Oluwapelumi is a believer in the transformative power Bitcoin and Blockchain industry holds. He is interested in sharing knowledge and ideas. When he is not writing, he is looking to meet new people and trying out new things.

Canonical kept its fund size small following the officials’ decision to concentrate on pre-seed and seed investments.

Canonical Crypto raised around $20 million in its first funding round to join the likes of a16z who also recently raised funds for the crypto space.

According to an official notice submitted to the SEC, the venture capital fund was initially looking to raise $15 million, but succeeded in raising beyond that after its funding round was oversubscribed in January.

Announcements about the development were kept private because of the ongoing war in Ukraine alongside other legal matters.

Some of the participants in the fundraiser were Andreessen Horowitz’s Marc Andreessen and Chris Dixon, Coinbase Ventures’ Shan Aggarwal, FTX Ventures’ Amy Wu, Dragonfly Capital’s Haseeb Qureshi, Haystack VC’s Semil Shah, and Dan Romero, one of the earliest employees at Coinbase.

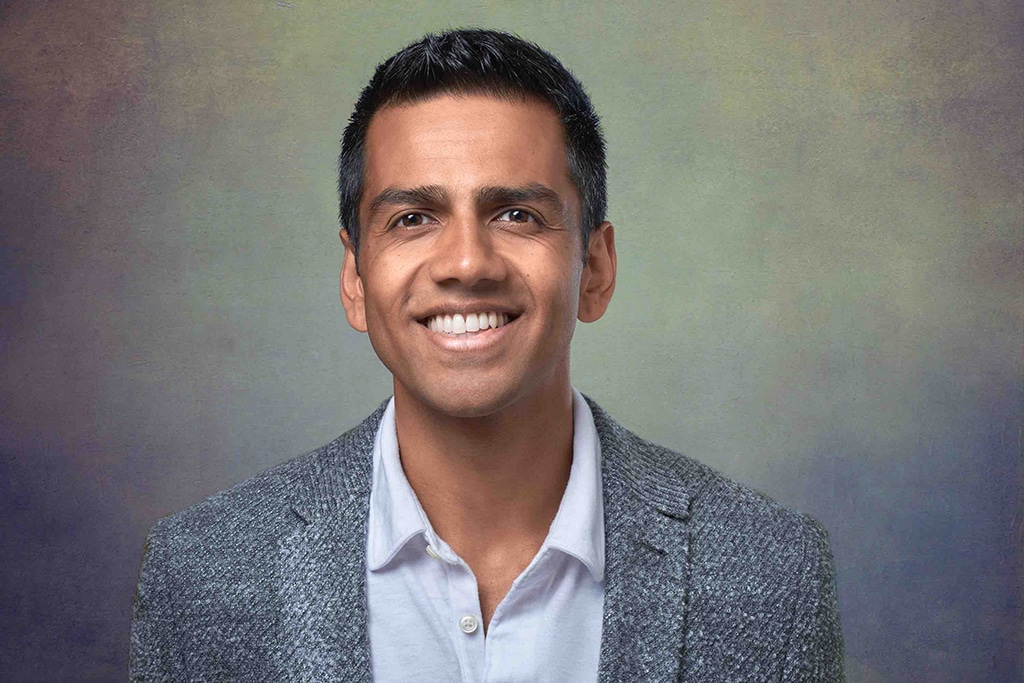

According to Anand Iyer, the founder of Canonical, despite the “small” stature of the firm, its ability to gather high-profile investors can be traced back to the longstanding relationship between himself and most of them, especially during his days as a serial entrepreneur and angel investor. “Having known various investors, doors open up relatively easily,” said he.

Iyer’s journey in the crypto space started in 2013 as a Bitcoin miner alongside friends. Iyer was a visiting partner at Pear Ventures focusing on crypto investments before he founded Canonical in September 2021.

Iyer’s personal website also described him as an angel investor and a limited partner in several venture capital funds such as Haystack, Chapter One, and Ravikant Capital standing alongside his wife Shreya.

The Canonical founder said he was less concerned about the current market downturn because he has witnessed a number of it in his career. He insists that the technology is here to stay, build and grow regardless of market waves.

According to Iyer, Canonical kept its fund size small following the officials’ decision to concentrate on pre-seed and seed investments. With this move, the firm would draw checks in an average range of $250K-$500K.

Canonical is focused on investing in Web3 infrastructure startups while also helping Web2 developers join the Web3 space. Per the Canonical founder, the early years of his career were spent advertising developer platforms at Microsoft, a foundation that inspires his resolve to build what he terms “better infrastructure for developers to be successful in Web3.”

Since they started, Canonical has supported over 10 startups like Vybe Network, Notifi, and Thirdweb. Iyer teaches a course on DeFi, and has trained 2,000+ people so far. Among these investments were made by founders Iyer met via his DeFi class.

At present, Iyer runs the venture capital fund by himself but has expressed willingness to bring in partners. This aligns with his plans to fully deploy the fund by the end of 2023 after investing in a total of 40-50 startups.

Disclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article aims to deliver accurate and timely information but should not be taken as financial or investment advice. Since market conditions can change rapidly, we encourage you to verify information on your own and consult with a professional before making any decisions based on this content.

Oluwapelumi is a believer in the transformative power Bitcoin and Blockchain industry holds. He is interested in sharing knowledge and ideas. When he is not writing, he is looking to meet new people and trying out new things.