TD Cowen: SEC’s Imminent Approval of Bitcoin ETFs Is Political Necessity

The anticipation of this approval has contributed to the recent rally in Bitcoin prices, currently hovering around $45,000.

The anticipation of this approval has contributed to the recent rally in Bitcoin prices, currently hovering around $45,000.

The latest report also suggests that Jane Street Capital will be the “authorized participant” for the Bitcoin ETFs of Fidelity.

The latest amendment makes it the third time Grayscale has updated its Bitcoin spot ETF application following the SEC’s directive to submit revised documents by December 29, 2023.

In a close resemblance to the early internet era, the Bitcoin ETF advertisement from Hashdex captures a similar temperament.

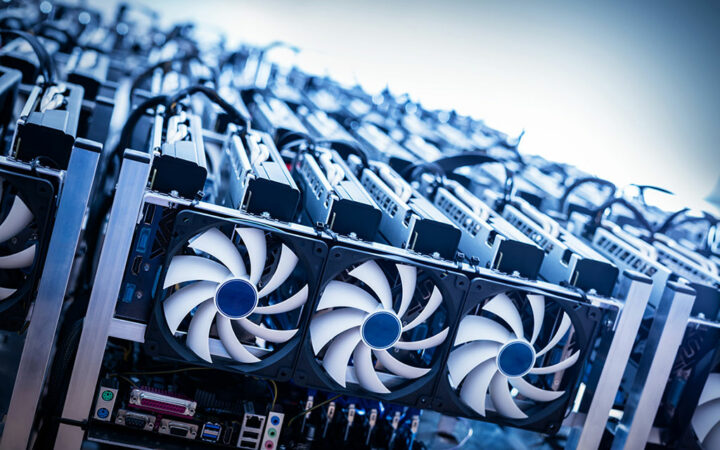

Marathon Digital and Riot Platforms, sensing the potential for increased demand, have made strategic moves to fortify their positions in the market.

The amended ETF application came after a series of meetings between Grayscale and the SEC in December.

2024 could be a slower year for the business landscape in the US economy, however, many economists are positive that the US recession could be thwarted with a soft landing.

Regarding custody arrangements, the SFC emphasizes that the fund’s trustee or custodian can delegate its crypto custody function solely to an SFC-licensed VATP or entities meeting the crypto custody standards set forth by the HKMA.

Recent reports demonstrate that Marathon Digital has been eager to expand its business.

In its initial filing, BlackRock mentioned that the Prime Execution Agent would obtain BTC to support the ETF’s shares on a 1-to-1 ratio. Although the company didn’t disclose the name of the chosen agent, it did identify Coinbase as the proposed custodian.

The analyst said TradFi institutions trying to get into crypto, but are unsure how to begin, may use Coinbase stock to enter.

The Bureau of Economic Analysis reported that GDP increased at a 4.9% annualized rate in Q3, slightly below the previously reported 5.2% pace.

While Hashdex and Bitwise are competing for public attention with their marketing campaigns, VanEck’s move to actually own Bitcoin may prove to be the wiser approach.

A spot Bitcoin ETF approval would open doors for institutional and retail investors to access the world’s largest cryptocurrency with greater ease and at a lower cost compared to Bitcoin ETFs tied to the futures market.

The collaboration between Affirm and Walmart is expected to increase the purchasing power during the end-of-year festive season as more shoppers can pay over time.