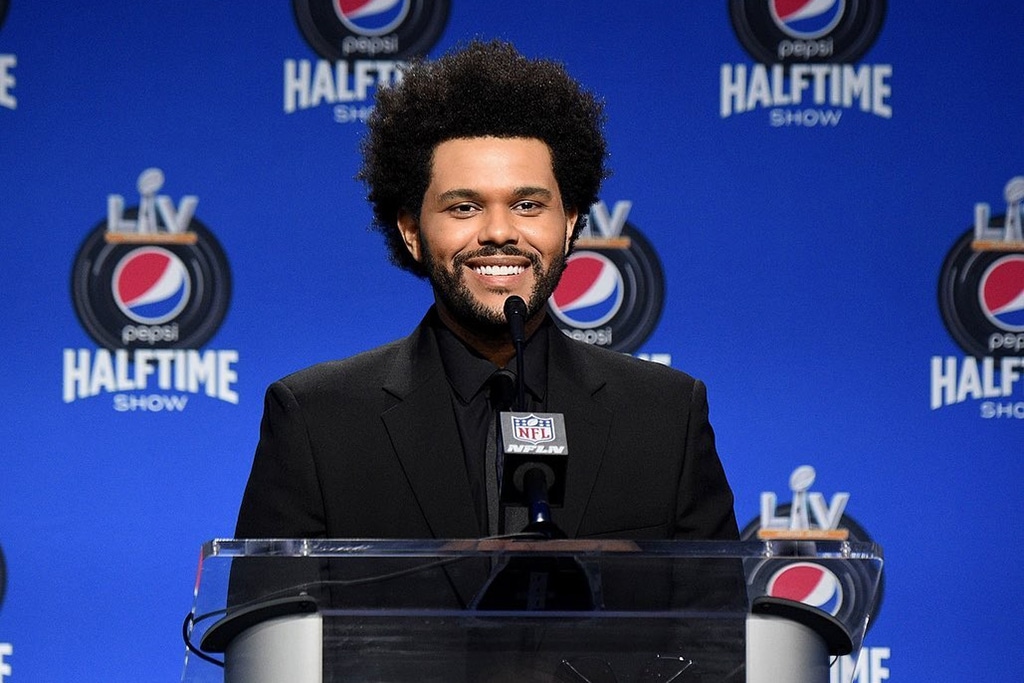

The Weeknd stated he was enthralled by Binance’s user focus and novel tech, noting that the company is all about community.

The Coinbase chief legal officer said that customers’ funds are safe with the company and will always be.

Gemini issued a memo to all its staff nationwide notifying them of an impending layoff to help the company survive the bear market.

El Salvador finance minister revealed that the country is not ready for a Bitcoin bond, blaming the Ukraine war for current market conditions.

The announcement comes just two weeks after Coinbase launched an initiative to cut down on spending in an effort to grow revenue. As its Q1 2022 results have shown, the exchange incurred a net loss of $430 million in its first-quarter earnings as well as saw its stock plunging.

In response to the lawsuit, Gemini said the company has always been open to constructive regulations and is ready to prove that it is ever abiding by existing rules and regulations governing the nascency of the product categories it offers to investors and traders.