Bitget Wallet Introduces BWB Partner Program For Ecosystem Growth

The BWB tokens will be released in the second quarter of this year. Users who have accrued BWB Points from the partner program will be able to swap them for the digital asset.

This news section spotlights emerging altcoins, project updates, tokenomics changes and ecosystem developments driving innovation in DeFi, Web3 and digital assets. Keep track of the next wave of digital currencies before they make headlines—and gain insights that matter in the altcoin sector.

The BWB tokens will be released in the second quarter of this year. Users who have accrued BWB Points from the partner program will be able to swap them for the digital asset.

Sam Bankman-Fried’s attorneys believe that any sentence beyond a maximum of 5-6 years in prison would be inappropriate.

Since the arrest of Do Kwon, both the United States and South Korea have submitted extradition requests, setting the stage for a legal war between the two countries.

Digital asset service providers already registered under the FIU will have to apply for new licenses with the FSA before the end of next year.

As a community token, PINK has been allocated to different parachains and communities involved in advancing the Polkadot ecosystem to ensure fair distribution.

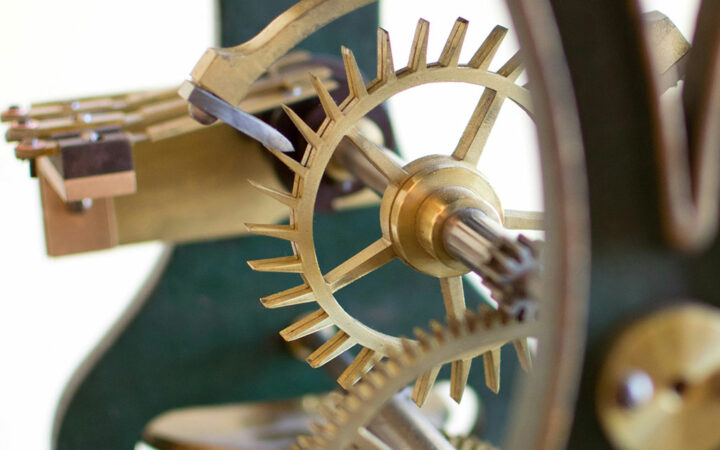

The Mintlayer sidechain enables users to create a decentralized ecosystem on the Bitcoin blockchain, including DeFi, smart contracts, atomic swaps, NFTs, and dApps.

SMOLE, SLERF, and Shroom are all meme coins based on the Solana network. Over the past few weeks, the protocol has seen an influx of memes on the ecosystem, propelled by the recent rally in the market.

Avalanche will off $1 million in incentives via the Memecoin Rush program to improve liquidity and general accessibility of community coins.

Bybit is rolling out a promotional deal offering a 7% cashback for each purchase made with the Bybit Card using Toncoin, with certain terms and conditions applicable.

US dollar-pegged stablecoins have an undeniable dominance of the stablecoin market. This has raised concerns among industry players who feel that an HKD stablecoin may not be necessary after all.

The company’s move to offer futures trading for DOGE, LTC, and BCH automatically qualifies the assets as commodities.

Renzo protocol intends to further leverage Chainlink’s tested services including automation and CCIP to grow as a reliable multichain platform.

FTX victims’ testimonies reveal the grim aftermath of FTX collapse, fueling calls for justice as 50-year sentencing looms for Sam Bankman-Fried.

Open League kicks off its inaugural season on April 1st, aiming to distribute $115 million worth of Toncoin over a month.

South Korea’s upcoming election sees cryptocurrency’s rising influence as parties propose contrasting policies, sparking debates over taxation and regulation.